2025 FB Price Prediction: Analyzing Trends and Factors Shaping Meta's Stock Future

Introduction: FB's Market Position and Investment Value

Fractal Bitcoin (FB), as the only Bitcoin scaling solution using Bitcoin Core code to recursively scale unlimited layers, has achieved significant milestones since its inception. As of 2025, Fractal Bitcoin's market capitalization has reached $35,698,307, with a circulating supply of approximately 89,112,099 tokens, and a price hovering around $0.4006. This asset, hailed as an "innovation playground" for Bitcoin, is playing an increasingly crucial role in supporting internet-scale applications while maintaining Bitcoin's core principles.

This article will comprehensively analyze Fractal Bitcoin's price trends from 2025 to 2030, considering historical patterns, market supply and demand, ecosystem development, and macroeconomic factors to provide investors with professional price predictions and practical investment strategies.

I. FB Price History Review and Current Market Status

FB Historical Price Evolution

- 2024: Initial launch, price peaked at $39.36 on September 15

- 2025: Market downturn, price dropped to an all-time low of $0.3694 on August 1

FB Current Market Situation

As of November 18, 2025, Fractal Bitcoin (FB) is trading at $0.4006, with a 24-hour trading volume of $373,963.99. The token has experienced a slight decrease of 0.04% in the past 24 hours. FB's market cap currently stands at $35,698,307.24, ranking it 683rd in the overall cryptocurrency market.

FB's price has shown mixed performance across different timeframes. In the past hour, it has seen a 0.29% increase. However, looking at longer periods, FB has experienced declines: -1.48% over the past week, -5.59% over the last 30 days, and a significant -89.79% over the past year.

The token's circulating supply is 89,112,099.95 FB, which represents 42.43% of its maximum supply of 210,000,000 FB. The fully diluted market cap is $84,126,000.00.

Despite the recent downtrend, FB's current price of $0.4006 is slightly above its all-time low, suggesting a potential stabilization or early signs of recovery in the market.

Click to view the current FB market price

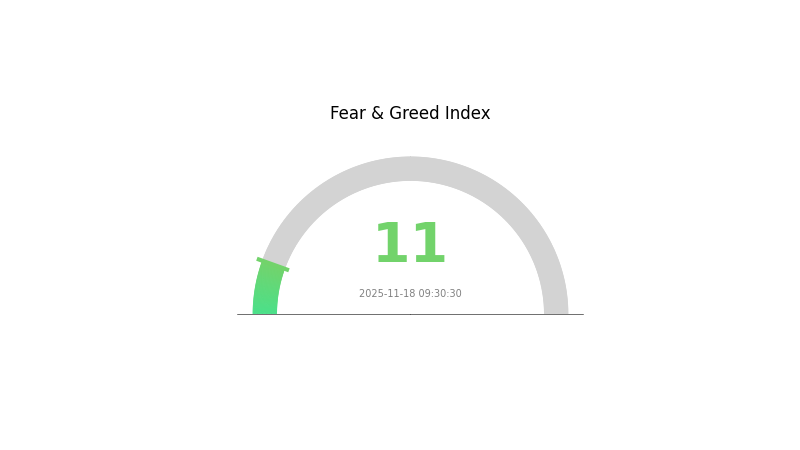

FB Market Sentiment Indicator

2025-11-18 Fear and Greed Index: 11 (Extreme Fear)

Click to view the current Fear & Greed Index

The crypto market is currently gripped by extreme fear, with the sentiment index plummeting to 11. This level of pessimism often presents potential buying opportunities for savvy investors. However, it's crucial to approach with caution and conduct thorough research. Remember, market sentiment can shift rapidly. Stay informed and consider diversifying your portfolio to mitigate risks. Gate.com offers a range of tools and resources to help you navigate these turbulent market conditions.

FB Holdings Distribution

The address holdings distribution data for FB reveals an interesting pattern in the token's ownership structure. This metric provides insights into the concentration of token holdings across different addresses, offering a glimpse into the level of decentralization and potential market dynamics.

Based on the available data, FB appears to have a relatively dispersed ownership structure. The absence of highly concentrated holdings in a few addresses suggests a more distributed token ecosystem. This distribution pattern can be interpreted as a positive sign for the token's market health, as it reduces the risk of market manipulation by large token holders, often referred to as "whales."

The current address distribution may contribute to a more stable market structure for FB. A wider distribution of tokens across numerous addresses typically leads to reduced price volatility and a lower likelihood of sudden, large-scale sell-offs. This ownership pattern also aligns with the principles of decentralization, potentially enhancing the token's appeal to investors who value a more equitable distribution of assets.

Click to view the current FB Holdings Distribution

| Top | Address | Holding Qty | Holding (%) |

|---|

II. Key Factors Affecting FB's Future Price

Supply and Demand Dynamics

- Market Supply and Demand: The relationship between supply and demand is a crucial factor influencing FB's price. When demand exceeds supply, prices tend to rise; when supply is excessive, prices may fall.

- Current Impact: Changes in market environment and regulatory policies can significantly affect the supply and demand balance.

Institutional and Whale Movements

- Corporate Adoption: Facebook's advertising display growth is expected to maintain double-digit increases in the coming years, influencing the platform's value.

Macroeconomic Environment

- Monetary Policy Impact: Macroeconomic factors, including changes in monetary policies, can affect Facebook's advertising prices and overall market performance.

- Geopolitical Factors: Global order restructuring and long-term growth expectations adjustments can impact asset prices, including FB's stock.

Technical Development and Ecosystem Building

- Advertising Model Shift: Facebook is gradually transitioning towards Stories-based advertising, which generally has lower unit prices compared to traditional formats.

- Privacy Policy Changes: Apple's privacy policy changes have affected Facebook's ability to precisely target users, impacting advertising revenue.

- Ecosystem Growth: Instagram's active user base has grown rapidly under Facebook's ecosystem, particularly boosted by increased social networking demands during the 2020 pandemic.

III. FB Price Prediction for 2025-2030

2025 Outlook

- Conservative prediction: $0.31632 - $0.40040

- Neutral prediction: $0.40040 - $0.50000

- Optimistic prediction: $0.50000 - $0.58058 (requires sustained market growth and increased adoption)

2027 Mid-term Outlook

- Market phase expectation: Potential consolidation and growth phase

- Price range forecast:

- 2026: $0.35806 - $0.58368

- 2027: $0.49412 - $0.78415

- Key catalysts: Technological advancements, expanded use cases, and broader market trends

2030 Long-term Outlook

- Base scenario: $0.75000 - $0.85000 (assuming steady market growth and adoption)

- Optimistic scenario: $0.85000 - $1.00000 (with favorable market conditions and increased utility)

- Transformative scenario: $1.00000 - $1.16278 (with breakthrough applications and mainstream adoption)

- 2030-12-31: FB $1.16278 (potential peak based on optimistic projections)

| 年份 | 预测最高价 | 预测平均价格 | 预测最低价 | 涨跌幅 |

|---|---|---|---|---|

| 2025 | 0.58058 | 0.4004 | 0.31632 | 0 |

| 2026 | 0.58368 | 0.49049 | 0.35806 | 22 |

| 2027 | 0.78415 | 0.53709 | 0.49412 | 34 |

| 2028 | 0.8522 | 0.66062 | 0.44261 | 64 |

| 2029 | 0.86987 | 0.75641 | 0.51436 | 88 |

| 2030 | 1.16278 | 0.81314 | 0.44722 | 102 |

IV. Professional Investment Strategies and Risk Management for FB

FB Investment Methodology

(1) Long-term Holding Strategy

- Suitable for: Long-term investors and Bitcoin enthusiasts

- Operation suggestions:

- Accumulate FB during market dips

- Hold for at least 1-2 years to realize potential growth

- Store in secure hardware wallets or reputable custodial services

(2) Active Trading Strategy

- Technical analysis tools:

- Moving Averages: Use to identify trends and potential reversal points

- Relative Strength Index (RSI): Monitor overbought/oversold conditions

- Key points for swing trading:

- Set clear entry and exit points based on technical indicators

- Monitor Bitcoin price movements as they may influence FB

FB Risk Management Framework

(1) Asset Allocation Principles

- Conservative investors: 1-3% of crypto portfolio

- Aggressive investors: 5-10% of crypto portfolio

- Professional investors: Up to 15% of crypto portfolio

(2) Risk Hedging Solutions

- Diversification: Balance FB with other crypto assets and traditional investments

- Stop-loss orders: Implement to limit potential losses

(3) Secure Storage Solutions

- Hot wallet recommendation: Gate Web3 wallet

- Cold storage solution: Hardware wallets for long-term holdings

- Security precautions: Use two-factor authentication, avoid sharing private keys

V. Potential Risks and Challenges for FB

FB Market Risks

- High volatility: Price may experience significant fluctuations

- Correlation with Bitcoin: FB performance may be heavily influenced by Bitcoin trends

- Limited adoption: Potential lack of widespread use could impact long-term value

FB Regulatory Risks

- Uncertain regulatory environment: Potential for stricter regulations on Bitcoin-related projects

- Cross-border compliance: Varying regulations across jurisdictions may limit global adoption

- Tax implications: Evolving tax laws may affect FB holders and transactions

FB Technical Risks

- Scalability challenges: Potential issues in handling increased transaction volumes

- Security vulnerabilities: Possibility of unforeseen weaknesses in the protocol

- Integration complexities: Challenges in seamless integration with existing Bitcoin infrastructure

VI. Conclusion and Action Recommendations

FB Investment Value Assessment

FB presents a unique proposition as a Bitcoin scaling solution with potential long-term value. However, it faces short-term risks related to market volatility, regulatory uncertainties, and technical challenges.

FB Investment Recommendations

✅ Beginners: Consider small, long-term investments after thorough research ✅ Experienced investors: Allocate a moderate portion of portfolio, employing risk management strategies ✅ Institutional investors: Conduct comprehensive due diligence and consider FB as part of a diversified crypto strategy

FB Trading Participation Methods

- Spot trading: Buy and hold FB on reputable exchanges like Gate.com

- DCA strategy: Implement a dollar-cost averaging approach for long-term accumulation

- Staking: Participate in staking programs if available to earn passive income

Cryptocurrency investments carry extremely high risks, and this article does not constitute investment advice. Investors should make decisions cautiously based on their own risk tolerance and are advised to consult professional financial advisors. Never invest more than you can afford to lose.

FAQ

What is Facebook worth in 2025?

Based on market projections, Facebook's stock price is expected to reach around $628 per share by November 2025, showing a 3.6% year-to-date increase.

Will Meta reach $1000 per share?

Yes, Meta is projected to reach $1000 per share by 2030. Analysts predict a range of $1000-$1400, with an average target of $1147 per share.

What is the Meta prediction for 2030?

Meta's stock is projected to reach $1,000-$1,500 by 2030, based on anticipated successes in AI, VR, and metaverse technologies.

What is the target price for Meta in 2025?

The target price for Meta in 2025 is $900, based on analysts' long-term confidence in the company's AI integration potential and user base growth.

Share

Content