Solana’s (SOL) Deal With JPMorgan Fails to Impress, Investors Still Choose GeeFi (GEE) to 100x Th...

Investors are constantly searching for projects that show strong early-stage momentum and presale success. GeeFi has captured significant attention with its impressive performance, starting with a Phase 1 that sold out 10 million tokens and raised $500,000 from a dedicated base of over 2,400

SOL0.46%

CaptainAltcoin·15m ago

Solana Must Hold $120 Support to Keep $500 Upside Path

Solana's price stabilization at the $120 support level is crucial for maintaining potential upside towards $500. A fall below this level could lead to a retracement towards $75, according to chart patterns and Fibonacci levels.

SOL0.46%

CryptoNewsLand·24m ago

Altcoin Season Set Up Again? Bitcoin Dominance Rejection Signals Potential 250%+ Rally for 5 High...

Bitcoin dominance rejection signals a potential shift toward high-risk altcoins.

Five selected assets show strong structural patterns within compressed trading zones.

Analysts report increased speculation as market rotation echoes past altcoin cycles.

A fresh rejection in Bitcoin dominance has re

CryptoNewsLand·53m ago

Ripple Receives Conditional OCC Approval to Charter Ripple National Trust Bank

Ripple has secured conditional approval from the OCC to charter Ripple National Trust Bank, allowing it to operate under federal oversight. This paves the way for custody and payment services, enhancing regulatory compliance for its stablecoin, RLUSD.

CryptoFrontNews·1h ago

SEC Educates Retail Investors on Holding Crypto as Custody Decisions Become Market-Critical

The SEC is educating retail crypto investors on how the storage of digital assets can determine whether holdings survive hacks, bankruptcies, or shutdowns, while urging closer scrutiny of custodians and stronger personal security as crypto risks persist.

SEC Lays out How Investors Can Hold

Coinpedia·1h ago

Bitcoin Veterans’ Covered Calls Strategy Sparks Sideways Market, Analyst Says

Bitcoin Price Dynamics Influenced by Long-Term Whales and Options Market Activity

Market analysts indicate that long-term Bitcoin holders, often referred to as “whales,” are actively employing a covered call strategy that is exerting downward pressure on the cryptocurrency’s price. This approach in

BTC-0.13%

CryptoBreaking·1h ago

Avalanche (AVAX) Expands Real-World Use, Yet Traders See GeeFi (GEE) As Best Choice for Life-Chan...

Many blockchain projects are moving at a measured pace, but GeeFi is accelerating through its funding stages with remarkable speed. The initial presale phase reached its hard cap in less than fourteen days, securing $500,000 and demonstrating immediate investor demand

This trajectory has

AVAX1.51%

CaptainAltcoin·2h ago

Dogecoin’s (DOGE) Downtrend Creates Shift to Utility Tokens, Why Experts See Suggest GeeFi (GEE) ...

In a market hungry for substantive projects, GeeFi is commanding attention with a presale performance that speaks volumes. The project’s initial phase was a complete triumph, clearing its entire allocation of 10 million tokens and securing $500,000 in funding in just over a week. This early

DOGE1.08%

CaptainAltcoin·2h ago

SUI Sees 0.5 Fib Fakeout As Price Works to Reclaim $1.75

SUI moved below the 0.5 fib zone, then quickly returned, showing a clear fakeout on the weekly chart

Price now holds above long-term support while buyers wait for a clean reclaim of $1.75

A recovery above the key zone may reopen higher levels shown on the longer trend

SUI briefly moved below a k

SUI2.96%

CryptoNewsLand·2h ago

Bitcoin Weekly RSI Returns to Historic Support as Market Pushes against Monthly Highs.

Bitcoin's weekly RSI near 36 indicates potential accumulation and cycle lows, aligning with historical patterns. The market shows consolidation near $90,000, suggesting long-term holder absorption rather than speculative behavior, reflecting structural resilience and balance in a bullish framework.

BTC-0.13%

CryptoFrontNews·2h ago

Is the Bittensor (TAO) Price Reset Complete? This Level Could Decide the Next 5x

The recent volatility of TAO appears dramatic, but it reflects past trading patterns. Following a 200% rally and a 50% correction, price stability above the $262–$215 zone is crucial for future growth, while a drop below $228 could signal a deeper decline.

TAO0.71%

CaptainAltcoin·2h ago

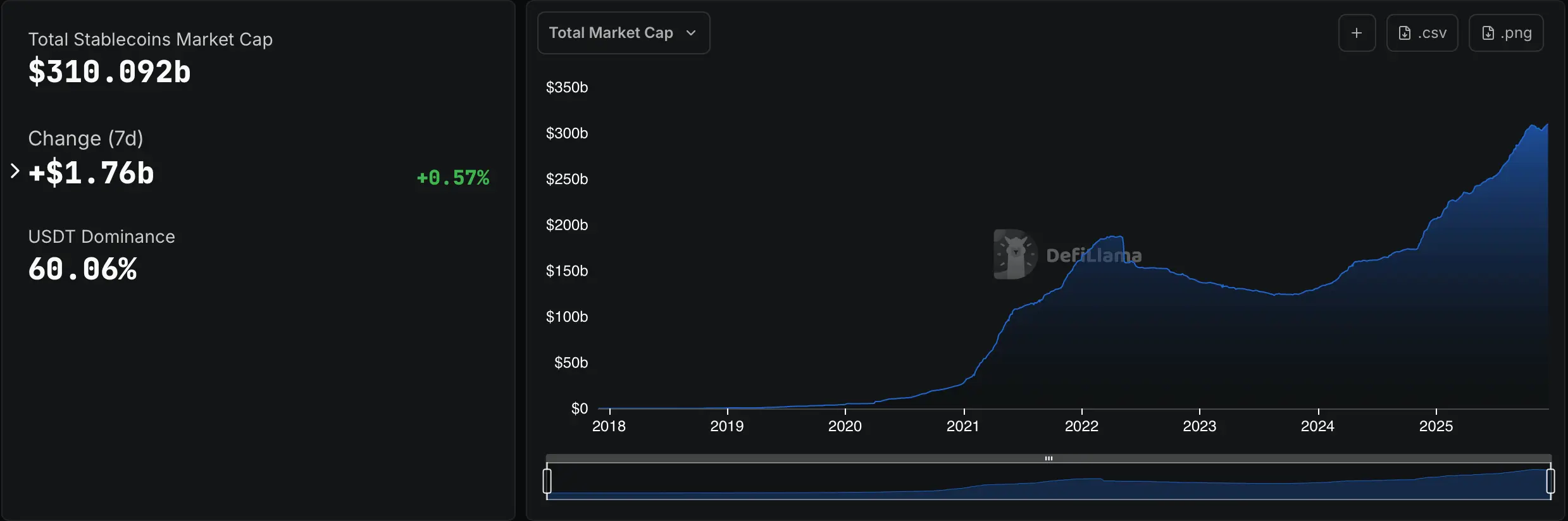

$310 Billion Stablecoin Market Hits New High While Yield Plays Lose Ground

Stablecoins are back on the move, with the fiat-pegged token economy notching another all-time high by clearing the $310 billion mark during the second week of December.

Stablecoin Market Reaches a New Peak Tapping $310 Billion

In mid-November, stablecoins logged a modest pullback after

Coinpedia·3h ago

Ozak AI Presale Momentum Sparks Massive FOMO, Potentially Delivering 2,000% ROI Compared to Major...

In a year when most leading cryptocurrencies have moved cautiously, one emerging token is generating the sort of urgency that the market hasn’t seen since the earliest days of top-performing altcoins. Ozak AI sits at a price of $0.014 in the presale with the surpassing of the $4.9 million funding ma

CaptainAltcoin·3h ago

Top Crypto Investors Believe This $0.035 New Altcoin Could Beat PEPE and SHIB Ahead of 2027, Here...

Some analysts believe the market is entering a new phase where meme-driven tokens are losing momentum while utility-driven altcoins are gaining strength. Market commentators suggest that several leading names, including SHIB and PEPE, now face structural challenges that limit their future upside.

CryptoDaily·3h ago

SEC Releases Essential Guide to Crypto Custody and Wallets for Investors

SEC Publishes Crypto Wallet and Custody Guidelines, Marking a Shift in Regulatory Approach

The U.S. Securities and Exchange Commission (SEC) has released a comprehensive investor bulletin highlighting best practices and potential risks associated with various methods of cryptocurrency storage. The

BTC-0.13%

CryptoBreaking·3h ago

Pyth Network Launches PYTH Reserve to Fuel Growth

Pyth Network's launch of PYTH Reserve aims to transform revenue into sustainable network value, bolstered by Pyth Pro's rapid growth. Capturing a small market share could significantly increase annual revenue, creating a self-reinforcing cycle of adoption and expansion.

PYTH1.63%

CryptoFrontNews·3h ago

Load More

Hot Tags

Hot Topics

MoreCrypto Calendar

MoreHayabusa Upgrade

VeChain has unveiled plans for the Hayabusa upgrade, scheduled for December. This upgrade aims to significantly enhance both protocol performance and tokenomics, marking what the team calls the most utility-focused version of VeChain to date.

2025-12-27

Litewallet Sunsets

Litecoin Foundation has announced that the Litewallet app will officially sunset on December 31. The app is no longer actively maintained, with only critical bug fixes addressed until that date. Support chat will also be discontinued after this deadline. Users are encouraged to transition to Nexus Wallet, with migration tools and a step-by-step guide provided within Litewallet.

2025-12-30

OM Tokens Migration Ends

MANTRA Chain issued a reminder for users to migrate their OM tokens to the MANTRA Chain mainnet before January 15. The migration ensures continued participation in the ecosystem as $OM transitions to its native chain.

2026-01-14

CSM Price Change

Hedera has announced that starting January 2026, the fixed USD fee for the ConsensusSubmitMessage service will increase from $0.0001 to $0.0008.

2026-01-27

Vesting Unlock Delayed

Router Protocol has announced a 6-month delay in the vesting unlock of its ROUTE token. The team cites strategic alignment with the project’s Open Graph Architecture (OGA) and the goal of maintaining long-term momentum as key reasons for the postponement. No new unlocks will take place during this period.

2026-01-28