2025 MIGGLES Price Prediction: Strategic Investment Analysis and Market Outlook for Cryptocurrency Enthusiasts

Introduction: MIGGLES Market Position and Investment Value

MIGGLES (MIGGLES), as a meme coin on the Base chain, has gained attention in the cryptocurrency market since its inception. As of 2025, MIGGLES has a market capitalization of $22,809,014, with a circulating supply of approximately 958,764,788 tokens, and a price hovering around $0.02379. This asset, often referred to as a "community-driven meme token," is playing an increasingly significant role in the realm of social tokens and community engagement on the Base blockchain.

This article will provide a comprehensive analysis of MIGGLES' price trends from 2025 to 2030, considering historical patterns, market supply and demand, ecosystem development, and macroeconomic factors to offer professional price predictions and practical investment strategies for investors.

I. MIGGLES Price History Review and Current Market Status

MIGGLES Historical Price Evolution

- 2024: Launch on Base chain, price reached ATH of $0.2 on July 19

- 2024: Market correction, price dropped to ATL of $0.01202 on August 5

- 2025: Gradual recovery, price stabilized around $0.02379

MIGGLES Current Market Situation

MIGGLES is currently trading at $0.02379, with a market cap of $22,809,014. The token has experienced mixed performance across different timeframes. In the past 24 hours, MIGGLES has seen a 2.05% decrease in price, with a trading volume of $77,787.98. However, the 7-day trend shows a positive 10.39% increase, indicating short-term bullish momentum. The 30-day and 1-year performance remain negative at -19.32% and -10.37% respectively, suggesting longer-term bearish pressure. The current price is 88.10% below its all-time high of $0.2, but 97.92% above its all-time low of $0.01202, indicating a potential for recovery.

Click to view the current MIGGLES market price

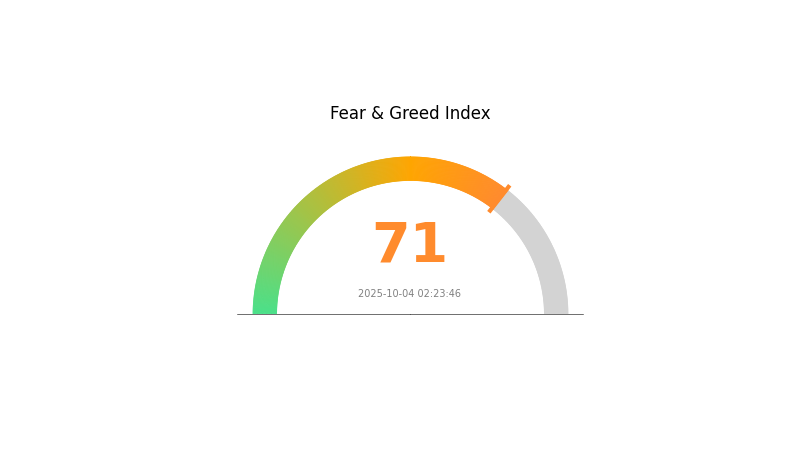

MIGGLES Market Sentiment Indicator

2025-10-04 Fear and Greed Index: 71 (Greed)

Click to view the current Fear & Greed Index

The crypto market is currently in a state of greed, with the Fear and Greed Index reaching 71. This high reading suggests investors are becoming overly optimistic, potentially signaling a market top. Experienced traders might consider taking some profits or hedging their positions. However, newcomers should exercise caution, as FOMO-driven buying at these levels could lead to losses if a correction occurs. Remember, market sentiment can shift quickly, so always conduct thorough research and manage your risk wisely.

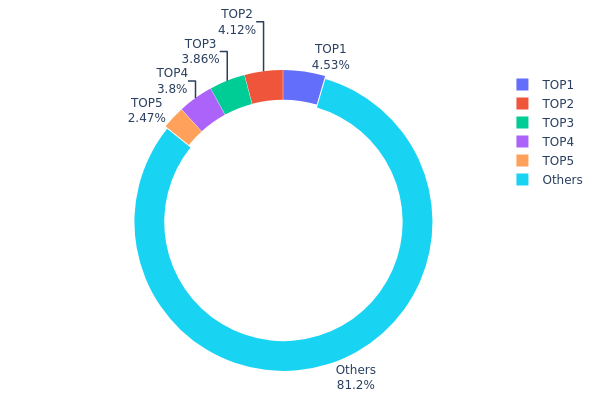

MIGGLES Holdings Distribution

The address holdings distribution data for MIGGLES reveals a relatively decentralized ownership structure. The top 5 addresses collectively hold 18.76% of the total supply, with the largest individual address owning 4.53%. This distribution suggests a moderate level of concentration, which is not uncommon in the cryptocurrency market.

Notably, the second-largest holder is a "dead" address (0x0000...00dead), likely representing burned tokens, which effectively reduces the circulating supply. The remaining top holders possess between 2.47% and 3.85% each. The majority of MIGGLES tokens (81.24%) are distributed among numerous other addresses, indicating a broad base of smaller holders.

This distribution pattern suggests a relatively healthy market structure for MIGGLES, with no single entity having overwhelming control. While the top holders could potentially influence short-term price movements, the widespread distribution among smaller holders may contribute to long-term price stability and reduced vulnerability to market manipulation.

Click to view the current MIGGLES Holdings Distribution

| Top | Address | Holding Qty | Holding (%) |

|---|---|---|---|

| 1 | 0x9b0c...ba8d46 | 45324.15K | 4.53% |

| 2 | 0x0000...00dead | 41235.31K | 4.12% |

| 3 | 0x4e3a...a31b60 | 38573.88K | 3.85% |

| 4 | 0x17a3...b2518a | 37970.49K | 3.79% |

| 5 | 0x0d07...b492fe | 24707.45K | 2.47% |

| - | Others | 812188.72K | 81.24% |

II. Key Factors Affecting MIGGLES Future Price

Supply Mechanism

- Market Dynamics: The supply and demand dynamics play a crucial role in influencing MIGGLES price.

- Current Impact: Investors should closely monitor supply changes as they can significantly affect price movements.

Institutional and Whale Activities

- Corporate Adoption: Companies adopting MIGGLES can potentially impact its price and market perception.

- Government Policies: National-level policies related to cryptocurrencies may influence MIGGLES' future price.

Macroeconomic Environment

- Inflation Hedging Properties: MIGGLES' performance in inflationary environments could affect its price.

- Geopolitical Factors: International situations and events may impact MIGGLES' price movements.

Technical Development and Ecosystem Building

- Ecosystem Applications: Major DApps and ecosystem projects built on MIGGLES could drive its value and adoption.

III. MIGGLES Price Prediction for 2025-2030

2025 Outlook

- Conservative prediction: $0.01709 - $0.02373

- Neutral prediction: $0.02373 - $0.03000

- Optimistic prediction: $0.03000 - $0.03156 (requires favorable market conditions)

2027-2028 Outlook

- Market stage expectation: Potential growth phase

- Price range forecast:

- 2027: $0.02176 - $0.04012

- 2028: $0.03113 - $0.04559

- Key catalysts: Increased adoption and technological advancements

2029-2030 Long-term Outlook

- Base scenario: $0.03847 - $0.04422 (assuming steady market growth)

- Optimistic scenario: $0.04422 - $0.04731 (assuming strong market performance)

- Transformative scenario: $0.04731+ (assuming breakthrough developments)

- 2030-12-31: MIGGLES $0.04731 (potential peak price)

| 年份 | 预测最高价 | 预测平均价格 | 预测最低价 | 涨跌幅 |

|---|---|---|---|---|

| 2025 | 0.03156 | 0.02373 | 0.01709 | 0 |

| 2026 | 0.04036 | 0.02765 | 0.02295 | 16 |

| 2027 | 0.04012 | 0.034 | 0.02176 | 42 |

| 2028 | 0.04559 | 0.03706 | 0.03113 | 55 |

| 2029 | 0.04711 | 0.04133 | 0.02273 | 73 |

| 2030 | 0.04731 | 0.04422 | 0.03847 | 85 |

IV. Professional Investment Strategies and Risk Management for MIGGLES

MIGGLES Investment Methodology

(1) Long-term Holding Strategy

- Suitable for: Risk-tolerant investors with a long-term perspective

- Operational advice:

- Accumulate MIGGLES during market dips

- Set long-term price targets and stick to the plan

- Store tokens in a secure Gate Web3 wallet

(2) Active Trading Strategy

- Technical analysis tools:

- Moving Averages: Use to identify trends and potential reversal points

- Relative Strength Index (RSI): Monitor overbought/oversold conditions

- Key points for swing trading:

- Monitor trading volume for trend confirmation

- Set stop-loss orders to manage downside risk

MIGGLES Risk Management Framework

(1) Asset Allocation Principles

- Conservative investors: 1-2%

- Aggressive investors: 5-10%

- Professional investors: 10-15%

(2) Risk Hedging Solutions

- Diversification: Spread investments across multiple cryptocurrencies

- Stop-loss orders: Implement to limit potential losses

(3) Secure Storage Solutions

- Hot wallet recommendation: Gate Web3 wallet

- Cold storage solution: Hardware wallet for long-term holdings

- Security precautions: Enable two-factor authentication, use strong passwords

V. Potential Risks and Challenges for MIGGLES

MIGGLES Market Risks

- High volatility: Meme coins are subject to extreme price swings

- Limited utility: Lack of real-world use cases may impact long-term value

- Market sentiment: Heavily influenced by social media trends

MIGGLES Regulatory Risks

- Uncertain regulations: Potential for stricter oversight of meme coins

- Exchange delistings: Risk of removal from trading platforms

- Taxation changes: Evolving tax laws may impact investment returns

MIGGLES Technical Risks

- Smart contract vulnerabilities: Potential for exploits or bugs

- Base chain dependencies: Issues with Base network could affect MIGGLES

- Limited development: Lack of ongoing technical improvements

VI. Conclusion and Action Recommendations

MIGGLES Investment Value Assessment

MIGGLES presents a high-risk, speculative investment opportunity. While it may offer short-term gains due to its meme coin status, the long-term value proposition remains uncertain due to limited utility and technical development.

MIGGLES Investment Recommendations

✅ Beginners: Limit exposure to a small portion of portfolio, if any

✅ Experienced investors: Consider short-term trading opportunities with strict risk management

✅ Institutional investors: Approach with caution, allocate only as part of a diversified crypto portfolio

MIGGLES Trading Participation Methods

- Spot trading: Buy and sell MIGGLES on Gate.com

- Limit orders: Set specific entry and exit points to manage risk

- Dollar-cost averaging: Gradually accumulate positions over time to mitigate volatility

Cryptocurrency investments carry extremely high risks, and this article does not constitute investment advice. Investors should make decisions carefully based on their own risk tolerance and are advised to consult professional financial advisors. Never invest more than you can afford to lose.

FAQ

How much is the miggles coin worth?

As of 2025-10-04, the miggles coin is worth $0.00000000000000000001, with a market cap of $23,533,778.

What crypto will 1000x prediction?

Bitcoin Hyper (HYPER), Maxi Doge (MAXI), and PEPENODE (PEPENODE) are predicted to 1000x based on current market trends.

What is the Miggles coin about?

Miggles is a meme coin on Base Blockchain, focusing on community, creativity, and collaboration. It aims to combine scalability with fun.

Which memecoin will reach $1 in 2025?

DOGE has the highest potential to reach $1 in 2025, followed by SHIB and PEPE. However, meme coin prices are highly volatile and unpredictable.

CATE vs NEAR: Comparing Two Novel Approaches for Efficient Deep Learning Training

CAW vs DOT: Analyzing the Unique Features and Market Potential of Two Competing Blockchain Protocols

2025 QKAPrice Prediction: Analyzing Market Trends and Future Growth Potential for Quantum Key Assets

TOMI vs SHIB: Battle of the Meme Coins in the Evolving Cryptocurrency Market

XTTA vs STX: A Comparative Analysis of Emerging AI Dialogue Processing Frameworks

Is Luckycoin (LKY) a good investment?: Analyzing the Potential and Risks of this Emerging Cryptocurrency

Crypto RSI Heatmap

Ethereum Maintains 62% NFT Market Share Despite Growing Competition

CryptoQuant On-Chain Analysis Tools: Bitcoin Market Insights and Whale Tracking for Crypto Traders in 2026

Mist Browser (Ethereum DApp Browser)

Moo Deng (MOODENG) — The Viral Hippo Taking Over Crypto