2025 TRUST Price Prediction: Expert Analysis and Market Forecast for the Coming Year

Introduction: Market Position and Investment Value of TRUST

Intuition (TRUST) serves as a decentralized knowledge graph protocol that merges cryptoeconomic incentives with information finance infrastructure. Built by a team of crypto industry veterans and decentralized identity pioneers—many of whom began collaborating at ConsenSys nearly a decade ago—Intuition extends blockchain technology beyond financial applications. As of December 2025, TRUST has achieved a market capitalization of approximately $109.97 million, with a circulating supply of around 179.65 million tokens and a current price hovering near $0.10997. This innovative asset, recognized as a "permissionless information finance protocol," is playing an increasingly critical role in decentralizing information distribution and enabling verifiable knowledge monetization across blockchain networks.

This article will provide a comprehensive analysis of TRUST's price trajectory and market dynamics, incorporating historical performance patterns, supply-demand fundamentals, ecosystem development, and macroeconomic factors to deliver professional price forecasts and actionable investment strategies for the period through 2030.

Intuition (TRUST) Market Analysis Report

I. TRUST Price History Review and Market Status

TRUST Current Market Performance

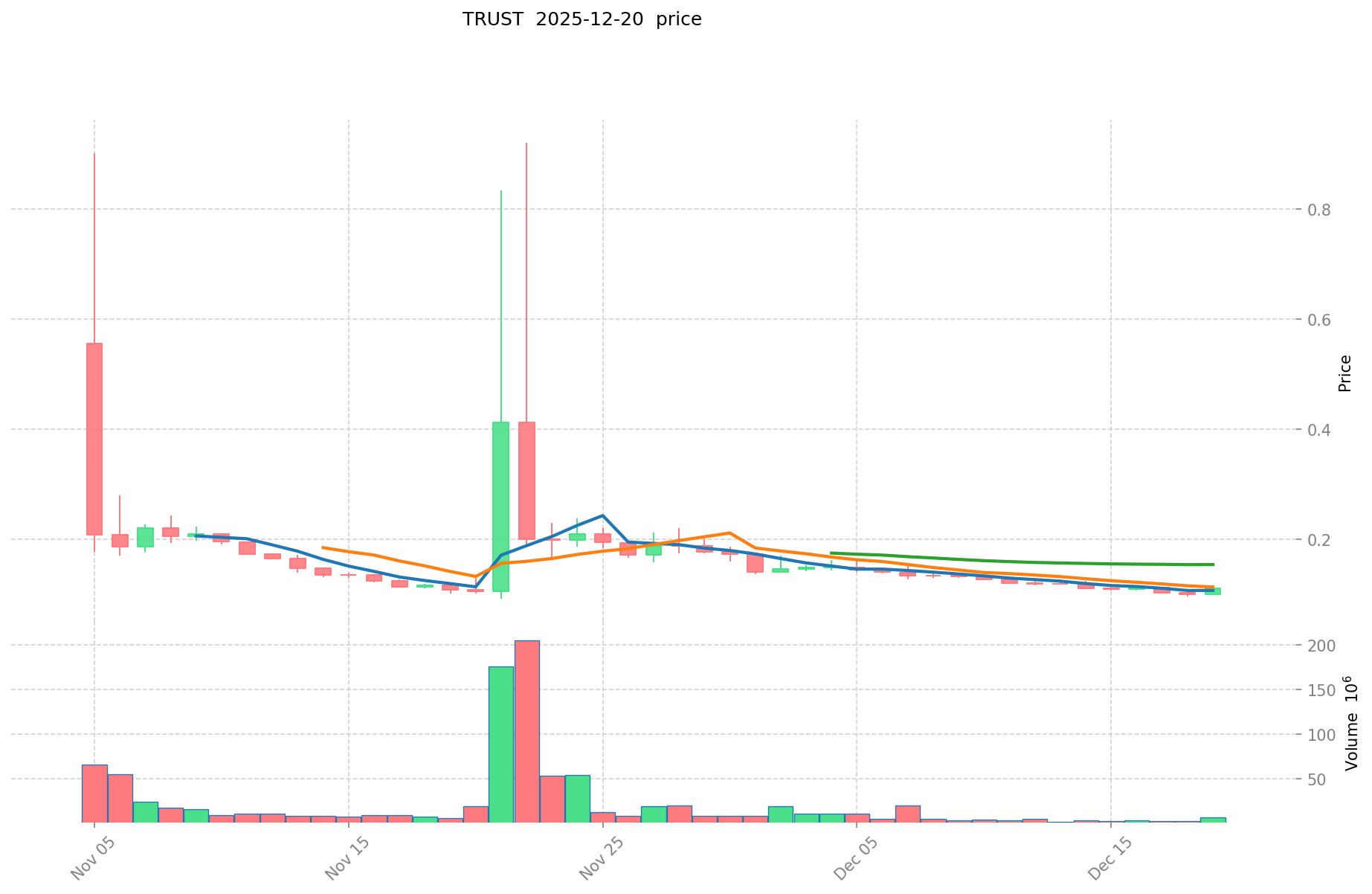

As of December 20, 2025, TRUST is trading at $0.10997, reflecting significant volatility since its recent launch. The token has experienced notable price movements within a short timeframe:

- All-Time High (ATH): $0.91999, reached on November 22, 2025

- All-Time Low (ATL): $0.09206, reached on November 21, 2025

This represents a dramatic price range of approximately 900% from ATL to ATH within just one day, indicating extreme market volatility characteristic of newly launched tokens.

TRUST Recent Price Trends

The 24-hour price performance shows a modest recovery with a +1.6% gain, though longer-term trends reveal significant pullback:

- 1-Hour Change: -0.75%

- 24-Hour Change: +1.6%

- 7-Day Change: -7.97%

- 30-Day Change: -5.28%

- 1-Year Change: -35.56%

The current trading range sits between $0.10628 (24-hour low) and $0.11708 (24-hour high), indicating consolidation around support levels.

TRUST Market Metrics

- Current Price: $0.10997

- Market Capitalization: $19,755,872.08504

- Fully Diluted Valuation (FDV): $109,970,000

- Circulating Supply: 179,647,832 TRUST (17.96% of total supply)

- Total Supply: 1,000,000,000 TRUST

- Market Cap/FDV Ratio: 17.96%

- 24-Hour Trading Volume: $650,683.02522

- Total Holders: 9,665

The token's market dominance stands at 0.0034%, positioning it outside the top 100 cryptocurrencies by market cap (current ranking: 875).

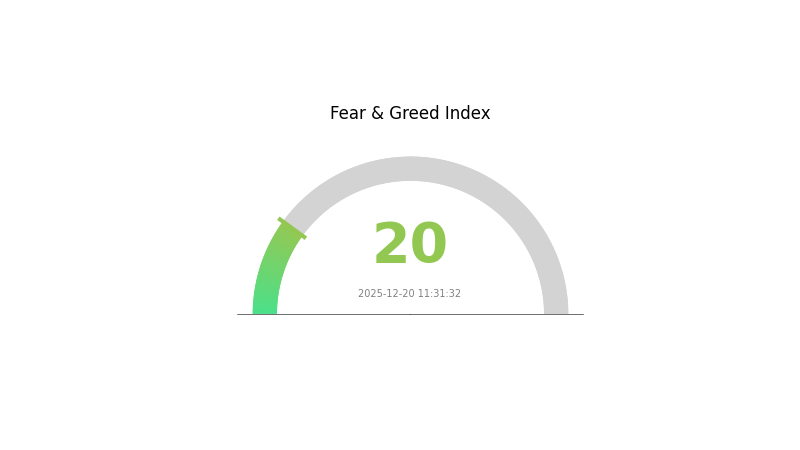

Market Sentiment and Conditions

The current market environment reflects "Extreme Fear" (VIX: 20), which typically influences risk asset valuations including emerging tokens. The significant gap between current market cap and FDV suggests limited current token circulation relative to total supply, indicating substantial upside or downside potential depending on market sentiment shifts.

Click to view current TRUST market price

TRUST Market Sentiment Index

2025-12-20 Fear and Greed Index: 20 (Extreme Fear)

Click to view current Fear & Greed Index

Market Analysis:

The crypto market is experiencing extreme fear with an index reading of 20. This indicates severe pessimism among investors, with widespread concern about market direction and potential further downturns. Such extreme fear levels historically present contrarian opportunities, as panic-driven selling often creates entry points for long-term investors. However, heightened volatility and risk remain present. Market participants should exercise caution, maintain proper risk management, and avoid emotional decision-making during periods of extreme market sentiment. Monitor Gate.com's market data tools for real-time sentiment tracking and trading opportunities.

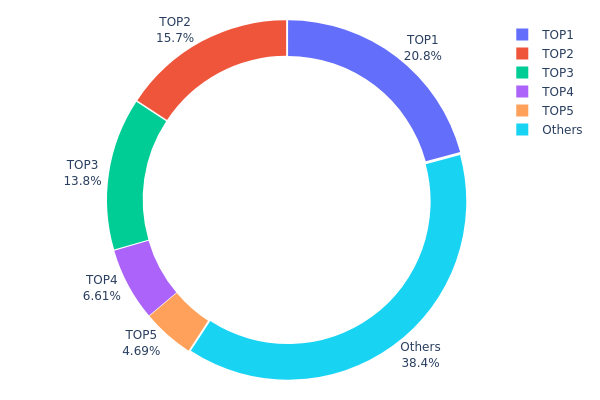

TRUST Holdings Distribution

The address holdings distribution represents the concentration of TRUST tokens across different wallet addresses on the blockchain. This metric is fundamental for assessing token decentralization, market structure stability, and the potential for price manipulation. By analyzing how token supply is distributed among top holders and the broader community, we can evaluate the health of the token's ecosystem and the degree of market concentration risk.

The current holdings data reveals a moderate concentration pattern in TRUST's token distribution. The top five addresses collectively control approximately 61.58% of the total token supply, with the largest holder commanding 20.79% and the second-largest holding 15.73%. While this concentration level warrants attention, it does not necessarily indicate extreme centralization, particularly if these addresses represent project reserves, team allocations, or institutional custody arrangements. The distribution of 38.42% among remaining addresses suggests a reasonably dispersed secondary holder base, which provides some resilience against single-point control scenarios.

From a market dynamics perspective, the current address concentration presents moderate structural implications. With the top three addresses holding 50.29% of all tokens, there exists a non-negligible risk of coordinated selling pressure or sudden liquidity adjustments that could trigger volatility. However, the presence of a substantial "Others" segment indicates that retail participation and smaller holders maintain meaningful representation in the token's ownership structure. This bifurcated distribution pattern—combining large concentrated positions with a distributed tail—is characteristic of maturing cryptocurrency projects transitioning from early-stage consolidation toward broader market adoption.

Click to view current TRUST holdings distribution

| Top | Address | Holding Qty | Holding (%) |

|---|---|---|---|

| 1 | 0xbc01...4f4cdf | 210359.71K | 20.79% |

| 2 | 0xa65f...c0bc4a | 159180.51K | 15.73% |

| 3 | 0x98bf...e06796 | 139364.60K | 13.77% |

| 4 | 0xca14...fdf881 | 66893.62K | 6.61% |

| 5 | 0x7461...ce551f | 47434.22K | 4.68% |

| - | Others | 388305.80K | 38.42% |

II. Core Factors Affecting TRUST's Future Price

Macroeconomic Environment

-

Federal Reserve Monetary Policy Impact: The Federal Reserve's policy stance is a critical factor influencing TRUST's price trajectory. Loose monetary policies, such as interest rate cuts, reduce the opportunity cost of holding non-yielding assets. The uncertainty surrounding the Fed's rate-cutting decisions directly impacts market sentiment. As of late 2024, the Fed maintains a cautious approach toward rate cuts, with officials emphasizing the need for greater confidence in inflation's sustained movement toward the 2% target before implementing cuts. Traders have priced in varying probabilities for Fed rate cuts at different horizons, creating volatility in asset prices.

-

Inflation Hedge Characteristics: TRUST serves as an inflation hedge in high-inflation environments. Historically, assets with inflation-protective qualities gain appeal when price pressures rise unexpectedly. In deflationary or low-inflation scenarios, such hedging demand diminishes. Recent CPI data showing slower growth rates—with June 2024 CPI at 3% year-over-year and core CPI at 3.3%—has reduced immediate inflation concerns, though long-term inflation expectations remain a key consideration for investors seeking to protect purchasing power.

-

Geopolitical Risk Factors: Global geopolitical tensions significantly influence risk sentiment and safe-haven demand. Events such as the ongoing Russia-Ukraine conflict, Middle East instability, and U.S.-Iran tensions create uncertainty that drives investors toward safe-haven assets. These geopolitical events can trigger sharp price movements, with historical precedent showing substantial rallies following major geopolitical escalations. The unpredictability of such events means geopolitical risk remains an ever-present factor affecting TRUST's valuation.

Macro Economic Conditions and Market Dynamics

-

Global Economic Uncertainty: Economic data volatility creates divergent signals for TRUST's direction. Strong PMI readings and labor market resilience may pressure prices by supporting economic growth expectations, while weaker economic indicators increase demand for defensive assets. The complex interplay between manufacturing activity, services sector performance, and employment data creates a nuanced backdrop for price determination.

-

Central Bank Gold Reserve Decisions: Central bank purchasing or selling decisions materially affect supply-demand dynamics over medium to long-term horizons. Following the Russia-Ukraine conflict, many central banks have increased gold reserve accumulation as part of de-dollarization efforts. However, notable interruptions—such as China's central bank suspending gold purchases in May 2024—can create short-term price pressure by reducing demand expectations and triggering speculative positioning adjustments.

-

Capital Flow Dynamics: Regional and cross-border capital flows significantly influence price volatility. The contrast between Asian and Western exchange-traded fund (ETF) inflows and outflows demonstrates how regional capital allocation decisions create pricing pressure. Strong inflows into global gold ETFs indicate growing investor risk-aversion and positioning for further appreciation, while outflows suggest reduced defensive positioning.

III. 2025-2030 TRUST Price Forecast

2025 Outlook

- Conservative Forecast: $0.0649 - $0.0999

- Neutral Forecast: $0.0999 - $0.1199

- Optimistic Forecast: $0.1199 - $0.1298 (requires sustained market momentum and positive ecosystem developments)

2026-2027 Mid-Term Outlook

- Market Stage Expectation: Recovery and consolidation phase with moderate growth trajectory

- Price Range Forecast:

- 2026: $0.0977 - $0.1585 (4% increase)

- 2027: $0.0943 - $0.1490 (24% increase)

- Key Catalysts: Enhanced protocol adoption, strategic partnerships within the ecosystem, improved market sentiment in the broader cryptocurrency sector

2028-2030 Long-Term Outlook

- Base Case Scenario: $0.1057 - $0.1729 (assumes steady adoption and market maturation)

- Optimistic Scenario: $0.1452 - $0.1642 (assumes accelerated ecosystem growth and institutional participation)

- Transformational Scenario: $0.1385 - $0.2287 (assumes breakthrough technological advancements, significant mainstream adoption, and favorable regulatory environment)

- 2030-12-20: TRUST at $0.2287 (predicted peak representing 46% cumulative gain from 2025 baseline)

| 年份 | 预测最高价 | 预测平均价格 | 预测最低价 | 涨跌幅 |

|---|---|---|---|---|

| 2025 | 0.11983 | 0.10994 | 0.06486 | 0 |

| 2026 | 0.15854 | 0.11489 | 0.09765 | 4 |

| 2027 | 0.14902 | 0.13672 | 0.09433 | 24 |

| 2028 | 0.17287 | 0.14287 | 0.10572 | 29 |

| 2029 | 0.16418 | 0.15787 | 0.14524 | 43 |

| 2030 | 0.22866 | 0.16103 | 0.13848 | 46 |

TRUST (Intuition) Professional Investment Strategy and Risk Management Report

IV. TRUST Professional Investment Strategy and Risk Management

TRUST Investment Methodology

(1) Long-term Holding Strategy

- Suitable for: Investors focused on decentralized information infrastructure with medium to long-term investment horizons

- Operational Recommendations:

- Accumulate TRUST tokens during market volatility periods when the price demonstrates significant pullbacks from all-time highs

- Participate in Intuition's ecosystem governance and knowledge validation mechanisms to earn additional rewards

- Monitor the development of the decentralized knowledge graph infrastructure and ecosystem adoption metrics

(2) Active Trading Strategy

- Technical Analysis Tools:

- Price momentum indicators: Track the 24-hour and weekly volatility patterns, particularly noting the 1.6% gain in 24-hour period versus the -7.97% decline over 7 days

- Support and resistance levels: Utilize historical price data with the all-time high of $0.91999 and all-time low of $0.09206 to identify key trading zones

- Wave Trading Key Points:

- Monitor the current trading volume of 650,683.02 USDT daily to ensure adequate liquidity for position entry and exit

- Watch for market sentiment shifts as the token remains ranked at 875 in overall market capitalization hierarchy

TRUST Risk Management Framework

(1) Asset Allocation Principles

- Conservative Investors: 1-3% of total cryptocurrency portfolio

- Active Investors: 3-7% of total cryptocurrency portfolio

- Professional Investors: 5-10% of total cryptocurrency portfolio, with hedging strategies

(2) Risk Hedging Solutions

- Volatility management: Implement dollar-cost averaging (DCA) strategy to mitigate impact of price fluctuations, especially given the -35.56% one-year decline

- Portfolio diversification: Balance TRUST holdings with other established digital assets to reduce concentration risk

(3) Secure Storage Solutions

- Hot Wallet Recommendation: Gate.com Web3 Wallet for active trading and ecosystem interaction with ease of access to knowledge validation opportunities

- Cold Storage Method: Transfer holdings to hardware-secured offline storage for long-term positions exceeding 6 months

- Security Precautions: Enable multi-factor authentication, use hardware security keys, maintain secure backup of private keys in geographically separate locations, and never share seed phrases

V. TRUST Potential Risks and Challenges

TRUST Market Risk

- Price Volatility: The token experienced extreme volatility, declining from an all-time high of $0.91999 (November 22, 2025) to $0.09206 (November 21, 2025), representing a 90% drawdown within a single day

- Low Liquidity: With only 650,683.02 USDT in 24-hour trading volume and a relatively small holder base of 9,665 addresses, the market may suffer from insufficient depth for large position liquidation

- Market Sentiment Risk: The current market emotion indicator suggests susceptibility to rapid sentiment shifts and potential panic selling during market downturns

TRUST Regulatory Risk

- Emerging regulatory framework: As information finance represents a novel blockchain use case, regulatory authorities may impose new compliance requirements on the Intuition ecosystem

- Jurisdictional uncertainty: Different regions may classify TRUST and the Intuition protocol differently, potentially affecting its operational status and token utility

- Compliance evolution: Changes in cryptocurrency regulations globally could impact token trading, staking, or governance participation mechanisms

TRUST Technology Risk

- Smart contract vulnerabilities: The BASE chain deployment may contain undiscovered security flaws or exploitable vulnerabilities in the knowledge graph consensus mechanism

- Ecosystem scalability: The current design may face performance bottlenecks as the decentralized knowledge graph grows in complexity and data volume

- Oracle dependency: The system's reliability on external data sources and validation mechanisms could introduce points of failure if consensus mechanisms are compromised

VI. Conclusion and Action Recommendations

TRUST Investment Value Assessment

Intuition represents a novel approach to decentralizing information infrastructure through cryptoeconomic incentives. The project addresses a significant market gap by extending blockchain technology beyond financial applications into information verification and reputation management. However, the extreme price volatility observed in the recent market history (90% crash followed by 900%+ recovery) indicates this remains a highly speculative and early-stage asset. The circulating supply of 179.6 million TRUST tokens represents only 17.96% of total supply, suggesting significant dilution risks from future token releases. With a market capitalization of approximately $109.97 million and relatively low trading volume, liquidity constraints may challenge investors seeking to accumulate or exit positions.

TRUST Investment Recommendations

✅ Beginners: Start with micro-allocations (less than 1% of crypto portfolio) through dollar-cost averaging on Gate.com. Learn about the Intuition ecosystem and knowledge validation mechanisms before increasing exposure.

✅ Experienced Investors: Allocate 3-7% of cryptocurrency portfolio through strategic accumulation during significant price drawdowns. Actively participate in ecosystem governance and validation to generate additional yield.

✅ Institutional Investors: Conduct comprehensive due diligence on smart contract security audits and ecosystem partnership developments. Consider positions aligned with multi-year infrastructure adoption timelines, with hedging strategies to manage volatility.

TRUST Trading Participation Methods

- Spot Trading: Purchase TRUST directly on Gate.com exchange with real-time price discovery and immediate settlement

- Recurring Investment: Implement automated dollar-cost averaging purchases through Gate.com to systematically reduce average acquisition cost regardless of price movements

- Ecosystem Participation: Engage with Intuition protocol's knowledge validation and claim verification mechanisms to earn protocol-native rewards beyond token appreciation

Cryptocurrency investments carry extreme risk. This report does not constitute investment advice. Investors must assess their personal risk tolerance and financial situation before making any investment decisions. We strongly recommend consulting with professional financial advisors. Never invest more capital than you can afford to lose completely.

FAQ

What is the trust coin prediction for 2025?

Trust coin is predicted to reach a peak of $0.04021 and a low of $0.0001928 in 2025, based on current market forecasts and analysis.

What factors affect TRUST token price movements?

TRUST token price is influenced by trading volume, market sentiment, and broader crypto market trends. Higher trading activity typically reflects stronger market interest and can drive price movements, while macroeconomic factors and investor confidence also play significant roles.

What is the historical price performance of TRUST coin?

TRUST coin showed strong upward momentum, trading at $7,453.91 on November 30, 2025, and rising to $7,543.43 by December 2, 2025, reflecting a gain of approximately $99.52 during this period.

What is the market cap and circulation supply of TRUST token?

TRUST token has a market cap of $63,426,467. The circulating supply and maximum supply information is not currently available or specified for this token.

How Will HOLO Price Evolve by 2030 Based on Current Market Trends?

2025 TCT Price Prediction: Navigating the Future of Cryptocurrency Investments

NKN (NKN) price soaring: What is the driving force behind the 2025 craze?

Aergo Price Analysis: 112% Surge in 90 Days - What's Next for 2025?

Canada Bitcoin Price: 2025 Market Analysis and Investment Outlook

Flare (FLR) Price Analysis: 6.73% Surge and 2025 Price Evolution Forecast

Understanding Bitcoin and Smart Contracts for Beginners

Understanding the Latest Bitcoin Enhancements: A Beginner's Guide

Understanding the Role of a Ledger in Blockchain Technology

Ethereum vs Cardano: A Comprehensive Comparison Guide

Golden Cross Explored: Master Crypto Trading with Technical Analysis