2025 COOK Price Prediction: Analyzing Market Trends and Growth Potential for the Top DeFi Token

Introduction: COOK's Market Position and Investment Value

mETH Protocol (COOK), as the first fully vertically integrated staking and restaking protocol in the market, has made significant strides since its inception. As of 2025, COOK's market capitalization has reached $15,216,000, with a circulating supply of approximately 960,000,000 tokens, and a price hovering around $0.01585. This asset, known for its "capital efficiency enhancement," is playing an increasingly crucial role in Ethereum staking and yield accumulation.

This article will comprehensively analyze COOK's price trends from 2025 to 2030, considering historical patterns, market supply and demand, ecosystem development, and macroeconomic factors to provide investors with professional price predictions and practical investment strategies.

I. COOK Price History Review and Current Market Status

COOK Historical Price Evolution

- 2024: Launch of mETH Protocol, price reached ATH of $0.04584

- 2025: Market correction, price dropped to ATL of $0.0064

- 2025: Recovery phase, price rebounded to current level

COOK Current Market Situation

As of October 7, 2025, COOK is trading at $0.01585, with a 24-hour trading volume of $154,640. The token has experienced a slight decline of 0.39% in the past 24 hours. However, it shows strong performance over longer periods, with a 29.36% increase in the past week and a 49.66% surge over the last 30 days.

COOK has a circulating supply of 960 million tokens and a total supply of 5 billion. The current market capitalization stands at $15,216,000, ranking it 1232nd in the cryptocurrency market. The fully diluted market cap is $79,250,000, with the circulating supply representing 19.2% of the total supply.

The token's all-time high of $0.04584 was recorded on November 9, 2024, while its all-time low of $0.0064 occurred on April 20, 2025. Currently, COOK is trading 65.42% below its ATH and 147.66% above its ATL, indicating a potential for growth but also suggesting caution due to historical volatility.

The market sentiment for COOK appears bullish, as evidenced by its recent price performance and increasing trading volume. However, investors should note that the cryptocurrency market remains highly volatile and unpredictable.

Click to view the current COOK market price

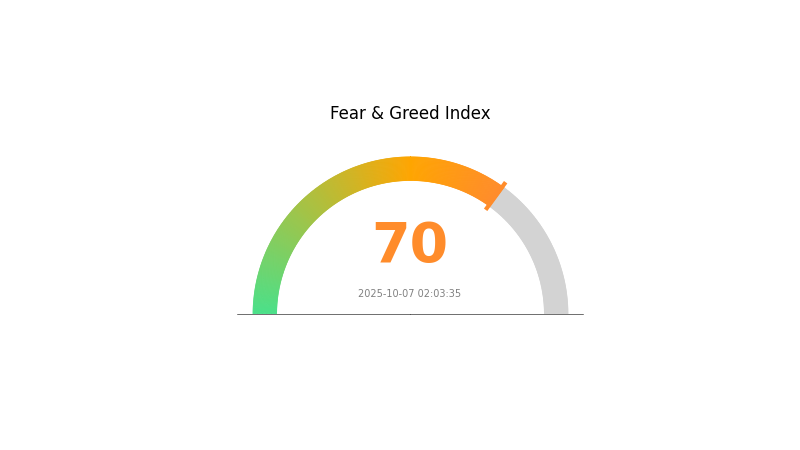

COOK Market Sentiment Indicator

2025-10-07 Fear and Greed Index: 70 (Greed)

Click to view the current Fear & Greed Index

The crypto market is showing signs of excessive optimism, with the Fear and Greed Index reaching 70, indicating a state of greed. This suggests that investors are becoming increasingly bullish, potentially driving prices higher. However, such heightened sentiment often precedes market corrections. Traders should exercise caution and consider taking profits or implementing risk management strategies. Remember, markets can remain irrational longer than you can remain solvent. Stay vigilant and avoid FOMO-driven decisions in this euphoric market environment.

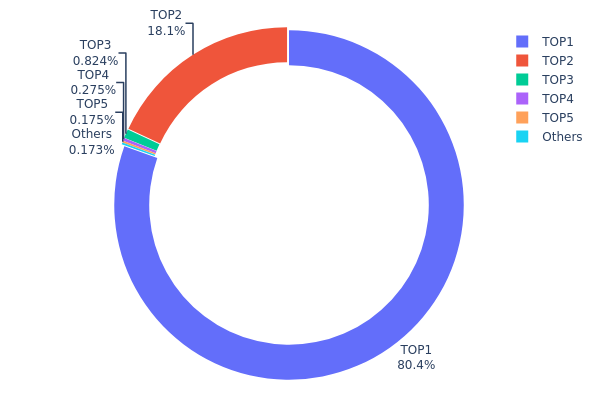

COOK Holdings Distribution

The address holdings distribution data for COOK reveals a highly concentrated ownership structure. The top address holds an overwhelming 80.43% of the total supply, amounting to 4,021,928.66K COOK tokens. This is followed by a second major holder with 18.11% of the supply. Together, these two addresses control 98.54% of all COOK tokens, indicating an extremely centralized distribution.

This level of concentration raises significant concerns about market manipulation and price volatility. With such a large portion of tokens held by so few addresses, any movement or decision by these major holders could have outsized effects on the COOK market. The lack of wider distribution limits liquidity and could potentially lead to sharp price swings if large amounts are moved or sold.

From a decentralization perspective, COOK's current distribution falls short of ideal. The high concentration in two addresses suggests a low level of on-chain structural stability and raises questions about the token's resistance to potential market manipulation. This distribution pattern may deter some investors concerned about fair market practices and could impact COOK's long-term sustainability and adoption.

Click to view the current COOK holdings distribution

| Top | Address | Holding Qty | Holding (%) |

|---|---|---|---|

| 1 | 0xc144...0bdca9 | 4021928.66K | 80.43% |

| 2 | 0x0035...20cb6a | 905736.95K | 18.11% |

| 3 | 0xf89d...5eaa40 | 41202.77K | 0.82% |

| 4 | 0x66be...6883da | 13741.46K | 0.27% |

| 5 | 0x0d07...b492fe | 8753.01K | 0.17% |

| - | Others | 8637.15K | 0.2% |

II. Key Factors Affecting COOK's Future Price

Supply Mechanism

- Token Unlock: A significant portion of core contributor tokens (23.8% of total supply) will begin linear unlocking on November 29, 2025.

- Historical Pattern: Not enough information provided.

- Current Impact: The token unlock is expected to create selling pressure, potentially leading to a 60-80% price drop during the 2025-2027 unlock period.

Institutional and Whale Dynamics

- Institutional Holdings: No specific information provided about institutional holdings for COOK.

- Corporate Adoption: No information provided about companies adopting COOK.

- National Policies: No specific national policies mentioned for COOK.

Macroeconomic Environment

- Monetary Policy Impact: Interest rates and monetary policies are likely to influence the broader crypto market, including COOK.

- Inflation Hedging Properties: No specific information provided about COOK's inflation hedging properties.

- Geopolitical Factors: Tariffs and economic tensions between countries may indirectly affect the crypto market and COOK's price.

Technical Development and Ecosystem Building

- DeFi Competition: The flourishing DeFi industry presents numerous competitors and potential security vulnerabilities for Cook Finance.

- Market Integration: Cook Finance aims to provide a seamless trading experience for spot and perpetual contracts, mimicking the efficiency of centralized exchanges.

- Ecosystem Applications: Cook Finance is developing a high-performance trading engine, integrating with EVM for programmability, and building stablecoin infrastructure.

Note: Price predictions for Cook Protocol (COOKPROTOCOL) on Gate.com suggest an average price of ¥0.000987 in 2025, with potential fluctuations between ¥0.0008587 and ¥0.001075.

III. COOK Price Prediction for 2025-2030

2025 Outlook

- Conservative prediction: $0.00938 - $0.01589

- Neutral prediction: $0.01589 - $0.01748

- Optimistic prediction: $0.01748 - $0.01907 (requires positive market sentiment)

2027-2028 Outlook

- Market phase expectation: Gradual growth and increased adoption

- Price range forecast:

- 2027: $0.0108 - $0.02395

- 2028: $0.01741 - $0.02182

- Key catalysts: Technological advancements and expanding use cases

2029-2030 Long-term Outlook

- Base scenario: $0.02140 - $0.02653 (assuming steady market growth)

- Optimistic scenario: $0.02653 - $0.03167 (with increased mainstream adoption)

- Transformative scenario: $0.03167 - $0.03500 (with breakthrough applications and partnerships)

- 2030-12-31: COOK $0.02812 (potential year-end price)

| 年份 | 预测最高价 | 预测平均价格 | 预测最低价 | 涨跌幅 |

|---|---|---|---|---|

| 2025 | 0.01907 | 0.01589 | 0.00938 | 0 |

| 2026 | 0.01853 | 0.01748 | 0.01014 | 10 |

| 2027 | 0.02395 | 0.01801 | 0.0108 | 13 |

| 2028 | 0.02182 | 0.02098 | 0.01741 | 32 |

| 2029 | 0.03167 | 0.0214 | 0.01754 | 34 |

| 2030 | 0.02812 | 0.02653 | 0.01645 | 67 |

IV. COOK Professional Investment Strategies and Risk Management

COOK Investment Methodology

(1) Long-term Holding Strategy

- Suitable for: Long-term value investors and believers in Ethereum staking

- Operation suggestions:

- Accumulate COOK tokens during market dips

- Stake COOK tokens to earn additional rewards

- Store tokens in secure non-custodial wallets

(2) Active Trading Strategy

- Technical analysis tools:

- Moving Averages: Use to identify trend directions and potential reversals

- Relative Strength Index (RSI): Gauge overbought or oversold conditions

- Key points for swing trading:

- Monitor ETH staking yields as they may impact COOK's value

- Watch for news and updates from the mETH Protocol team

COOK Risk Management Framework

(1) Asset Allocation Principles

- Conservative investors: 1-3% of crypto portfolio

- Aggressive investors: 5-10% of crypto portfolio

- Professional investors: Up to 15% of crypto portfolio

(2) Risk Hedging Solutions

- Diversification: Balance COOK with other crypto assets

- Stop-loss orders: Set predetermined exit points to limit potential losses

(3) Secure Storage Solutions

- Hot wallet recommendation: Gate Web3 wallet

- Cold storage solution: Hardware wallets for long-term holdings

- Security precautions: Enable two-factor authentication, use strong passwords

V. Potential Risks and Challenges for COOK

COOK Market Risks

- Volatility: COOK may experience significant price fluctuations

- Liquidity: Limited trading volumes may lead to slippage

- Correlation: Performance may be tied to overall crypto market sentiment

COOK Regulatory Risks

- Staking regulations: Changes in staking rules could impact mETH Protocol

- Token classification: Potential for COOK to be classified as a security

- Cross-border restrictions: Varying regulations across jurisdictions

COOK Technical Risks

- Smart contract vulnerabilities: Potential for exploits or bugs

- Scalability challenges: Ability to handle increased user adoption

- Interoperability issues: Compatibility with other blockchain networks

VI. Conclusion and Action Recommendations

COOK Investment Value Assessment

COOK presents a unique opportunity in the Ethereum staking ecosystem, offering potential long-term value for those bullish on ETH. However, short-term volatility and regulatory uncertainties pose significant risks.

COOK Investment Recommendations

✅ Beginners: Start with small positions, focus on learning about staking ✅ Experienced investors: Consider allocating a portion of ETH holdings to COOK ✅ Institutional investors: Conduct thorough due diligence and monitor regulatory developments

COOK Trading Participation Methods

- Spot trading: Buy and sell COOK on Gate.com

- Staking: Participate in mETH Protocol's staking program

- DeFi integration: Explore liquidity provision opportunities if available

Cryptocurrency investments carry extremely high risks. This article does not constitute investment advice. Investors should make decisions carefully based on their own risk tolerance. It is recommended to consult a professional financial advisor. Never invest more than you can afford to lose.

FAQ

What is the stock price prediction for cook in 2025?

Based on current forecasts, COOK's stock price is predicted to average $2.04 in 2025, with potential highs of $4.06 and lows of $0.02.

What is the price prediction for Cook token?

Cook token is predicted to reach $2.00 by 2025, $3.00 by 2026, $4.00 by 2027, $5.00 by 2028, and $10.00 by 2030, based on current market trends.

What is the price target for cook?

The price target for COOK is $1.75, with estimates ranging from $1.25 to $3.00 by 2026, based on current market analysis and expert forecasts.

What crypto has the highest price prediction?

Bitcoin has the highest price prediction, with forecasts suggesting it could reach $139,045 by 2025. The current price is around $124,798.

USD1 stablecoin on Gate: Analysis and Investment Opportunities for WLFI Token

What is STETH: Understanding the Liquid Staking Derivative Token and Its Role in the Ethereum Ecosystem

USD1 Points Program Launch: Gate and WLFI Team Up for Multiple Earning Opportunities

Gate has partnered with WLFI to launch the USD1 points program: a comprehensive upgrade of the stablecoin investment experience.

Gate and WLFI launch the USD1 points program: a new era of stablecoin utility

What is ENA: A Comprehensive Guide to the European Nucleotide Archive

How to Purchase Bitcoin (BTC) in India: A Comprehensive Guide

Understanding Soulbound Tokens: A Comprehensive Guide

How to Purchase Bitcoin in India – A Complete Guide

How to Construct a Cryptocurrency Mining Rig

August 2025 Crypto Announcements: Emerging Tokens to Keep an Eye On