2025 USELESS Price Prediction: Expert Analysis, Market Trends, and Investment Outlook for the Next 12 Months

Introduction: USELESS Market Position and Investment Value

USELESS (USELESS) is a decentralized meme token launched with no presale, no team allocation, and no roadmap, embodying the spirit of internet culture by flipping the concept of value on its head. As a community-powered experiment in irony, virality, and decentralized belief entirely run by contributors worldwide, USELESS has emerged as a unique phenomenon in the cryptocurrency market. As of December 2025, USELESS has achieved a market capitalization of approximately $65.95 million with a circulating supply of 1 billion tokens, currently trading around $0.06595. Since its launch, the token has demonstrated remarkable volatility, reaching an all-time high of $0.443 and showcasing the speculative nature characteristic of meme tokens in the digital asset ecosystem.

This comprehensive analysis will examine USELESS price movements through 2025-2030, integrating historical price patterns, market supply dynamics, ecosystem developments, and macroeconomic factors to provide investors with professional price forecasts and actionable investment strategies. By understanding the unique positioning of this community-driven asset and its market behavior, investors can make informed decisions regarding their exposure to this distinctive segment of the cryptocurrency market.

Useless Coin (USELESS) Market Analysis Report

I. USELESS Price History Review and Market Status

USELESS Historical Price Evolution

Useless Coin was launched on December 18, 2024, representing a recent entry into the meme token market. Since its inception, the token has experienced significant volatility:

- October 14, 2025: All-Time High (ATH) reached at $0.443, marking the peak of market enthusiasm and early adoption momentum

- December 17, 2025: All-Time Low (ATL) established at $0.06529, reflecting sustained selling pressure and market correction

- December 18, 2025: Current trading price at $0.06595, showing minimal recovery from recent lows

USELESS Current Market Status

Price Performance:

- Current Price: $0.06595

- 24-Hour Change: -13.75% (-$0.010513)

- 7-Day Change: -35.26% (-$0.035919)

- 30-Day Change: -40.96% (-$0.045753)

- 1-Year Change: +94763.69% (+$0.065880)

Market Capitalization Metrics:

- Market Cap: $65,950,000

- Fully Diluted Valuation: $65,950,000

- 24-Hour Trading Volume: $1,265,256.35

- Market Dominance: 0.0021%

Token Supply Details:

- Circulating Supply: 1,000,000,000 USELESS

- Total Supply: 1,000,000,000 USELESS

- Maximum Supply: 1,000,000,000 USELESS

- Circulation Ratio: 100%

- Token Holders: 37,596

Market Sentiment:

- Current sentiment indicator shows extreme fear, with a market emotion index of 0

- The token ranks 431st by market capitalization across all cryptocurrencies

- Listed on 24 cryptocurrency exchanges globally

Network & Availability:

- Built on the Solana blockchain (SPL token standard)

- Contract Address: Dz9mQ9NzkBcCsuGPFJ3r1bS4wgqKMHBPiVuniW8Mbonk

- Actively trading on Gate.com and other major platforms

The token's recent price action shows a notable downtrend from its October peak, with the current price near all-time lows. The negative short-term performance across 1-hour, 24-hour, 7-day, and 30-day periods contrasts sharply with the extraordinary year-to-date gains, reflecting the volatile nature characteristic of newly launched meme tokens.

Click to view current USELESS market price

USELESS Market Sentiment Index

2025-12-17 Fear and Greed Index: 16 (Extreme Fear)

Click to view current Fear & Greed Index

The crypto market is experiencing extreme fear, with the Fear and Greed Index plummeting to just 16. This indicates significant panic among investors, suggesting capitulation and potential overselling conditions. Such extreme readings historically present contrarian opportunities for contrarian traders. However, caution is warranted as further downside cannot be ruled out. Investors should consider their risk tolerance and investment timeline carefully. Monitoring key support levels and market catalysts will be crucial in determining the next significant market move. Only risk capital you can afford to lose during such volatile periods.

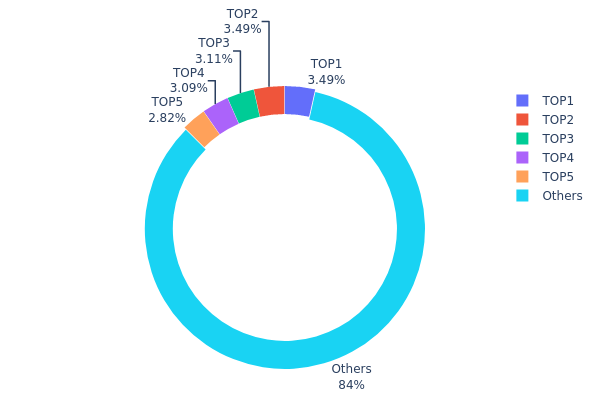

USELESS Holding Distribution

The address holding distribution map illustrates the concentration of token ownership across the blockchain network. It identifies the largest individual holders and quantifies their proportional stake in the total circulating supply, providing critical insight into the decentralization characteristics and potential concentration risks of the asset.

Current analysis of USELESS reveals a relatively moderate concentration profile. The top five addresses collectively hold approximately 16% of the total supply, with the largest holder commanding 3.49% and the fifth-largest holding 2.81%. This distribution pattern suggests that while significant holders do exist, the token exhibits reasonable dispersion across the network. The dominance of the "Others" category at 84.04% indicates that the majority of USELESS tokens are distributed among numerous smaller addresses, which is a positive indicator of broader ownership participation.

The existing address distribution presents a balanced market structure with manageable concentration levels. The absence of any single address exceeding 5% of total supply reduces the immediate risk of coordinated large-scale liquidation events or potential price manipulation through concentrated dumps. The relatively even distribution among top holders, with holdings ranging between 2.81% and 3.49%, further suggests limited influence concentration. This structure promotes greater market resilience and reduces the likelihood of extreme price volatility triggered by individual whale activities, thereby contributing to a more stable on-chain ecosystem.

Click to view current USELESS Holding Distribution

| Top | Address | Holding Qty | Holding (%) |

|---|---|---|---|

| 1 | FZaypZ...89wK4g | 34908.53K | 3.49% |

| 2 | u6PJ8D...ynXq2w | 34856.05K | 3.48% |

| 3 | 6LY1Jz...kZzkzF | 31047.65K | 3.10% |

| 4 | EFE3j1...o4ewqR | 30846.33K | 3.08% |

| 5 | 584apK...CHQRVU | 28166.85K | 2.81% |

| - | Others | 839264.86K | 84.04% |

II. Core Factors Influencing USELESS Future Price

Macroeconomic Environment

-

Monetary Policy Impact: The U.S. Federal Reserve has completed three rate cuts in 2025, bringing the federal funds rate target range to 3.50%-3.75%. However, policy uncertainty persists, with market participants divided on future rate trajectories. Traders currently estimate a 76% probability of the Fed maintaining rates in January 2026, while futures markets show approximately 68% probability of two or more rate cuts within 2026. This lower interest rate environment reduces opportunity costs for holding non-yielding crypto assets like USELESS, providing fundamental support for meme coin valuations.

-

Risk Sentiment and Safe-Haven Demand: Growing geopolitical tensions and economic data volatility have increased demand for alternative assets. As traditional markets face uncertainty regarding economic soft landings versus inflation rebound risks, investors increasingly seek portfolio diversification through cryptocurrency holdings. This flight-to-safety dynamic, while typically favoring precious metals, can indirectly support speculative assets like meme coins during periods of broader market risk appetite shifts.

-

Market Sentiment and Investor Behavior: USELESS price movements are significantly influenced by market demand, meme coin popularity cycles, and broader crypto market sentiment. Key drivers include regulatory changes and macroeconomic trends. As the cryptocurrency market matures, investor behavior patterns around meme coins become increasingly sensitive to shifts in overall market risk appetite and the rotation of capital between traditional and digital assets.

III. 2025-2030 USELESS Price Forecast

2025 Outlook

- Conservative Forecast: $0.04888 - $0.06606

- Neutral Forecast: $0.06606

- Optimistic Forecast: $0.09248 (requires sustained market sentiment and increased adoption)

2026-2028 Medium-Term Outlook

- Market Stage Expectations: Gradual accumulation phase with potential breakout patterns as project development progresses

- Price Range Predictions:

- 2026: $0.04756 - $0.09037 (20% upside potential)

- 2027: $0.05768 - $0.12045 (28% upside potential)

- 2028: $0.0739 - $0.14779 (55% upside potential)

- Key Catalysts: Project ecosystem expansion, increased community engagement, strategic partnerships, and market recovery cycles

2029-2030 Long-Term Outlook

- Base Case Scenario: $0.10643 - $0.17279 (89% appreciation potential by 2029, assuming steady market growth and continued development)

- Optimistic Scenario: $0.149 - $0.21605 (125% appreciation by 2030, assuming favorable regulatory environment and mainstream adoption acceleration)

- Transformative Scenario: Potential for further upside should emerge as a major catalyst in the broader altcoin market landscape

- 2030-12-31: USELESS projected at approximately $0.21605 (peak scenario under sustained bullish conditions)

| 年份 | 预测最高价 | 预测平均价格 | 预测最低价 | 涨跌幅 |

|---|---|---|---|---|

| 2025 | 0.09248 | 0.06606 | 0.04888 | 0 |

| 2026 | 0.09037 | 0.07927 | 0.04756 | 20 |

| 2027 | 0.12045 | 0.08482 | 0.05768 | 28 |

| 2028 | 0.14779 | 0.10263 | 0.0739 | 55 |

| 2029 | 0.17279 | 0.12521 | 0.10643 | 89 |

| 2030 | 0.21605 | 0.149 | 0.11324 | 125 |

USELESS Coin Investment Strategy and Risk Management Report

IV. USELESS Professional Investment Strategy and Risk Management

USELESS Investment Methodology

(1) Long-Term Holding Strategy

- Target Audience: Community-oriented investors who believe in decentralized meme culture and are willing to tolerate high volatility

- Operational Recommendations:

- Accumulate during market downturns when prices are significantly depressed from all-time highs

- Hold positions through multiple market cycles to benefit from potential viral adoption momentum

- Set clear entry and exit targets based on personal risk tolerance rather than emotional reactions

(2) Active Trading Strategy

- Price Action Observation:

- Monitor 24-hour volatility patterns: Current 24-hour price change of -13.75% indicates significant short-term fluctuation

- Track 7-day and 30-day trends: -35.26% (7D) and -40.96% (30D) show sustained downward pressure

- Trading Considerations:

- Consider the extreme 1-year performance (+94,763.69%) which reflects highly speculative nature

- Use limit orders on Gate.com to execute trades at predetermined price levels

- Monitor trading volume (currently $1,265,256.353421 in 24h volume) for liquidity assessment

USELESS Risk Management Framework

(1) Asset Allocation Principles

- Conservative Investors: 0-1% of portfolio

- Active Investors: 1-3% of portfolio

- Experienced Speculators: 3-5% of portfolio

(2) Risk Mitigation Strategies

- Position Sizing: Only allocate capital you can afford to lose completely given the meme token nature

- Diversification: Never concentrate holdings in USELESS alone; balance with established assets

- Stop-Loss Implementation: Set predetermined exit points to prevent catastrophic losses during market corrections

(3) Secure Storage Solutions

- Hot wallet for Trading: Gate.com wallet for active trading and frequent transactions

- Security Best Practices: Enable two-factor authentication, use strong passwords, never share private keys, and keep recovery phrases in secure offline locations

- Important Security Warnings: As a community-run token with no official team structure, verify all communications through official channels (https://theuselesscoin.com/ and https://x.com/theuselesscoin)

V. USELESS Potential Risks and Challenges

USELESS Market Risks

- Extreme Volatility: The token has experienced 94,763.69% gains over one year followed by 40.96% losses in 30 days, indicating severe price instability unsuitable for risk-averse investors

- Meme Token Sustainability: As a decentralized meme token with no roadmap or official development plan, long-term viability depends entirely on community sentiment and viral adoption

- Liquidity Concerns: With 37,596 holders and market cap of $65,950,000, liquidity can evaporate rapidly during market stress, making exit difficult at desired prices

USELESS Regulatory Risks

- Regulatory Uncertainty: Governments worldwide continue developing crypto regulations; meme tokens without clear utility face potential legal challenges

- Decentralized Structure Liability: The absence of a defined team or official entity makes regulatory compliance unclear and accountability ambiguous

- Exchange Delisting Risk: As regulatory frameworks tighten, trading platforms may delist USELESS, severely restricting trading opportunities

USELESS Technical Risks

- Blockchain Dependency: Built on Solana (SPL token), USELESS inherits any technical vulnerabilities or network issues affecting the Solana blockchain

- Smart Contract Exposure: Any technical flaws in the token's contract code could result in permanent loss of funds

- Community Abandonment: With no formal development team or roadmap, technical maintenance and security updates depend on voluntary community participation

VI. Conclusion and Action Recommendations

USELESS Investment Value Assessment

USELESS Coin represents an extreme risk, high reward speculative asset designed as a community experiment in irony and decentralized culture rather than a functional protocol. Its valuation is driven entirely by sentiment, virality, and community participation rather than fundamental utility. The token's dramatic volatility—ranging from all-time high of $0.443 (October 14, 2025) to current lows near $0.06529—demonstrates its purely speculative nature. Investment in USELESS should be approached as participation in a cultural phenomenon rather than a serious wealth-building strategy.

USELESS Investment Recommendations

✅ Beginners: Avoid USELESS entirely unless you have substantial experience with volatile assets and can afford complete loss of investment. If you choose to participate, limit exposure to less than 1% of your total portfolio and use only capital from discretionary funds.

✅ Experienced Investors: USELESS may serve as a small speculative position (1-3% of portfolio) for those understanding meme token dynamics. Trade on Gate.com using limit orders, implement strict stop-losses at 20-30% below entry, and maintain discipline regarding position sizing.

✅ Institutional Investors: USELESS presents limited institutional value due to its speculative nature, lack of governance structure, and regulatory uncertainty. Participation would be limited to designated risk capital with strict oversight and compliance review.

USELESS Trading Participation Methods

- Gate.com Direct Trading: Execute USELESS trades directly on Gate.com with multiple trading pairs and order types available for optimal entry and exit strategies

- Spot Trading: Purchase and hold USELESS tokens for medium-term speculation, suitable for those betting on continued viral adoption

- Technical Analysis Tools: Utilize Gate.com's charting capabilities to track price patterns, volume trends, and support/resistance levels

Cryptocurrency investment carries extreme risk. This report does not constitute financial advice. All investors must assess USELESS investment decisions based on individual risk tolerance and financial circumstances. Consult with professional financial advisors before making investment decisions. Never invest capital you cannot afford to lose completely.

FAQ

Can useless coins reach $1?

Useless coins can potentially reach $1, but it requires significant market momentum, effective community engagement, and sustained hype. Without these key factors, achieving this price level would be extremely challenging.

Will useless coins go up?

Yes, Useless Coin shows strong bullish potential with technical indicators suggesting price appreciation ahead. The coin has demonstrated resilience and momentum, with analysts projecting it could break through resistance levels and potentially reach new all-time highs in the coming period.

What crypto will 1000x prediction?

USELESS token has strong fundamentals with growing community support and utility expansion. Early adopters positioning in this cycle could see significant 1000x potential as adoption accelerates and market recognition increases.

Will Shiba hit $1 in 2040?

Unlikely. Long-term predictions suggest Shiba Inu will not reach $1 by 2040. Current forecasts estimate maximum price around $0.0001204 by 2030, with analysts remaining uncertain about achieving $1 in the foreseeable future.

XZXX: A Comprehensive Guide to the BRC-20 Meme Token in 2025

Bitcoin Fear and Greed Index: Market Sentiment Analysis for 2025

Top Crypto ETFs to Watch in 2025: Navigating the Digital Asset Boom

5 ways to get Bitcoin for free in 2025: Newbie Guide

Bitcoin Market Cap in 2025: Analysis and Trends for Investors

2025 Bitcoin Price Prediction: Trump's Tariffs' Impact on BTC

Exploring Why NFT Apps Are Missing from the Apple App Store

Guide to Integrate Polygon Network with Your Crypto Wallet

Comparing BEP2 and BEP20 Token Standards: Key Differences Explained

What is MMT: A Comprehensive Guide to Modern Monetary Theory and Its Impact on Economic Policy

Understanding Liquid Restaking in Web3: A Detailed Guide to Protocols