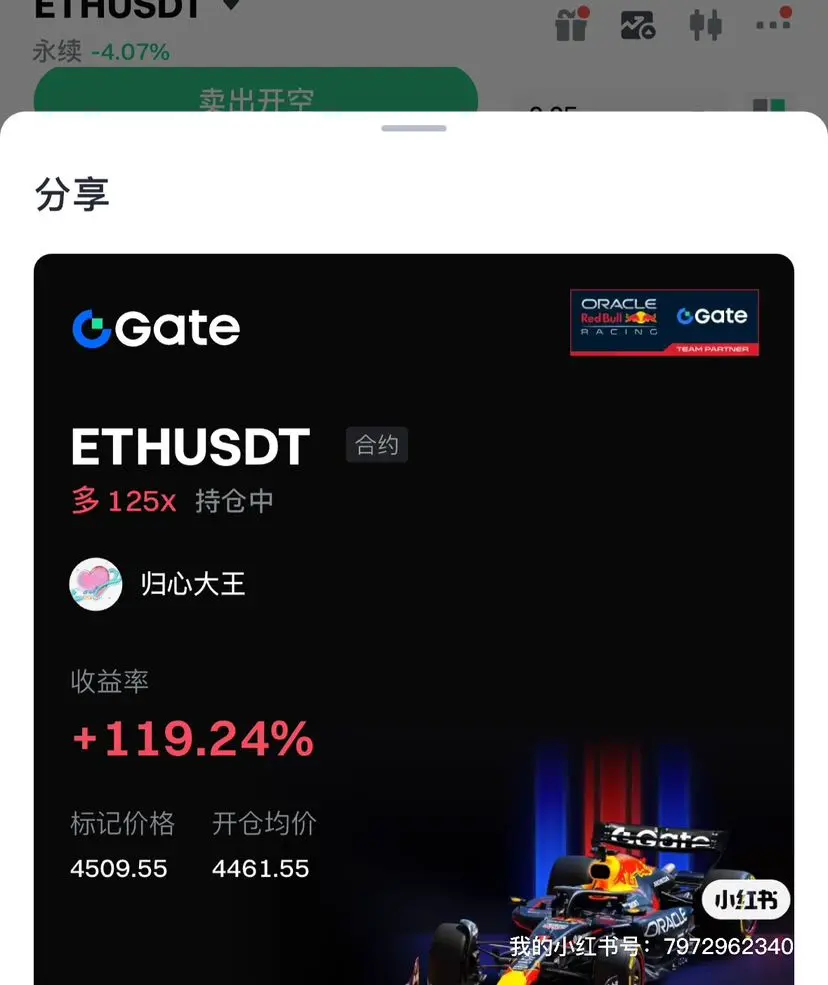

Just now, take the opposite position at 4510 for shorting, stop loss at 4525. I usually share strategies in the group, but short-term high-frequency updates are not very timely. Double cloud line suppression, short position.

View OriginalKingOfReturn

short-term high-frequency aggressive Position management

KingOfReturn

In the face of such extreme market conditions, I would like to share the following thoughts with everyone:

1. Respect the market and control leverage: The fact that more than 1.6 million people were liquidated this time is a bloody lesson. No matter how big the bull market is, high leverage can make you lose everything within minutes. Always prioritize risk control.

2. Pay attention to macro events: The cryptocurrency space is no longer an isolated island. The trigger for this crash was the United States' tariff policy, indicating that global political and economic events will directly aff

View Original1. Respect the market and control leverage: The fact that more than 1.6 million people were liquidated this time is a bloody lesson. No matter how big the bull market is, high leverage can make you lose everything within minutes. Always prioritize risk control.

2. Pay attention to macro events: The cryptocurrency space is no longer an isolated island. The trigger for this crash was the United States' tariff policy, indicating that global political and economic events will directly aff

- Reward

- like

- Comment

- Repost

- Share

make money Today I will eat two orders I will get my 100w back

View Original

- Reward

- like

- 1

- Repost

- Share

GateUser-ec8ac194 :

:

What's going on, why was it sealed?day1 I need a companion

View Original

- Reward

- like

- Comment

- Repost

- Share

- Reward

- like

- Comment

- Repost

- Share

eth4445 current price go long waiting for this to close 4411 not breaking infinite long

View Original- Reward

- like

- 1

- Repost

- Share

KingOfReturn :

:

stop loss 4436A tuition fee of 1 million, bought a lesson that is deeply imprinted in my memory:

Technical analysis and win rates have become empty talk, collapsing due to the "position management" pitfalls.

It was only after I lost a million that I truly "learned" how to trade.

In the past, I was obsessed with studying various technical indicators, confident that I could accurately capture every buying and selling point. In my trading journal, the win rate was the only medal.

Until an extreme market situation told me with a cold scar of -100w: the technology I was proud of is no match for an uncontrollable

View OriginalTechnical analysis and win rates have become empty talk, collapsing due to the "position management" pitfalls.

It was only after I lost a million that I truly "learned" how to trade.

In the past, I was obsessed with studying various technical indicators, confident that I could accurately capture every buying and selling point. In my trading journal, the win rate was the only medal.

Until an extreme market situation told me with a cold scar of -100w: the technology I was proud of is no match for an uncontrollable

[The user has shared his/her trading data. Go to the App to view more.]

- Reward

- like

- 1

- Repost

- Share

GateUser-91fb684f :

:

666 is not the time for you to lose others' money.