BrotherJingAh

Joined the circle as a sucker in 2019, experienced nearly two rounds of bull and bear markets. Usually sharing daily life and insights…【A hardcore fan of PiNetwork】

BrotherJingAh

Emotions are a double-edged sword.

Investors can easily overreact, leading them to sell near the bottom or buy near the top.

Going against public sentiment is the right path.

Be greedy when others are extremely fearful, and be cautious when others are extremely greedy; this is a viable strategy to conquer the market.

One aspect of a crisis is risk, while the other aspect is opportunity.

Although everyone hates uncertainty, it is uncertainty that is the source of excess returns, and the market always spirals upward in divergence.

When everything has settled, the reversal might have arrived.

#成长

View OriginalInvestors can easily overreact, leading them to sell near the bottom or buy near the top.

Going against public sentiment is the right path.

Be greedy when others are extremely fearful, and be cautious when others are extremely greedy; this is a viable strategy to conquer the market.

One aspect of a crisis is risk, while the other aspect is opportunity.

Although everyone hates uncertainty, it is uncertainty that is the source of excess returns, and the market always spirals upward in divergence.

When everything has settled, the reversal might have arrived.

#成长

- Reward

- 31

- 3

- Repost

- Share

MiaoRenfeng :

:

Emotion is a double-edged sword. Investors can easily overreact, leading to selling near the bottom or buying near the top.

Going against the public sentiment is the right path.

Being greedy when everyone is in extreme panic and being cautious when everyone is in extreme greed is a viable strategy to conquer the market.

One side of a crisis is risk, the other side is opportunity.

Although everyone hates uncertainty, it is the source of excess returns; the market always rises in a spiral of divergence.

When everything settles down, a reversal may also be upon us.

View More

The public dislikes uncertainty the most.

But when everything is confirmed, when the public is unanimously bullish on the market, or unanimously bearish on the market, it is often the most dangerous time.

Predicting market fluctuations is very difficult.

But it is possible to study group behavior, be in extreme panic or extreme greed, and make contrarian investments.

Market conditions are reflexive.

What the public collectively considers good news may actually be bad news for the market, especially when the news materializes.

The main factor driving changes in asset prices is still supply and

View OriginalBut when everything is confirmed, when the public is unanimously bullish on the market, or unanimously bearish on the market, it is often the most dangerous time.

Predicting market fluctuations is very difficult.

But it is possible to study group behavior, be in extreme panic or extreme greed, and make contrarian investments.

Market conditions are reflexive.

What the public collectively considers good news may actually be bad news for the market, especially when the news materializes.

The main factor driving changes in asset prices is still supply and

- Reward

- 42

- 6

- Repost

- Share

LegendOfBaiSuzhen :

:

Steadfast HODL💎View More

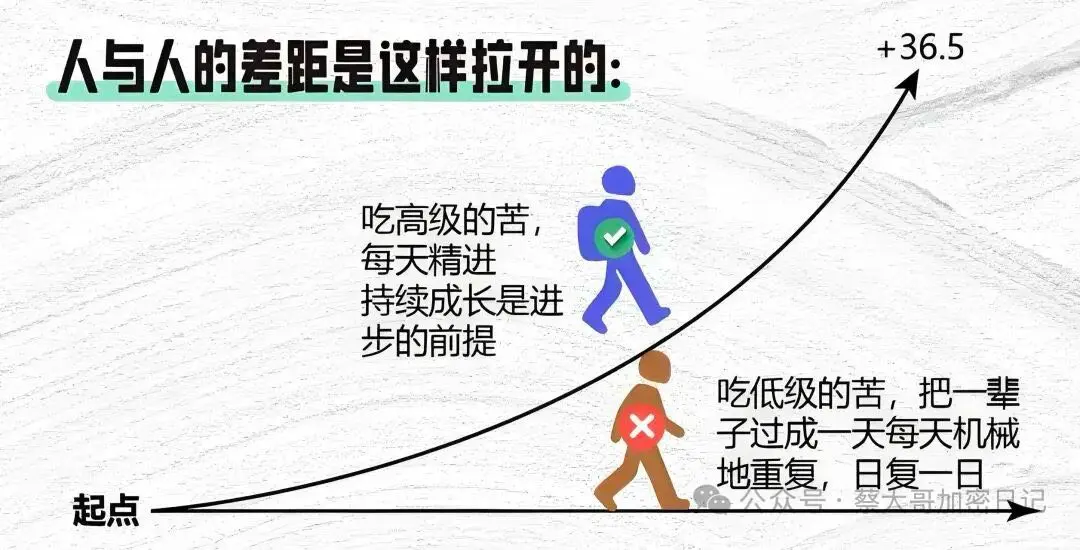

People from ordinary families should not be too anxious.

Stay calm and take the initiative when opportunities arise. When there are no opportunities, keep a low profile and nurture your strengths. The vast majority of people usually see progress in their careers by the age of 30.

When encountering bad people, don't be calculative; when facing troublesome matters, don't get entangled. More important than ability, wealth, and status is a person's mindset; your mindset determines how far you can go.

Remember, making money and achieving success is not an overnight thing. You must conti

View OriginalStay calm and take the initiative when opportunities arise. When there are no opportunities, keep a low profile and nurture your strengths. The vast majority of people usually see progress in their careers by the age of 30.

When encountering bad people, don't be calculative; when facing troublesome matters, don't get entangled. More important than ability, wealth, and status is a person's mindset; your mindset determines how far you can go.

Remember, making money and achieving success is not an overnight thing. You must conti

- Reward

- 41

- 3

- Repost

- Share

Dafang888HuangRong :

:

Steadfast HODL💎View More

Since BTC broke through 69,000 USD, there have been too many people looking bearish, and of course, most of the bearish predictions have been wrong.

It is difficult for the community to transition into a real bear market amidst the doubts.

When it was actually time to look at the bear, people were instead afraid to look at the bear, only leveraging AI IIN to chase the rise, fearing they would miss the opportunity.

Either don't make predictions or predict large fluctuations.

Predicting those short-term small fluctuations, even if correct, will not bring high returns and will only lead you t

View OriginalIt is difficult for the community to transition into a real bear market amidst the doubts.

When it was actually time to look at the bear, people were instead afraid to look at the bear, only leveraging AI IIN to chase the rise, fearing they would miss the opportunity.

Either don't make predictions or predict large fluctuations.

Predicting those short-term small fluctuations, even if correct, will not bring high returns and will only lead you t

- Reward

- 41

- 5

- Repost

- Share

LegendOfBaiSuzhen :

:

Steadfast HODL💎View More

Men should meet two conditions when trading:

1. Fast for more than twelve hours

2. In Sage Mode

Hunger can keep the brain awake

The saint period can ensure that adrenaline and dopamine are at low concentrations, avoiding impulsive trading.

The probability of making money through this kind of trading is relatively high.

In summary

Do not trade after meals

Do not trade when it's hard.

Did you learn all of the above?

#LaunchpadXPL认购开启 #狗狗币ETF进展 #加密市场回调

View Original1. Fast for more than twelve hours

2. In Sage Mode

Hunger can keep the brain awake

The saint period can ensure that adrenaline and dopamine are at low concentrations, avoiding impulsive trading.

The probability of making money through this kind of trading is relatively high.

In summary

Do not trade after meals

Do not trade when it's hard.

Did you learn all of the above?

#LaunchpadXPL认购开启 #狗狗币ETF进展 #加密市场回调

- Reward

- 24

- 1

- Repost

- Share

BrotherJingAh :

:

When men are trading, it is best to meet two conditions: 1. Be hungry for more than twelve hours

2. Be in a saint mode

Hunger can keep the brain alert

Saint mode ensures that adrenaline and dopamine are at low concentrations, avoiding impulsive trading

This way, the probability of making money in trading is relatively high

In summary

Do not trade after meals

Do not trade when it's hard

So, have you learned this?

The confidence of the public can be influenced by a Bullish line.

Most indicators that are widely recognized are basically very lagging indicators and do not provide much help.

Focusing too much on short-term market trends will only lead to small losses and big gains.

In the past, no one was able to grasp quality assets through technical analysis or news.

Low liquidity and no one cares, which makes it easier to buy at a lower price.

No strategy can consistently beat the market. BTC has outperformed the market for a long time, but there have also been periods when it underperformed.

Small-cap c

View OriginalMost indicators that are widely recognized are basically very lagging indicators and do not provide much help.

Focusing too much on short-term market trends will only lead to small losses and big gains.

In the past, no one was able to grasp quality assets through technical analysis or news.

Low liquidity and no one cares, which makes it easier to buy at a lower price.

No strategy can consistently beat the market. BTC has outperformed the market for a long time, but there have also been periods when it underperformed.

Small-cap c

- Reward

- 40

- 5

- Repost

- Share

LiuChuxuanOfSuishanS :

:

F1 protocol with SPI JS drive, Consensus super strong! Offline expansion accelerates, ecological synergy is robust, industry influence is rising! #F1# #PI JSChain#View More

The first principle of the bull to bear transition is excessive leverage, not unfavourable information.

If you have a long-term vision, you won't act impulsively due to a temporary surge in a copycat project or feel distressed over a temporary drop in value coins.

The rise of a bull market will deplete future annual returns.

The decline in a bear market will increase future annualized returns.

Even if the motivation for chasing after altcoins belongs to greed, human nature will still veil this action with a layer of rational logic.

In fact, the crowd deeply trapped in greed has no rational

View OriginalIf you have a long-term vision, you won't act impulsively due to a temporary surge in a copycat project or feel distressed over a temporary drop in value coins.

The rise of a bull market will deplete future annual returns.

The decline in a bear market will increase future annualized returns.

Even if the motivation for chasing after altcoins belongs to greed, human nature will still veil this action with a layer of rational logic.

In fact, the crowd deeply trapped in greed has no rational

- Reward

- 39

- 6

- Repost

- Share

DreamyHeavenlyMountainChild :

:

Hold on tight, we're going to da moon 🛫View More

Liquidity is the lifeblood of a bull run.

Every time a bull run begins, there is a monetary easing (interest rate reduction) policy that fuels it, leading to widespread investment becoming a trend.

But if the market is overly leveraged, even interest rate cuts will be powerless to turn things around.

The appropriate skepticism and caution of the crowd are beneficial for the long-term operation of a bull run, but the fear is that the crowd will unanimously leverage and overdraw future Liquidity.

Excessive leverage is the first principle of the downward reversal in a bull run.

Excess returns com

View OriginalEvery time a bull run begins, there is a monetary easing (interest rate reduction) policy that fuels it, leading to widespread investment becoming a trend.

But if the market is overly leveraged, even interest rate cuts will be powerless to turn things around.

The appropriate skepticism and caution of the crowd are beneficial for the long-term operation of a bull run, but the fear is that the crowd will unanimously leverage and overdraw future Liquidity.

Excessive leverage is the first principle of the downward reversal in a bull run.

Excess returns com

- Reward

- 32

- 2

- Repost

- Share

DreamyHeavenlyMountainChild :

:

Hold on tight, we are about to To da moon 🛫View More

Human financial memory is very short.

Retail investors who were previously trapped by chasing the rise will still harbor a fluke mentality and chase the rise again when they see the next wave of hype.

Before every market crash, there are stock market gurus everywhere.

In the current market, since the vast majority of people have not made any money yet, I estimate that the bull market has not yet reached the turning point.

Everyone will be quite pleased in the later stages of a bull market.

Everything, whether good or bad, will eventually come to an end. Cycles always exist, and those who ignor

View OriginalRetail investors who were previously trapped by chasing the rise will still harbor a fluke mentality and chase the rise again when they see the next wave of hype.

Before every market crash, there are stock market gurus everywhere.

In the current market, since the vast majority of people have not made any money yet, I estimate that the bull market has not yet reached the turning point.

Everyone will be quite pleased in the later stages of a bull market.

Everything, whether good or bad, will eventually come to an end. Cycles always exist, and those who ignor

- Reward

- 52

- 10

- 1

- Share

MoonShadow_ :

:

Steadfast HODL💎View More

If you want to keep the fruits of victory, do not take a Heavy Position in altcoins.

Of course, even with core assets, you should not chase prices at high levels. Instead, you should take a Heavy Position when the price is undervalued and the risk-reward ratio is high.

Preventing drawdowns is more important than making profits.

As the bull market reaches its later stages, the sight of easily becoming wealthy will drive the public into a frenzy, which is also an important characteristic of market turning points.

It seems that everything is rising, and you can make money buying anything.

When ev

View OriginalOf course, even with core assets, you should not chase prices at high levels. Instead, you should take a Heavy Position when the price is undervalued and the risk-reward ratio is high.

Preventing drawdowns is more important than making profits.

As the bull market reaches its later stages, the sight of easily becoming wealthy will drive the public into a frenzy, which is also an important characteristic of market turning points.

It seems that everything is rising, and you can make money buying anything.

When ev

- Reward

- 31

- 5

- Repost

- Share

DreamyHeavenlyMountainChild :

:

Hold on tight, we're taking off To da moon 🛫View More

No one can always be right.

But if every investment you make is a strategy with high profits and low drawdowns, then you will ultimately be able to make a lot of money.

Do not be swayed by temporary emotions and fluctuations.

A single bearish candlestick adjustment can make countless people bearish. However, looking at it over a longer period, it is merely an inconspicuous bump.

The masses will always fall into irrational emotions.

In the field of investment, once people apply past experiences to the future, the future state also changes.

When everyone is carving boats in the same direction, r

View OriginalBut if every investment you make is a strategy with high profits and low drawdowns, then you will ultimately be able to make a lot of money.

Do not be swayed by temporary emotions and fluctuations.

A single bearish candlestick adjustment can make countless people bearish. However, looking at it over a longer period, it is merely an inconspicuous bump.

The masses will always fall into irrational emotions.

In the field of investment, once people apply past experiences to the future, the future state also changes.

When everyone is carving boats in the same direction, r

- Reward

- 46

- 11

- Repost

- Share

MoonShadow_ :

:

Hold on tight, we're taking off to da moon 🛫View More

"Today, hundreds of millions of people are engraving boats in the alt season of Q1 2021, the anti-human moment has arrived." — December 26, 2024, Brother Cai's encryption diary "Preventing Altcoin Sacrifice."

Trying to make money by chasing prices is a very foolish thing to do.

Be cautious of colleagues, friends, online acquaintances, and influencers (in fact, be wary of anyone) recommending cryptocurrencies to you, especially those that have risen significantly.

The cryptocurrencies that everyone chases will crash badly in the future.

Before buying a particular stock or cryptocurrency, yo

View OriginalTrying to make money by chasing prices is a very foolish thing to do.

Be cautious of colleagues, friends, online acquaintances, and influencers (in fact, be wary of anyone) recommending cryptocurrencies to you, especially those that have risen significantly.

The cryptocurrencies that everyone chases will crash badly in the future.

Before buying a particular stock or cryptocurrency, yo

- Reward

- 50

- 8

- Repost

- Share

MoonShadow_ :

:

Steadfast HODL💎View More

Anyone who mixes with the public must be out of their mind.

What truly caused the market to plummet is not which institution is offloading, but rather that the overall market capitalization has been pushed too high.

Sometimes a proper pullback is just to protect retail investors.

If the market does not correct for a long time and continues to gap up, what awaits retail investors will be a violent bear market.

True wealth is not money, but your understanding.

If things look cheap enough, buy in batches; if they look high enough, sell in batches.

Only eating the body of the fish and not the tail

View OriginalWhat truly caused the market to plummet is not which institution is offloading, but rather that the overall market capitalization has been pushed too high.

Sometimes a proper pullback is just to protect retail investors.

If the market does not correct for a long time and continues to gap up, what awaits retail investors will be a violent bear market.

True wealth is not money, but your understanding.

If things look cheap enough, buy in batches; if they look high enough, sell in batches.

Only eating the body of the fish and not the tail

- Reward

- 38

- 3

- Repost

- Share

DreamyHeavenlyMountainChild :

:

Buckle up, we are about to To da moon 🛫View More

The market will always oscillate between optimism and pessimism, with optimistic sentiment driving asset rise and pessimistic sentiment driving asset fall.

Always remember that the development of things is cyclical.

All speculators who lose their minds and blindly chase the rise of popular assets will ultimately see their assets halved or even lose everything.

Preventing a pullback is harder than gaining profits.

The end of a bull market is usually pushed to the peak by an impulsive, passionate, and excited crowd that has completely lost its rationality.

The fact that most people lose money is

View OriginalAlways remember that the development of things is cyclical.

All speculators who lose their minds and blindly chase the rise of popular assets will ultimately see their assets halved or even lose everything.

Preventing a pullback is harder than gaining profits.

The end of a bull market is usually pushed to the peak by an impulsive, passionate, and excited crowd that has completely lost its rationality.

The fact that most people lose money is

- Reward

- 50

- 6

- Repost

- Share

MoonShadow_ :

:

Sit tight and hold on, we are about to To da moon 🛫View More

Never follow the crowd to buy popular coins.

Stick to your opinions, focus on the value coins that you believe in and that have a better cost-performance ratio than the market, even if the short-term performance is not good.

All investments that go against reason will ultimately turn into bubbles.

Value is your first layer of insurance, low-position layout is the second layer of insurance, and portfolio configuration is the third layer of insurance.

Even if the coin is good, if the risk-reward ratio is unfavorable for you, it is not good.

It's a good thing for the market to have proper ske

View OriginalStick to your opinions, focus on the value coins that you believe in and that have a better cost-performance ratio than the market, even if the short-term performance is not good.

All investments that go against reason will ultimately turn into bubbles.

Value is your first layer of insurance, low-position layout is the second layer of insurance, and portfolio configuration is the third layer of insurance.

Even if the coin is good, if the risk-reward ratio is unfavorable for you, it is not good.

It's a good thing for the market to have proper ske

- Reward

- 51

- 8

- Repost

- Share

MoonShadow_ :

:

Steadfast HODL💎View More

Lack of patience is the root cause of failure for most investors.

Those who try to get rich quickly often end up putting more money into the market than they earn in the short term, and more often than not, this money serves as fuel for the market.

When things are cheap, the public is always on edge.

When things are expensive, the public always cheers.

When buying any asset, the first principle is the risk-reward ratio. It is not about whether it will rise in the short term or whether there are any short-term favorable factors.

Proceed with caution to achieve long-term success.

Getting used to

View OriginalThose who try to get rich quickly often end up putting more money into the market than they earn in the short term, and more often than not, this money serves as fuel for the market.

When things are cheap, the public is always on edge.

When things are expensive, the public always cheers.

When buying any asset, the first principle is the risk-reward ratio. It is not about whether it will rise in the short term or whether there are any short-term favorable factors.

Proceed with caution to achieve long-term success.

Getting used to

- Reward

- 44

- 5

- Repost

- Share

TianshanGrandma :

:

Steadfast HODL💎View More

What matters is not the number of coins or bulls, but the ratio of profit to loss when buying.

No matter how good a coin is, if the buying price is too expensive, it may not be possible to make money for many consecutive years.

No coin is good enough to make you buy in without considering the cost.

The lower the public sentiment, the more likely the market is to be undervalued. The more enthusiastic the public sentiment, the more likely the market is to be overvalued.

When the buying opportunity arises, most people often do not want to buy.

One of the most foolish questions investors ponder is

View OriginalNo matter how good a coin is, if the buying price is too expensive, it may not be possible to make money for many consecutive years.

No coin is good enough to make you buy in without considering the cost.

The lower the public sentiment, the more likely the market is to be undervalued. The more enthusiastic the public sentiment, the more likely the market is to be overvalued.

When the buying opportunity arises, most people often do not want to buy.

One of the most foolish questions investors ponder is

- Reward

- 77

- 8

- Repost

- Share

Mr.Huang :

:

Steadfast HODL💎View More

Choosing the right targets increases the probability of making money.

High-quality assets + buying during a crash = double protection. Holding a long-term portfolio of quality assets means your investment has almost no risk.

The biggest mistake in investing is treating investment like gambling.

The rise of quality assets is not linear; it may lie dormant for a long time and then complete its rise in a very short period.

The future profit and loss ratio for buying is high, but the short-term performance is not good.

Avoid following the crowd's consensus, even if the short-term performance i

View OriginalHigh-quality assets + buying during a crash = double protection. Holding a long-term portfolio of quality assets means your investment has almost no risk.

The biggest mistake in investing is treating investment like gambling.

The rise of quality assets is not linear; it may lie dormant for a long time and then complete its rise in a very short period.

The future profit and loss ratio for buying is high, but the short-term performance is not good.

Avoid following the crowd's consensus, even if the short-term performance i

- Reward

- 53

- 8

- Repost

- Share

CircumferenceZhang :

:

The PIJS Foundation has extended an olive branch to F1, and both parties are exploring a depth of cooperation, hoping to achieve a win-win ecological outcome. Keep following for continuous excitement! Win-win collaboration!View More

The rise of value coins is driven by value and emotions, while the big pump of altcoins relies entirely on emotions.

The primary duty of investment is to invest in assets that rise in the long term.

If an asset is destined to go to zero, then you shouldn't touch it from the very beginning; avoid junk assets.

Identify and avoid losing investments, and winning investments will naturally come.

#Gate Alpha晒单挑战

#Gate上线Ondo专区现货交易

#非农就业数据来袭 #PI #GT

View OriginalThe primary duty of investment is to invest in assets that rise in the long term.

If an asset is destined to go to zero, then you shouldn't touch it from the very beginning; avoid junk assets.

Identify and avoid losing investments, and winning investments will naturally come.

#Gate Alpha晒单挑战

#Gate上线Ondo专区现货交易

#非农就业数据来袭 #PI #GT

- Reward

- 61

- 8

- Repost

- Share

MiaoRenfeng :

:

Hold on tight, we're taking off to da moon 🛫View More