What is Stacks BTC (SBTC)?

What Is Stacks BTC?

(Source: Stacks)

The crypto landscape recognizes Bitcoin (BTC) as the most secure and valuable digital asset. However, its design does not support smart contracts or decentralized finance (DeFi) applications, leaving much of Bitcoin’s vast market capitalization inactive and unable to unleash its full liquidity or innovative potential. Stacks introduced the protocol to solve this issue, giving rise to Stacks BTC (sBTC)—a Bitcoin-pegged asset at a 1:1 ratio that enables BTC to engage directly with DeFi and Web3 ecosystems.

Why Is sBTC Needed?

As the pioneering blockchain, Bitcoin prioritizes security and decentralization, resulting in a notably conservative design and several limitations:

- No Native Smart Contracts: The Bitcoin network cannot directly execute complex contract logic.

- Limited Liquidity: Hundreds of billions of dollars in Bitcoin mostly sit idle, making it challenging for BTC to access DeFi.

- Cross-Chain Risk: Most wrapped BTC products (e.g., WBTC) depend on centralized custodians, introducing trust and single-point-of-failure vulnerabilities.

sBTC solves these critical pain points. Leveraging the Stacks architecture, BTC can securely participate in smart contract environments, unlocking use cases such as decentralized lending, staking, NFT purchases, DAO governance, and more—while fully maintaining its peg to native Bitcoin.

sBTC Core Design

sBTC’s most distinctive features are its native Bitcoin anchoring and decentralized architecture, which deliver:

- 1:1 BTC Peg

Users lock BTC on the Bitcoin chain, and the Stacks protocol mints an equal amount of sBTC on the Stacks chain. When redeeming, the protocol burns sBTC, unlocking the corresponding BTC on the Bitcoin blockchain. - Full Decentralization

sBTC operates independently from any single custodian, instead relying on a decentralized set of signers and protocol rules to safeguard assets. Signers are collectively maintained by Stacks ecosystem participants, reducing centralization risks. - Bitcoin-Level Security

Stacks utilizes Bitcoin as its final settlement layer, recording every transaction on the Bitcoin blockchain. This guarantees sBTC’s security, transparency, and inherits Bitcoin’s resistance to censorship. - Smart Contract Capability

Powered by Stacks’ Clarity smart contract language, sBTC can participate in diverse DeFi applications, including decentralized exchanges (DEX), lending protocols, and yield farming.

Key Use Cases

sBTC introduces a wealth of new Bitcoin applications:

- Decentralized Finance (DeFi)

sBTC enables liquidity provision, lending, and yield farming, allowing Bitcoin to function as a true yield-generating asset. - NFTs and GameFi

With sBTC, users and collectors can use BTC directly to purchase NFTs or participate in gaming economies, eliminating the need for asset conversion. - DAO & Governance

Communities can leverage sBTC for DAO governance, giving Bitcoin holders greater influence within the Web3 ecosystem. - Cross-Chain Payments

sBTC can move seamlessly across multiple blockchains, serving as a cross-chain payment mechanism.

Security and Trust Model

sBTC’s security foundation derives from the Stacks protocol’s Bitcoin settlement layer and its decentralized network of signers.

- Bitcoin Settlement Finality: Every transaction is immutably recorded on the Bitcoin blockchain.

- Multi-Signature Architecture: Releasing sBTC requires consensus among multiple signers, preventing single-node compromise and theft.

- Economic Incentives & Penalties: Signers must stake assets and are penalized for malicious activity.

This robust model ensures sBTC’s decentralized nature and reliability, which makes it more trustworthy than traditional, centralized wrapped BTC products.

Token Model

sBTC and the native token STX are mutually reinforcing. sBTC is a 1:1 BTC-pegged asset; STX powers protocol governance and incentives.

STX Functions:

- Serves as transaction fees within the Stacks network.

- Enables staking and consensus participation, securing the network.

- Supports protocol governance, including upgrades and fund allocation.

sBTC Functions:

- Acts as Bitcoin’s mirrored asset for DeFi.

- Provides liquidity and access to lending and DEX markets.

- Serves as the main value exchange medium within the Stacks ecosystem.

The interplay between sBTC and STX empowers true Bitcoin utility, establishing a sustainable economic cycle within Stacks.

Future Outlook

sBTC does more than enable Bitcoin DeFi—it serves as foundational infrastructure that drives the Bitcoin ecosystem’s evolution. As more DeFi protocols, NFT platforms, and cross-chain infrastructure integrate, sBTC will become the premier gateway for BTC holders into Web3.

- Scalability: Stacks continues to boost throughput and smart contract efficiency to support broader sBTC applications.

- Cross-Chain Expansion: sBTC aims to interoperate with chains like Ethereum and Cosmos, enabling truly cross-chain Bitcoin.

- Institutional Adoption: With enhanced security and regulatory compliance, institutional investors can confidently use sBTC for decentralized finance participation.

Ultimately, sBTC’s mission is to transform Bitcoin from mere digital gold into the central force driving on-chain finance.

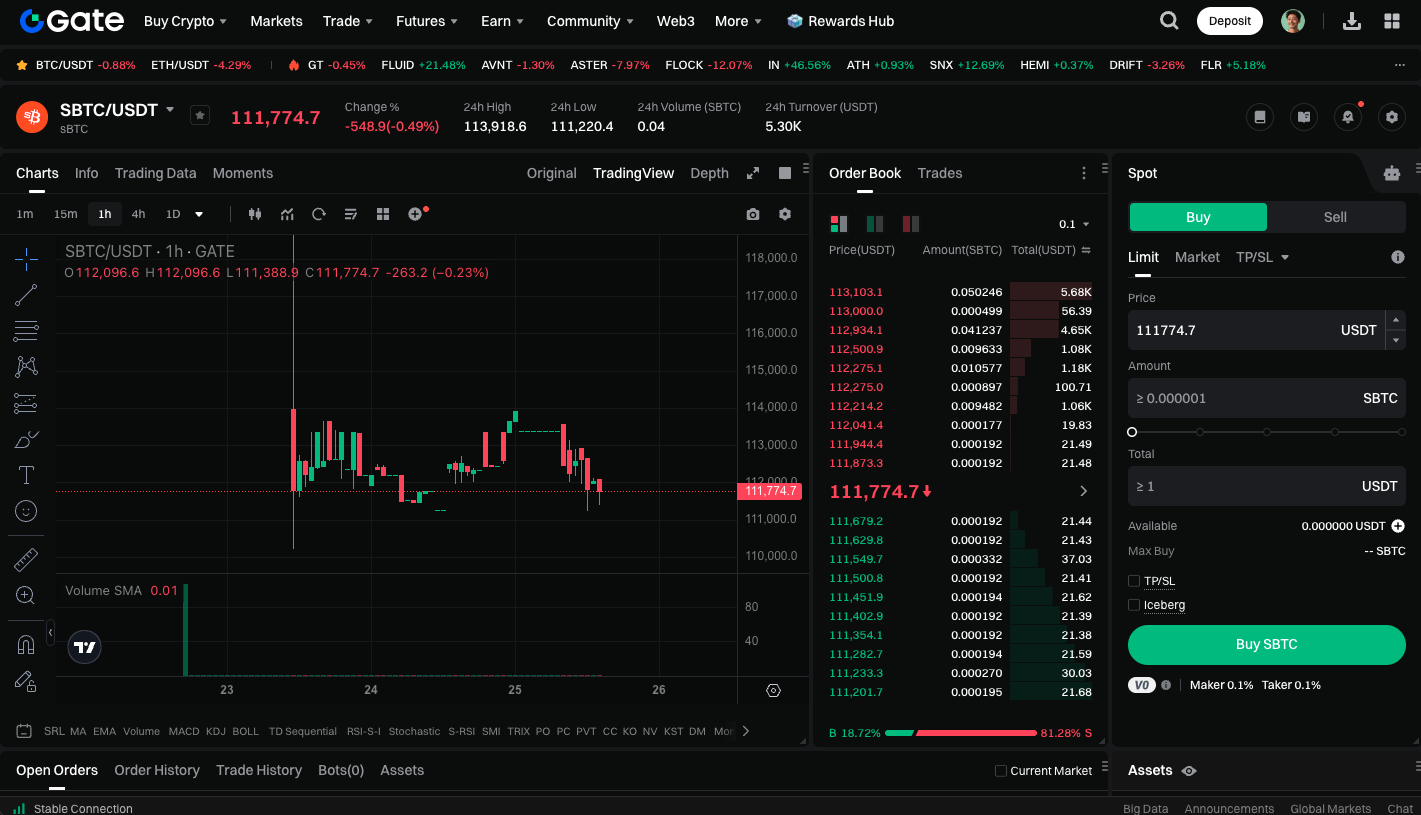

Start trading SBTC spot now: https://www.gate.com/trade/SBTC_USDT

Summary

Stacks BTC (sBTC) marks the next evolution of Bitcoin. It turns BTC from a dormant asset into a dynamic instrument for DeFi, NFT, DAO, and cross-chain payments. sBTC preserves Bitcoin’s security and decentralization. Through Stacks’ innovative design, sBTC serves as both a technical breakthrough and a gateway for expanding Bitcoin’s practical applications.

Related Articles

Crypto Future Profit Calculator: How to Calculate Your Potential Gains

Crypto Futures Calculator: Easily Estimate Your Profits & Risks

What is Oasis Network (ROSE)?

The $50M Crypto Scam Nobody Is Talking About

What Are Crypto Options?