a16z: Privacy Is Becoming the Defining Moat of Blockchain Finance

Privacy Is Reshaping the Blockchain Competitive Landscape

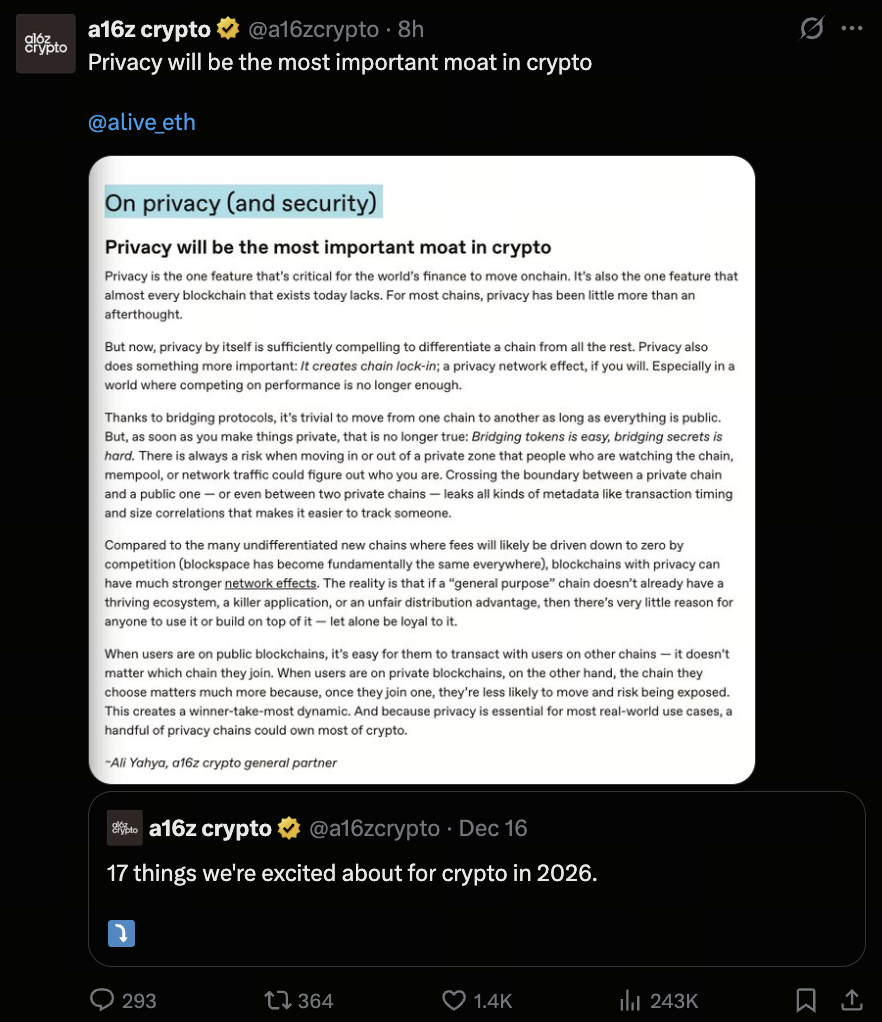

a16z crypto recently highlighted that for blockchains to support real-world financial activities, privacy is no longer a nice-to-have—it’s a fundamental requirement. Unlike public chains, privacy chains introduce risks related to metadata such as transaction timing, amounts, and behavioral patterns, prompting users to be much more selective about which chain they use.

(Source: a16zcrypto)

On-Chain Lock-In Effects Are Emerging

a16z General Partner Ali Yahya notes that because private data is hard to transfer securely, privacy features themselves foster strong user retention. Once users build an activity history on a privacy chain, migrating to another chain could reveal their past behavior. As a result, users are more likely to stay with their original chain for the long term.

Privacy Chains Are No Longer Easily Replaceable Options

Ali points out that while cross-chain interactions on public blockchains come with relatively low costs, in privacy-centric environments, choosing a chain is a critical decision. This dynamic positions privacy chains as foundational infrastructure, rather than just application platforms.

Market Capital Is Refocusing on Privacy Assets

With the privacy narrative regaining momentum, Zcash recently saw a single-day price surge of more than 25%. Traders are now eyeing a $700 price target, and some expect even higher levels by 2026. This shift signals that privacy coins are back in the investment spotlight.

Institutional-Grade Privacy Infrastructure Is Accelerating

Beyond established privacy coins, investment is flowing into next-generation privacy execution frameworks. Miden, supported by a16z, has secured $25 million in funding to focus on private computation and verifiable execution. Rayls Labs is developing private ledger systems designed for institutional needs, aiming to strike a balance between compliance and privacy.

Regulatory Pressure Remains a Real Challenge for Privacy Projects

Even as technology and capital converge, privacy chains still face ongoing risks from exchange delistings and regulatory scrutiny. The ability to protect user data while meeting transparency requirements will determine which privacy projects can achieve mainstream adoption.

A Few Privacy Chains May Become the Ultimate Winners

Ali Yahya believes that because most real-world use cases depend heavily on privacy, the crypto ecosystem may evolve into a winner-takes-all market. Ultimately, only a handful of chains that deliver privacy, security, and usability will be positioned to support large-scale financial activity.

If you want to explore more about Web3, click to register: https://www.gate.com/

Summary

As blockchain adoption expands into real-world financial scenarios, privacy has shifted from a fringe concern to a core competitive advantage. a16z’s insights reveal a pivotal trend: chains that offer robust privacy will become indispensable long-term infrastructure, not just technical options. With capital, technology, and market sentiment all rebounding, the privacy sector is quietly being repriced.

Related Articles

Crypto Future Profit Calculator: How to Calculate Your Potential Gains

Crypto Futures Calculator: Easily Estimate Your Profits & Risks

What is Oasis Network (ROSE)?

The $50M Crypto Scam Nobody Is Talking About

What Are Crypto Options?