2025 ACH Price Prediction: Expert Analysis and Market Outlook for Alchemy Pay Token

Introduction: Market Position and Investment Value of ACH

Alchemy Pay (ACH) is a leading decentralized digital currency payment solution provider in the Asia Pacific region, dedicated to seamlessly connecting fiat and cryptocurrency economies for global consumers, merchants, developers, and institutions. Since its establishment in 2018, the project has achieved significant milestones including partnerships with industry leaders and expansion to over 300 payment channels across 70+ countries. As of December 2025, ACH has a market capitalization of approximately $75.84 million with a circulating supply of around 4.94 billion tokens, maintaining a price point near $0.007584. This innovative payment infrastructure, recognized for its hybrid payment solutions combining cryptocurrency and legal currency, is playing an increasingly critical role in facilitating blockchain ecosystem adoption and Web3 accessibility.

This article will provide a comprehensive analysis of ACH's price trends from 2025 through 2030, incorporating historical patterns, market supply and demand dynamics, ecosystem development, and macroeconomic factors to deliver professional price forecasts and actionable investment strategies for investors seeking exposure to this payment infrastructure asset.

Alchemy Pay (ACH) Market Analysis Report

I. ACH Price History Review and Current Market Status

ACH Historical Price Movement Trajectory

-

August 2021: ACH reached its all-time high of $0.198666 on August 7, 2021, marking the peak of its initial market enthusiasm following the project's growth phase.

-

July 2021: The token hit its all-time low of $0.00135537 on July 21, 2021, just weeks before reaching its peak, reflecting significant volatility during the early market discovery phase.

-

2021-2025: Over the subsequent four-year period, ACH experienced a substantial decline of approximately 73.63% year-over-year, reflecting broader market cycles and shifting investor sentiment in the cryptocurrency payment solutions sector.

ACH Current Market Status

As of December 19, 2025, ACH is trading at $0.007584 with a 24-hour trading volume of approximately $248,891.80. The token has experienced short-term downward pressure, declining 4.95% over the last 24 hours and 14.069% over the past week. Over the 30-day period, ACH has fallen 26.57%, indicating continued bearish momentum in recent market activity.

ACH maintains a market capitalization of approximately $75.84 million (fully diluted valuation), with a circulating supply of approximately 4.94 billion tokens out of a total supply of 10 billion tokens, representing about 49.44% of the maximum supply in circulation. The token currently ranks 584th by market capitalization among all cryptocurrencies, with a market dominance of 0.0024%.

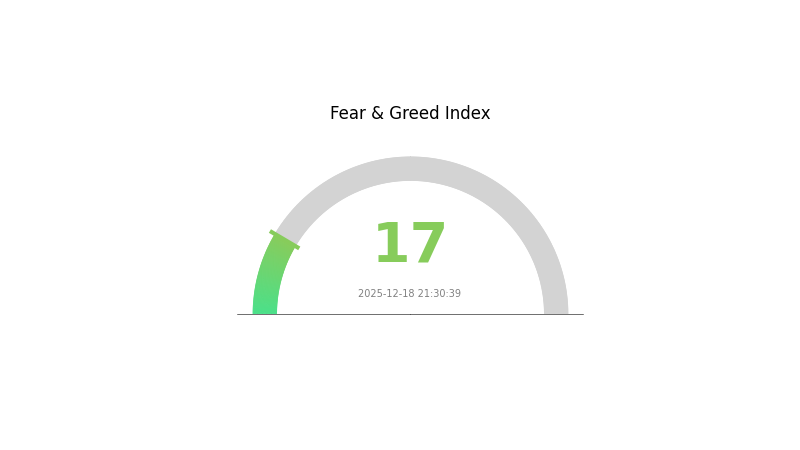

The current market sentiment reflects extreme fear conditions (VIX level: 17), suggesting heightened market anxiety that may be influencing broader digital asset valuations. ACH maintains presence across 37 exchange platforms and has attracted 37,423 token holders, demonstrating sustained community participation despite recent price depreciation.

Click to view current ACH market price

ACH Market Sentiment Indicator

2025-12-18 Fear and Greed Index: 17 (Extreme Fear)

Click to view current Fear & Greed Index

The ACH market is experiencing extreme fear, with the Fear and Greed Index at 17. This historically low reading indicates significant market pessimism and heightened investor anxiety. During such periods, panic selling often accelerates, creating substantial volatility. However, extreme fear has historically presented contrarian opportunities for long-term investors, as prices may become oversold. Market participants should exercise caution while remaining vigilant for potential entry points. Monitor key support levels and consider dollar-cost averaging strategies to navigate this turbulent sentiment environment on Gate.com.

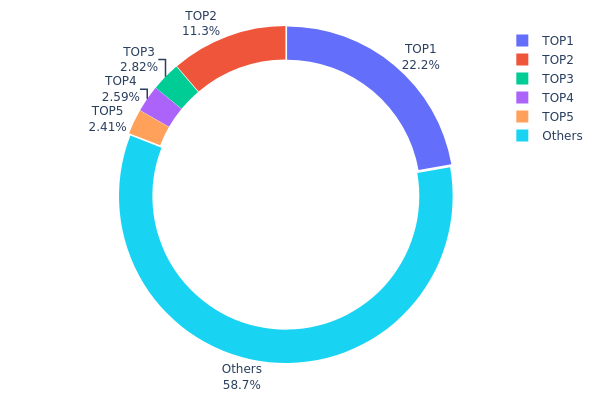

ACH Holdings Distribution

The address holdings distribution chart illustrates the concentration of ACH tokens across different blockchain addresses, revealing the degree of token centralization within the network. This metric is essential for assessing the decentralization level and identifying potential risks associated with token concentration among major holders.

The current distribution of ACH demonstrates a moderate concentration pattern with notable implications for market stability. The top holder (0xf977...41acec) commands 22.22% of total supply, while the second-largest address (0x7196...97c3fe) holds 11.26%. Combined, the top five addresses control approximately 41.28% of all ACH tokens in circulation. While this concentration level is non-negligible, it remains within acceptable parameters for established blockchain projects, as the remaining 58.72% is distributed among other addresses, suggesting a reasonably diversified holder base that mitigates extreme centralization risks.

The distribution structure presents a balanced risk profile for market dynamics. The significant concentration among the top five addresses could theoretically create conditions for coordinated actions or substantial price movements if these holders execute large transactions simultaneously. However, the majority of tokens distributed across the "Others" category provides a stabilizing effect, limiting the potential for unilateral market manipulation. This composition reflects a typical structure seen in mature tokens, where institutional holdings and major stakeholders coexist with a substantial decentralized participant base, thereby maintaining reasonable market resilience and preventing excessive price volatility driven by single-actor decisions.

For current ACH holdings distribution data, visit Gate.com

| Top | Address | Holding Qty | Holding (%) |

|---|---|---|---|

| 1 | 0xf977...41acec | 2222080.34K | 22.22% |

| 2 | 0x7196...97c3fe | 1126652.68K | 11.26% |

| 3 | 0x0529...c553b7 | 281532.23K | 2.81% |

| 4 | 0x8132...3c0b64 | 259176.60K | 2.59% |

| 5 | 0x2220...4245e1 | 240952.58K | 2.40% |

| - | Others | 5869605.57K | 58.72% |

II. Core Factors Influencing ACH's Future Price

Market Demand and Protocol Development

-

Alchemix Protocol Progress: The advancement and adoption of the Alchemix protocol directly impacts market demand for ACH tokens. Protocol improvements and feature expansions can drive increased token utility and investor interest.

-

Market Maturity: ACH operates in a market with relatively low maturity, making it more susceptible to volatility. As the market matures and institutional adoption increases, price stability may improve over time.

-

Investor Sentiment: Price fluctuations are significantly influenced by investor emotions and market psychology. The nascent nature of the project means sentiment shifts can lead to substantial volatility.

Macroeconomic Environment

-

Cryptocurrency Market Volatility: ACH's price is directly affected by broader cryptocurrency market instability. Market-wide downturns or uptrends typically have pronounced effects on mid-cap tokens like ACH.

-

Interest Rate Environment: Macroeconomic factors, including interest rate fluctuations and monetary policy decisions, influence overall cryptocurrency market conditions and investor risk appetite.

Regulatory and Risk Factors

-

Regulatory Landscape: Technological innovation and regulatory policies serve as key factors affecting ACH's price trajectory. Evolving regulatory frameworks for cryptocurrency and blockchain-based protocols can create both opportunities and challenges.

-

Project Risk Factors: The inherent risks associated with the Alchemix project and its underlying technology contribute to price volatility. Investors should consider protocol security, smart contract audits, and development team credibility.

Three、2025-2030 ACH Price Forecast

2025 Outlook

- Conservative Forecast: $0.00554 - $0.00759

- Neutral Forecast: $0.00759 - $0.00887

- Optimistic Forecast: $0.01123 (requires sustained ecosystem adoption and positive market sentiment)

2026-2027 Medium-term Outlook

- Market Stage Expectation: Gradual recovery phase with increasing institutional interest and protocol development maturation

- Price Range Forecast:

- 2026: $0.00527 - $0.01129 (24% upside potential)

- 2027: $0.00797 - $0.01428 (36% growth trajectory)

- Key Catalysts: Layer 2 scaling solutions implementation, DeFi protocol innovations, strategic partnerships, and improved market liquidity on major platforms like Gate.com

2028-2030 Long-term Outlook

- Base Case: $0.01167 - $0.01306 (2028), progressing to $0.0117 - $0.01756 (2030); assumes steady technological advancement and moderate market adoption

- Optimistic Case: $0.01428 - $0.01586 (2029); assumes accelerated ecosystem growth and expanded use cases in decentralized finance

- Transformational Case: $0.01756+ (2030); predicated on breakthrough mainstream adoption, regulatory clarity enabling institutional capital inflows, and fundamental utility expansion across blockchain applications

- 2030-12-19: ACH at $0.01756 (long-term resistance level achieved under favorable market conditions)

| 年份 | 预测最高价 | 预测平均价格 | 预测最低价 | 涨跌幅 |

|---|---|---|---|---|

| 2025 | 0.01123 | 0.00759 | 0.00554 | 0 |

| 2026 | 0.01129 | 0.00941 | 0.00527 | 24 |

| 2027 | 0.01428 | 0.01035 | 0.00797 | 36 |

| 2028 | 0.01306 | 0.01232 | 0.00887 | 62 |

| 2029 | 0.01586 | 0.01269 | 0.01167 | 67 |

| 2030 | 0.01756 | 0.01427 | 0.0117 | 88 |

Alchemy Pay (ACH) Investment Strategy and Risk Management Report

IV. ACH Professional Investment Strategy and Risk Management

ACH Investment Methodology

(1) Long-Term Holding Strategy

- Target Investors: Institutional investors, cryptocurrency enthusiasts, and payment ecosystem believers

- Operational Recommendations:

- Accumulate during market downturns, particularly leveraging ACH's 73.63% one-year decline as a potential entry opportunity

- Hold through ecosystem development cycles as Alchemy Pay expands its 300+ payment channels across 70+ countries

- Participate in governance activities through ACH token utility for system access and ecosystem incentives

(2) Active Trading Strategy

- Technical Analysis Tools:

- Moving Average Convergence Divergence (MACD): Identify trend reversals and momentum shifts in ACH's volatile price action

- Relative Strength Index (RSI): Detect overbought and oversold conditions given ACH's 24-hour volatility of -4.95%

- Wave Trading Key Points:

- Monitor resistance at historical highs ($0.198666) and support at recent lows

- Execute trades during market sentiment shifts, with current 24-hour volume of 248,891.80 ACH indicating moderate liquidity

ACH Risk Management Framework

(1) Asset Allocation Principles

- Conservative Investors: 1-2% portfolio allocation

- Active Investors: 3-5% portfolio allocation

- Professional Investors: 5-10% portfolio allocation with hedging strategies

(2) Risk Hedging Solutions

- Position Sizing: Limit individual ACH holdings to prevent catastrophic losses given the -73.63% one-year decline

- Dollar-Cost Averaging (DCA): Distribute purchases over multiple periods to reduce timing risk and average entry prices

(3) Secure Storage Solutions

- Cold wallet Approach: Transfer ACH tokens to hardware wallets for long-term holdings exceeding 3 months

- Hot Wallet Method: Maintain a small trading portion on Gate.com for active market participation

- Security Precautions: Enable two-factor authentication on all exchange accounts, regularly audit wallet permissions, and never share private keys or seed phrases

V. ACH Potential Risks and Challenges

ACH Market Risk

- Severe Historical Depreciation: ACH has declined 73.63% over the past year, indicating sustained selling pressure and potential lack of market confidence

- Limited Market Capitalization: With a market cap of $37.49 million, ACH faces liquidity constraints that amplify price volatility

- Low Trading Volume: 24-hour volume of $248,891 suggests limited daily trading activity and potential slippage during large transactions

ACH Regulatory Risk

- Payment Infrastructure Compliance: Regulatory frameworks for cryptocurrency payment solutions remain fragmented across different jurisdictions where Alchemy Pay operates

- Government Scrutiny: Central bank digital currency (CBDC) initiatives and anti-money laundering regulations could impact decentralized payment adoption

- Cross-Border Challenges: Alchemy Pay's presence in 70+ countries exposes ACH to divergent regulatory requirements and potential compliance costs

ACH Technology Risk

- Smart Contract Vulnerability: ACH operates as an ERC-20 token on Ethereum and BSC chains, exposing it to potential vulnerabilities in underlying blockchain infrastructure

- Protocol Obsolescence: Rapid evolution in blockchain payment technologies could render Alchemy Pay's current ADPS 2.0 system outdated

- Integration Dependency: Heavy reliance on partnerships with payment providers creates operational risk if key integrations fail or partners exit the market

VI. Conclusion and Action Recommendations

ACH Investment Value Assessment

Alchemy Pay presents a niche investment opportunity within the cryptocurrency payment infrastructure sector. While the project demonstrates genuine utility through 2+ million merchant partnerships and 300+ payment channels across 70+ countries, current market conditions present significant challenges. The 73.63% one-year decline reflects broader market skepticism regarding cryptocurrency payment adoption rates. However, ACH's position as a bridge between fiat and crypto economies retains long-term relevance, particularly if institutional adoption accelerates. Investors should view ACH as a speculative, high-risk holding requiring thorough due diligence.

ACH Investment Recommendations

✅ Beginners: Start with minimal positions (0.5-1% portfolio) through dollar-cost averaging on Gate.com, focusing on understanding payment infrastructure dynamics before increasing exposure

✅ Experienced Investors: Consider 3-5% allocations with tactical entry points during market weakness, utilizing technical analysis to optimize entry and exit timing

✅ Institutional Investors: Conduct comprehensive due diligence on Alchemy Pay's partnership pipeline, regulatory compliance framework, and competitive positioning before considering material allocations

ACH Trading Participation Methods

- Gate.com Spot Trading: Direct purchase and sale of ACH tokens with real-time price discovery

- Gate.com futures: Leverage market exposure through derivatives for experienced traders seeking amplified returns

- Dollar-Cost Averaging Programs: Automated periodic purchases to reduce timing risk and market cycle volatility

Cryptocurrency investments carry extreme risk. This report does not constitute investment advice. Investors must make decisions based on their risk tolerance and should consult professional financial advisors. Never invest more than you can afford to lose.

FAQ

Will ACH reach $1?

ACH reaching $1 would require significant market expansion and adoption growth. While ACH has shown potential in the payment ecosystem, current price levels and market conditions suggest this milestone would need substantial catalyst events and broader cryptocurrency market adoption to materialize.

Does ACH crypto have a future?

Yes, ACH has promising potential with growing adoption in blockchain payments. Market analysts predict upward momentum, especially as the crypto ecosystem expands. Long-term prospects remain positive for projects with strong utility and development.

What is the price prediction for ACHR 2025?

Based on current market analysis, ACHR is predicted to trade between $7.48 and $8.52 in 2025. This forecast reflects ongoing market trends and investor sentiment toward Archer Aviation Inc.

Is ACH a good investment?

ACH shows strong potential with growing adoption in crypto payments. Price predictions suggest upside movement, supported by platform innovation and strategic partnerships. Strong fundamentals and market interest make it an attractive investment opportunity.

2025 PUNDIX Price Prediction: Will This Crypto Asset Reach New Heights in the DeFi Era?

Is Amp (AMP) a good investment?: Analyzing the potential and risks of this cryptocurrency token

Avalanche (AVAX) 2025 Price Analysis and Market Trends

SEI Staking Analysis: 60-70% Supply Locked and Its Price Impact

Latest Analysis and Investment Outlook for Chainlink Price in June 2025

FTT Explained

How can on-chain data analysis reveal Bitcoin market trends through active addresses, transaction volume, and whale movements in 2025?

What is Cryptocurrency Mining? | Understanding The Process and Mechanisms

How Does Resolv (RESOLV) Maintain 50,000+ Active Users With 35% Network Growth and 56% Monthly Engagement Rate?

Understanding Polygon Addresses: Key Features and Functions in Crypto

Is Cryptocurrency Mining Allowed in India? | Comprehensive Guide