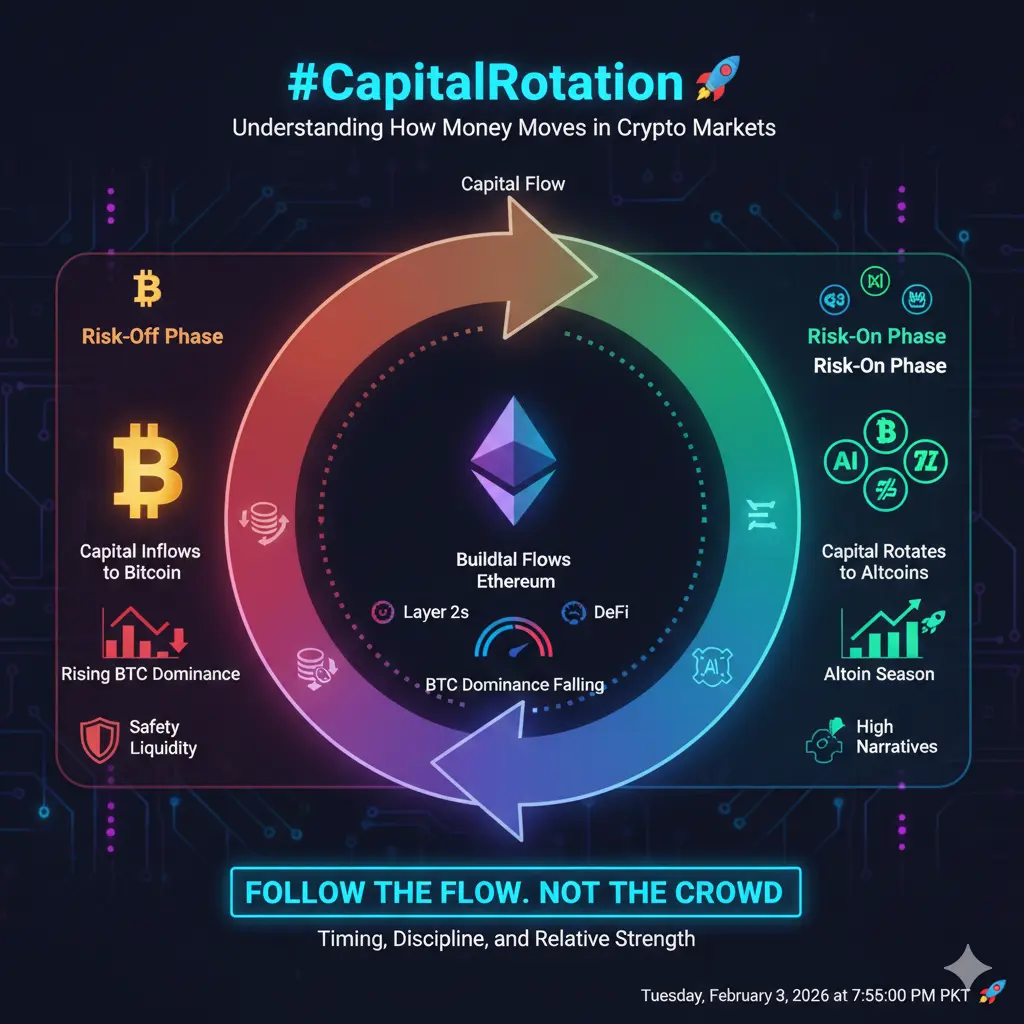

🔄 Trading Patterns Shift — Where Is Capital Leaning?

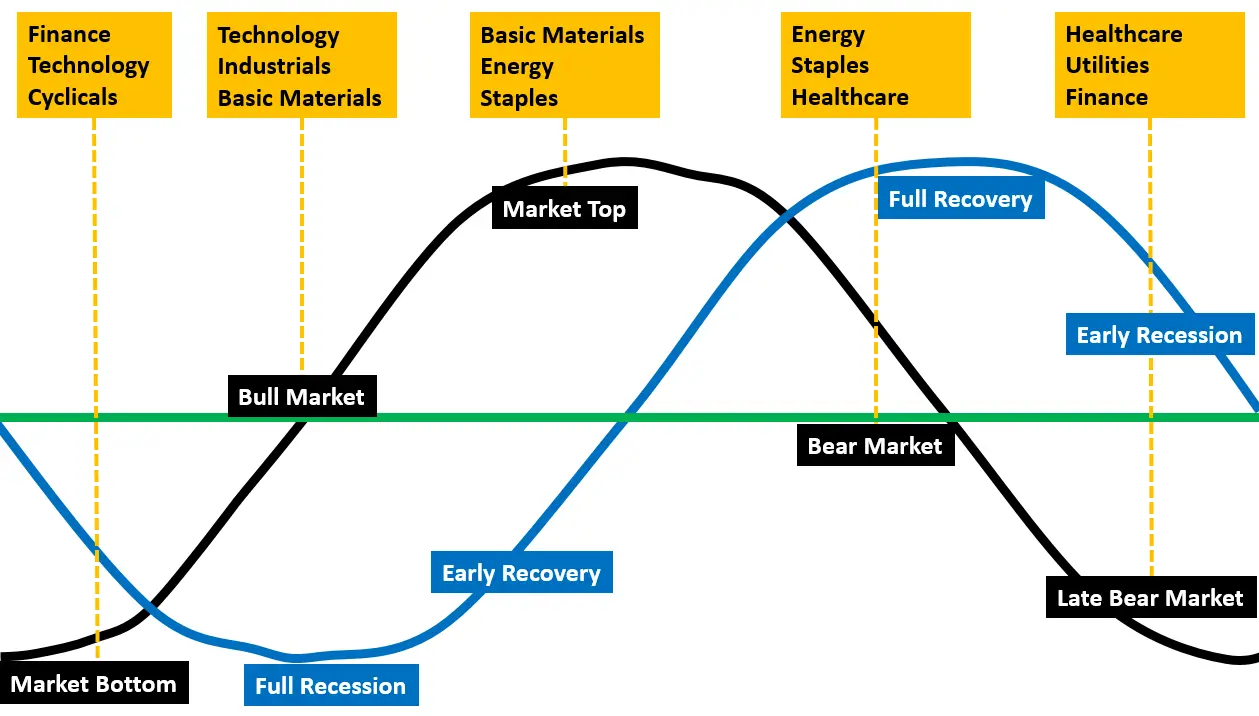

During the current crypto pullback, trading patterns are showing notable changes. Capital is moving differently compared to the previous bullish phase, highlighting both risk aversion and selective accumulation.

1️⃣ Institutional vs Retail Behavior

Institutions: selectively accumulating BTC, ETH, and high-quality altcoins at support levels. They are also using hedging strategies and structured products to manage volatility.

Retail traders: more cautious, often reducing exposure or waiting on clear trend confirmation. Low-cap altcoins see heavier sell-offs.

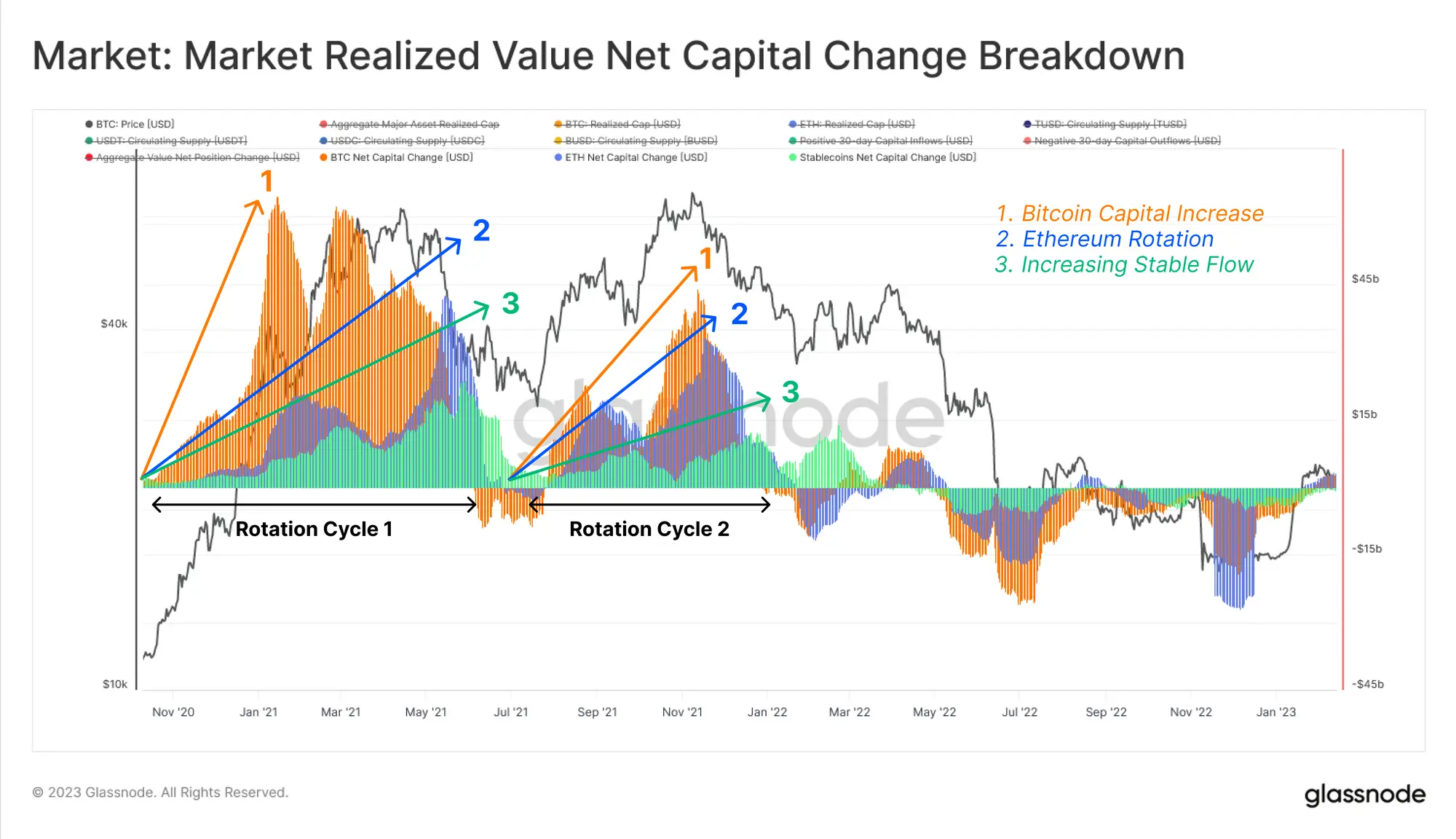

2️⃣ Capital Flow Trends

Stablecoins inflows are increasing — suggesting capital is waiting on sidelines for strategic entry points.

Layer-2 and DeFi projects with strong fundamentals are attracting relative strength capital, even during a pullback.

BTC and ETH continue to absorb liquidity from weaker altcoins, reinforcing dominance during market uncertainty.

3️⃣ Technical Observations

High-volume nodes around key BTC and ETH levels are acting as capital magnets, guiding accumulation.

Short-term pullbacks are met with strategic buying rather than panic selling among institutional players.

On-chain and derivative data indicate rotation into quality projects, not indiscriminate risk-taking.

Dragon Fly Official Insight

Capital is leaning towards quality and defensible positions, not speculative chasing.

Traders should observe volume and on-chain flows to anticipate where smart money is moving.

Pullbacks are opportunities if aligned with high-liquidity zones, strong fundamentals, and institutional activity.

#CapitalRotation

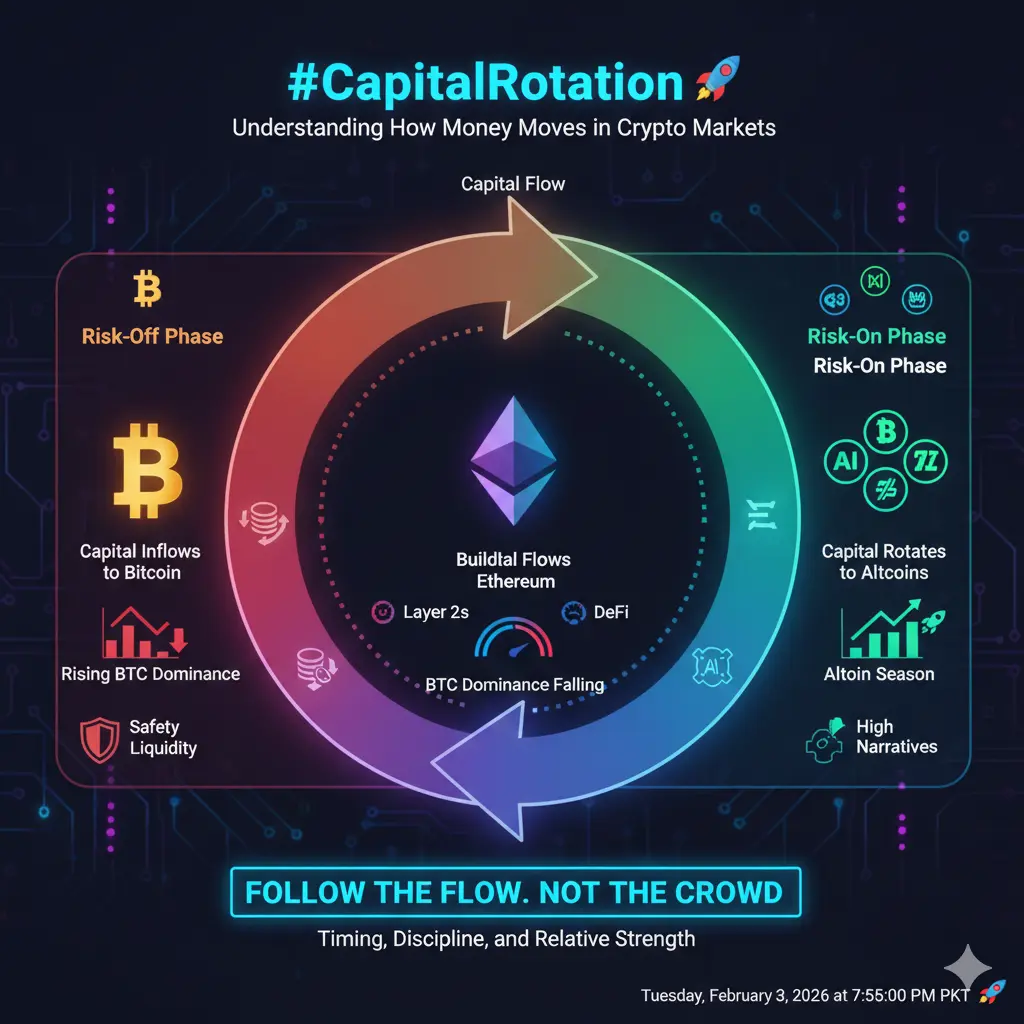

During the current crypto pullback, trading patterns are showing notable changes. Capital is moving differently compared to the previous bullish phase, highlighting both risk aversion and selective accumulation.

1️⃣ Institutional vs Retail Behavior

Institutions: selectively accumulating BTC, ETH, and high-quality altcoins at support levels. They are also using hedging strategies and structured products to manage volatility.

Retail traders: more cautious, often reducing exposure or waiting on clear trend confirmation. Low-cap altcoins see heavier sell-offs.

2️⃣ Capital Flow Trends

Stablecoins inflows are increasing — suggesting capital is waiting on sidelines for strategic entry points.

Layer-2 and DeFi projects with strong fundamentals are attracting relative strength capital, even during a pullback.

BTC and ETH continue to absorb liquidity from weaker altcoins, reinforcing dominance during market uncertainty.

3️⃣ Technical Observations

High-volume nodes around key BTC and ETH levels are acting as capital magnets, guiding accumulation.

Short-term pullbacks are met with strategic buying rather than panic selling among institutional players.

On-chain and derivative data indicate rotation into quality projects, not indiscriminate risk-taking.

Dragon Fly Official Insight

Capital is leaning towards quality and defensible positions, not speculative chasing.

Traders should observe volume and on-chain flows to anticipate where smart money is moving.

Pullbacks are opportunities if aligned with high-liquidity zones, strong fundamentals, and institutional activity.

#CapitalRotation