2025 TNSR Price Prediction: Expert Analysis and Market Forecast for Tensar International Holdings

Introduction: Market Position and Investment Value of TNSR

Tensor (TNSR), positioned as Solana's leading NFT marketplace for both traders and creators, has established itself as a significant player in the digital asset ecosystem since its inception. As of December 2025, TNSR has achieved a market capitalization of $86.38 million, with a circulating supply of approximately 334.61 million tokens trading at around $0.08638. This innovative platform is playing an increasingly critical role in facilitating NFT trading and creation on the Solana blockchain.

This article will provide a comprehensive analysis of TNSR's price dynamics, integrating historical performance patterns, market supply and demand dynamics, ecosystem development, and macroeconomic factors to deliver professional price forecasts and practical investment strategies for investors looking to understand TNSR's trajectory through 2025 and beyond.

Tensor (TNSR) Market Analysis Report

I. TNSR Price History Review and Market Status

TNSR Historical Price Evolution

- April 2024: Project reached its all-time high (ATH) of $3.89, marking peak market enthusiasm for Tensor's Solana NFT marketplace platform.

- October 2025: Price declined to all-time low (ATL) of $0.02852, representing a significant contraction from peak valuations.

- December 2025: Current trading price stands at $0.08638, reflecting ongoing volatility and market adjustments.

TNSR Current Market Position

TNSR is currently ranked #712 by market capitalization, with a total market cap of approximately $86.38 million. The token exhibits a circulating supply of 334.61 million TNSR out of a total supply of 1 billion tokens, representing approximately 33.46% circulation.

24-Hour Price Performance: TNSR declined by 2.55% over the past 24 hours, with daily trading ranging between $0.08368 and $0.08958. The 24-hour trading volume reached $442,024.15.

Medium-term Performance Metrics:

- 1-hour change: +0.88%

- 7-day change: -8.98%

- 30-day change: -2.27%

- 1-year change: -82.95%

The token has experienced substantial long-term depreciation, declining over 82% year-over-year from its previous valuations. The market sentiment currently reflects extreme fear, indicating cautious market conditions.

TNSR operates on the Solana blockchain using the SPL token standard and is available for trading across 38 cryptocurrency exchanges. The token maintains an active holder community of approximately 22,667 addresses.

Click to view current TNSR market price

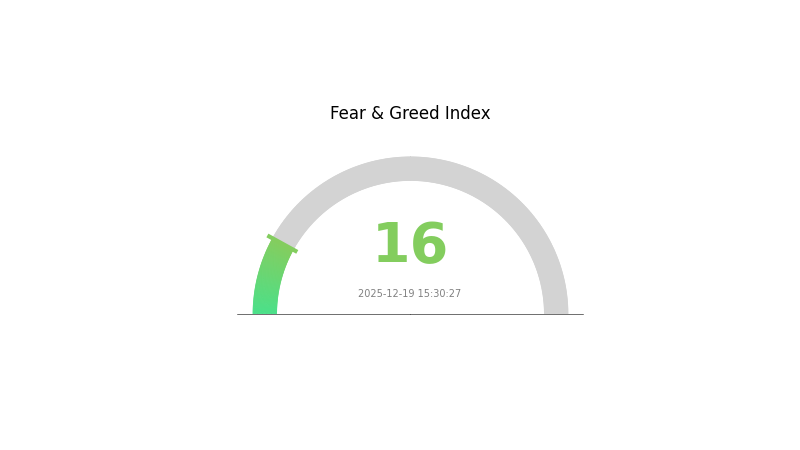

TNSR Market Sentiment Indicator

2025-12-19 Fear and Greed Index: 16 (Extreme Fear)

Click to view the current Fear & Greed Index

The crypto market is experiencing extreme fear, with the index dropping to 16. This rare signal suggests intense market pessimism and significant selling pressure. Investors are displaying heightened risk aversion, potentially creating oversold conditions. Such extreme readings historically precede market reversals, offering contrarian opportunities for long-term investors. However, caution remains advisable as downside risks persist. Monitor key support levels closely and consider your risk tolerance before making investment decisions. Stay informed through Gate.com's comprehensive market data tools.

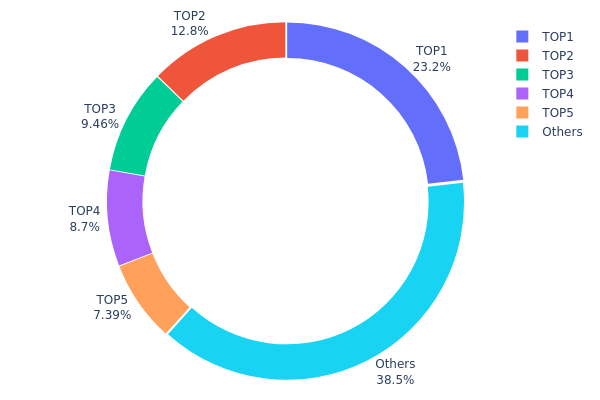

TNSR Holdings Distribution

Address holdings distribution represents the allocation of TNSR tokens across different wallet addresses on the blockchain, serving as a critical indicator of token concentration and market structure. By analyzing how tokens are distributed among top holders and the broader network, investors can assess the level of decentralization, potential risks of market manipulation, and the overall health of the token ecosystem.

The current TNSR holdings distribution reveals a moderately concentrated market structure. The top five addresses collectively control approximately 61.5% of all tokens in circulation, with the largest holder (FZDZuL...FLQ6ND) commanding 23.20% of the total supply. While this concentration level is not uncommon in emerging blockchain projects, it does present notable considerations. The second-largest address holds 12.75%, followed by progressively smaller positions among the third through fifth addresses. The remaining 38.5% of tokens are distributed among numerous other addresses, indicating a relatively fragmented secondary market structure that could provide some resilience against coordinated large-scale movements.

This distribution pattern suggests moderate centralization risks paired with underlying market diversification. The concentration of over one-fifth of the token supply in a single address could potentially influence price movements during periods of volatility or significant market events, though the substantial portion held by dispersed addresses mitigates extreme manipulation scenarios. The current structure reflects a market in transition, balancing between early investor concentration and broader community participation, which is typical during the maturation phase of protocol adoption.

Click to view current TNSR Holdings Distribution

| Top | Address | Holding Qty | Holding (%) |

|---|---|---|---|

| 1 | FZDZuL...FLQ6ND | 181912.39K | 23.20% |

| 2 | GzFKSq...TCQZRg | 99999.90K | 12.75% |

| 3 | 9WzDXw...YtAWWM | 74149.99K | 9.46% |

| 4 | FEhNUh...KK7H4J | 68214.75K | 8.70% |

| 5 | DUhy8s...uHyvrc | 57943.11K | 7.39% |

| - | Others | 301570.96K | 38.5% |

II. Core Factors Influencing TNSR's Future Price

Technology Development and Ecosystem Building

-

Technology Upgrades: TNSR's price is influenced by ongoing technology upgrades and protocol improvements. These technical enhancements drive ecosystem adoption and user engagement.

-

AI-DeFi Narrative: The AI-DeFi narrative represents a significant growth vector for TNSR, positioning the token within emerging market trends that attract investor interest and capital inflows.

-

Ecosystem Applications: TNSR's utility spans multiple use cases including governance voting, trading fee discounts, and ecosystem incentives. These applications expand continuously as the Solana ecosystem develops, providing tangible value drivers for token holders.

Solana Ecosystem Development

The price trajectory of TNSR remains closely correlated with the broader Solana ecosystem's growth and adoption. As Solana continues to strengthen its position as a leading blockchain platform, TNSR benefits from increased network activity, developer engagement, and user adoption within the ecosystem.

Governance and Incentive Mechanisms

TNSR operates through community-led governance administered by Tensor DAO, with investors focusing on the token's governance structure and incentive mechanisms. These mechanisms directly influence token demand and long-term holder sentiment.

Market Volatility

TNSR exhibits significant price volatility, indicating sensitivity to market sentiment shifts, news events, and broader cryptocurrency market dynamics. This heightened volatility requires careful risk assessment from investors considering positions in the token.

Three、2025-2030 TNSR Price Forecast

2025 Outlook

- Conservative Forecast: $0.06151 - $0.08664

- Neutral Forecast: $0.08664

- Optimistic Forecast: $0.09964 (requires sustained market momentum and positive ecosystem developments)

2026-2027 Mid-term Outlook

- Market Stage Expectation: Gradual recovery and consolidation phase with increasing institutional adoption

- Price Range Forecast:

- 2026: $0.05775 - $0.12574

- 2027: $0.06785 - $0.15321

- Key Catalysts: Protocol upgrades, ecosystem expansion, increased developer adoption, and strengthening market sentiment

2028-2030 Long-term Outlook

- Base Case Scenario: $0.06829 - $0.18385 (assuming moderate adoption growth and stable market conditions)

- Optimistic Scenario: $0.11504 - $0.22112 (contingent on mainstream adoption acceleration and positive regulatory environment)

- Transformative Scenario: $0.22112+ (representing extreme favorable conditions with breakthrough technological innovations and widespread enterprise integration)

Key Price Milestones: By 2030, TNSR is projected to potentially reach $0.22112 at peak levels, representing an approximate 82-92% cumulative gain from current 2025 levels, reflecting sustained development momentum and expanding market recognition across the crypto ecosystem.

| 年份 | 预测最高价 | 预测平均价格 | 预测最低价 | 涨跌幅 |

|---|---|---|---|---|

| 2025 | 0.09964 | 0.08664 | 0.06151 | 0 |

| 2026 | 0.12574 | 0.09314 | 0.05775 | 7 |

| 2027 | 0.15321 | 0.10944 | 0.06785 | 26 |

| 2028 | 0.18385 | 0.13132 | 0.06829 | 52 |

| 2029 | 0.17492 | 0.15759 | 0.11504 | 82 |

| 2030 | 0.22112 | 0.16626 | 0.14963 | 92 |

TNSR Professional Investment Strategy and Risk Management Report

IV. TNSR Professional Investment Strategy and Risk Management

TNSR Investment Methodology

(1) Long-term Holding Strategy

- Suitable Investors: NFT market participants, Solana ecosystem believers, and long-term blockchain technology supporters

- Operational Recommendations:

- Accumulate TNSR during market downturns, particularly when prices experience significant corrections from all-time highs

- Maintain a position for 12+ months to benefit from potential ecosystem growth on Solana

- Dollar-cost averaging (DCA) approach to reduce timing risk and smooth out volatility

(2) Active Trading Strategy

- Technical Analysis Tools:

- Support and Resistance Levels: Monitor key price levels at $0.08368 (24H low) and $0.08958 (24H high) for entry and exit signals

- Moving Averages: Utilize both short-term (7-day) and long-term (30-day) moving averages to identify trend direction and momentum shifts

- Wave Trading Key Points:

- Take advantage of the recent 24-hour decline of -2.55% for potential reversal opportunities

- Monitor the 7-day performance (-8.98%) to identify whether downtrend momentum is weakening

TNSR Risk Management Framework

(1) Asset Allocation Principles

- Conservative Investors: 1-3% of total portfolio allocation to TNSR and similar NFT marketplace tokens

- Active Investors: 3-8% of total portfolio allocation, considering higher volatility tolerance

- Professional Investors: 5-15% of total portfolio allocation with sophisticated hedging strategies

(2) Risk Hedging Strategies

- Diversification Across Blockchain Platforms: Balance Solana ecosystem exposure with positions in other blockchain networks to reduce single-chain dependency risk

- Stablecoin Reserve Strategy: Maintain 30-50% of allocated capital in stablecoins to capitalize on significant price corrections

(3) Secure Storage Solution

- Hot Wallet Method: Gate.com Web3 Wallet for active trading and frequent transactions

- Cold Storage Approach: Transfer TNSR tokens to Solana-compatible hardware security solutions for long-term holdings exceeding 12 months

- Security Precautions: Never share private keys or seed phrases; enable two-factor authentication on all exchange accounts; verify contract addresses before any transfers

V. TNSR Potential Risks and Challenges

TNSR Market Risk

- Extreme Volatility: TNSR has experienced an 82.95% decline over the past year, demonstrating significant price instability that can result in substantial losses for investors

- Limited Trading Liquidity: With 24-hour trading volume of $442,024.14, the token exhibits relatively low liquidity compared to major cryptocurrencies, which may result in slippage during large transactions

- Market Sentiment Dependency: As an NFT marketplace token, TNSR is highly sensitive to broader NFT market trends and sentiment shifts, which can trigger rapid price corrections

TNSR Regulatory Risk

- Evolving Regulatory Landscape: Different jurisdictions continue to develop varying regulations for cryptocurrency tokens and NFT platforms, potentially impacting TNSR's operational scope

- Securities Classification Uncertainty: The classification of utility tokens as securities remains uncertain in many regions, creating potential compliance challenges

- Cross-Border Compliance: Tensor's operations across multiple jurisdictions require ongoing compliance with diverse regulatory frameworks

TNSR Technical Risk

- Smart Contract Vulnerability: Any undiscovered vulnerabilities in Tensor's smart contracts could compromise user funds and platform security

- Solana Network Dependency: TNSR's functionality is entirely dependent on Solana blockchain's stability and performance; network outages or congestion directly impact operations

- Competition from Alternatives: Other NFT marketplaces and platforms may introduce superior features or better user experiences, potentially reducing Tensor's market share

VI. Conclusion and Action Recommendations

TNSR Investment Value Assessment

Tensor (TNSR) represents exposure to the Solana NFT marketplace ecosystem, which remains a critical component of Solana's DeFi and Web3 infrastructure. However, the token's 82.95% year-over-year decline and relatively low market capitalization ($28.9 million) indicate significant volatility and limited mainstream adoption. The token's fundamental value is intrinsically linked to NFT market cycles and Solana's continued development. Investors should carefully evaluate whether the potential upside aligns with their risk tolerance, considering the speculative nature of NFT marketplace tokens and current market headwinds in the broader NFT sector.

TNSR Investment Recommendations

✅ Beginners: Start with minimal allocations (0.5-1% of portfolio) through Gate.com's spot trading platform, using limit orders to avoid market volatility. Focus on understanding the Solana ecosystem and NFT market dynamics before increasing exposure.

✅ Experienced Investors: Implement a structured DCA approach during extended downtrends, combining technical analysis with fundamental assessment of Tensor's market position. Consider allocating 3-5% of your portfolio for tactical positions based on technical support levels.

✅ Institutional Investors: Conduct comprehensive due diligence on Tensor's tokenomics, governance structure, and competitive positioning within the Solana NFT ecosystem. Develop customized hedging strategies and use Gate.com's institutional trading services for optimal execution.

TNSR Trading Participation Methods

- Spot Trading: Purchase TNSR directly on Gate.com using stablecoins or other cryptocurrencies, ideal for long-term holders and conservative investors

- Limit Orders: Set specific price targets on Gate.com to accumulate TNSR at predetermined levels, reducing emotional decision-making

- Portfolio Rebalancing: Periodically adjust TNSR holdings as part of a broader cryptocurrency portfolio rebalancing strategy to maintain target allocation percentages

Cryptocurrency investments carry extreme risk. This report does not constitute investment advice. All investors must carefully evaluate their risk tolerance and financial situation before participating in cryptocurrency markets. It is strongly recommended to consult with professional financial advisors. Never invest capital that you cannot afford to lose completely.

FAQ

What is TNSR crypto?

TNSR is a decentralized governance token for Solana's NFT marketplace, enabling traders to participate in protocol decisions and support the ecosystem's leading NFT protocols.

Who is the owner of TNSR coin?

TNSR coin is owned and led by Richard Wu, the CEO, alongside co-founder and CTO Kamran Rawji. The project is managed by the Tensor team.

What factors influence TNSR price movements?

TNSR price movements are driven by market sentiment, trading volume, technological developments, and user adoption trends. Network activity and broader crypto market conditions also impact price fluctuations.

What is the market cap and trading volume of TNSR?

As of December 15, 2025, TNSR's market cap is $32 million with a daily trading amount of $20,000. These metrics reflect current market conditions and may vary based on trading activity.

What are expert price predictions for TNSR in 2025?

Expert forecasts suggest TNSR could reach a minimum of $0.091191229 and average of $0.09773767 in 2025. These predictions are based on machine gradient methods and WalletInvestor analysis, indicating potential upside from current levels.

2025 BLUR Price Prediction: Analyzing Market Trends and Future Potential for the NFT Marketplace Token

2025 RAYPrice Prediction: Analyzing Growth Factors and Market Potential for RAY Token in the Coming Years

2025 RAY Price Prediction: Will This Layer-1 Protocol Reach New Heights in the Evolving DeFi Landscape?

2025 SAROS Price Prediction: Analyzing Future Growth Potential and Market Trends for this Emerging Cryptocurrency

2025 SAROS Price Prediction: Comprehensive Analysis and Future Outlook for the Digital Asset Market

2025 SOL Price Prediction: Analyzing Market Trends and Potential Growth Factors for Solana

Getting Started with Blockchain Development: A Beginner's Guide

Understanding How Crypto Lending Works: A Guide to Cryptocurrency Loan Platforms

Crypto Faucet Access: Simple Steps to Log In to Your Account

Understanding Cryptocurrency Records: The Basics Explained

Understanding the Concept and Significance of NFTs