2025 PYUSD Price Prediction: Market Analysis, Expert Forecasts, and Investment Opportunities for PayPal's Stablecoin

Introduction: PYUSD's Market Position and Investment Value

PayPal USD (PYUSD), as a stablecoin designed to contribute to payment opportunities, has made significant strides since its launch in 2023. As of 2025, PYUSD's market capitalization has reached $3.86 billion, with a circulating supply of approximately 3.87 billion tokens, maintaining a price close to $0.9992. This asset, known as a "digital dollar alternative," is playing an increasingly crucial role in facilitating digital payments and cross-border transactions.

This article will comprehensively analyze PYUSD's price trends from 2025 to 2030, combining historical patterns, market supply and demand, ecosystem development, and macroeconomic factors to provide investors with professional price predictions and practical investment strategies.

I. PYUSD Price History Review and Current Market Status

PYUSD Historical Price Evolution

- 2023: PYUSD launched, price stabilized around $1

- 2024: Increased adoption, price remained stable with minor fluctuations

- 2025: Market expansion, price ranged between $0.9987 (24h low) and $0.9998 (24h high)

PYUSD Current Market Situation

As of December 16, 2025, PYUSD is trading at $0.9992, maintaining its peg to the US dollar. The 24-hour trading volume stands at $20,858.311512, indicating moderate market activity. PYUSD's market capitalization is $3,862,630,314.79, ranking it 34th in the global cryptocurrency market. The circulating supply is 3,865,722,893.10 PYUSD, with a total supply of 967,614,865 tokens. The all-time high of $1.2 was reached on September 12, 2023, while the all-time low of $0.833 occurred on August 22, 2023. Over the past 24 hours, PYUSD has experienced a slight decrease of 0.01%, demonstrating its stability as a stablecoin.

Click to view the current PYUSD market price

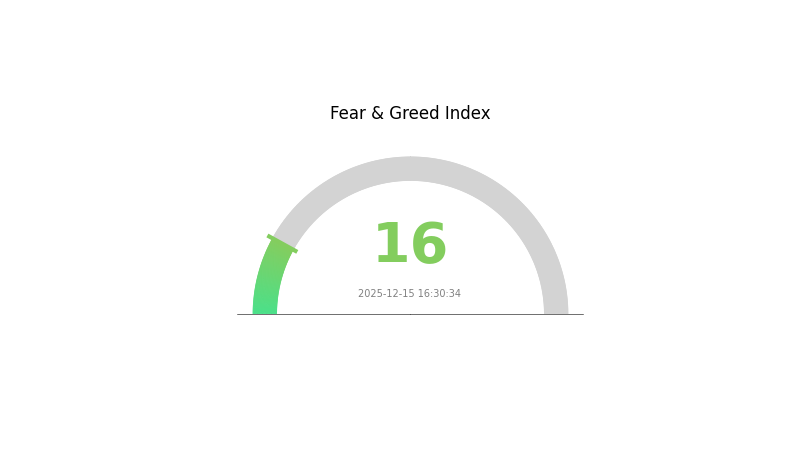

PYUSD Market Sentiment Indicator

2025-12-15 Fear and Greed Index: 16 (Extreme Fear)

Click to view the current Fear & Greed Index

The crypto market is currently experiencing a state of extreme fear, with the Fear and Greed Index plummeting to 16. This indicates a highly pessimistic sentiment among investors, potentially signaling oversold conditions. During such periods of extreme fear, contrarian investors often view it as a potential buying opportunity, adhering to the adage "be greedy when others are fearful." However, caution is advised as market volatility may persist. Traders on Gate.com should closely monitor market trends and conduct thorough research before making any investment decisions.

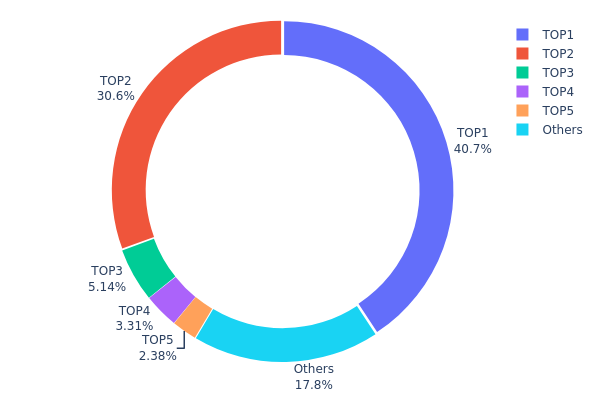

PYUSD Holdings Distribution

The address holdings distribution data for PYUSD reveals a significant concentration of tokens among a few top addresses. The top two addresses collectively hold over 71% of the total supply, with 40.74% and 30.62% respectively. This high concentration suggests a potential centralization risk in the PYUSD market.

The top five addresses account for approximately 82.17% of the total PYUSD supply, leaving only 17.83% distributed among other holders. This imbalanced distribution could have substantial implications for market dynamics. Such concentration may lead to increased volatility and susceptibility to price manipulation, as large holders could significantly impact the market with their trading activities.

From a market structure perspective, this high concentration indicates a relatively low level of decentralization for PYUSD. While this may provide some stability in terms of large, potentially institutional holdings, it also poses risks to the broader market ecosystem and could affect investor confidence in the long term.

Click to view the current PYUSD Holdings Distribution

| Top | Address | Holding Qty | Holding (%) |

|---|---|---|---|

| 1 | 9DrvZv...yDWpmo | 436040.40K | 40.74% |

| 2 | 5gUuDF...aUUPE4 | 327701.22K | 30.62% |

| 3 | 5stwKM...vudFde | 54953.50K | 5.13% |

| 4 | 5SybwT...yPT8ey | 35441.33K | 3.31% |

| 5 | 22Wnk8...h7zkBa | 25433.78K | 2.37% |

| - | Others | 190561.98K | 17.83% |

II. Key Factors Affecting PYUSD's Future Price

Supply Mechanism

- Controlled Supply: PYUSD is issued and managed by PayPal, allowing for controlled supply adjustments based on market demand.

- Historical Patterns: Supply changes have historically impacted PYUSD's price stability and market confidence.

- Current Impact: PayPal's supply management aims to maintain PYUSD's 1:1 peg to the US dollar, influencing price stability.

Institutional and Whale Dynamics

- Institutional Holdings: Major financial institutions and payment companies are increasingly adopting PYUSD for cross-border transactions and settlements.

- Corporate Adoption: PayPal's integration of PYUSD into its payment ecosystem has driven corporate adoption.

- National Policies: Regulatory clarity in the US and other major economies is shaping the institutional acceptance of PYUSD.

Macroeconomic Environment

- Monetary Policy Impact: Federal Reserve's interest rate decisions and monetary policies directly affect PYUSD's attractiveness as a dollar-pegged asset.

- Inflation Hedging Properties: PYUSD serves as a digital representation of the US dollar, reflecting its inflation hedging characteristics.

- Geopolitical Factors: Global economic uncertainties and trade tensions influence the demand for dollar-pegged stablecoins like PYUSD.

Technological Developments and Ecosystem Building

- Layer 2 Integration: PYUSD's planned integration with Layer 2 solutions aims to enhance transaction speed and reduce costs.

- Cross-chain Compatibility: Efforts to make PYUSD compatible across multiple blockchain networks to increase its utility and adoption.

- Ecosystem Applications: Growing number of DApps and financial services integrating PYUSD, expanding its use cases beyond payments.

III. PYUSD Price Prediction for 2025-2030

2025 Outlook

- Conservative forecast: $0.71942 - $0.9992

- Neutral forecast: $0.9992 - $1.27898

- Optimistic forecast: $1.27898 - $1.58333 (requires increased adoption and market stability)

2027 Mid-term Outlook

- Market phase expectation: Potential growth phase with increasing adoption

- Price range prediction:

- 2026: $0.80875 - $1.58333

- 2027: $0.83034 - $1.75596

- Key catalysts: Wider acceptance of stablecoins, regulatory clarity, and technological advancements

2030 Long-term Outlook

- Base scenario: $1.18811 - $2.1602 (assuming steady growth and adoption)

- Optimistic scenario: $2.1602 - $2.52743 (with accelerated mainstream adoption)

- Transformative scenario: $2.52743+ (under extremely favorable market conditions and widespread use)

- 2030-12-31: PYUSD $2.52743 (potential peak, subject to market dynamics)

| 年份 | 预测最高价 | 预测平均价格 | 预测最低价 | 涨跌幅 |

|---|---|---|---|---|

| 2025 | 1.27898 | 0.9992 | 0.71942 | 0 |

| 2026 | 1.58333 | 1.13909 | 0.80875 | 14 |

| 2027 | 1.75596 | 1.36121 | 0.83034 | 36 |

| 2028 | 2.04175 | 1.55859 | 1.29363 | 55 |

| 2029 | 2.52023 | 1.80017 | 1.74616 | 80 |

| 2030 | 2.52743 | 2.1602 | 1.18811 | 116 |

IV. Professional Investment Strategies and Risk Management for PYUSD

PYUSD Investment Methodology

(1) Long-term Holding Strategy

- Suitable for: Conservative investors seeking stable returns

- Operation suggestions:

- Accumulate PYUSD during market dips

- Set up recurring purchases to average out entry prices

- Store in a secure, non-custodial wallet

(2) Active Trading Strategy

- Technical analysis tools:

- Moving Averages: Monitor short-term and long-term trends

- Relative Strength Index (RSI): Identify overbought or oversold conditions

- Key points for swing trading:

- Observe trading volume for trend confirmation

- Set strict stop-loss orders to manage risk

PYUSD Risk Management Framework

(1) Asset Allocation Principles

- Conservative investors: 5-10% of portfolio

- Aggressive investors: 10-20% of portfolio

- Professional investors: 20-30% of portfolio

(2) Risk Hedging Solutions

- Diversification: Allocate across different stablecoins and asset classes

- Collateralization: Use PYUSD as collateral in DeFi protocols

(3) Secure Storage Solutions

- Hardware wallet recommendation: Gate Web3 Wallet

- Software wallet option: Official PayPal wallet

- Security precautions: Enable two-factor authentication, use strong passwords

V. Potential Risks and Challenges for PYUSD

PYUSD Market Risks

- Liquidity risk: Potential difficulty in large-scale redemptions

- Competition: Increased competition from other stablecoins

- Market perception: Changes in trust or reputation of PayPal or Paxos

PYUSD Regulatory Risks

- Regulatory scrutiny: Increased oversight of stablecoins by financial authorities

- Compliance changes: Potential new regulations affecting stablecoin issuers

- Cross-border restrictions: Varying legal status in different jurisdictions

PYUSD Technical Risks

- Smart contract vulnerabilities: Potential bugs in the underlying code

- Blockchain congestion: Transaction delays during high network activity

- Integration issues: Challenges with broader ecosystem adoption

VI. Conclusion and Action Recommendations

PYUSD Investment Value Assessment

PYUSD offers a stable store of value backed by a reputable company, with potential for increased adoption in the PayPal ecosystem. However, it faces regulatory uncertainties and competition from other stablecoins.

PYUSD Investment Recommendations

✅ Beginners: Start with small allocations as part of a diversified portfolio

✅ Experienced investors: Utilize PYUSD for trading pairs and DeFi opportunities

✅ Institutional investors: Consider PYUSD for treasury management and cross-border transactions

PYUSD Participation Methods

- Direct purchase: Buy PYUSD on Gate.com or other supported exchanges

- PayPal integration: Acquire PYUSD through the PayPal app

- DeFi protocols: Use PYUSD in various decentralized finance applications

Cryptocurrency investments carry extremely high risks, and this article does not constitute investment advice. Investors should make decisions based on their own risk tolerance and are advised to consult professional financial advisors. Never invest more than you can afford to lose.

FAQ

Will PayPal USD go up in value?

PayPal USD is projected to reach $0.9999 by end of 2025, showing a slight increase. This forecast is based on current market trends.

How much is Pyusd worth today?

As of December 15, 2025, Pyusd is worth $0.9996. This price reflects the current market value of the stablecoin, which typically aims to maintain a value close to $1.

How much will 1 pi be worth in 2025?

Based on current projections, 1 Pi is expected to be worth around $0.16 in 2025, with a potential range between $0.14 and $0.21.

What is the price prediction for PayPal in 2025?

Based on analyst forecasts, PayPal's stock price is predicted to reach $83.10 by 2025, representing a potential 36.90% increase from its current value.

XZXX: A Comprehensive Guide to the BRC-20 Meme Token in 2025

Bitcoin Fear and Greed Index: Market Sentiment Analysis for 2025

Top Crypto ETFs to Watch in 2025: Navigating the Digital Asset Boom

5 ways to get Bitcoin for free in 2025: Newbie Guide

Bitcoin Market Cap in 2025: Analysis and Trends for Investors

2025 Bitcoin Price Prediction: Trump's Tariffs' Impact on BTC

What is Zcash (ZEC) fundamentals: zk-SNARKs technology, tokenomics, and privacy adoption in 2025?

What is VVV: A Comprehensive Guide to Understanding Virtual Venture Validation in Modern Business

What is NOT: The Common Misconceptions About Artificial Intelligence That You Should Know

What is COTI: A Comprehensive Guide to the Scalable Payment Network for Enterprise Solutions

What is LON: A Comprehensive Guide to Understanding Local Area Networks