- Trending TopicsView More

10.7K Popularity

4.7M Popularity

123K Popularity

79.2K Popularity

164.7K Popularity

- Pin

- 🍁 Golden Autumn, Big Prizes Await!

Gate Square Growth Points Lucky Draw Carnival Round 1️⃣ 3️⃣ Is Now Live!

🎁 Prize pool over $15,000+, iPhone 17 Pro Max, Gate exclusive Merch and more awaits you!

👉 Draw now: https://www.gate.com/activities/pointprize/?now_period=13&refUid=13129053

💡 How to earn more Growth Points for extra chances?

1️⃣ Go to [Square], tap the icon next to your avatar to enter [Community Center]

2️⃣ Complete daily tasks like posting, commenting, liking, and chatting to rack up points!

🍀 100% win rate — you’ll never walk away empty-handed. Try your luck today!

Details: ht - 💥 Gate Square Event: #Post0GWinUSDT# 💥

Post original content on Gate Square related to 0G or the ongoing campaigns (Earn, CandyDrop, or Contract Trading Competition) for a chance to share 200 USDT rewards!

📅 Event Period: Sept 25, 2025, 18:00 – Oct 2, 2025, 16:00 UTC

📌 Related Campaigns:

Earn: Enjoy stable earnings

👉 https://www.gate.com/announcements/article/47290

CandyDrop: Claim 0G rewards

👉 https://www.gate.com/announcements/article/47286

Contract Trading Competition: Trade to win prizes

👉 https://www.gate.com/announcements/article/47221

📌 How to Participate:

1️⃣ Post original cont - 🚀 #GateNewbieVillageEpisode2# ✖️ @独领风骚必暴富

💰 Share your first profit on Gate | 🎉 Recall your most unexpected gain | 🤝 Grow with the community

⏰ Event Date:Sept 24 04:00 – Sept 30 16:00 UTC+8

How to Join:

1️⃣ Follow Gate_Square + @独领风骚必暴富

2️⃣ Post on Gate Square with the hashtag #GateNewbieVillageEpisode2#

3️⃣ Share your first pot of gold or your most surprising profit on Gate—more detailed and interesting posts have a higher chance to win!

🎁 Rewards

3 lucky winners → Gate X RedBull Tumbler + $20 Futures Trial Voucher

If merchandise cannot be shipped, it will be replaced with a $30 Futures - 🚗 #GateSquareCommunityChallenge# Round 2 — Which coin is not listed on Gate Launchpad❓

Time to prove if you’re a true Gate veteran!

💰 Join the challenge — 5 lucky winners will share $50 in GT!

👉 How to participate:

1️⃣ Follow Gate_Square

2️⃣ Like this post

3️⃣ Comment with your answer

🗓️ Deadline: October 8, 2025, 24:00 (UTC+8) - 🥊 You’ve entered the Trading PK Arena, matching your opponent now...

One click to place an order and jump into the battle! Who will climb the leaderboard and claim the 👑?

Gate’s brand-new Indicators Radar feature is live! Here you can:

📈 Share your trades on the live candlestick chart to [Square] 👉️ https://www.gate.com/post

👀 Watch others’ trading moves in real time;

💬 Go head-to-head with fellow traders in the community!

Don’t just read—follow the tutorial below and get started 👇

📌 Note: This feature is available only on app version 7.20.5 or above.

Understanding Inverse Perpetual Contracts in Square Transactions

Bitcoin's Bullish Formation: Inverse Head-and-Shoulders Points to $140K

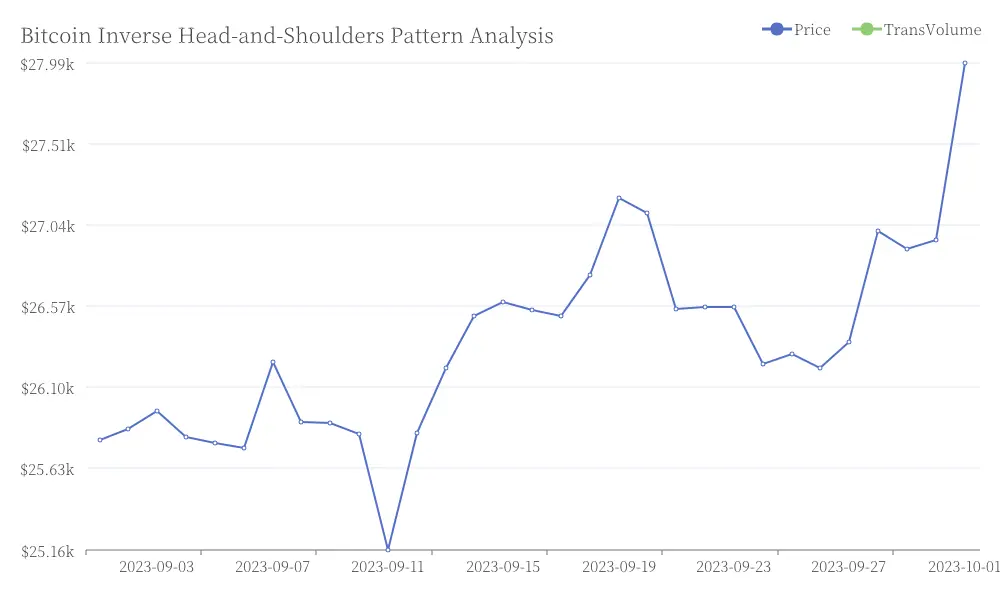

A recent chart analysis has identified an intriguing inverse head-and-shoulders pattern on the BTC/USD pair, setting a potential target between $139,000 and $140,000. This formation is typically associated with trend reversals, and its appearance at this scale has caught the attention of many market observers. Bitcoin Inverse Head-and-Shoulders Pattern Analysis

Bitcoin Inverse Head-and-Shoulders Pattern Analysis

Anatomy of the Pattern

The inverse head-and-shoulders pattern consists of three key components: the left shoulder (initial dip in price), the head (deeper dip, lower than the shoulders), and the right shoulder (higher low, completing the pattern). This structure often precedes a significant breakout. If Bitcoin manages to surpass the neckline (a key resistance level implied by the pattern), it could pave the way for a substantial move towards the $140K range.

Cautious Optimism

While the symmetry of this formation appears convincing, it's crucial to remember that no pattern guarantees future price movements. Market dynamics are complex, and various factors can influence cryptocurrency prices.

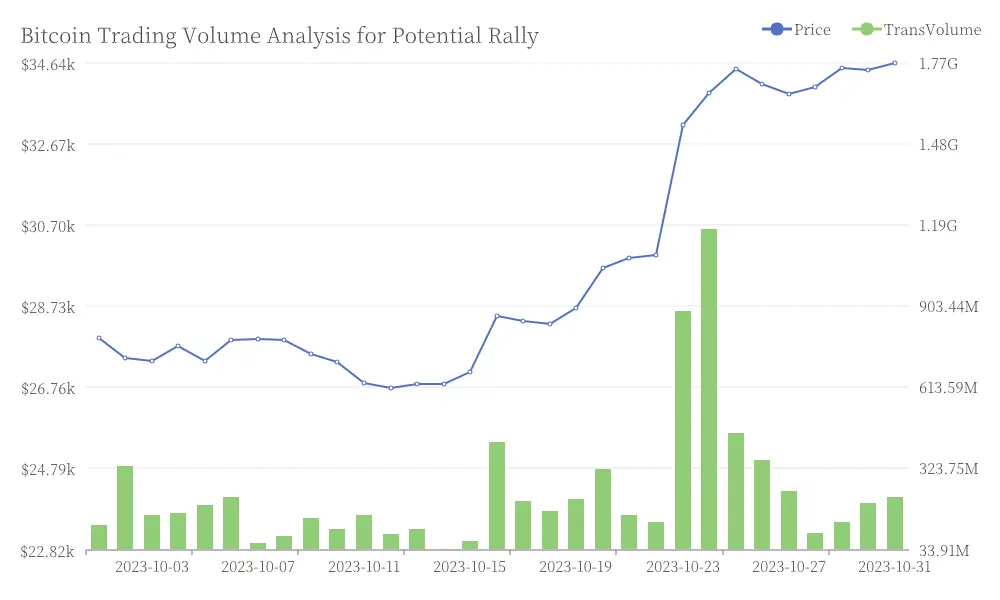

Volume: The Missing Piece

For this potential rally to gain traction, increased trading volume will be essential. A surge in volume would provide the necessary momentum to sustain a push beyond current levels and validate the pattern's bullish implications. Bitcoin Trading Volume Analysis for Potential Rally

Bitcoin Trading Volume Analysis for Potential Rally

Shifting Gears?

This chart formation suggests that Bitcoin might be transitioning from a period of consolidation to one of acceleration. Market participants are closely monitoring Bitcoin's next moves, wondering if this will develop into a substantial rally or if the momentum will fade before reaching the critical neckline.

The Inverse Perspective

Understanding inverse relationships in financial markets can provide valuable insights. In the context of cryptocurrencies, inverse perpetual contracts offer traders a unique way to speculate on price movements without directly holding the underlying asset. These contracts, which have no expiration date, use the cryptocurrency itself as collateral, allowing for potentially higher leverage and more efficient use of capital.

As the crypto market evolves, these sophisticated trading instruments are becoming increasingly popular among experienced traders. However, it's important to note that while they offer new opportunities, they also come with increased risks due to their leveraged nature.

Looking Ahead

Whether Bitcoin will fulfill the promise of this bullish pattern remains to be seen. Traders and investors alike are watching closely, understanding that while technical analysis can provide valuable insights, it's just one piece of the complex puzzle that is the cryptocurrency market.