📉 Dragon Fly Official Analysis: Price vs Fundamentals

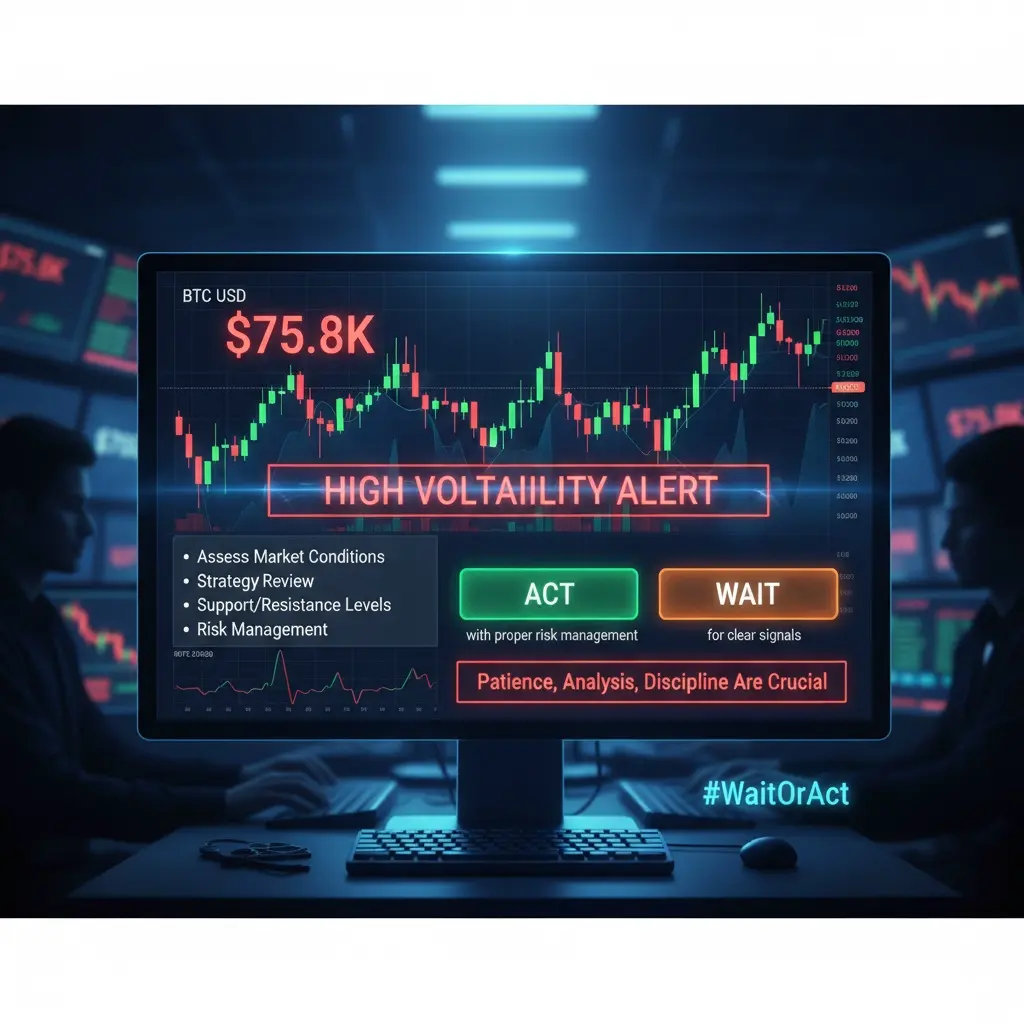

ETH is showing higher volatility while the direction remains uncertain. In my view, this is exactly the kind of market where patience and structured engagement matter.

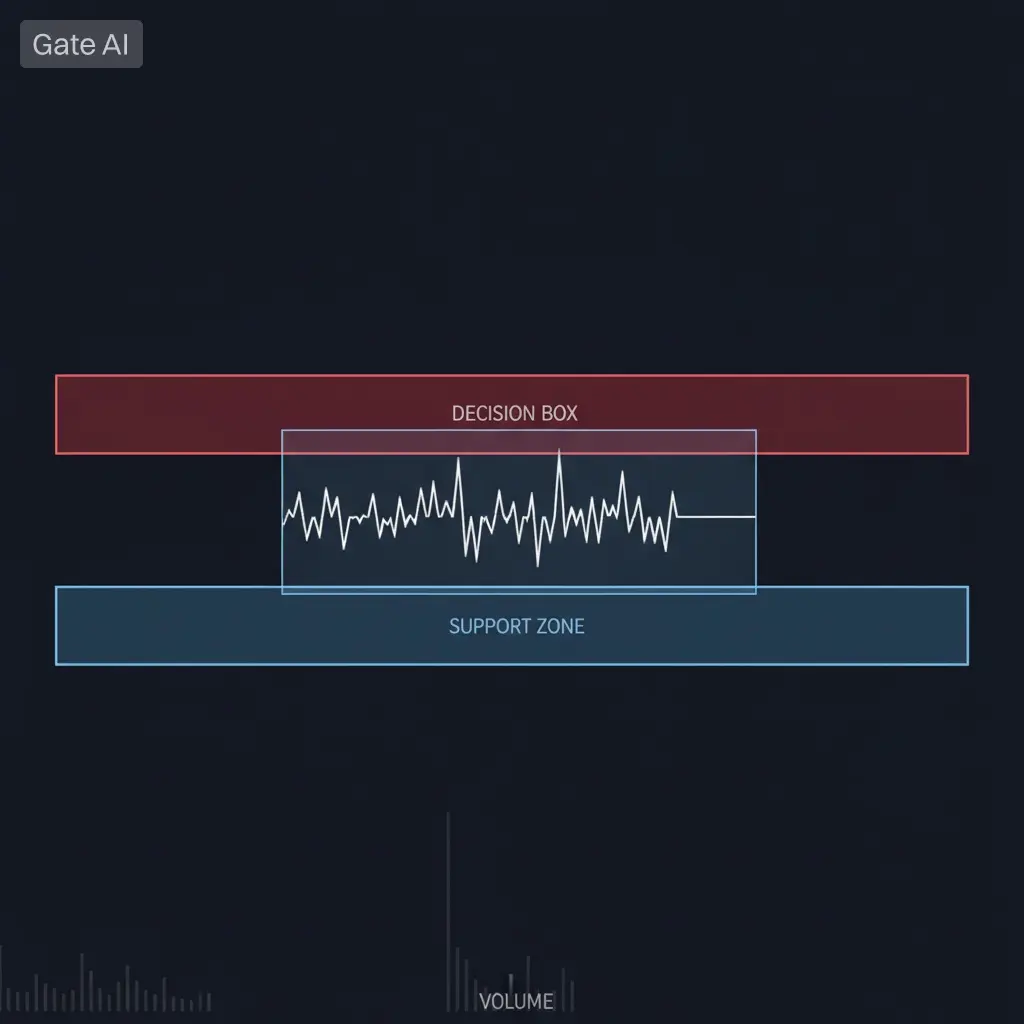

Price Signals (Dragon Fly Official):

Sudden swings and wider ranges show indecision.

Short-term momentum is mixed — no clear breakout yet.

Fundamentals (Dragon Fly Official):

On-chain activity and active addresses are rising steadily.

Layer-2 adoption (Arbitrum, Optimism, Base) continues to grow aggressively.

Ethereum network upgrades, like Fusaka improvements, are live — throughput is better, fees are lower.

Institutional flows and staking activity indicate strong structural demand.

Insight (Dragon Fly Official): Even if price seems messy, the underlying network health is solid, making gradual engagement or strategic accumulation worth considering.

🔎 Why Volatility Is High (Dragon Fly Official Perspective)

Macro Uncertainty: Global markets are cautious, and crypto reacts strongly.

Layer-2 Activity: Surging usage sometimes disconnects short-term price from fundamentals.

Burn & Fee Changes: Temporary post-upgrade burn fluctuations add volatility.

Holder Behavior: Whales are accumulating cautiously, retail reacts fast — classic short-term swings.

💡 How Dragon Fly Official Positions ETH

Gradual Entry: Layered buying reduces timing risk.

Wait for Confirmation: Short-term traders can wait for support/resistance confirmation before acting.

Monitor Layer-2 Growth: TVL and transactions are my leading indicators for the next directional move.

Risk Management: Stop-losses and proper sizing are essential during volatile periods.

📈 Long-Term Thesis (Dragon Fly Official View – 2026+)

Layer-2 adoption, network upgrades, and institutional interest create long-term structural growth for ETH.

Volatility may persist, but fundamentals point toward medium-to-long-term upside ($4k–$8k+).

📊 Summary Table

Price TrendVolatile, unclear directionOn-Chain ActivityRising steadilyLayer-2 AdoptionStrong, growingFundamental HealthSolidMarket SentimentMixed, cautious

Key Takeaway (Dragon Fly Official): Volatility is high now, but ETH’s fundamentals remain strong — gradual engagement or patient confirmation is the smart move.

⚠️ Risk Warning

Trading or investing in Ethereum (ETH) carries significant risk:

Price swings can be unpredictable.

Past performance does not guarantee future results.

Market sentiment can remain disconnected from fundamentals.

Only invest what you can afford to lose; always use proper risk management.

#WaitOrAct

ETH is showing higher volatility while the direction remains uncertain. In my view, this is exactly the kind of market where patience and structured engagement matter.

Price Signals (Dragon Fly Official):

Sudden swings and wider ranges show indecision.

Short-term momentum is mixed — no clear breakout yet.

Fundamentals (Dragon Fly Official):

On-chain activity and active addresses are rising steadily.

Layer-2 adoption (Arbitrum, Optimism, Base) continues to grow aggressively.

Ethereum network upgrades, like Fusaka improvements, are live — throughput is better, fees are lower.

Institutional flows and staking activity indicate strong structural demand.

Insight (Dragon Fly Official): Even if price seems messy, the underlying network health is solid, making gradual engagement or strategic accumulation worth considering.

🔎 Why Volatility Is High (Dragon Fly Official Perspective)

Macro Uncertainty: Global markets are cautious, and crypto reacts strongly.

Layer-2 Activity: Surging usage sometimes disconnects short-term price from fundamentals.

Burn & Fee Changes: Temporary post-upgrade burn fluctuations add volatility.

Holder Behavior: Whales are accumulating cautiously, retail reacts fast — classic short-term swings.

💡 How Dragon Fly Official Positions ETH

Gradual Entry: Layered buying reduces timing risk.

Wait for Confirmation: Short-term traders can wait for support/resistance confirmation before acting.

Monitor Layer-2 Growth: TVL and transactions are my leading indicators for the next directional move.

Risk Management: Stop-losses and proper sizing are essential during volatile periods.

📈 Long-Term Thesis (Dragon Fly Official View – 2026+)

Layer-2 adoption, network upgrades, and institutional interest create long-term structural growth for ETH.

Volatility may persist, but fundamentals point toward medium-to-long-term upside ($4k–$8k+).

📊 Summary Table

Price TrendVolatile, unclear directionOn-Chain ActivityRising steadilyLayer-2 AdoptionStrong, growingFundamental HealthSolidMarket SentimentMixed, cautious

Key Takeaway (Dragon Fly Official): Volatility is high now, but ETH’s fundamentals remain strong — gradual engagement or patient confirmation is the smart move.

⚠️ Risk Warning

Trading or investing in Ethereum (ETH) carries significant risk:

Price swings can be unpredictable.

Past performance does not guarantee future results.

Market sentiment can remain disconnected from fundamentals.

Only invest what you can afford to lose; always use proper risk management.

#WaitOrAct