ElCryptoChapo

Belum ada konten

ElCryptoChapo

Apa yang membuat investor mengatakan ya itu sederhana. Percayalah bahwa Anda nyata. Risiko yang terkandung. Keuntungan asimetris. Bukti eksekusi. Bukti sosial yang sudah diyakini oleh orang serius lainnya. Itulah daftar periksa yang berjalan di latar belakang setiap pertemuanBerlangganan Youtube saya untuk video serupa di mana saya akan memandu pendiri Web 3 dari A-Z:

Lihat Asli- Hadiah

- suka

- Komentar

- Posting ulang

- Bagikan

Pendapat panas: Pendiri yang tidak bisa menjelaskan tingkat pembakaran mereka seharusnya tidak membakar modal sama sekali.

Lihat Asli

- Hadiah

- suka

- Komentar

- Posting ulang

- Bagikan

gm, Selamat Jumat!\n\n“Tidak ada yang seburuk melakukan sesuatu secara efisien yang seharusnya tidak dilakukan sama sekali.” \n — Peter Drucker\n\nKebanyakan orang tidak terjebak karena mereka malas. Mereka terjebak karena mereka sibuk dengan hal yang salah.\n\nKemajuan nyata biasanya berasal dari pengurangan. Hilangkan gesekan.\n\nLebih sedikit gangguan.\nLebih sedikit prioritas palsu.\nLebih banyak waktu yang dihabiskan untuk hal yang benar-benar penting.\n\nPotong SATU hal hari ini yang diam-diam mencuri minggu Anda! 🥂

Lihat Asli

- Hadiah

- suka

- Komentar

- Posting ulang

- Bagikan

Claude Code tidak memasarkan dirinya sendiri\n\nIa mengirimkan sesuatu yang dibutuhkan orang, merancangnya dengan baik, dan berita menyebar karena benar-benar berhasil!\n\nMereka tidak membutuhkan siklus hype atau kampanye influencer.\n\nMereka sudah memiliki pengguna yang tidak pernah bisa lepas lagi dan terus bertambah setiap hari.\n\nKredibilitas selalu bertambah ketika eksekusi yang konsisten mendukungnya.\n\nPelajaran dari itu sejujurnya.

Lihat Asli- Hadiah

- suka

- Komentar

- Posting ulang

- Bagikan

Proyek privasi dari 2020-2021 kembali muncul dengan tim yang lebih baik, eksekusi yang lebih bersih, & jauh dari keserakahan.

Ide yang sama. Kemasan yang berbeda. Waktu mungkin sebenarnya tepat kali ini.

Fhenix: privasi di lapisan eksekusi, bukan hanya penyamaran transaksi. Smart contract berjalan di data terenkripsi.

Inco Network: infrastruktur privasi lengkap yang didukung oleh a16z & Coinbase. Lightning testnet sudah aktif.

Temple: privasi prioritas kepatuhan untuk perdagangan institusional. Kerahasiaan tanpa mengorbankan keterbukaan.

Ini bukan lagi taruhan moonshot.

Mereka menyelesaikan ma

Lihat AsliIde yang sama. Kemasan yang berbeda. Waktu mungkin sebenarnya tepat kali ini.

Fhenix: privasi di lapisan eksekusi, bukan hanya penyamaran transaksi. Smart contract berjalan di data terenkripsi.

Inco Network: infrastruktur privasi lengkap yang didukung oleh a16z & Coinbase. Lightning testnet sudah aktif.

Temple: privasi prioritas kepatuhan untuk perdagangan institusional. Kerahasiaan tanpa mengorbankan keterbukaan.

Ini bukan lagi taruhan moonshot.

Mereka menyelesaikan ma

- Hadiah

- suka

- Komentar

- Posting ulang

- Bagikan

89% dari token baru tidak memiliki model pendapatan. tidak ada.

Mereka tidak membangun bisnis. Mereka membangun likuiditas keluar dengan sebuah white paper.

11% dengan aliran pendapatan nyata? Mereka adalah yang MUNGKIN masih diperdagangkan 18 bulan kemudian sementara yang lain dihapus dari daftar catatan kaki.

Pendapatan tidak menarik sampai pasar ingat bahwa pembakaran atau insentif lain tanpa pendapatan hanyalah karpet yang lambat dengan PR yang lebih baik..

Lihat AsliMereka tidak membangun bisnis. Mereka membangun likuiditas keluar dengan sebuah white paper.

11% dengan aliran pendapatan nyata? Mereka adalah yang MUNGKIN masih diperdagangkan 18 bulan kemudian sementara yang lain dihapus dari daftar catatan kaki.

Pendapatan tidak menarik sampai pasar ingat bahwa pembakaran atau insentif lain tanpa pendapatan hanyalah karpet yang lambat dengan PR yang lebih baik..

- Hadiah

- suka

- Komentar

- Posting ulang

- Bagikan

$ETH memiliki TVL 10x lebih banyak karena ini adalah lapisan penyelesaian institusional.

$SOL memiliki 110x lebih banyak transaksi karena ini adalah rantai aplikasi konsumen.

Mereka menyelesaikan masalah yang berbeda untuk pengguna yang berbeda.

Proyek beroperasi dengan cara yang beragam. Beberapa fokus pada menarik modal institusional yang menuntut kepatuhan ketat.

Yang lain memprioritaskan menarik komunitas ritel yang mencari solusi inovatif.

Kedua jalur tersebut valid. Keduanya melayani sumber modal yang berbeda. Keduanya memerlukan strategi yang berbeda, disesuaikan dengan kebutuhan dan

Lihat Asli$SOL memiliki 110x lebih banyak transaksi karena ini adalah rantai aplikasi konsumen.

Mereka menyelesaikan masalah yang berbeda untuk pengguna yang berbeda.

Proyek beroperasi dengan cara yang beragam. Beberapa fokus pada menarik modal institusional yang menuntut kepatuhan ketat.

Yang lain memprioritaskan menarik komunitas ritel yang mencari solusi inovatif.

Kedua jalur tersebut valid. Keduanya melayani sumber modal yang berbeda. Keduanya memerlukan strategi yang berbeda, disesuaikan dengan kebutuhan dan

- Hadiah

- suka

- Komentar

- Posting ulang

- Bagikan

🚨 Vibecoding hack 🚨

Prompt untuk meningkatkan Latensi API & Mengurangi Panggilan/API Biaya menggunakan Claude Code:

" Baca dan pahami repo ini sepenuhnya. Tinjau bagaimana Anda dapat menerapkan konsep-konsep ini ke build saat ini yang kita miliki untuk meningkatkan kecepatan, kinerja, atau biaya. Buat rencana implementasi lengkap untuk menerapkan konsep-konsep ini. Setelah rencana selesai, buat PRD dan file task .md untuk peningkatan yang dapat Anda referensikan untuk menjalankan loop Ralph yang panjang."

<>

Lihat AsliPrompt untuk meningkatkan Latensi API & Mengurangi Panggilan/API Biaya menggunakan Claude Code:

" Baca dan pahami repo ini sepenuhnya. Tinjau bagaimana Anda dapat menerapkan konsep-konsep ini ke build saat ini yang kita miliki untuk meningkatkan kecepatan, kinerja, atau biaya. Buat rencana implementasi lengkap untuk menerapkan konsep-konsep ini. Setelah rencana selesai, buat PRD dan file task .md untuk peningkatan yang dapat Anda referensikan untuk menjalankan loop Ralph yang panjang."

<>

- Hadiah

- 1

- 1

- Posting ulang

- Bagikan

GateUser-eb7edcd9 :

:

Terima kasih atas informasi yang diberikan 👋Semua orang membicarakan model, alat, dan keterampilan terbaru. Tidak ada yang membicarakan RAM.

Sampai seluruh sistem mereka membeku.

Lihat AsliSampai seluruh sistem mereka membeku.

- Hadiah

- suka

- Komentar

- Posting ulang

- Bagikan

Hanya membutuhkan satu entri yang baik & satu keluar yang baik.

Ingat itu.

Lihat AsliIngat itu.

- Hadiah

- suka

- Komentar

- Posting ulang

- Bagikan

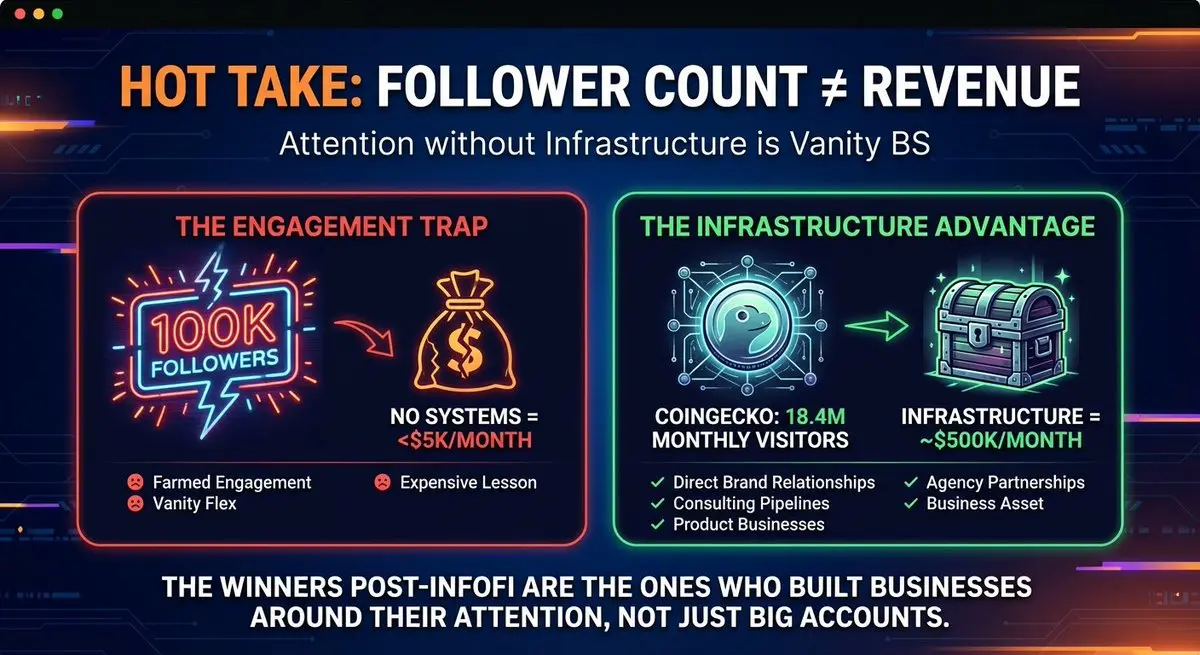

Pendapat panas: Jumlah pengikutmu tidak berarti apa-apa jika kamu tidak bisa mengubah perhatian menjadi pendapatan.

@coingecko memiliki 18,4 juta pengunjung bulanan. Dengan tarif iklan standar, itu sekitar $500K per bulan hanya dari monetisasi dasar..

Kebanyakan pembuat konten dengan 100K pengikut bahkan tidak bisa memonetisasi $5K per bulan karena mereka tidak pernah membangun sistem yang nyata.

Era InfoFi mengajarkan semua orang untuk menumbuhkan keterlibatan tetapi BEBERAPA yang belajar bagaimana membangun bisnis di sekitar perhatian mereka.

Sekarang uang mudah mengering, semua orang beru

Lihat Asli@coingecko memiliki 18,4 juta pengunjung bulanan. Dengan tarif iklan standar, itu sekitar $500K per bulan hanya dari monetisasi dasar..

Kebanyakan pembuat konten dengan 100K pengikut bahkan tidak bisa memonetisasi $5K per bulan karena mereka tidak pernah membangun sistem yang nyata.

Era InfoFi mengajarkan semua orang untuk menumbuhkan keterlibatan tetapi BEBERAPA yang belajar bagaimana membangun bisnis di sekitar perhatian mereka.

Sekarang uang mudah mengering, semua orang beru

- Hadiah

- suka

- Komentar

- Posting ulang

- Bagikan

gm selamat Jumat

“Disiplin sama dengan kebebasan.”

– Jocko Willink

Kebanyakan orang mendengar Jumat & bersantai. Itu jebakan.

Anda ingin kebebasan?

Bergeraklah saat orang lain melambat.

Disiplin hari ini, kebebasan besok.

Selesaikan apa yang 🫵 katakan akan kamu lakukan!

Lihat Asli“Disiplin sama dengan kebebasan.”

– Jocko Willink

Kebanyakan orang mendengar Jumat & bersantai. Itu jebakan.

Anda ingin kebebasan?

Bergeraklah saat orang lain melambat.

Disiplin hari ini, kebebasan besok.

Selesaikan apa yang 🫵 katakan akan kamu lakukan!

- Hadiah

- suka

- Komentar

- Posting ulang

- Bagikan

Mungkin baru saja terpikir penggunaan Claude Work terbaik untuk banyak orang.. atau mungkin ini hanya saya.

Minta dia untuk membuat catatan kecil dan menyimpan file semua tab & browser yang sedang Anda buka.

Jadi Anda bisa menutup semuanya tanpa penyesalan karena lupa sesuatu.

Selalu berakhir dengan labirin profil, browser, tab.. ini satu-satunya hal yang saya rasa mungkin akan bekerja dengan baik

Akan melaporkan kembali

Lihat AsliMinta dia untuk membuat catatan kecil dan menyimpan file semua tab & browser yang sedang Anda buka.

Jadi Anda bisa menutup semuanya tanpa penyesalan karena lupa sesuatu.

Selalu berakhir dengan labirin profil, browser, tab.. ini satu-satunya hal yang saya rasa mungkin akan bekerja dengan baik

Akan melaporkan kembali

- Hadiah

- suka

- Komentar

- Posting ulang

- Bagikan

Tim yang membangun UFO Gaming menjadi $1.5B sedang meluncurkan $SPACE / @intodotspace - platform pasar prediksi dengan leverage 10x di @solana

Penjualan umum mereka akan berakhir dalam sekitar satu hari, dan telah melebihi permintaan sekitar 543%, mengumpulkan $13.7M dari target $2.5M, dan terus berjalan..

Apa yang menarik perhatian saya: mereka tidak hanya menyalin Polymarket.

$SPACE menggunakan roda pendorong deflasi di mana 50% dari biaya perdagangan digunakan untuk buyback & pembakaran.

Setiap prediksi secara harfiah mengurangi pasokan token.

Pasar-pasar ini sudah aktif dengan volume seriu

Penjualan umum mereka akan berakhir dalam sekitar satu hari, dan telah melebihi permintaan sekitar 543%, mengumpulkan $13.7M dari target $2.5M, dan terus berjalan..

Apa yang menarik perhatian saya: mereka tidak hanya menyalin Polymarket.

$SPACE menggunakan roda pendorong deflasi di mana 50% dari biaya perdagangan digunakan untuk buyback & pembakaran.

Setiap prediksi secara harfiah mengurangi pasokan token.

Pasar-pasar ini sudah aktif dengan volume seriu

Lihat Asli

- Hadiah

- suka

- Komentar

- Posting ulang

- Bagikan

GM Selamat Kamis

Jika Anda masih ragu, bagus.

Itu berarti Anda mendorong batas.

Yang tidak tahu merasa nyaman.

Yang tajam merasakan ketegangannya.

Kamis bukan garis finish.

Itu tempat kebanyakan melambat.

Jangan.

Tetap tekan pedal gas!

Terus membangun.

Lihat AsliJika Anda masih ragu, bagus.

Itu berarti Anda mendorong batas.

Yang tidak tahu merasa nyaman.

Yang tajam merasakan ketegangannya.

Kamis bukan garis finish.

Itu tempat kebanyakan melambat.

Jangan.

Tetap tekan pedal gas!

Terus membangun.

- Hadiah

- suka

- Komentar

- Posting ulang

- Bagikan

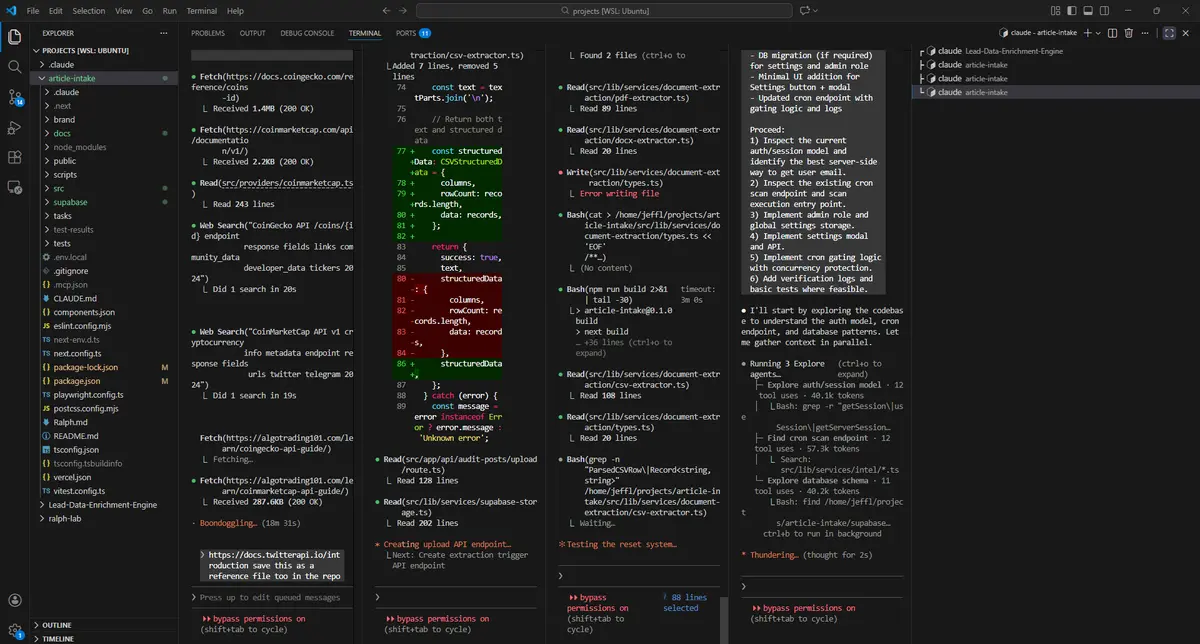

Jika salah satu monitor Anda tidak terlihat seperti ini sepanjang hari Anda, Anda tidak menjalankan 2026 dengan benar.

Kode Claude adalah alat paling kuat yang pernah saya gunakan.

Saya telah menjadi pengembang perangkat lunak full-stack dalam waktu kurang dari 3 bulan. Anda tidak akan belajar hanya dengan membaca posting di X.

Mulailah vibecoding.

Lihat AsliKode Claude adalah alat paling kuat yang pernah saya gunakan.

Saya telah menjadi pengembang perangkat lunak full-stack dalam waktu kurang dari 3 bulan. Anda tidak akan belajar hanya dengan membaca posting di X.

Mulailah vibecoding.

- Hadiah

- suka

- Komentar

- Posting ulang

- Bagikan

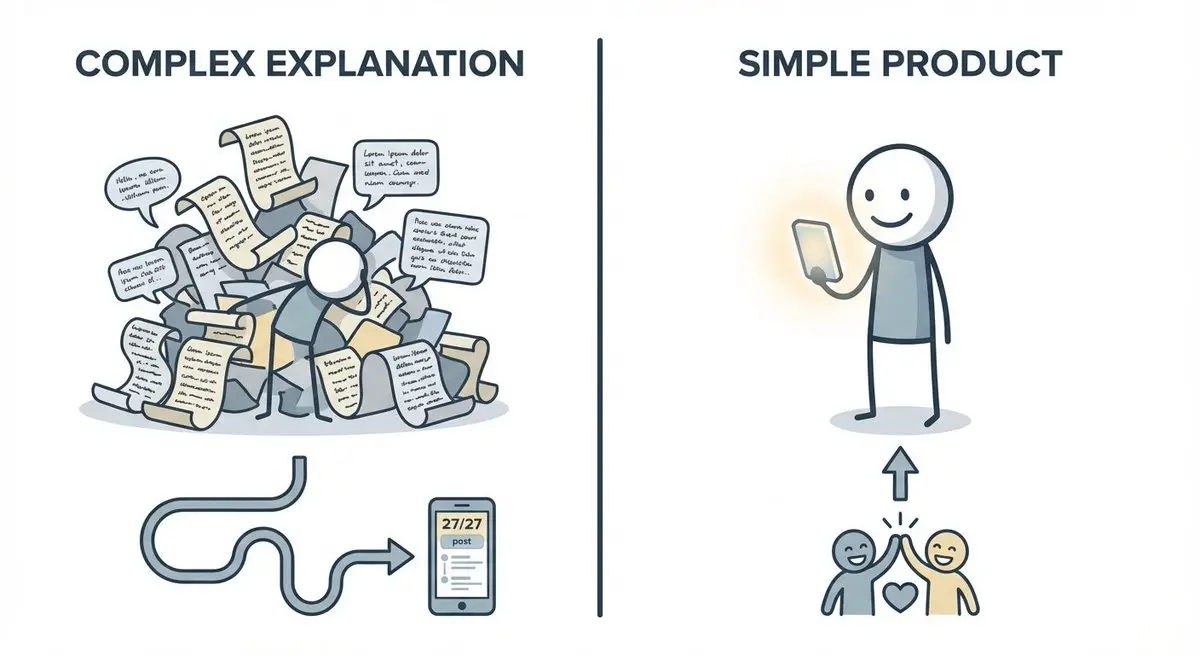

Pendapat panas: Jika Anda membutuhkan rangkaian X sebanyak 27 posting untuk menjelaskan mengapa proyek Anda revolusioner, kemungkinan besar produk Anda buruk..

Produk yang bagus tidak membutuhkan manifesto.

Mereka membutuhkan PENGGUNA yang tidak bisa membayangkan kembali.

Pelajaran dari situ.

Lihat AsliProduk yang bagus tidak membutuhkan manifesto.

Mereka membutuhkan PENGGUNA yang tidak bisa membayangkan kembali.

Pelajaran dari situ.

- Hadiah

- 1

- 1

- Posting ulang

- Bagikan

ybaser :

:

2026 Pergi Pergi 👊- Hadiah

- suka

- Komentar

- Posting ulang

- Bagikan

Topik Trending

Lihat Lebih Banyak14.39K Popularitas

12.31K Popularitas

10.24K Popularitas

4.25K Popularitas

42.47K Popularitas

Hot Gate Fun

Lihat Lebih Banyak- MC:$3.26KHolder:10.00%

- MC:$3.24KHolder:10.00%

- MC:$3.22KHolder:10.00%

- MC:$3.27KHolder:20.00%

- MC:$3.27KHolder:10.00%

Sematkan