2025 BCH Price Prediction: Expert Analysis and Market Outlook for Bitcoin Cash

Introduction: BCH's Market Position and Investment Value

Bitcoin Cash (BCH), as a leading cryptocurrency forked from Bitcoin, has achieved significant milestones since its inception in 2017. As of 2025, BCH's market capitalization has reached $11.29 billion, with a circulating supply of approximately 19,967,078 coins and a price hovering around $565.5. This asset, often referred to as "digital cash," is playing an increasingly crucial role in the field of peer-to-peer electronic cash systems.

This article will comprehensively analyze BCH's price trends from 2025 to 2030, considering historical patterns, market supply and demand, ecosystem development, and macroeconomic factors to provide investors with professional price predictions and practical investment strategies.

I. BCH Price History Review and Current Market Status

BCH Historical Price Evolution

- 2017: BCH hard forked from Bitcoin, initial price around $555.89

- 2017: Reached all-time high of $3,785.82 on December 20

- 2018: Market downturn, price dropped to all-time low of $76.93 on December 16

BCH Current Market Situation

As of December 15, 2025, Bitcoin Cash (BCH) is trading at $565.5, ranking 13th in the crypto market with a market capitalization of $11.29 billion. The 24-hour trading volume stands at $2.69 million. BCH has experienced a slight decline of 1.66% in the past 24 hours, but shows a significant 13.86% increase over the last 30 days. The current price is 85.07% below its all-time high and 635.08% above its all-time low. With a circulating supply of 19,967,078 BCH, representing 95.08% of the total supply, BCH maintains a strong presence in the market.

Click to view the current BCH market price

BCH Market Sentiment Indicator

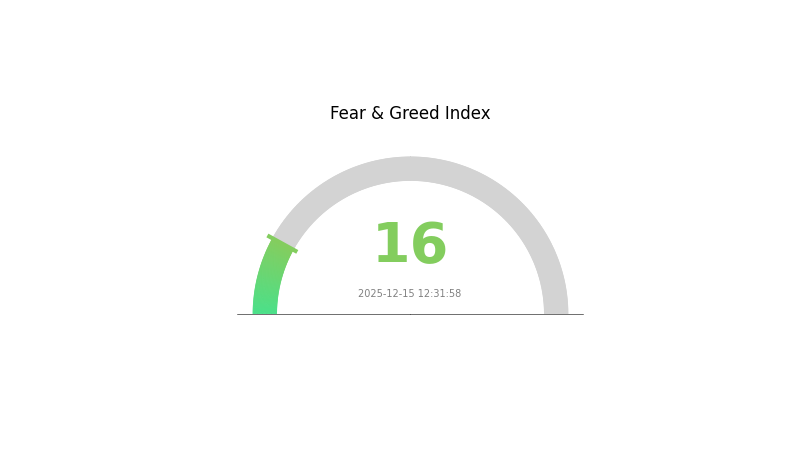

2025-12-15 Fear and Greed Index: 16 (Extreme Fear)

Click to view the current Fear & Greed Index

The cryptocurrency market is currently experiencing a state of extreme fear, with the Fear and Greed Index plummeting to 16. This low reading suggests that investors are highly cautious and pessimistic about the market's short-term prospects. Such extreme fear levels often indicate a potential buying opportunity for contrarian investors, as markets tend to overreact in times of panic. However, traders should remain vigilant and conduct thorough research before making any investment decisions in this volatile environment.

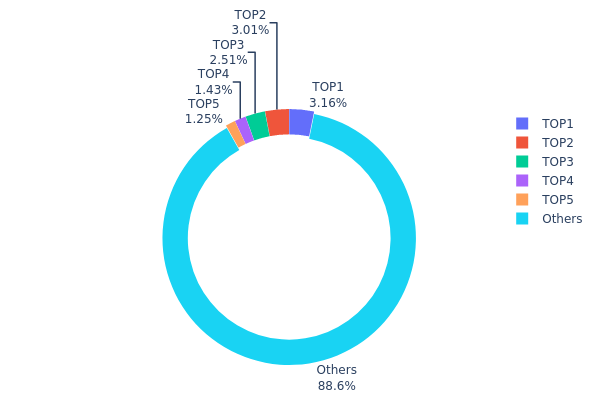

BCH Holdings Distribution

The address holdings distribution data for Bitcoin Cash (BCH) provides valuable insights into the concentration of ownership within the network. According to the data, the top 5 addresses collectively hold approximately 11.33% of the total BCH supply, with individual holdings ranging from 1.24% to 3.15%. This level of concentration suggests a relatively decentralized ownership structure, as no single address controls a significant portion of the supply.

The majority of BCH tokens (88.67%) are distributed among numerous other addresses, indicating a broad base of holders. This distribution pattern is generally favorable for market stability and resistance to manipulation. While the top addresses do hold substantial amounts, their individual influence is limited, reducing the risk of large-scale market movements triggered by a single entity.

Overall, the current BCH address distribution reflects a healthy balance between major stakeholders and smaller holders. This structure supports the network's decentralization goals and may contribute to more organic price discovery and reduced volatility in the long term.

Click to view the current BCH Holdings Distribution

| Top | Address | Holding Qty | Holding (%) |

|---|---|---|---|

| 1 | qrmfke...wse7ve | 630.72K | 3.15% |

| 2 | qre24q...28z85p | 601.26K | 3.01% |

| 3 | qrwcmu...e0z839 | 500.55K | 2.50% |

| 4 | qqwj7g...yyk82r | 285.99K | 1.43% |

| 5 | qpz8uc...mwzsl9 | 248.95K | 1.24% |

| - | Others | 17699.41K | 88.67% |

II. Key Factors Affecting BCH's Future Price

Institutional and Whale Dynamics

- Institutional Holdings: Major institutions have shown increasing interest in BCH, potentially influencing its future price movements.

- Corporate Adoption: Some companies have begun accepting BCH as a payment method, contributing to its real-world utility.

- National Policies: Government regulations and policies regarding cryptocurrencies continue to shape the market environment for BCH.

Macroeconomic Environment

- Monetary Policy Impact: Central bank policies, especially those of the Federal Reserve, may affect BCH's price as investors seek alternative assets.

- Inflation Hedging Properties: BCH's performance in inflationary environments could impact its appeal as a potential hedge.

- Geopolitical Factors: International tensions and economic uncertainties may drive interest in cryptocurrencies like BCH.

Technological Development and Ecosystem Building

- Block Size Increase: BCH's larger block size aims to improve transaction processing capacity and reduce fees.

- Smart Contract Platform: The development of smart contract capabilities on BCH could expand its ecosystem and use cases.

- Ecosystem Applications: The growth of DApps and other projects within the BCH ecosystem may drive adoption and value.

III. BCH Price Prediction for 2025-2030

2025 Outlook

- Conservative prediction: $526.01 - $565.60

- Neutral prediction: $565.60 - $600.00

- Optimistic prediction: $600.00 - $622.16 (requires increased adoption and positive market sentiment)

2027-2028 Outlook

- Market stage expectation: Potential growth phase with increasing adoption

- Price range forecast:

- 2027: $575.47 - $853.05

- 2028: $657.93 - $1124.60

- Key catalysts: Technological improvements, wider acceptance of BCH as a payment method

2029-2030 Long-term Outlook

- Base scenario: $944.82 - $982.61 (assuming steady market growth and adoption)

- Optimistic scenario: $1020.41 - $1287.22 (assuming favorable regulatory environment and increased institutional interest)

- Transformative scenario: $1500.00 - $2000.00 (assuming breakthrough in scalability and mass adoption)

- 2030-12-31: BCH $982.61 (73% increase from 2025 levels)

| 年份 | 预测最高价 | 预测平均价格 | 预测最低价 | 涨跌幅 |

|---|---|---|---|---|

| 2025 | 622.16 | 565.6 | 526.01 | 0 |

| 2026 | 760.17 | 593.88 | 332.57 | 5 |

| 2027 | 853.05 | 677.02 | 575.47 | 19 |

| 2028 | 1124.6 | 765.04 | 657.93 | 35 |

| 2029 | 1020.41 | 944.82 | 661.37 | 67 |

| 2030 | 1287.22 | 982.61 | 550.26 | 73 |

IV. BCH Professional Investment Strategies and Risk Management

BCH Investment Methodology

(1) Long-term Holding Strategy

- Suitable for: Long-term value investors

- Operation suggestions:

- Accumulate BCH during market dips

- Hold through market cycles

- Store in secure hardware wallets

(2) Active Trading Strategy

- Technical analysis tools:

- Moving Averages: Identify trends and potential reversal points

- Relative Strength Index (RSI): Gauge overbought/oversold conditions

- Key points for swing trading:

- Monitor support and resistance levels

- Use stop-loss orders to manage risk

BCH Risk Management Framework

(1) Asset Allocation Principles

- Conservative investors: 1-3%

- Aggressive investors: 5-10%

- Professional investors: 10-20%

(2) Risk Hedging Solutions

- Diversification: Spread investments across multiple cryptocurrencies

- Dollar-Cost Averaging: Regularly invest fixed amounts to reduce timing risk

(3) Secure Storage Solutions

- Hot wallet recommendation: Gate Web3 Wallet

- Cold storage solution: Hardware wallets for large holdings

- Security precautions: Use two-factor authentication, backup private keys securely

V. Potential Risks and Challenges for BCH

BCH Market Risks

- Volatility: Significant price fluctuations common in crypto markets

- Competition: Pressure from other cryptocurrencies and payment solutions

- Liquidity: Potential challenges in large-scale buying or selling

BCH Regulatory Risks

- Global regulatory uncertainty: Varying regulatory stances across jurisdictions

- Potential restrictions: Risk of government limitations on cryptocurrency use

- Tax implications: Evolving tax policies for cryptocurrency transactions

BCH Technical Risks

- Network security: Potential vulnerabilities to 51% attacks

- Scalability challenges: Balancing transaction speed and decentralization

- Development governance: Risks of community disagreements on protocol changes

VI. Conclusion and Action Recommendations

BCH Investment Value Assessment

Bitcoin Cash offers potential as a payment-focused cryptocurrency with faster and cheaper transactions than Bitcoin. However, it faces significant competition and regulatory uncertainties in the evolving crypto landscape.

BCH Investment Recommendations

✅ Newcomers: Consider small, experimental positions to understand the market ✅ Experienced investors: Implement dollar-cost averaging strategy with strict risk management ✅ Institutional investors: Conduct thorough due diligence and consider BCH as part of a diversified crypto portfolio

BCH Trading Participation Methods

- Spot trading: Direct buying and selling on Gate.com

- Futures trading: Leverage opportunities for experienced traders on Gate.com

- Staking: Explore potential staking options if available on Gate.com

Cryptocurrency investments carry extremely high risks, and this article does not constitute investment advice. Investors should make decisions carefully based on their own risk tolerance and are advised to consult professional financial advisors. Never invest more than you can afford to lose.

FAQ

What is the price prediction for BCH in 2030?

Based on current market trends and expert analysis, the price prediction for BCH in 2030 ranges from $1,579 to $2,376. This forecast suggests significant potential growth for Bitcoin Cash over the next few years.

Can BCH reach $10,000?

Yes, BCH has the potential to reach $10,000. Its focus on fast, low-cost transactions and global adoption as electronic cash could drive significant value growth in the future.

Is BCH a good investment now?

Yes, BCH appears to be a good investment as of 2025-12-15. It has shown steady growth and remains a viable alternative to Bitcoin, with potential for further price appreciation.

Can Bitcoin Cash reach $100K?

While unlikely, BCH reaching $100K would require massive adoption and market growth over many years. It's an ambitious target given current trends.

XZXX: A Comprehensive Guide to the BRC-20 Meme Token in 2025

Bitcoin Fear and Greed Index: Market Sentiment Analysis for 2025

Top Crypto ETFs to Watch in 2025: Navigating the Digital Asset Boom

5 ways to get Bitcoin for free in 2025: Newbie Guide

Bitcoin Market Cap in 2025: Analysis and Trends for Investors

2025 Bitcoin Price Prediction: Trump's Tariffs' Impact on BTC

Is Falcon Finance (FF) a good investment?: A Comprehensive Analysis of Returns, Risks, and Market Potential

Is Zebec Protocol (ZBCN) a good investment?: A Comprehensive Analysis of Tokenomics, Use Cases, and Market Potential in 2024

Is Audiera (BEAT) a good investment?: A Comprehensive Analysis of Tokenomics, Market Potential, and Risk Factors

Is zkSync (ZK) a good investment?: A Comprehensive Analysis of Layer 2 Scaling Solutions and Future Prospects

TBC vs MANA: A Comprehensive Comparison of Two Leading Blockchain Governance Tokens