Post content & earn content mining yield

placeholder

GateUser-f97b82d4

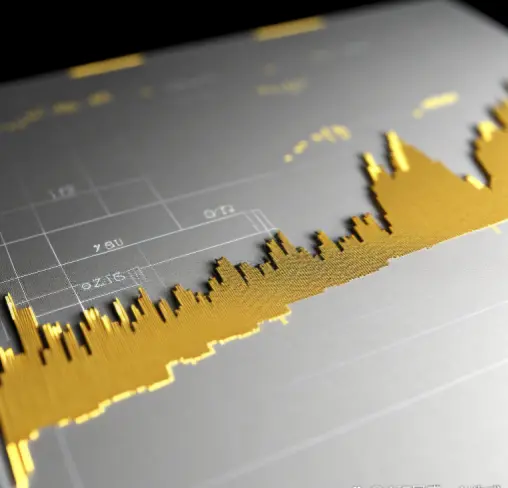

🟦 BTC/GOLD approaching macro floor.

BTC priced in gold has been in a relative bear market since Dec 2024.

Every prior BTC/GOLD bear regime:

• Lasted ~395–400 days

• Saw −85% to −75% relative drawdowns (2017,2021)

• Resolved with a structural expansion phase

This cycle, simple regression + volatility decay imply a terminal zone around −60% to −65%.

We’re now fully inside that historical compression zone.

Not hopium - just facts.

This is where relative bottoms have formed and where the next regime begins.

Ignore my analysis at your own risk. #bitcoin #gold

BTC priced in gold has been in a relative bear market since Dec 2024.

Every prior BTC/GOLD bear regime:

• Lasted ~395–400 days

• Saw −85% to −75% relative drawdowns (2017,2021)

• Resolved with a structural expansion phase

This cycle, simple regression + volatility decay imply a terminal zone around −60% to −65%.

We’re now fully inside that historical compression zone.

Not hopium - just facts.

This is where relative bottoms have formed and where the next regime begins.

Ignore my analysis at your own risk. #bitcoin #gold

BTC-6.31%

- Reward

- like

- Comment

- Repost

- Share

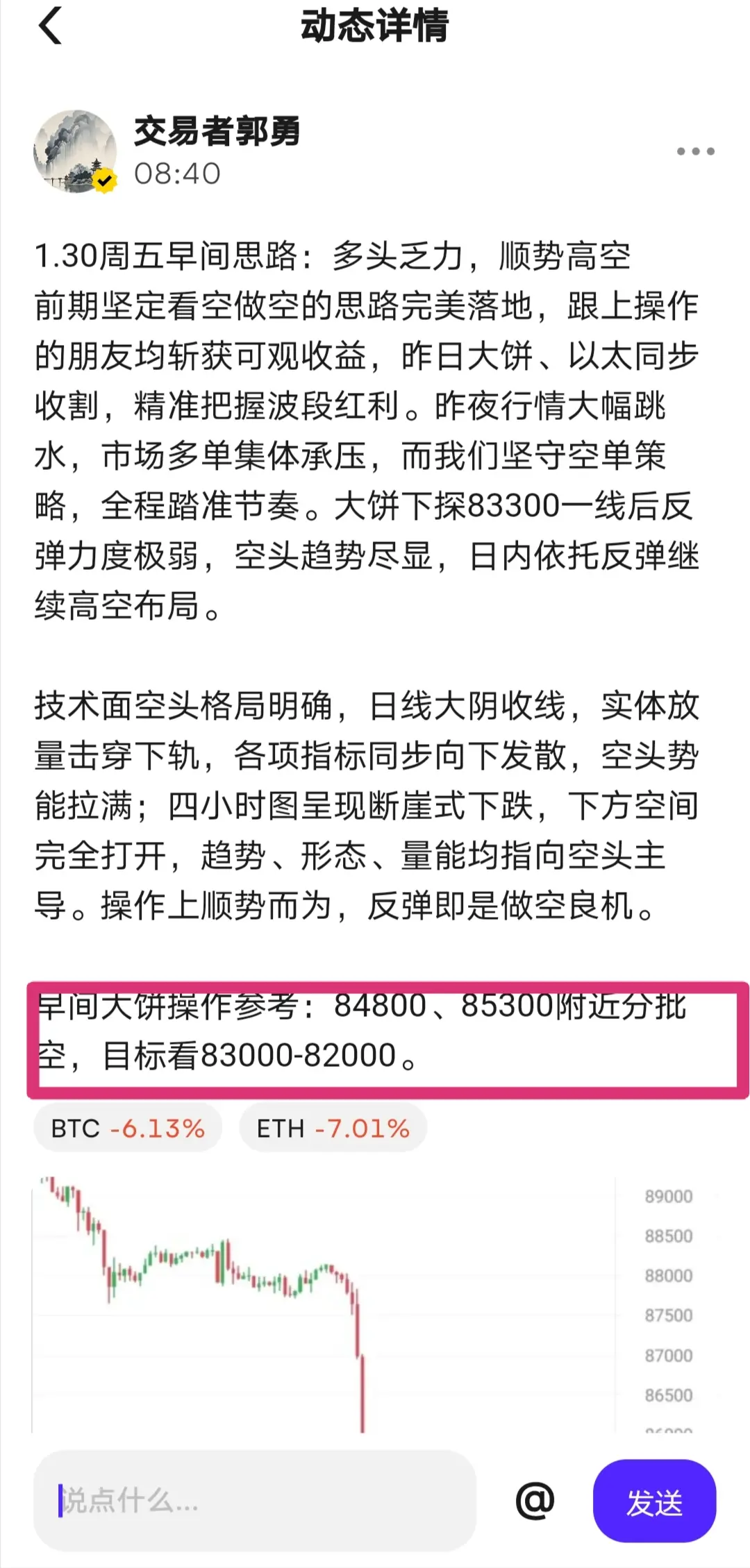

1. Friday Afternoon BTC/ETH Market Update

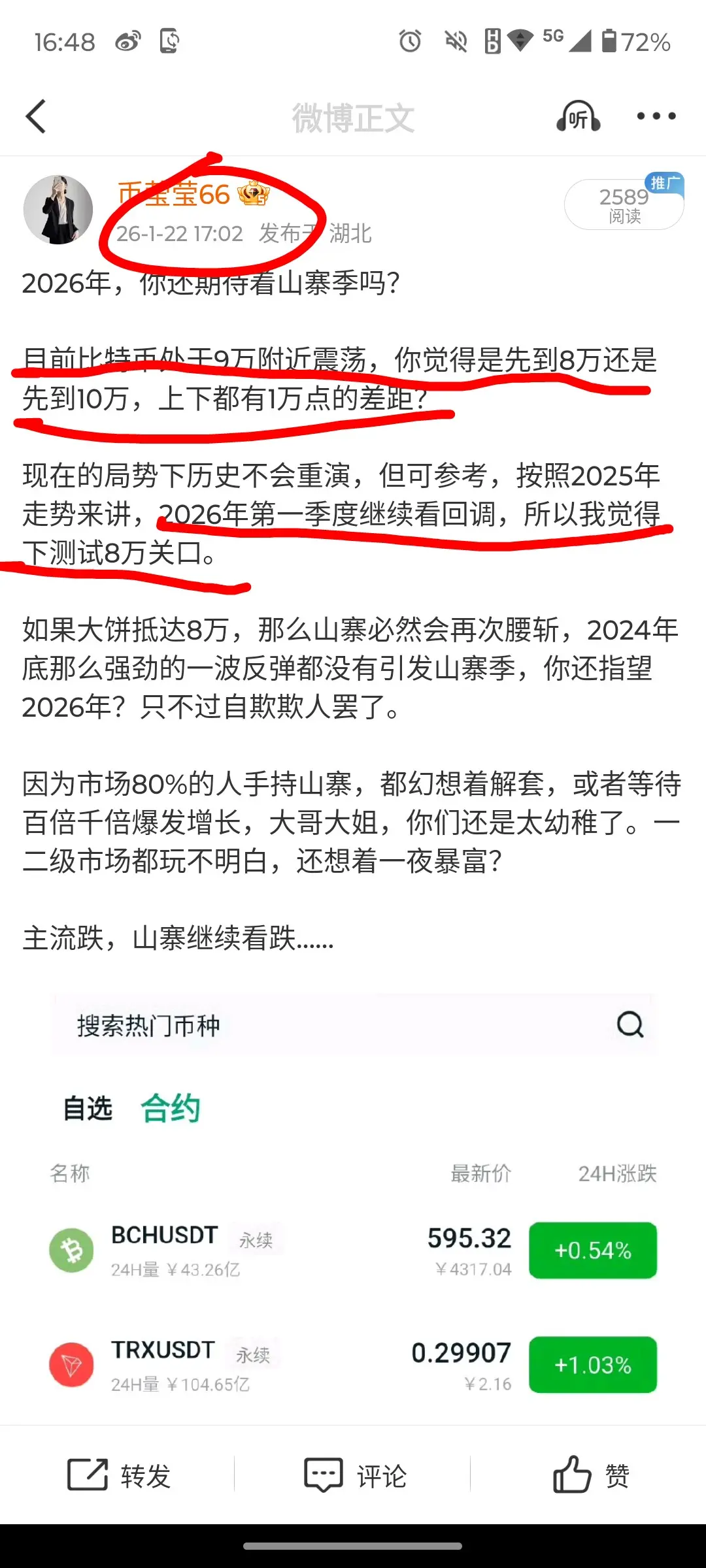

Following the Federal Reserve decision early this morning, the crypto market responded with a sharp decline, hitting new lows. Our clear bearish outlook from this morning has been perfectly validated.

The current rebound is not a trend reversal but a golden opportunity to establish short positions. From macroeconomic analysis to market sentiment, the bear market pattern has been confirmed. The brief rebound lacks sustainable momentum, making it an excellent time for bears to strike.

Coinciding with Black Friday, market selling pressure is likely to fur

View OriginalFollowing the Federal Reserve decision early this morning, the crypto market responded with a sharp decline, hitting new lows. Our clear bearish outlook from this morning has been perfectly validated.

The current rebound is not a trend reversal but a golden opportunity to establish short positions. From macroeconomic analysis to market sentiment, the bear market pattern has been confirmed. The brief rebound lacks sustainable momentum, making it an excellent time for bears to strike.

Coinciding with Black Friday, market selling pressure is likely to fur

- Reward

- like

- 2

- Repost

- Share

PrayingToBuddha :

:

These are thousands of dollars earned from a lot of U in shohas.View More

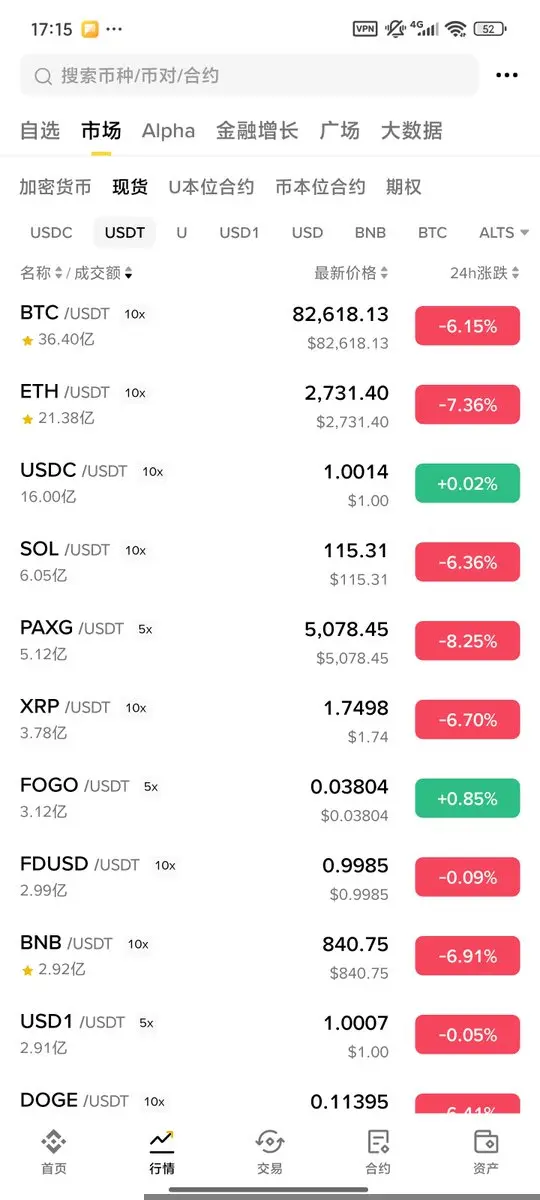

$SOL is trading near $115, after breaking below the $123–125 support. Sellers are clearly stronger right now. This level decides the next move — hold and bounce, or lose it and fall toward lower supports.

$SOL #PreciousMetalsPullBack #GateLiveMiningProgramPublicBeta #GoldandSilverHitNewHighs #TokenizedSilverTrend

$SOL #PreciousMetalsPullBack #GateLiveMiningProgramPublicBeta #GoldandSilverHitNewHighs #TokenizedSilverTrend

SOL-6.32%

- Reward

- like

- Comment

- Repost

- Share

新年好

新年好

Created By@HurryUpAndEmpty

Subscription Progress

0.00%

MC:

$0

Create My Token

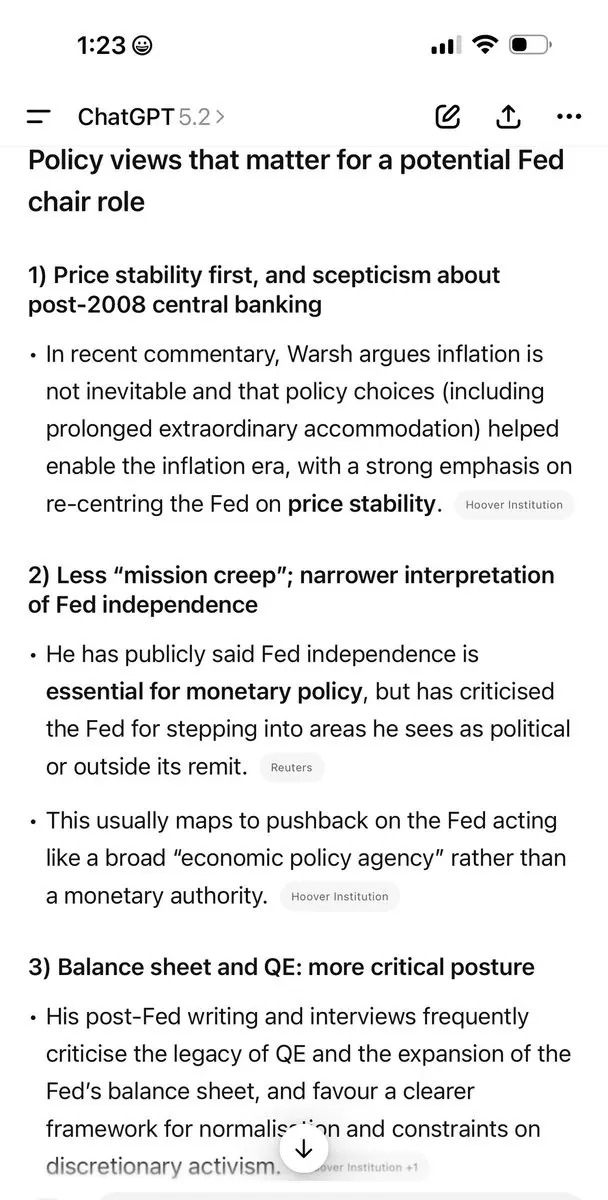

Global markets crashed on the suspicion that Trump’s Fed chair pick Kevin Warsh might hold logical and common sense monetary policy views instead of being a pump fun economist. We live in hilarious times

- Reward

- like

- Comment

- Repost

- Share

- Reward

- like

- 2

- Repost

- Share

富大叔 :

:

I don't believe it, unless you send me gift coins.View More

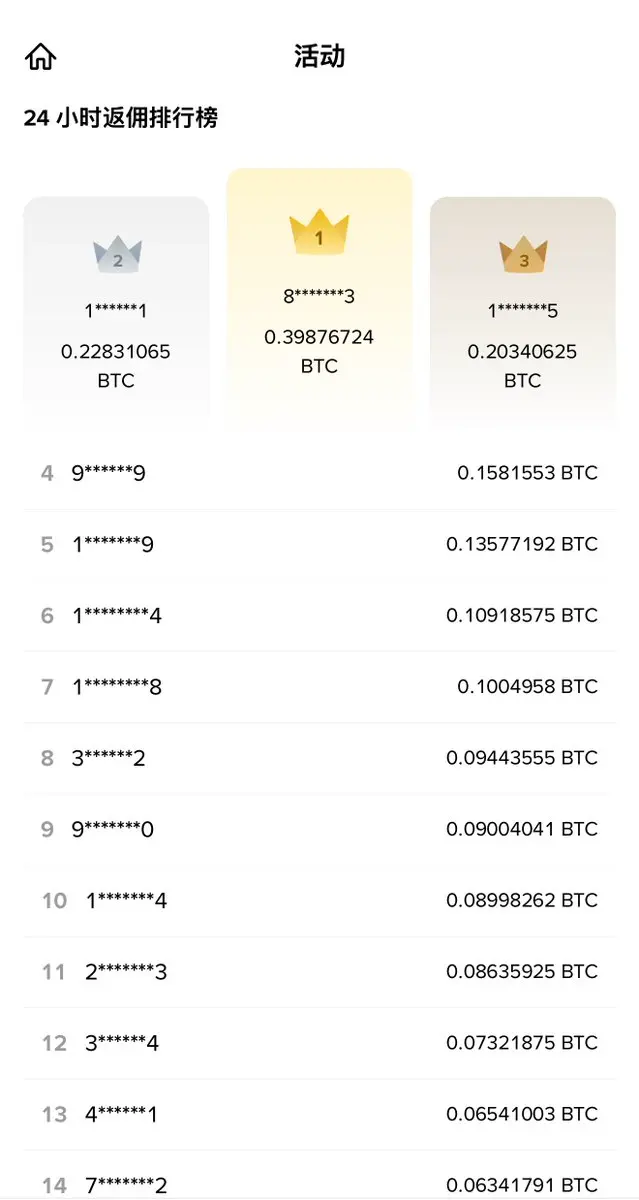

Is the first place rebate this low? It shows how bad the market is.

View Original

- Reward

- like

- 1

- Repost

- Share

GateUser-71f57687 :

:

Yes, the market is bad. I just entered here, and it feels quite unfriendly😅😅$XRP is trading around $1.74, after failing to hold above $1.90. Sellers have taken control and pressure remains heavy. If buyers don’t step in soon, XRP could slide further — but a strong bounce here could spark a quick recovery.

$XRP #PreciousMetalsPullBack #CryptoMarketPullback #AIBotClawdbotGoesViral #SEConTokenizedSecurities

$XRP #PreciousMetalsPullBack #CryptoMarketPullback #AIBotClawdbotGoesViral #SEConTokenizedSecurities

XRP-7.35%

- Reward

- like

- Comment

- Repost

- Share

POV: Newbie looking at that one idolo after being rugged by the same idolo on a meme project the 5th time for ECA. Gm.

MEME-6.08%

- Reward

- like

- Comment

- Repost

- Share

#CryptoMarketPullback

🧠 Crypto Market Under Extreme Fear — Structure Over Emotion

The crypto market has entered a high-stress correction phase, with BTC and ETH down 6–7% in a short window. The Fear & Greed Index at 16 (Extreme Fear) confirms one thing clearly:

this is no longer an emotional market — it’s a liquidity-driven one.

📉 What Just Happened?

Over $1.7B in liquidations wiped out leveraged and weak positions

Panic selling intensified as regulatory uncertainty, macro pressure, and geopolitical risks aligned

Trading volume is fading — a classic sign that “weak money” has exited

This be

🧠 Crypto Market Under Extreme Fear — Structure Over Emotion

The crypto market has entered a high-stress correction phase, with BTC and ETH down 6–7% in a short window. The Fear & Greed Index at 16 (Extreme Fear) confirms one thing clearly:

this is no longer an emotional market — it’s a liquidity-driven one.

📉 What Just Happened?

Over $1.7B in liquidations wiped out leveraged and weak positions

Panic selling intensified as regulatory uncertainty, macro pressure, and geopolitical risks aligned

Trading volume is fading — a classic sign that “weak money” has exited

This be

- Reward

- 3

- 4

- Repost

- Share

AylaShinex :

:

Happy New Year! 🤑View More

An Ethereum whale sold 10,000 stETH, locking in about $1.04M in profits

- Reward

- like

- Comment

- Repost

- Share

- Reward

- like

- Comment

- Repost

- Share

Baron made 100 million from shorting, but lost everything by going long. Gold and silver continue to jump. Believers go home for the New Year.

View Original

- Reward

- like

- 1

- Repost

- Share

Feihong :

:

Who is Barren? He's so rich, why bother?!!

争议币

Created By@GateUser-3fc26220

Listing Progress

0.00%

MC:

$3.21K

Create My Token

My Gate 2025 Year-End Summary is here! See how I performed this year.

Click the link to view your exclusive #2025GateYearEndSummary and claim a 20 USDT Position Voucher. https://www.gate.com/competition/your-year-in-review-2025?ref=VQRDBLANVQ&ref_type=126&shareUid=U1lDUV1XCQcO0O0O

Click the link to view your exclusive #2025GateYearEndSummary and claim a 20 USDT Position Voucher. https://www.gate.com/competition/your-year-in-review-2025?ref=VQRDBLANVQ&ref_type=126&shareUid=U1lDUV1XCQcO0O0O

- Reward

- like

- Comment

- Repost

- Share

- Reward

- like

- Comment

- Repost

- Share

🔥 CLAWDBOT & Meme Coin FOMO — History Repeating? 🤖💎

The local AI tool Clawdbot has gone viral, and meme coins like CLAWD are surging sharply 🚀📈

Traders are piling in as FOMO reignites, drawing comparisons to past rallies like GOAT or ACT. But is this just hype, or is there a deeper pattern forming? 🧐

🟢 Key Observations

✔ Social & AI hype driving attention: Viral trends can create short-term price spikes

✔ Low market cap + liquidity: Enables rapid moves but increases volatility risk ⚡

✔ Pattern similarities: Previous meme rallies show fast gains followed by corrections

🔴 Cautionary Note

The local AI tool Clawdbot has gone viral, and meme coins like CLAWD are surging sharply 🚀📈

Traders are piling in as FOMO reignites, drawing comparisons to past rallies like GOAT or ACT. But is this just hype, or is there a deeper pattern forming? 🧐

🟢 Key Observations

✔ Social & AI hype driving attention: Viral trends can create short-term price spikes

✔ Low market cap + liquidity: Enables rapid moves but increases volatility risk ⚡

✔ Pattern similarities: Previous meme rallies show fast gains followed by corrections

🔴 Cautionary Note

- Reward

- 5

- 4

- Repost

- Share

DragonFlyOfficial :

:

💬 Meme coin spikes are fun, but FOMO is double-edged ⚡ I’m watching volume + trend sustainability before entering. Are you trading the hype, or waiting for confirmation? Drop your view below 👇👇View More

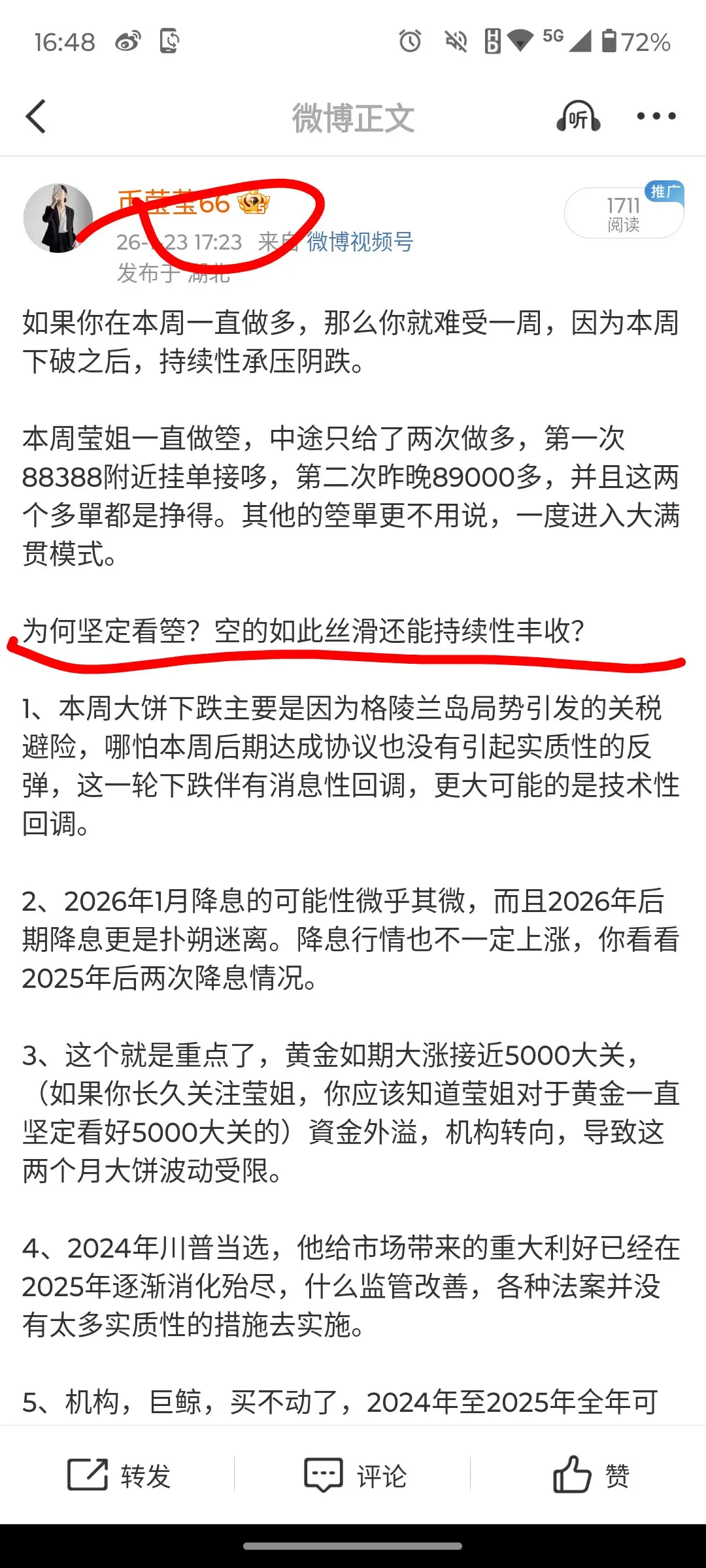

Spot Gold Midday Analysis (January 30)

Midday spot gold fluctuated widely between $5100 and $5200. After a sharp plunge of over 400 points from the high of $5594 overnight, bottom-fishing funds and selling pressure engaged in a tug-of-war. Before the monthly close, it is highly likely to continue oscillating and correcting, with a breakout awaiting guidance from the European session.

First, Cheng Jingsheng explains the main reasons for the plunge: The Federal Reserve maintains interest rates, Powell states that inflation is receding slowly, and expectations of rate cuts in March have cooled. T

Midday spot gold fluctuated widely between $5100 and $5200. After a sharp plunge of over 400 points from the high of $5594 overnight, bottom-fishing funds and selling pressure engaged in a tug-of-war. Before the monthly close, it is highly likely to continue oscillating and correcting, with a breakout awaiting guidance from the European session.

First, Cheng Jingsheng explains the main reasons for the plunge: The Federal Reserve maintains interest rates, Powell states that inflation is receding slowly, and expectations of rate cuts in March have cooled. T

XAUT-9.66%

- Reward

- 1

- 1

- Repost

- Share

Short-TermContractKingS :

:

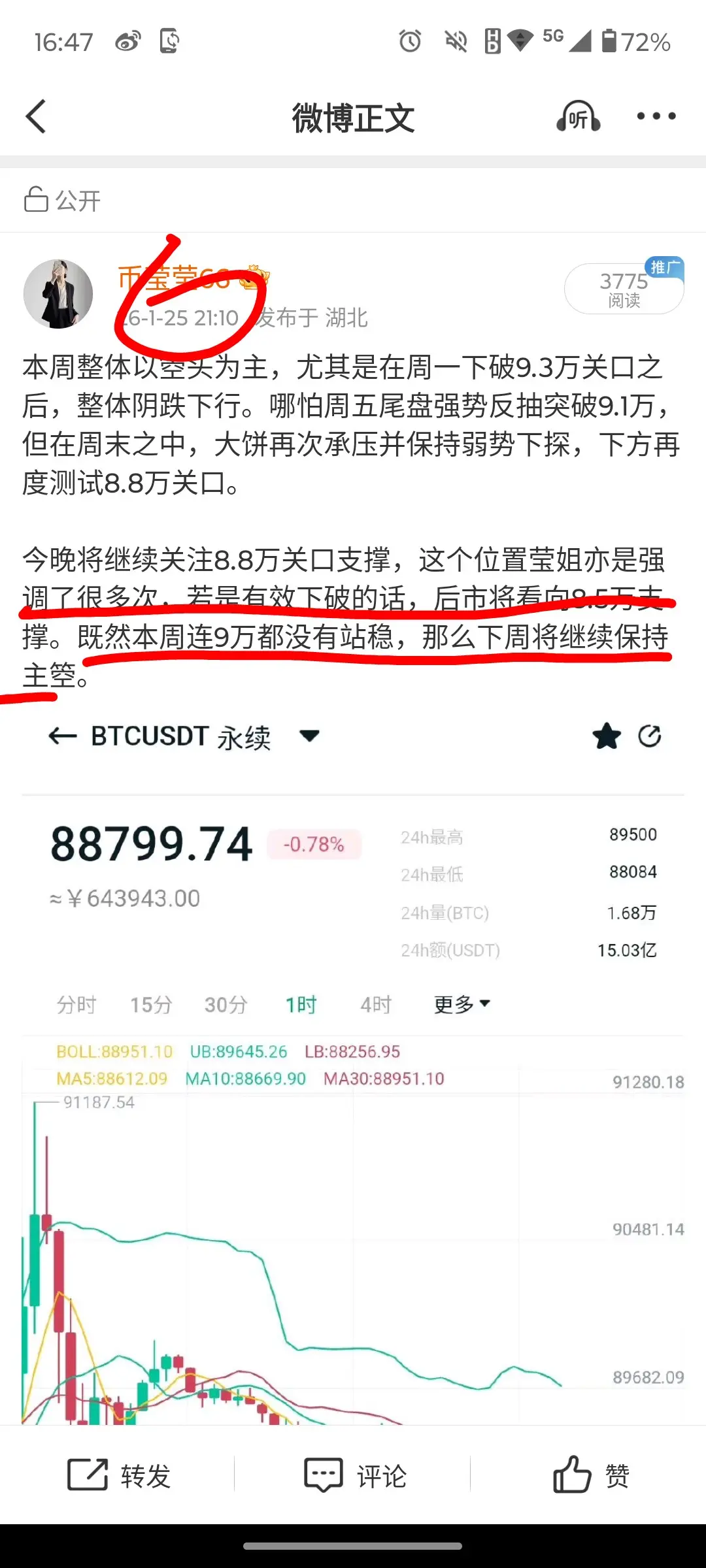

BTC is currently in a situation where the bulls are desperately holding on, and the bears are sharpening their knives. Currently, the long liquidation dominance is as high as 97%, and almost all margin calls are on longs.

This indicates that market sentiment has become extremely distorted. Although such extreme values usually suggest a short-term rebound (because the selling pressure is intense), without subsequent funds stepping in to buy, this stabilization is just a dead fish jump.

Moreover, after a normal sharp decline, the funding rate should turn negative (bears paying longs). But the current funding rate is still positive.

In my opinion, this suggests that the longs in the market haven't given up yet and are desperately rebuilding their positions at extremely high costs. Since the position structure still leans towards longs, the rebound is likely a panic escape wave.

Remember this saying — only when the longs no longer believe in the rally will the market truly start to rise. The current funding rate indicates that the longs haven't been defeated yet, and the market may still undergo a more intense drop to force the funding rate to zero.

12469464674946464949494664949494979499464949494946766764949494949494949949498686899494949494949499494949464959

- Reward

- like

- Comment

- Repost

- Share

#加密市场回调 Another round of bear market has arrived. I still have a large amount of GT that I haven't sold. I believe that Zhima can go further. Actually, even if you are trapped, you should remain confident because, based on gold and silver, the potential of Bitcoin and other crypto assets is still significant. It just takes time, and time is nothing more than a World Cup cycle. Live well, work hard to make money, and when the bottom truly hits, I will not hesitate to tell my brothers to buy the dip! Just like when I sold the top.

View Original

- Reward

- like

- Comment

- Repost

- Share

Market Structure: Higher Highs & Lower Lows

- Reward

- like

- Comment

- Repost

- Share

Has crypto died? Or is it time to buy the dip and increase positions?

View Original

- Reward

- like

- Comment

- Repost

- Share

Load More

Join 40M users in our growing community

⚡️ Join 40M users in the crypto craze discussion

💬 Engage with your favorite top creators

👍 See what interests you

Trending Topics

View More6.84K Popularity

23.5K Popularity

351.66K Popularity

31.7K Popularity

47.49K Popularity

Hot Gate Fun

View More- MC:$3.23KHolders:20.05%

- MC:$3.2KHolders:10.00%

- MC:$3.22KHolders:10.00%

- MC:$3.21KHolders:20.00%

- MC:$3.2KHolders:20.00%

News

View MoreBitcoin and Ethereum ETFs lose nearly $1 billion in a single day, institutional withdrawals put pressure on the crypto market

4 m

The US Dollar Index rises, and non-US currencies generally decline.

4 m

Vitalik Buterin withdraws $17 million worth of ETH: What signals are being sent behind the Ethereum Foundation's "mild contraction"?

11 m

Brevis Co-founder and CEO Michael confirms attendance at ChainCatcher Hong Kong "Build and Scale in 2026" themed forum

11 m

Ethereum's $100 million 'Ghost Fund' resurrected: Originating from the 2016 DAO hack, will this rewrite the security landscape?

13 m

Pin

Gate Square New & Returning Creator Rewards are ongoing!

Your ideas may be more valuable than you think!

Make your first post or come back post to share a $20,000 monthly prize pool!

Post with #MyFirstPostOnSquare to receive a $50 Position Voucher each

Monthly Top Posters and Top Engagers will each earn an extra $50 reward

Your crypto insights could inspire many—start creating today!

👉 https://www.gate.com/postGate Square “Creator Certification Incentive Program” — Recruiting Outstanding Creators!

Join now, share quality content, and compete for over $10,000 in monthly rewards.

How to Apply:

1️⃣ Open the App → Tap [Square] at the bottom → Click your [avatar] in the top right.

2️⃣ Tap [Get Certified], submit your application, and wait for approval.

Apply Now: https://www.gate.com/questionnaire/7159

Token rewards, exclusive Gate merch, and traffic exposure await you!

Details: https://www.gate.com/announcements/article/47889