AylaShinex

#TrumpTariffRuling #TrumpTariffRuling 📈🌎

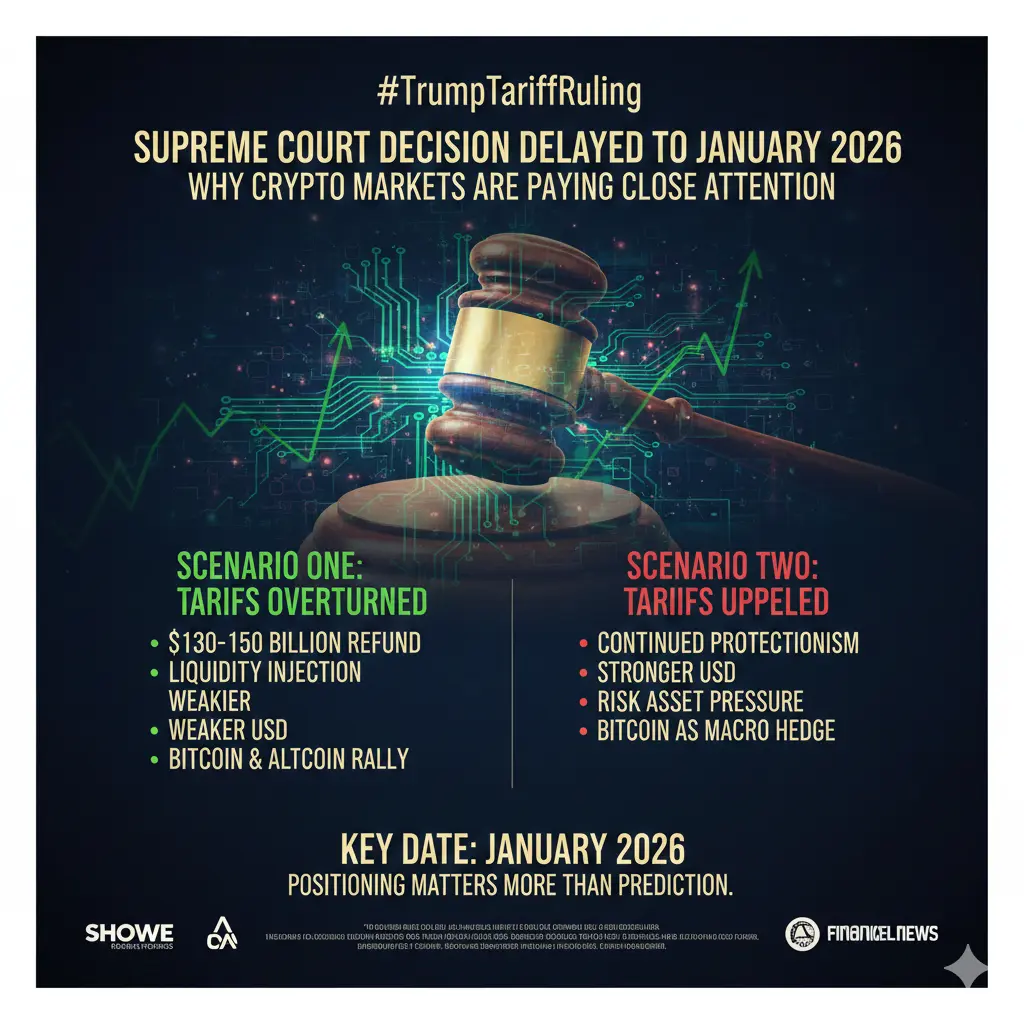

The latest U.S. tariff ruling is shaking global trade and sending ripples through the markets.

🔹 Impact on Imports & Exports: Key commodities and tech goods may see price adjustments.

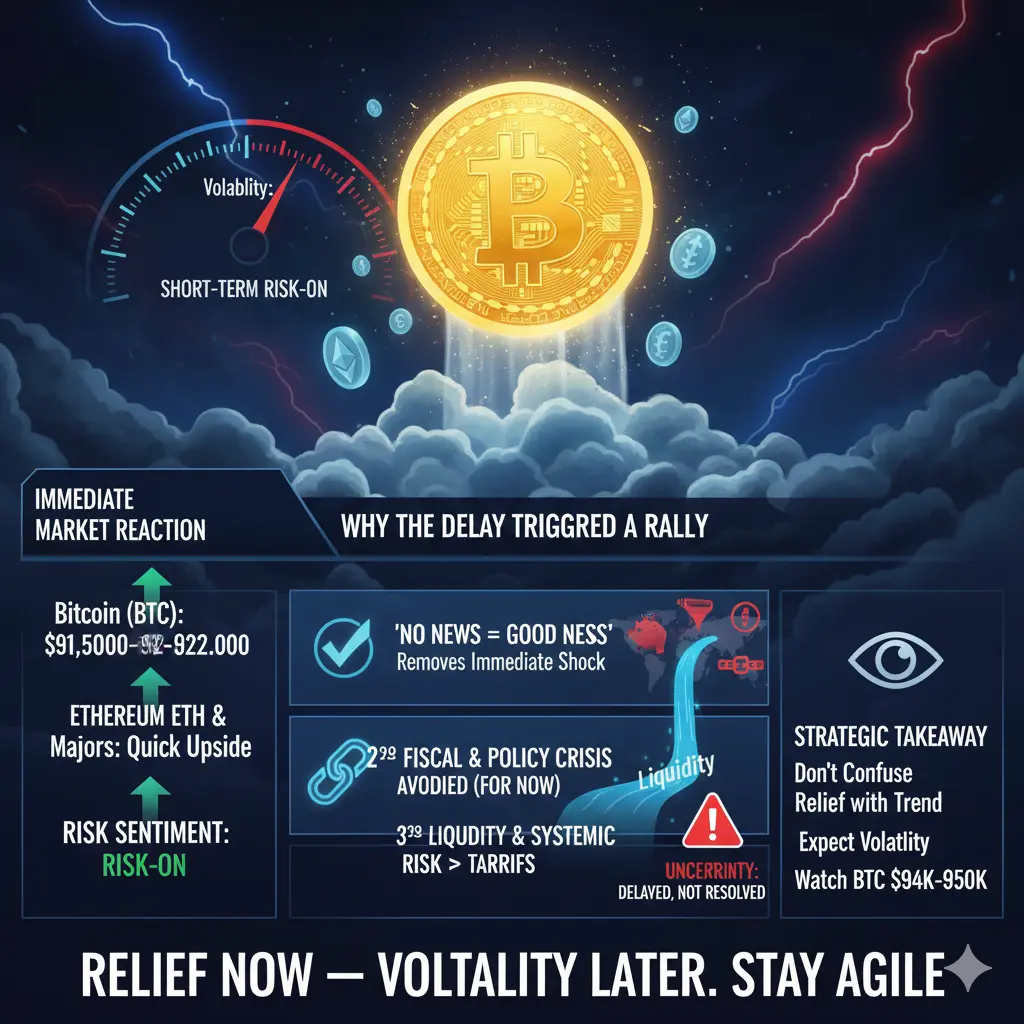

🔹 Market Reaction: Stocks and crypto respond to trade uncertainties — risk sentiment is shifting.

🔹 Investor Tip: Focus on diversification and hedge against sudden volatility.

💡 Takeaway: Trade policy isn’t just headlines — it directly affects liquidity, sentiment, and investment flows. Stay informed, stay strategic.

#GlobalMarkets #TradeUpdate #CryptoImpact #MarketS

The latest U.S. tariff ruling is shaking global trade and sending ripples through the markets.

🔹 Impact on Imports & Exports: Key commodities and tech goods may see price adjustments.

🔹 Market Reaction: Stocks and crypto respond to trade uncertainties — risk sentiment is shifting.

🔹 Investor Tip: Focus on diversification and hedge against sudden volatility.

💡 Takeaway: Trade policy isn’t just headlines — it directly affects liquidity, sentiment, and investment flows. Stay informed, stay strategic.

#GlobalMarkets #TradeUpdate #CryptoImpact #MarketS