Crypto “Golden Cross” Recovery? 2025 Latest Golden Cross Signals and Market Outlook

What Is a Golden Cross?

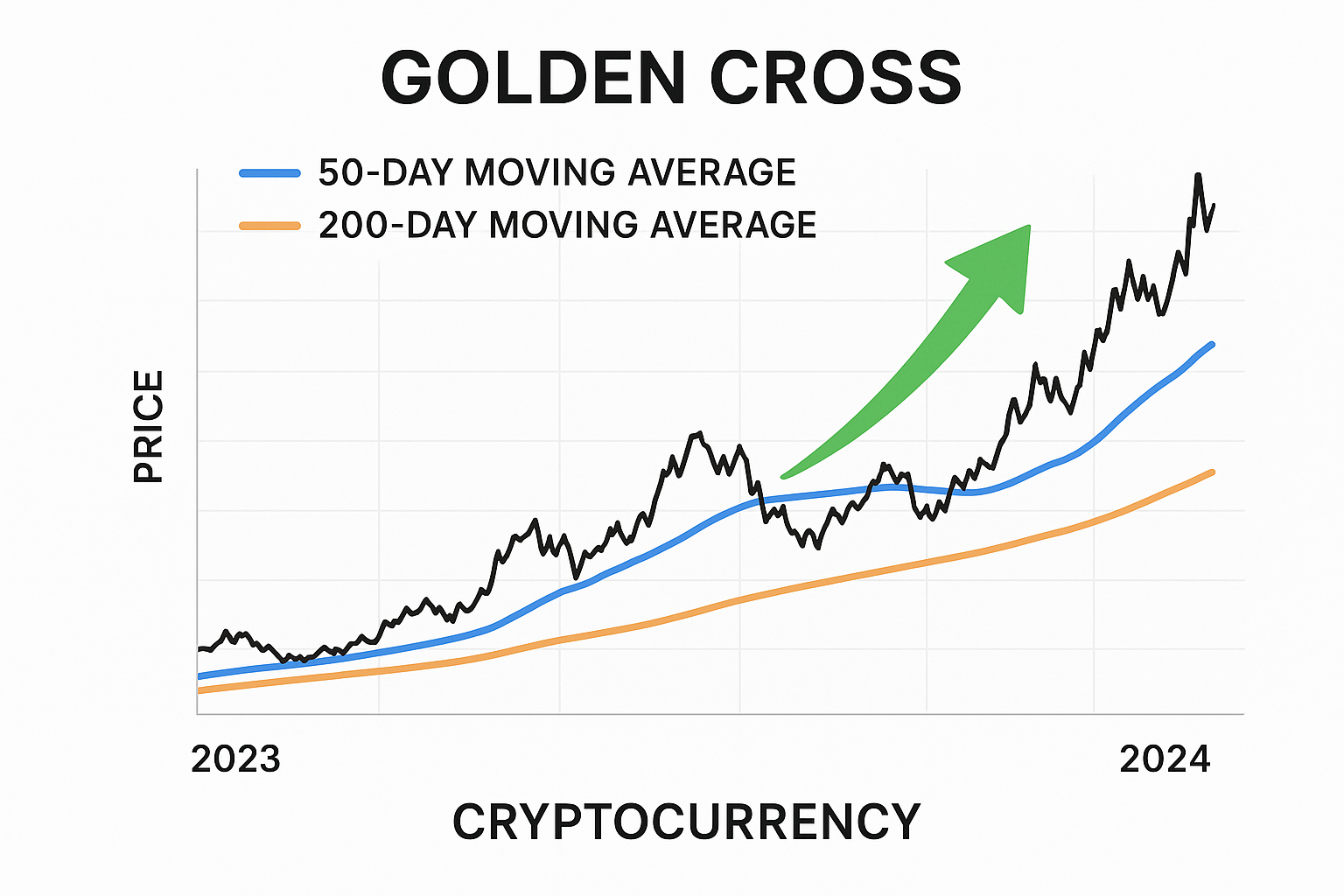

In traditional technical analysis, a Golden Cross occurs when a short-term moving average—typically the 50-day moving average—crosses above a long-term moving average, such as the 200-day moving average. This pattern signals increasing price momentum and may indicate a shift from a bearish to a bullish trend. Both traditional financial and crypto market traders often consider the Golden Cross a potential buy signal or an indicator of a trend reversal.

However, the Golden Cross only suggests that a trend change is possible. For a sustained rally to develop, additional factors like higher trading volume, increased capital inflows, and improved market sentiment are required.

Recent Golden Cross Signals in the Crypto Market

- Bitcoin (BTC): Analysts note that after BTC surpassed $110,000, its 50-day moving average crossed above the 200-day moving average, forming a classic Golden Cross. Many believe it could drive the price toward $113,000.

- Ethereum (ETH): Around May 20, 2025, ETH also saw its 50-day moving average cross above the 200-day moving average, becoming a key topic in recent crypto market discussions.

- Several other altcoins and tokens have exhibited similar technical patterns. While not all are widely reported, they offer diverse perspectives for market observation.

These Golden Cross signals have renewed trader interest in the crypto market, and many now anticipate a rebound.

Why Is the Golden Cross Especially Noteworthy Now? Macro and Market Factors Explained

- Macro Asset Trends and Renewed Safe-Haven Demand: In 2025, gold prices surged, drawing investor interest to precious metals and digital assets as both a safe-haven and investment. This environment makes crypto assets with positive technical signals more attractive to those seeking diversified portfolios.

- Crypto Market Transition From Bear to Bull: After recent volatility and price corrections, many larger investors remained cautious. The emergence of Golden Cross signals now suggests a potential advantage for bullish traders, prompting renewed capital inflows.

- Combined Technical and Capital Support: While the Golden Cross is just one technical indicator, its reliability increases when supported by rising trading volumes, capital inflows, and positive institutional sentiment. For example, ETH’s bullish sentiment is driven by both whale accumulation and Golden Cross signals.

Potential Impact on Major Cryptocurrencies: Opportunities and Risks

Opportunities:

- If BTC breaks through $113,000, it could retest $120,000 or higher, presenting new profit opportunities for bullish traders.

- If ETH overcomes resistance, it may rally above $3,200 and start a new upward cycle for leading cryptocurrencies.

- A combination of Golden Cross signals and bullish sentiment may drive coordinated gains in altcoins and DeFi tokens across the crypto market.

Risks:

- The Golden Cross is a lagging indicator. If trading volume, capital inflows, or market confidence falter, it may result in a False Golden Cross, making rallies unsustainable.

- Macro factors—including economic trends, interest rates, and US dollar movements—can still pressure the crypto market. For instance, despite gold’s rise this year, crypto assets have at times diverged due to capital flows and macro concerns.

- Market sentiment remains volatile, and crypto assets are highly subject to short-term price swings. Trading risks remain significant.

How Should Investors Interpret and Respond?

- View the Golden Cross as a potential trend-change signal, but avoid excessive optimism or panic.

- Analyze trading volume, on-chain data, capital flows, and macro factors together. Do not rely solely on moving average crossovers.

- When trading, set clear stop-loss and take-profit levels, manage position sizes, and protect yourself against losses from sharp volatility.

- For medium- and long-term investors, consider the Golden Cross a potential entry opportunity, and consider building positions gradually instead of investing all at once.

Related Articles

Crypto Future Profit Calculator: How to Calculate Your Potential Gains

Crypto Futures Calculator: Easily Estimate Your Profits & Risks

What is Oasis Network (ROSE)?

The $50M Crypto Scam Nobody Is Talking About

What Are Crypto Options?