TAKEとDYDX:DeFiエコシステムを代表する暗号資産取引プラットフォームの比較

DeFi領域で際立つTAKEとDYDXの強みを比較します。時価総額ランキングや用途事例に加え、これまでの価格推移、投資戦略、今後の展望を詳しく分析し、どちらの暗号資産があなたに最適か判断するための材料を提供します。はじめに:TAKEとDYDXの投資比較

暗号資産市場では、TAKEとDYDXの比較は投資家にとって重要な話題です。両者は時価総額ランキング、用途、価格推移に明確な違いがあり、資産ポジションも異なります。

Overtake(TAKE):Web3インフラを活用し、Web2・Web3ゲーム資産の真の所有権を実現したことから市場の評価を獲得しています。

dYdX(DYDX):2017年に登場し、分散型デリバティブ取引プロトコルとして高い評価を受け、世界的にも活発に取引されています。

この記事では、TAKEとDYDXの投資価値について、過去の価格推移、供給メカニズム、機関投資家の動向、技術エコシステム、将来予測に焦点を当て、投資家が最も関心を持つ疑問に迫ります。

「今、どちらを買うべきか?」 以下は、提供されたテンプレートとデータに基づくレポートです。

I. 価格履歴比較および現在の市場状況

TAKE(コインA)とDYDX(コインB)の過去価格推移

- 2024年:DYDXは3月8日、$4.52で過去最高値を記録。市場の好意的なムードやプロジェクト進展が寄与した可能性があります。

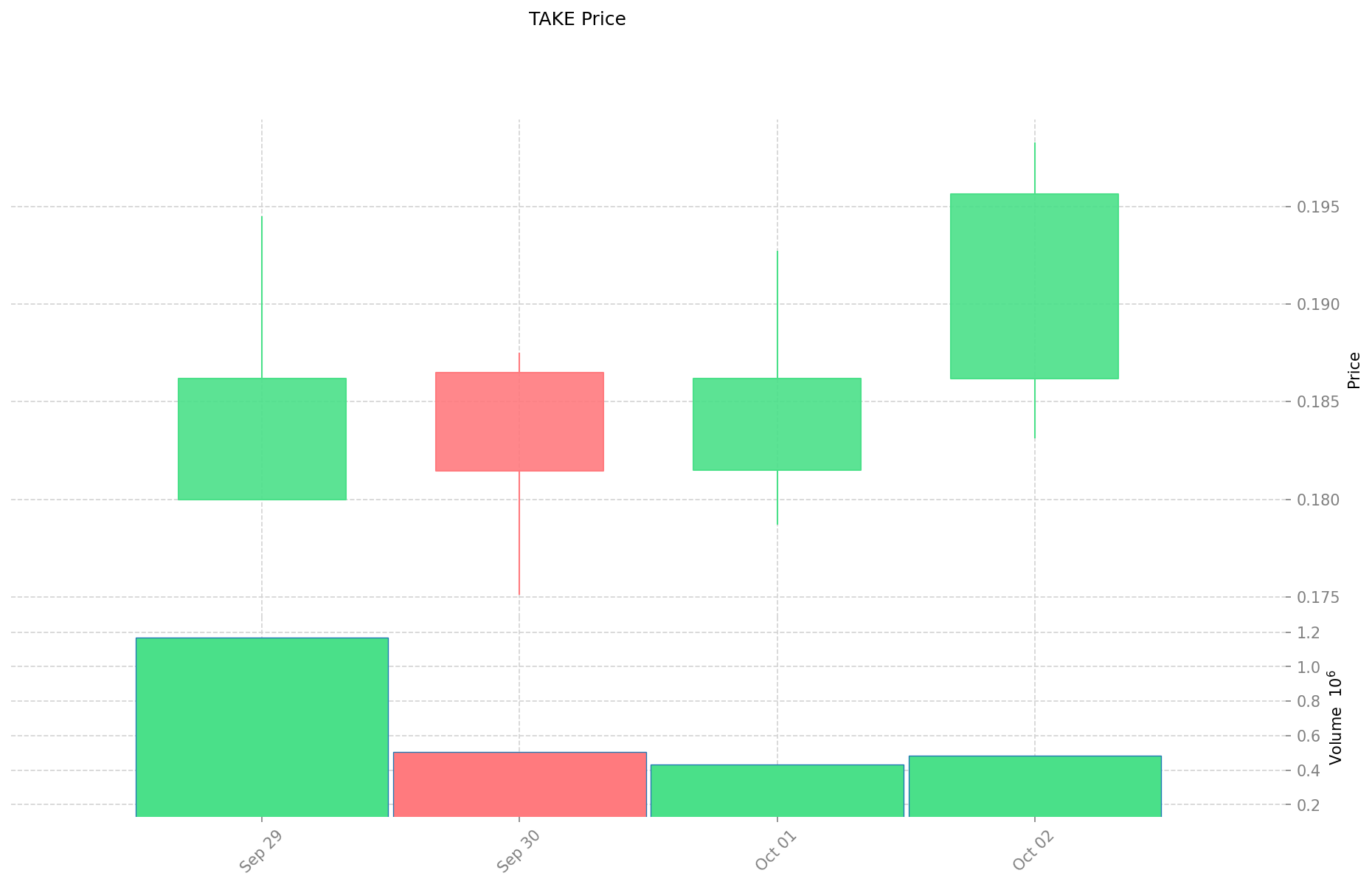

- 2025年:TAKEは10月2日、$0.19829で過去最高値を更新し、直近で好調な推移を見せています。

- 比較分析:現サイクルでは、TAKEは9月30日最安値$0.1751から直近高値まで力強く上昇。一方DYDXは2024年高値以降、長期的な下落傾向が続いています。

現在の市場状況(2025年10月03日)

- TAKE 現在価格:$0.187

- DYDX 現在価格:$0.6253

- 24時間取引高:TAKE $113,473/DYDX $743,426

- マーケットセンチメント指数(Fear & Greed Index):64(Greed)

リアルタイム価格はこちら:

II. TAKEとDYDXの投資価値を左右する主な要素

供給メカニズム比較(トークノミクス)

- TAKE:PoT(Proof of Trading)モデルを導入し、取引量・市場需要を基準に参加者リターンを設計

- DYDX:分散型取引所エコシステム内で主にガバナンストークンとして機能

- 📌 過去傾向:供給メカニズムは市場需要とユーティリティの統合を通じて周期的な価格変動を促進

機関投資家の採用・市場応用

- 機関保有:両トークン間の機関投資家好みについては情報が限定的

- 企業導入:DYDXは分散型取引所分野で確固たる地位を築き、TAKEはTelegram連携のMaigaXBTによるAI取引支援を提供

- 規制姿勢:両トークンに対する具体的な規制情報は参考資料に記載なし

技術開発・エコシステム構築

- TAKEの技術強化:Telegram連携AI取引アシスタント「MaigaXBT」が市場指標分析・取引推奨を提供

- DYDXの技術開発:取引所エコシステム内で優れた取引機能を持つことで高評価

- エコシステム比較:DYDXはDEX(分散型取引所)として圧倒的な契約取引優位性、「過小評価された宝DEX」とも呼ばれています

マクロ経済要因・市場サイクル

- インフレ時のパフォーマンス:参考資料に情報なし

- 金融政策の影響:参考資料に情報なし

- 地政学的要因:参考資料に情報なし

III. 2025~2030年価格予測:TAKE vs DYDX

短期予測(2025年)

- TAKE:保守的 $0.10817~$0.1865|楽観的 $0.1865~$0.240585

- DYDX:保守的 $0.506736~$0.6256|楽観的 $0.6256~$0.832048

中期予測(2027年)

- TAKEは成長期に入り、$0.23585769125~$0.353786536875と予想

- DYDXは安定成長期で、$0.7082711632~$0.947106788と見込まれる

- 主な推進要因:機関資本流入、ETF、エコシステム拡大

長期予測(2030年)

- TAKE:ベースシナリオ $0.40440755658764~$0.493377219036921|楽観シナリオ $0.493377219036921以上

- DYDX:ベースシナリオ $1.1270807553897~$1.363767714021537|楽観シナリオ $1.363767714021537以上

免責事項

TAKE:

| 年 | 予測最高値 | 予測平均値 | 予測最安値 | 騰落率 |

|---|---|---|---|---|

| 2025 | 0.240585 | 0.1865 | 0.10817 | 0 |

| 2026 | 0.288282375 | 0.2135425 | 0.172969425 | 14 |

| 2027 | 0.353786536875 | 0.2509124375 | 0.23585769125 | 34 |

| 2028 | 0.426312776934375 | 0.3023494871875 | 0.275138033340625 | 61 |

| 2029 | 0.444483981114343 | 0.364331132060937 | 0.280534971686921 | 94 |

| 2030 | 0.493377219036921 | 0.40440755658764 | 0.274997138479595 | 116 |

DYDX:

| 年 | 予測最高値 | 予測平均値 | 予測最安値 | 騰落率 |

|---|---|---|---|---|

| 2025 | 0.832048 | 0.6256 | 0.506736 | 0 |

| 2026 | 0.91831824 | 0.728824 | 0.63407688 | 16 |

| 2027 | 0.947106788 | 0.82357112 | 0.7082711632 | 31 |

| 2028 | 0.94731268078 | 0.885338954 | 0.73483133182 | 41 |

| 2029 | 1.3378356933894 | 0.91632581739 | 0.6872443630425 | 46 |

| 2030 | 1.363767714021537 | 1.1270807553897 | 0.845310566542275 | 80 |

IV. 投資戦略比較:TAKE vs DYDX

長期・短期投資戦略

- TAKE:Web3ゲームインフラやAI取引支援に関心のある投資家に適する

- DYDX:分散型デリバティブ取引や取引所エコシステムを重視する投資家に適する

リスク管理・資産配分

- 保守型投資家:TAKE 30%/DYDX 70%

- 積極型投資家:TAKE 60%/DYDX 40%

- ヘッジツール:ステーブルコイン、オプション、クロス通貨ポートフォリオ

V. 潜在リスク比較

市場リスク

- TAKE:新規プロジェクト特有の高いボラティリティ

- DYDX:暗号資産市場動向及びデリバティブ取引リスクへのエクスポージャー

技術リスク

- TAKE:AI統合のスケーラビリティ・ネットワーク安定性

- DYDX:スマートコントラクトの脆弱性、流動性リスク

規制リスク

- 世界的な規制政策は両トークンに異なる影響を及ぼし、分散型取引所への監視強化がDYDXに影響する可能性がある

VI. 結論:どちらが買いか?

📌 投資価値まとめ

- TAKEの強み:Web3ゲームインフラ、AI取引アシスタント、直近の価格パフォーマンス

- DYDXの強み:分散型デリバティブ取引所としての地位、取引量、長期の市場実績

✅ 投資アドバイス

- 新規投資家:DYDXを中心にバランス配分を検討

- 経験投資家:TAKEの成長可能性も探りつつ、DYDXも保有

- 機関投資家:DYDXはデリバティブ分野、TAKEはWeb3ゲーム分野で評価

⚠️ リスク警告:暗号資産市場は非常に変動性が高いため、本記事は投資助言ではありません。 None

VII. FAQ

Q1: TAKEとDYDXの主な違いは? A: TAKEはWeb3ゲームインフラとAI取引支援に特化し、DYDXは分散型デリバティブ取引プロトコルです。TAKEは新規で最近のパフォーマンスが高く、DYDXは長期の市場実績と取引量が特徴です。

Q2: 直近でより好調な価格パフォーマンスを示したのは? A: データによると、TAKEは2025年10月2日に過去最高値$0.19829を記録し、直近のパフォーマンスが際立っています。DYDXは2024年3月に$4.52の最高値を記録した後、下落しています。

Q3: TAKEエコシステムの主な特徴は? A: Telegram連携AI取引アシスタント「MaigaXBT」を備え、市場指標分析や取引推奨を行い、Web3インフラでゲーム資産の所有権を実現します。

Q4: DYDXはエコシステム内でどのように機能する? A: 分散型取引所エコシステムのガバナンストークンとして機能し、分散型デリバティブ取引のプラットフォームとして高く評価されています。

Q5: 2030年のTAKE、DYDXの予測価格レンジは? A: TAKEはベースシナリオ$0.40440755658764~$0.493377219036921、楽観的シナリオ$0.493377219036921以上。DYDXはベースシナリオ$1.1270807553897~$1.363767714021537、楽観的シナリオ$1.363767714021537以上です。

Q6: TAKEとDYDXの配分はどう考えるべきか? A: 保守型はTAKE 30%/DYDX 70%、積極型はTAKE 60%/DYDX 40%が推奨例。配分はリスク許容度や投資目標に応じて調整してください。

Q7: TAKE・DYDX投資の主なリスクは? A: TAKEは新規性ゆえの高いボラティリティやAI統合・スケーラビリティの技術リスク。DYDXは市場動向・デリバティブ取引リスク・規制強化リスクが挙げられます。