2025 TON Price Prediction: Will Telegram's Native Token Reach New Highs Amid Growing Adoption?

Introduction: TON's Market Position and Investment Value

The Open Network (TON) has established itself as a next-generation blockchain platform since its inception in 2021, achieving significant milestones in speed, security, and scalability. As of 2025, TON's market capitalization has reached $3.67 billion, with a circulating supply of approximately 2.45 billion coins, and a price hovering around $1.499. This asset, often referred to as the "Telegram-inspired blockchain," is playing an increasingly crucial role in decentralized finance (DeFi) and mainstream cryptocurrency adoption.

This article will provide a comprehensive analysis of TON's price trends from 2025 to 2030, considering historical patterns, market supply and demand, ecosystem development, and macroeconomic factors to offer professional price predictions and practical investment strategies for investors.

I. TON Price History Review and Current Market Status

TON Historical Price Evolution

- 2021: TON launched at $0.4296, reaching an all-time low of $0.519364 on September 21

- 2024: TON hit its all-time high of $8.25 on June 15, marking a significant milestone

- 2025: Market cycle shift, price dropped from the peak to the current $1.499

TON Current Market Situation

TON is currently trading at $1.499, ranking 35th in the crypto market with a market capitalization of $3,673,057,675. The 24-hour trading volume stands at $1,630,206, indicating moderate market activity. TON has experienced a 5.6% decrease in the last 24 hours and a more substantial 17.25% decline over the past 30 days. The coin's circulating supply is 2,450,338,675.85 TON, representing 47.59% of the total supply. Despite the recent downtrend, TON's price remains significantly higher than its initial offering price, showing a 249% increase since launch.

Click to view the current TON market price

TON Market Sentiment Indicator

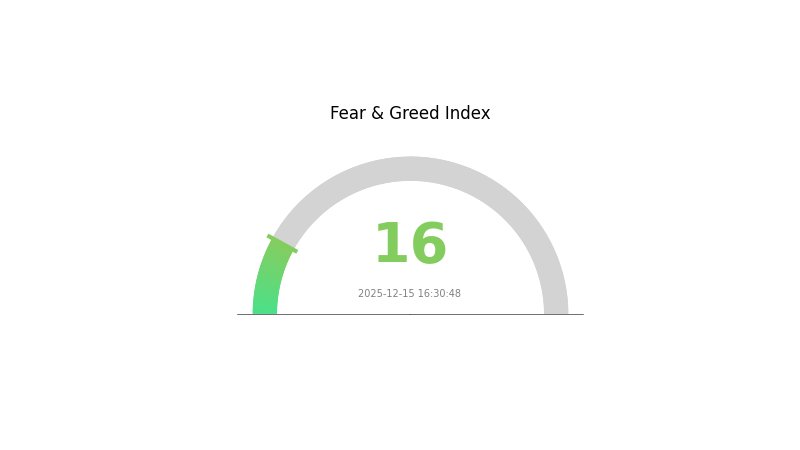

2025-12-15 Fear and Greed Index: 16 (Extreme Fear)

Click to view the current Fear & Greed Index

The crypto market sentiment for TON has plunged into extreme fear territory, with the index registering a mere 16 points. This significant drop signals a highly pessimistic outlook among investors, potentially creating oversold conditions. Historically, such extreme fear levels have often preceded market bottoms, presenting potential buying opportunities for contrarian investors. However, caution is advised as market volatility may persist. Traders should closely monitor key support levels and any signs of sentiment reversal before making investment decisions.

TON Holdings Distribution

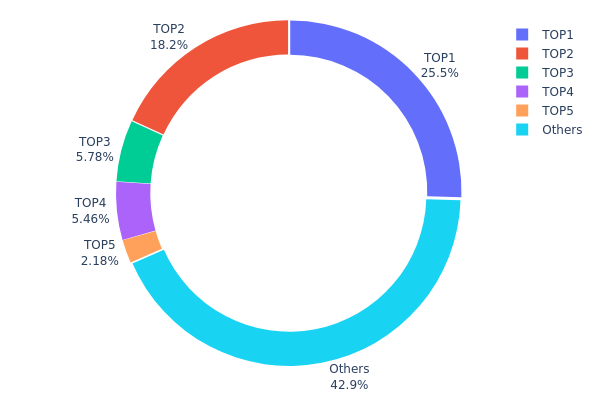

The address holdings distribution data reveals significant concentration in TON ownership. The top address holds 25.51% of the total supply, while the top five addresses collectively control 57.08% of TON tokens. This high level of concentration suggests a potentially centralized ownership structure, which could have implications for market dynamics and price volatility.

The substantial holdings by a few addresses may pose risks to market stability. Large-scale transactions by these major holders could potentially influence TON's price movements and liquidity. Furthermore, this concentration may raise concerns about the network's decentralization, as a small number of entities could potentially exert significant influence over governance decisions or network operations.

However, it's worth noting that 42.92% of TON tokens are distributed among other addresses, indicating some level of wider distribution. This suggests a balance between major stakeholders and a broader community of holders, which could contribute to the overall stability and resilience of the TON ecosystem.

Click to view the current TON holdings distribution

| Top | Address | Holding Qty | Holding (%) |

|---|---|---|---|

| 1 | 0:ED16...5EF8A7 | 1313644.03K | 25.51% |

| 2 | -1:333...333333 | 935015.99K | 18.16% |

| 3 | 0:8C39...B47AB3 | 297521.80K | 5.77% |

| 4 | 0:66CD...F61640 | 281223.66K | 5.46% |

| 5 | -1:E69...C30104 | 112400.33K | 2.18% |

| - | Others | 2208465.86K | 42.92% |

II. Key Factors Influencing TON's Future Price

Supply Mechanism

- Network Utility: The utility of Toncoin within the TON ecosystem will influence its price.

- Current Impact: The expansion of TON's ecosystem and increased adoption are expected to positively impact the token's value.

Institutional and Whale Dynamics

- Corporate Adoption: Telegram's integration and promotion of TON are likely to drive corporate adoption and usage.

Macroeconomic Environment

- Inflation Hedging Properties: TON's performance in inflationary environments may affect its appeal as a potential hedge.

Technological Development and Ecosystem Building

- Infinite Sharding: This technology solves network scaling issues, enhancing TON's efficiency and scalability.

- Instant Hypercube Routing: Ensures low-latency cross-chain interactions, improving overall network performance.

- Self-Healing Vertical Blockchain: Unique design that corrects invalid blocks without forking, maintaining system consistency and stability.

- Ecosystem Applications: As of May 28, 2024, the TON ecosystem had 792 apps, with 14 listed on DeFiLlama, covering various sectors including liquidity staking, DEX, DeFi, privacy, SocialFi, and gaming.

III. TON Price Prediction for 2025-2030

2025 Outlook

- Conservative prediction: $0.87 - $1.5

- Neutral prediction: $1.5 - $1.8

- Optimistic prediction: $1.8 - $2.175 (requires sustained network growth and adoption)

2026-2028 Outlook

- Market stage expectation: Potential consolidation and gradual growth

- Price range forecast:

- 2026: $1.176 - $2.07638

- 2027: $1.52641 - $2.03522

- 2028: $1.41721 - $2.51506

- Key catalysts: Increased dApp ecosystem, institutional adoption, and technological improvements

2029-2030 Long-term Outlook

- Base scenario: $2.25557 - $2.43601 (assuming steady market growth and adoption)

- Optimistic scenario: $2.61646 - $3.11809 (assuming accelerated adoption and favorable market conditions)

- Transformative scenario: $3.11809+ (extreme positive developments in the crypto market and TON ecosystem)

- 2030-12-31: TON $3.11809 (potential peak based on optimistic projections)

| 年份 | 预测最高价 | 预测平均价格 | 预测最低价 | 涨跌幅 |

|---|---|---|---|---|

| 2025 | 2.175 | 1.5 | 0.87 | 0 |

| 2026 | 2.07638 | 1.8375 | 1.176 | 22 |

| 2027 | 2.03522 | 1.95694 | 1.52641 | 30 |

| 2028 | 2.51506 | 1.99608 | 1.41721 | 32 |

| 2029 | 2.61646 | 2.25557 | 1.51123 | 49 |

| 2030 | 3.11809 | 2.43601 | 1.99753 | 61 |

IV. Professional TON Investment Strategies and Risk Management

TON Investment Methodology

(1) Long-term Holding Strategy

- Suitable for: Long-term investors with high risk tolerance

- Operational suggestions:

- Accumulate TON during market dips

- Set price targets and stick to your investment plan

- Store TON in secure non-custodial wallets

(2) Active Trading Strategy

- Technical analysis tools:

- Moving Averages: Use to identify trends and potential reversal points

- Relative Strength Index (RSI): Helps gauge overbought/oversold conditions

- Key points for swing trading:

- Monitor TON's correlation with broader crypto market trends

- Set strict stop-loss orders to manage downside risk

TON Risk Management Framework

(1) Asset Allocation Principles

- Conservative investors: 1-3% of crypto portfolio

- Aggressive investors: 5-10% of crypto portfolio

- Professional investors: Up to 15% of crypto portfolio

(2) Risk Hedging Solutions

- Diversification: Spread investments across different blockchain projects

- Options strategies: Use options to protect against downside risk

(3) Secure Storage Solutions

- Hot wallet recommendation: Gate Web3 Wallet

- Cold storage solution: Hardware wallets for long-term holdings

- Security precautions: Enable two-factor authentication, use strong passwords

V. Potential Risks and Challenges for TON

TON Market Risks

- High volatility: TON price can experience significant short-term fluctuations

- Market sentiment: Influenced by broader crypto market trends and news

- Liquidity risk: Potential challenges in large-volume trades during market stress

TON Regulatory Risks

- Uncertain regulatory landscape: Potential for stricter regulations in various jurisdictions

- Legal status: Ongoing debates about classification of cryptocurrencies

- Cross-border transactions: Potential restrictions on international transfers

TON Technical Risks

- Network security: Potential vulnerabilities in the blockchain infrastructure

- Scalability challenges: Ability to handle increased transaction volume

- Smart contract risks: Potential bugs or exploits in smart contract code

VI. Conclusion and Action Recommendations

TON Investment Value Assessment

TON presents a high-risk, high-potential investment opportunity. Its long-term value proposition is based on its scalable blockchain technology and potential for mass adoption. However, short-term risks include market volatility and regulatory uncertainties.

TON Investment Recommendations

✅ Newcomers: Start with small positions, focus on education and understanding the technology ✅ Experienced investors: Consider TON as part of a diversified crypto portfolio, actively manage risk ✅ Institutional investors: Conduct thorough due diligence, consider TON for long-term blockchain exposure

TON Trading Participation Methods

- Spot trading: Buy and hold TON on reputable exchanges like Gate.com

- Staking: Participate in TON staking programs for potential passive income

- DeFi integration: Explore decentralized finance opportunities within the TON ecosystem

Cryptocurrency investments carry extremely high risks, and this article does not constitute investment advice. Investors should make decisions carefully based on their own risk tolerance and are advised to consult professional financial advisors. Never invest more than you can afford to lose.

FAQ

What will TON be worth in 2025?

TON is expected to be worth between $1.55 and $1.70 in December 2025, based on current market trends and adoption rates.

Does Toncoin have a future?

Yes, Toncoin has potential. Despite recent price dips, its innovative blockchain technology and growing ecosystem suggest long-term viability. Adoption and development continue to progress.

Can Toncoin reach $50?

Yes, Toncoin is projected to reach $50 by 2025 based on current market trends and development prospects.

Can Toncoin reach $100?

Toncoin reaching $100 is possible but unlikely in the near future. It may occur in the very long term, possibly beyond 2040, with extraordinary adoption and market growth.

XZXX: A Comprehensive Guide to the BRC-20 Meme Token in 2025

Bitcoin Fear and Greed Index: Market Sentiment Analysis for 2025

Top Crypto ETFs to Watch in 2025: Navigating the Digital Asset Boom

5 ways to get Bitcoin for free in 2025: Newbie Guide

Bitcoin Market Cap in 2025: Analysis and Trends for Investors

2025 Bitcoin Price Prediction: Trump's Tariffs' Impact on BTC

Is Falcon Finance (FF) a good investment?: A Comprehensive Analysis of Returns, Risks, and Market Potential

Is Zebec Protocol (ZBCN) a good investment?: A Comprehensive Analysis of Tokenomics, Use Cases, and Market Potential in 2024

Is Audiera (BEAT) a good investment?: A Comprehensive Analysis of Tokenomics, Market Potential, and Risk Factors

Is zkSync (ZK) a good investment?: A Comprehensive Analysis of Layer 2 Scaling Solutions and Future Prospects

TBC vs MANA: A Comprehensive Comparison of Two Leading Blockchain Governance Tokens