2025 NETMIND Price Prediction: Expert Analysis and Market Forecast for the Next Bull Run

Introduction: NetMind's Market Position and Investment Value

NetMind Token (NETMIND) serves as the governance and utility token for NetMind Power, a decentralized computing platform dedicated to developing infrastructure, technology, and an ecosystem for future AGI, making artificial intelligence both accessible and affordable for everyone. Since its launch in February 2024, the project has established itself in the decentralized computing sector. As of December 2025, NETMIND's market capitalization has reached approximately $6.94 million, with a circulating supply of approximately 55.81 million tokens and a current price hovering around $0.1243. This asset, which represents a bridge between decentralized computing resources and AGI infrastructure development, is playing an increasingly important role in the emerging ecosystem of democratized artificial intelligence services.

This article will comprehensively analyze NETMIND's price trends through 2030, combining historical patterns, market supply and demand dynamics, ecosystem development, and macroeconomic factors to provide investors with professional price forecasts and practical investment strategies.

NETMIND Token Market Analysis Report

I. NETMIND Price History Review and Current Market Status

NETMIND Historical Price Trajectory

- 2024: Project launch phase, token reached an all-time high of $4.997 on December 2, 2024, reflecting strong initial market momentum and investor interest.

- 2025: Market correction phase, token experienced significant depreciation, declining from its peak to current levels, with the all-time low of $0.1221 recorded on December 22, 2025.

NETMIND Current Market Position

As of December 23, 2025, NETMIND is trading at $0.1243, representing a substantial 95.93% decline from its all-time high over the one-year period. The token exhibits extreme market weakness with a 24-hour price decline of 3.79%, though showing modest hourly recovery of 0.24%. Over the 7-day and 30-day periods, NETMIND has depreciated by 10.63% and 17.41% respectively.

The token currently holds a market capitalization of approximately $6.94 million with a fully diluted valuation of $18.34 million, ranking 1,355 in the overall cryptocurrency market. Daily trading volume stands at $117,494, indicating relatively modest liquidity. The circulating supply comprises 55.81 million tokens out of a total supply of 147.57 million NETMIND tokens, representing 37.82% circulation ratio.

Market sentiment indicators point to "Extreme Fear" (VIX: 25), reflecting widespread pessimism in the broader market environment. The token maintains a distributed holder base of 23,497 addresses, suggesting reasonable community participation despite the significant price depreciation.

Click to view current NETMIND market price

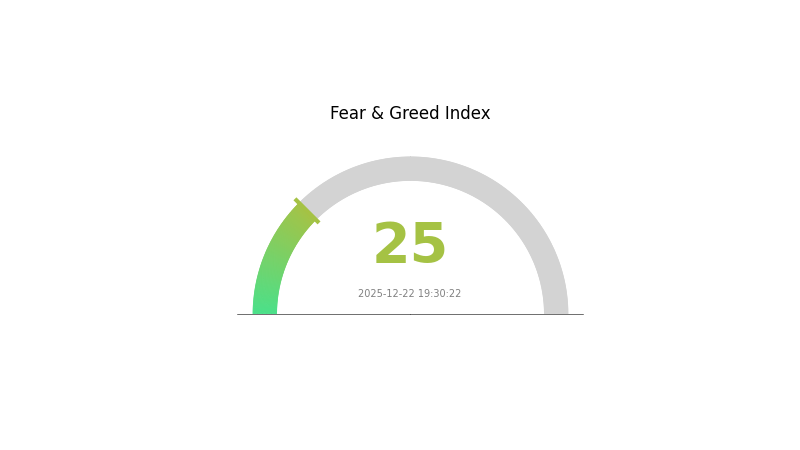

NETMIND Market Sentiment Index

2025-12-22 Fear and Greed Index: 25 (Extreme Fear)

Click to view current Fear & Greed Index

The cryptocurrency market is currently experiencing extreme fear, with the Fear and Greed Index standing at 25. This indicates significant market pessimism and heightened investor anxiety. During periods of extreme fear, market volatility typically increases as traders react to negative sentiment. However, such conditions often present contrarian opportunities for long-term investors. Consider analyzing market fundamentals and risk management strategies carefully before making investment decisions. Monitor Gate.com's market sentiment tools to stay informed about shifting market dynamics.

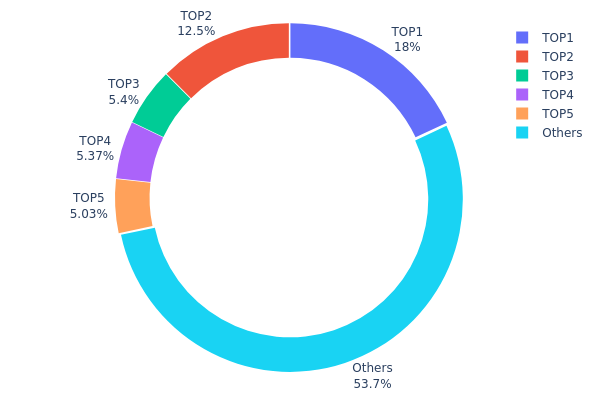

NETMIND Token Distribution

The address holding distribution chart represents the concentration of NETMIND token ownership across the blockchain network. It illustrates how the total token supply is allocated among different wallet addresses, providing critical insights into the decentralization level and potential risks associated with wealth concentration. This metric serves as a key indicator for assessing market structure stability and identifying potential liquidity or manipulation vulnerabilities.

NETMIND currently exhibits a moderately concentrated distribution pattern. The top five addresses collectively control approximately 46.32% of the circulating supply, with the largest holder commanding 18.02% of tokens. While this concentration level is not extreme by industry standards, it warrants attention as a single address maintains nearly one-fifth of the total holdings. The distribution among the top five addresses shows reasonable fragmentation, with holdings ranging from 18.02% to 5.03%, suggesting that control is not dominated by a single entity. However, the concentration in the top tier addresses does present potential risks regarding coordinated actions or sudden market movements initiated by major holders.

The remaining 53.68% of tokens distributed across other addresses indicates a substantial degree of decentralization for the broader holder base. This distributed tail mitigates systemic risks while maintaining reasonable concentration at the top tier. From a market structure perspective, NETMIND demonstrates balanced characteristics typical of established projects—sufficient decentralization to ensure network resilience, yet concentrated enough to maintain strategic stakeholder involvement. This distribution pattern suggests moderate price stability potential, though significant moves by top-tier holders could generate temporary volatility.

Click to view current NETMIND token distribution

| Top | Address | Holding Qty | Holding (%) |

|---|---|---|---|

| 1 | 0xc8d3...4b90d5 | 2344.77K | 18.02% |

| 2 | 0x118e...be1a2b | 1626.24K | 12.50% |

| 3 | 0x32e3...aef59f | 703.10K | 5.40% |

| 4 | 0x2e8f...725e64 | 698.66K | 5.37% |

| 5 | 0xddd0...478b18 | 654.76K | 5.03% |

| - | Others | 6982.19K | 53.68% |

II. Core Factors Influencing NETMIND's Future Price

Technology Development and Ecosystem Building

-

Decentralized AI Infrastructure: The advancement of NetMind's decentralized AI infrastructure and platform updates directly impact investor confidence and token utility. Progress in this area supports the long-term value proposition of the network.

-

AI Computing Services Adoption: Market demand for NetMind's AI computing services drives token utility and demand. Increased adoption of the platform's computational capabilities strengthens the fundamental use case for the NMT token.

-

GPU Technology Integration: The platform's core GPU technology capabilities are essential for maintaining competitive advantages in the decentralized AI computing space.

Market Dynamics and Investor Sentiment

-

Market Supply and Demand: NMT token price is subject to significant fluctuations driven by market supply and demand dynamics, which can substantially impact investment returns.

-

Investor Sentiment: Market sentiment plays a crucial role in price movements, influenced by technological progress, platform updates, and broader market conditions.

-

Mainstream Adoption of Digital Assets: As digital assets continue to gain mainstream acceptance, the cryptocurrency market is experiencing unprecedented growth, which can positively influence NETMIND's price trajectory.

Macroeconomic Environment

-

Monetary Policy Impact: Interest rate changes affect market conditions through two primary channels: reducing borrowing costs and lowering risk-free returns, which influences investor allocation decisions toward alternative assets like cryptocurrencies.

-

Regulatory Development: Favorable regulatory developments and increased institutional adoption support positive price momentum and market expansion for digital assets in the broader ecosystem.

Three、2025-2030 NETMIND Price Forecast

2025 Outlook

- Conservative Forecast: $0.1206 - $0.1243

- Neutral Forecast: $0.1243

- Optimistic Forecast: $0.1815 (requires sustained ecosystem development and increased institutional adoption)

2026-2028 Medium-term Outlook

- Market Stage Expectation: Gradual recovery and consolidation phase with increasing market participation and protocol maturation

- Price Range Forecast:

- 2026: $0.0917 - $0.2186 (23% upside potential)

- 2027: $0.1375 - $0.2638 (49% upside potential)

- 2028: $0.1821 - $0.2877 (81% upside potential)

- Key Catalysts: Expansion of NETMIND's computing network infrastructure, strategic partnerships with major enterprises, increased adoption of decentralized AI computing solutions, and positive regulatory developments

2029-2030 Long-term Outlook

- Base Case: $0.2255 - $0.3126 (106% upside from current levels, assuming steady network growth and market stabilization)

- Optimistic Case: $0.2843 - $0.3783 (129% upside potential, assuming accelerated AI adoption and significant enterprise integration)

- Transformative Case: Beyond $0.3783 (extraordinary conditions including breakthrough AI applications, mainstream institutional adoption, and market-wide positive sentiment shift)

Note: These forecasts are based on predictive analysis and should not be considered as investment advice. Price volatility in cryptocurrency markets remains significant. For trading and investment decisions, please conduct thorough due diligence and consider using established platforms like Gate.com for secure transactions.

| 年份 | 预测最高价 | 预测平均价格 | 预测最低价 | 涨跌幅 |

|---|---|---|---|---|

| 2025 | 0.18148 | 0.1243 | 0.12057 | 0 |

| 2026 | 0.21863 | 0.15289 | 0.09173 | 23 |

| 2027 | 0.26378 | 0.18576 | 0.13746 | 49 |

| 2028 | 0.28771 | 0.22477 | 0.18206 | 81 |

| 2029 | 0.31261 | 0.25624 | 0.22549 | 106 |

| 2030 | 0.37828 | 0.28442 | 0.15359 | 129 |

NetMind Token (NETMIND) Professional Investment Report

I. Executive Summary

NetMind Token (NETMIND) is a decentralized computing platform token designed to provide infrastructure, technology, and ecosystem support for future Artificial General Intelligence (AGI). As of December 23, 2025, NETMIND trades at $0.1243 with a market capitalization of $6.94 million and a fully diluted valuation of $18.34 million.

Key Metrics:

- Current Price: $0.1243

- 24-Hour Change: -3.79%

- Market Cap Rank: 1,355

- Circulating Supply: 55,811,896.68 NETMIND

- Total Supply: 147,571,163 NETMIND

- All-Time High: $4.997 (December 2, 2024)

- All-Time Low: $0.1221 (December 22, 2025)

II. Project Overview

Project Description

NetMind Power is a decentralized computing platform dedicated to developing infrastructure, technology, and an ecosystem for future AGI, making AI both accessible and affordable for everyone.

Tokenomics

- Token Standard: BEP-20 (Binance Smart Chain)

- Total Supply: 147,571,163 NETMIND

- Circulating Supply: 55,811,896.68 NETMIND (37.82% of total supply)

- Fully Diluted Valuation: $18,343,095.56

- Token Holders: 23,497

Network Distribution

- Primary Blockchain: Binance Smart Chain (BSC)

- Contract Address: 0x03aa6298f1370642642415edc0db8b957783e8d6

III. Market Performance Analysis

Price Trends

| Timeframe | Change Percentage | Change Amount |

|---|---|---|

| 1 Hour | +0.24% | +$0.000298 |

| 24 Hours | -3.79% | -$0.00490 |

| 7 Days | -10.63% | -$0.01478 |

| 30 Days | -17.41% | -$0.02620 |

| 1 Year | -95.93% | -$2.9298 |

Market Position

- Market Dominance: 0.00056%

- 24-Hour Trading Volume: $117,494.19

- Price Range (24H): $0.1221 - $0.1329

- Exchange Listings: 1 primary exchange

Performance Context

NETMIND has experienced significant price decline over the past year, trading approximately 97.5% below its all-time high established in December 2024. The token reached its all-time low on December 22, 2025, reflecting current market pressures.

IV. NETMIND Professional Investment Strategy and Risk Management

NETMIND Investment Methodology

(1) Long-Term Holding Strategy

Target Investors: AGI infrastructure believers, technology-focused institutional investors, patient capital holders

Operational Recommendations:

- Dollar-cost averaging (DCA) approach to mitigate volatility exposure

- Accumulation during market downturns when project fundamentals remain intact

- Minimum holding period of 18-24 months to allow ecosystem maturation

Storage Solution:

- Secure wallet storage for long-term holdings on BSC-compatible wallets

- Private key management through secure offline methods

(2) Active Trading Strategy

Technical Analysis Tools:

- Support and Resistance Levels: Identify key price points at $0.1221 (ATL) and $0.1329 (recent 24H high) for entry and exit points

- Volume Analysis: Monitor 24-hour trading volume fluctuations to confirm price movements

Wave Trading Key Points:

- Entry signals: Convergence of positive volume and price consolidation above $0.1250

- Exit signals: Breaking below support level of $0.1221 or exceeding resistance at $0.1350

NETMIND Risk Management Framework

(1) Asset Allocation Principles

- Conservative Investors: 1-3% of total cryptocurrency portfolio

- Aggressive Investors: 3-8% of total cryptocurrency portfolio

- Institutional Investors: 2-5% of total digital asset allocation

(2) Risk Hedging Strategies

- Portfolio Diversification: Combine NETMIND holdings with established blockchain projects to reduce concentration risk

- Position Sizing: Implement strict maximum position size limits to prevent catastrophic losses

(3) Secure Storage Solutions

- Hot Wallet Method: Use Gate.com platform for active trading and frequent transactions

- Cold Storage Method: Transfer long-term holdings to secure offline storage solutions for BSC-compatible assets

- Security Considerations: Enable two-factor authentication, use hardware verification for transactions, avoid public Wi-Fi for wallet access, and maintain separate keys for hot and cold storage

V. NETMIND Potential Risks and Challenges

Market Risks

- High Volatility: NETMIND has demonstrated extreme price fluctuations, declining 95.93% year-over-year, indicating substantial volatility that can result in significant portfolio losses

- Liquidity Risk: With 24-hour trading volume of only $117,494, limited liquidity may result in wide bid-ask spreads and potential slippage during large trades

- Market Sentiment Deterioration: Current negative sentiment reflected in year-long downtrend suggests potential for further price depreciation

Regulatory Risks

- Jurisdictional Uncertainty: Evolving global regulations regarding AI tokens and decentralized computing platforms may impact project operations and token utility

- Compliance Requirements: Potential regulatory changes in blockchain technology could necessitate platform modifications, affecting token functionality

Technology Risks

- Development Execution: The success of AGI infrastructure depends on the project team's ability to deliver promised technological milestones and ecosystem integration

- Network Adoption: Without significant user adoption and computing power contribution to the network, the platform may fail to achieve its AGI infrastructure objectives

- Technical Obsolescence: Competing decentralized AI computing platforms may render NetMind's technology less competitive

VI. Conclusion and Action Recommendations

NETMIND Investment Value Assessment

NetMind Token represents a speculative investment in decentralized AGI infrastructure. The project's long-term value proposition depends on successful ecosystem development, widespread adoption, and the realization of its vision for accessible AI computing. However, the current market conditions indicate substantial challenges, with the token declining 95.93% year-over-year and trading near historical lows. This presents both risk and potential opportunity for opportunistic investors, but requires careful evaluation of project fundamentals versus market sentiment.

NETMIND Investment Recommendations

✅ Beginners: Start with minimal position sizing (0.5-1% of crypto portfolio) through dollar-cost averaging on Gate.com. Focus on understanding the project roadmap before committing additional capital. Prioritize secure storage practices immediately upon purchase.

✅ Experienced Investors: Consider tactical accumulation during confirmed support levels, using technical analysis to identify entry points. Implement systematic profit-taking strategies at key resistance levels. Diversify within AI infrastructure token exposure rather than concentrating solely on NETMIND.

✅ Institutional Investors: Conduct thorough due diligence on project team, technology development progress, and partnership announcements. Allocate only within strict parameters of total digital asset portfolios (2-5%). Establish clear exit criteria tied to development milestones or regulatory changes.

NETMIND Trading Participation Methods

- Direct Purchase on Gate.com: Access NETMIND trading pairs through Gate.com's platform for buying, selling, and trading NETMIND tokens with multiple trading pairs and fiat options

- Peer-to-Peer Transactions: Engage in direct NETMIND transfers between wallets for OTC transactions, ensuring secure smart contract verification before executing large transactions

- Staking and Yield Opportunities: Monitor project announcements for potential staking programs or liquidity provision opportunities that generate additional yields on NETMIND holdings

Cryptocurrency investments carry extreme risk. This report does not constitute investment advice. Investors should make decisions based on their individual risk tolerance and financial circumstances. Consult with professional financial advisors before investing. Never invest more than you can afford to lose.

FAQ

How much is NetMind AI?

NetMind AI (NMT) is currently trading at approximately $0.131. The token has experienced recent price fluctuations, with a 24-hour decline of around 3.33%. For real-time pricing and market data, check major crypto platforms.

What is a NetMind token?

NetMind Token (NMT) is a multi-utility token within the NetMind ecosystem, primarily used for GPU service payments, AI model training, governance, and staking on the NetMind Chain blockchain designed for AI-related transactions.

What is the NetMind price prediction for 2025?

Based on current market analysis, NetMind (NMT) is predicted to reach a maximum price of approximately $29.84 by end of 2025, with a minimum expected price around $21.52. The token shows potential for growth within this range throughout the year.

What factors influence NetMind token price?

NetMind token price is influenced by demand for AI computing services, technology advancements, market adoption, token supply, and trading volume. Network utility and ecosystem growth also play important roles in price movements.

Is NetMind a good investment?

NetMind shows strong potential with predicted value increases by October 2026. Strong fundamentals and growing adoption in AI infrastructure position it well for long-term gains.

2025 HOLO Price Prediction: Analyzing Market Trends and Growth Potential in the Post-Halving Crypto Landscape

2025 COOKIE Price Prediction: Market Analysis and Future Outlook for Digital Cookie Economy

2025 SIREN Price Prediction: Future Outlook, Market Analysis, and Key Factors Driving This Emerging Crypto Asset

2025 AVAAIPrice Prediction: Analyzing Market Trends and Growth Potential for AVAAI in the Expanding AI Sector

2025 XNY Price Prediction: Analyzing Market Trends, Technical Indicators and Future Outlook for Cryptocurrency Investors

2025 ACTPrice Prediction: Analyzing Market Trends and Future Valuation of ACT Tokens in the Evolving Crypto Ecosystem

Is MATH (MATH) a good investment?: A Comprehensive Analysis of Token Utility, Market Performance, and Future Potential in the DeFi Ecosystem

What is Fartcoin's fundamental analysis: whitepaper logic, use cases, and team background explained?

What is Tether Gold (XAUT) market overview with $1.63B market cap and $38.13M 24-hour trading volume?

How Will HYPE's Technical Indicators Like MACD, RSI, and Bollinger Bands Predict Its Next Price Move?

How Does ARTX Price Volatility Compare to Bitcoin and Ethereum in 2025?