- Trending TopicsView More

10.8K Popularity

4.7M Popularity

123K Popularity

79.2K Popularity

164.7K Popularity

- Pin

- 🍁 Golden Autumn, Big Prizes Await!

Gate Square Growth Points Lucky Draw Carnival Round 1️⃣ 3️⃣ Is Now Live!

🎁 Prize pool over $15,000+, iPhone 17 Pro Max, Gate exclusive Merch and more awaits you!

👉 Draw now: https://www.gate.com/activities/pointprize/?now_period=13&refUid=13129053

💡 How to earn more Growth Points for extra chances?

1️⃣ Go to [Square], tap the icon next to your avatar to enter [Community Center]

2️⃣ Complete daily tasks like posting, commenting, liking, and chatting to rack up points!

🍀 100% win rate — you’ll never walk away empty-handed. Try your luck today!

Details: ht - 💥 Gate Square Event: #Post0GWinUSDT# 💥

Post original content on Gate Square related to 0G or the ongoing campaigns (Earn, CandyDrop, or Contract Trading Competition) for a chance to share 200 USDT rewards!

📅 Event Period: Sept 25, 2025, 18:00 – Oct 2, 2025, 16:00 UTC

📌 Related Campaigns:

Earn: Enjoy stable earnings

👉 https://www.gate.com/announcements/article/47290

CandyDrop: Claim 0G rewards

👉 https://www.gate.com/announcements/article/47286

Contract Trading Competition: Trade to win prizes

👉 https://www.gate.com/announcements/article/47221

📌 How to Participate:

1️⃣ Post original cont - 🚀 #GateNewbieVillageEpisode2# ✖️ @独领风骚必暴富

💰 Share your first profit on Gate | 🎉 Recall your most unexpected gain | 🤝 Grow with the community

⏰ Event Date:Sept 24 04:00 – Sept 30 16:00 UTC+8

How to Join:

1️⃣ Follow Gate_Square + @独领风骚必暴富

2️⃣ Post on Gate Square with the hashtag #GateNewbieVillageEpisode2#

3️⃣ Share your first pot of gold or your most surprising profit on Gate—more detailed and interesting posts have a higher chance to win!

🎁 Rewards

3 lucky winners → Gate X RedBull Tumbler + $20 Futures Trial Voucher

If merchandise cannot be shipped, it will be replaced with a $30 Futures - 🚗 #GateSquareCommunityChallenge# Round 2 — Which coin is not listed on Gate Launchpad❓

Time to prove if you’re a true Gate veteran!

💰 Join the challenge — 5 lucky winners will share $50 in GT!

👉 How to participate:

1️⃣ Follow Gate_Square

2️⃣ Like this post

3️⃣ Comment with your answer

🗓️ Deadline: October 8, 2025, 24:00 (UTC+8) - 🥊 You’ve entered the Trading PK Arena, matching your opponent now...

One click to place an order and jump into the battle! Who will climb the leaderboard and claim the 👑?

Gate’s brand-new Indicators Radar feature is live! Here you can:

📈 Share your trades on the live candlestick chart to [Square] 👉️ https://www.gate.com/post

👀 Watch others’ trading moves in real time;

💬 Go head-to-head with fellow traders in the community!

Don’t just read—follow the tutorial below and get started 👇

📌 Note: This feature is available only on app version 7.20.5 or above.

Mastering Crypto Asset Flipping: A Guide to Profitable Trading Strategies

Retail Sentiment Shifts as Bitcoin Dips Below Key Level

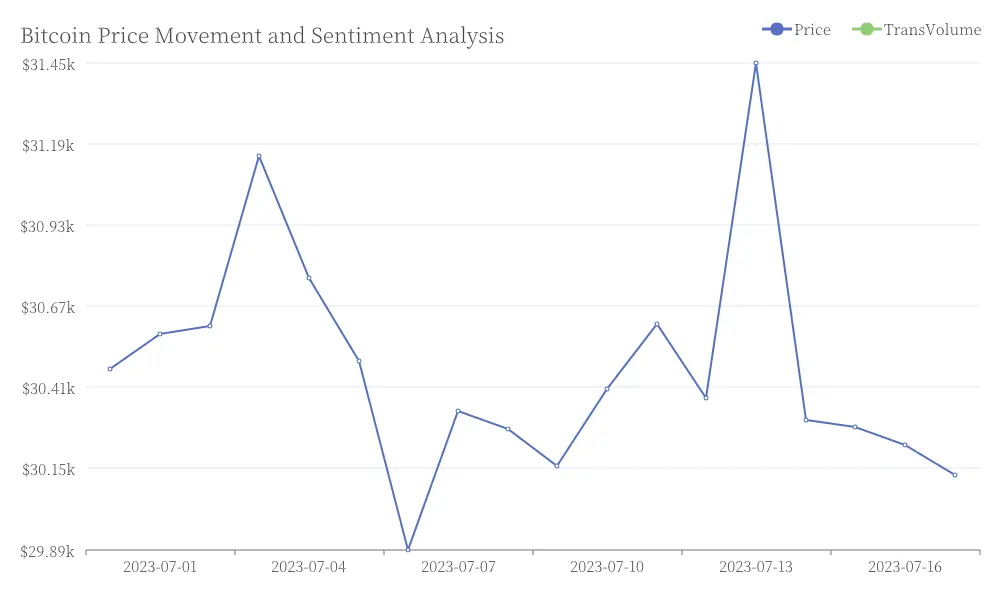

Bitcoin (BTC) recently slipped to a 17-day low under a critical price threshold, triggering what one blockchain analytics firm described as "the most bearish sentiment on social media since late June." This sudden shift in retail trader sentiment comes after Bitcoin failed to reclaim important support levels. Bitcoin Price Movement and Sentiment Analysis

Bitcoin Price Movement and Sentiment Analysis

The analytics firm noted that such spikes in negative sentiment often precede a "dip bounce," as short-term panic sellers exit positions while long-term holders identify potential buying opportunities. This pattern reflects the volatile nature of cryptocurrency markets and the importance of managing emotions during price swings.

Regulatory Developments in the Digital Asset Space

A prominent senator recently spoke at a blockchain symposium, expressing optimism about bipartisan support for upcoming digital asset legislation when Congress reconvenes. The senator highlighted the potential for 12 to 18 members of the opposition party to back the more complex market structure bill, drawing parallels to earlier support for stablecoin regulation.

Ongoing outreach efforts aim to secure votes beyond the banking committee, signaling a growing recognition of the need for comprehensive crypto regulation across party lines. This development could have significant implications for the future of digital asset policy in the United States.

Strategic Appointment Signals Industry Evolution

A major player in the stablecoin sector announced the appointment of a former government official as a strategic adviser for digital assets and domestic strategy. The new adviser, who previously worked on digital asset policy in a prior administration, will guide the company's entry into the US market and serve as a liaison with policymakers.

This strategic move highlights the increasing intersection between traditional finance, government policy, and the cryptocurrency industry. The company's CEO emphasized the value of the adviser's experience as they expand their footprint in the United States.

The appointment comes as the firm has already reinvested nearly $5 billion in the US economy, signaling a stronger push into domestic markets. This development underscores the growing maturity and mainstream adoption of digital assets, as well as the industry's efforts to navigate complex regulatory landscapes.