MrBeast, the well-known YouTuber and influencer, has reportedly increased his crypto portfolio by purchasing 244,000 more ASTER tokens, signaling growing confidence in the project. This move may boost market sentiment around ASTER since his influence often attracts retail interest and increases visibility for tokens he supports.

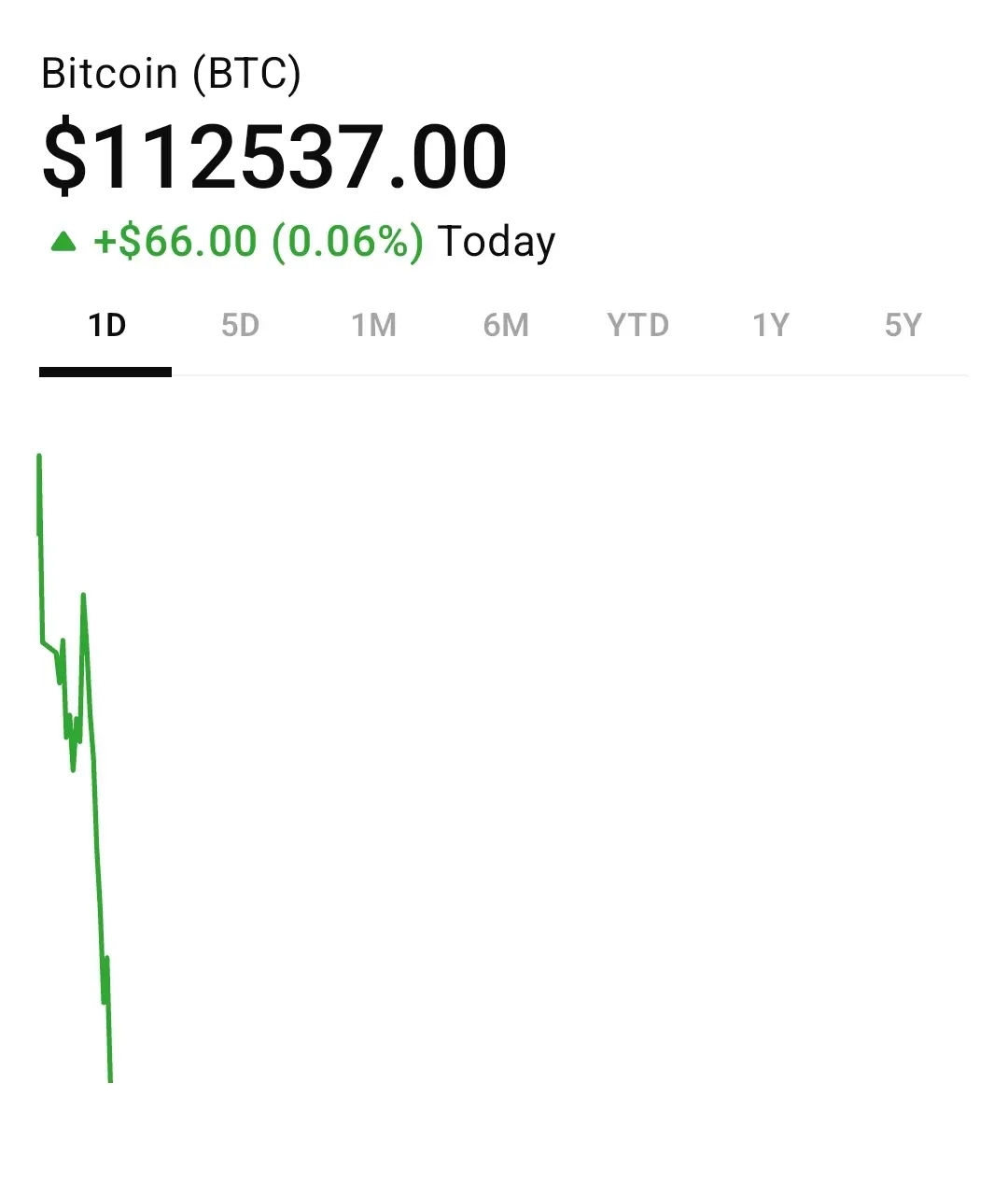

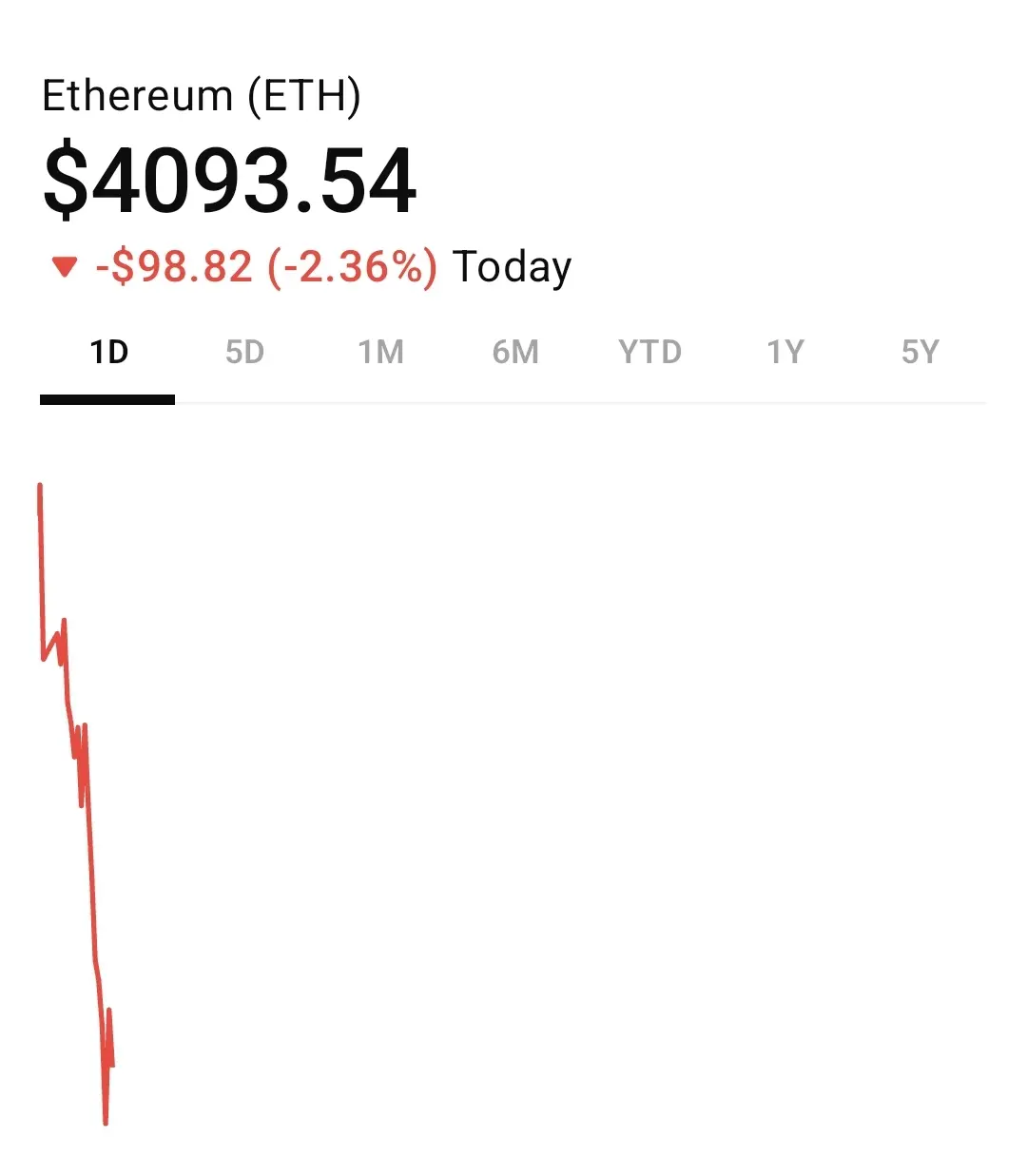

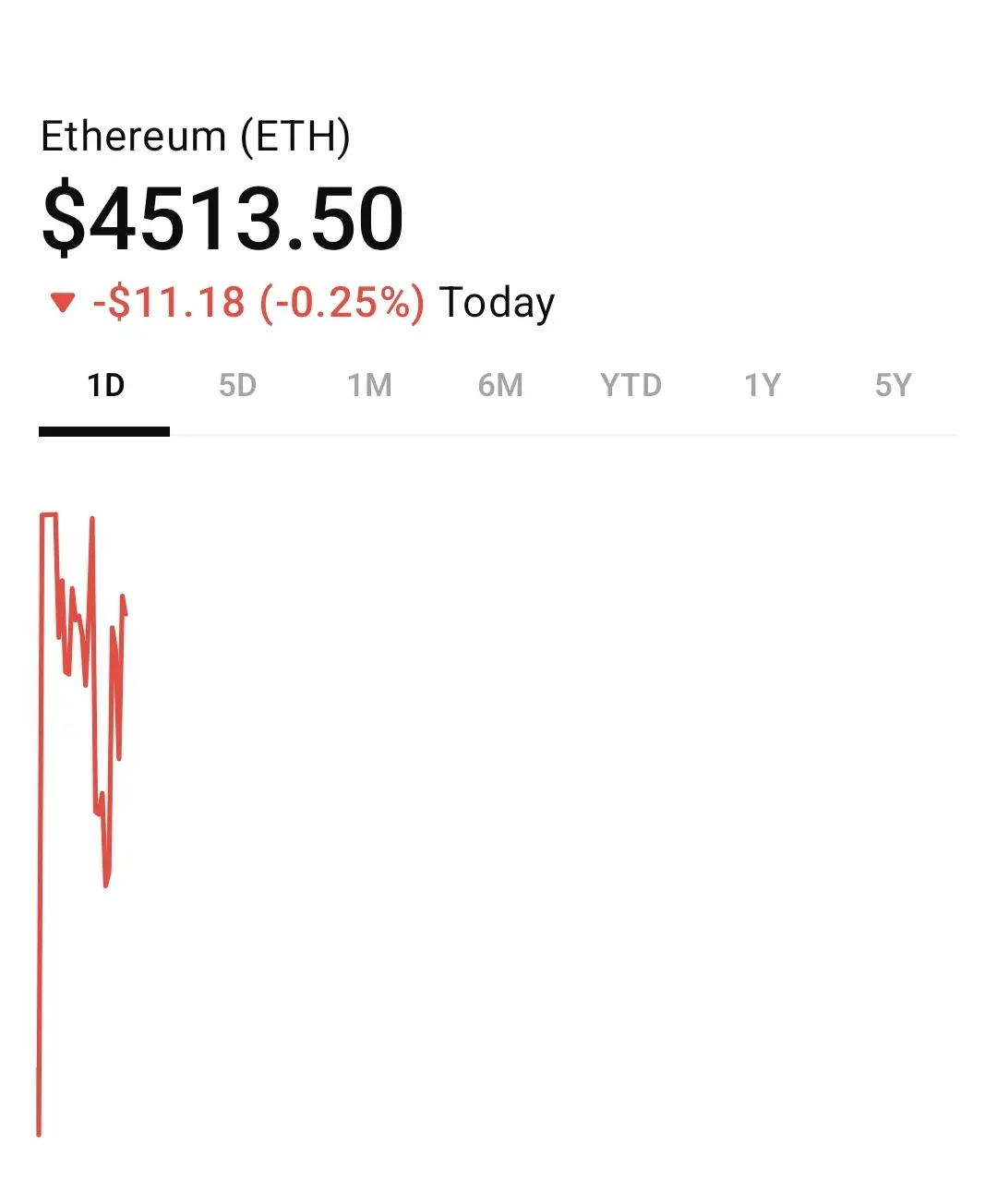

# market

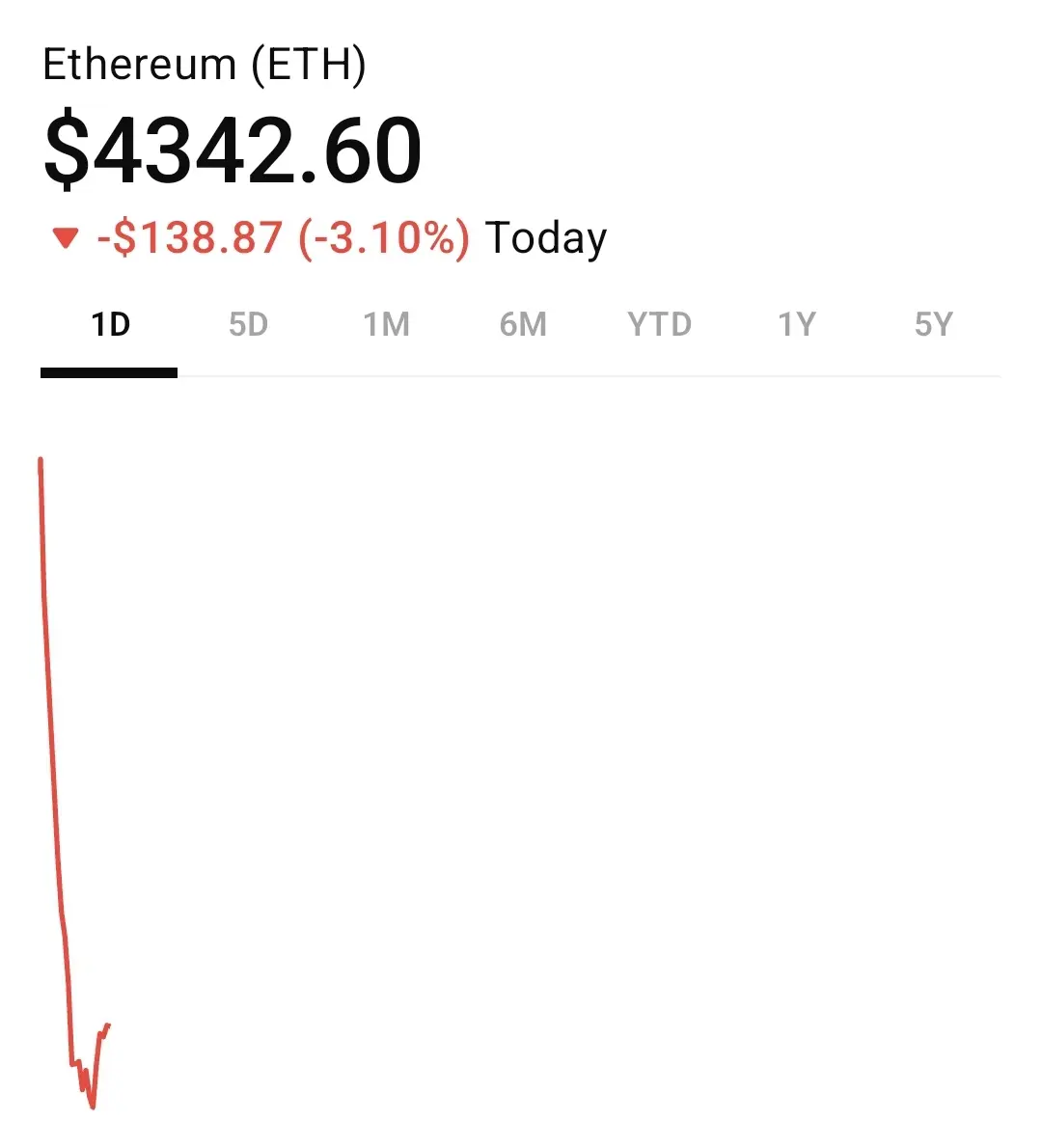

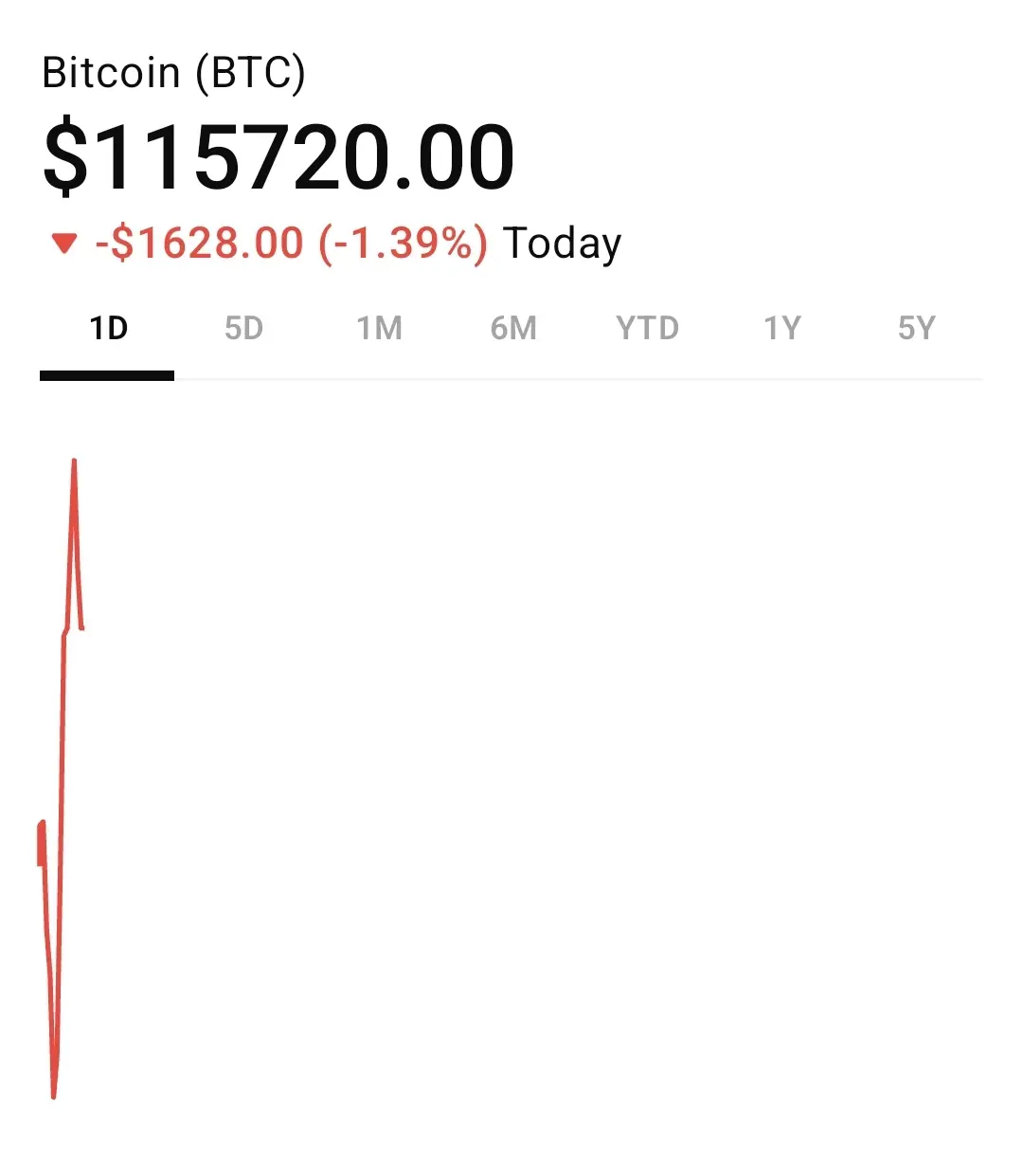

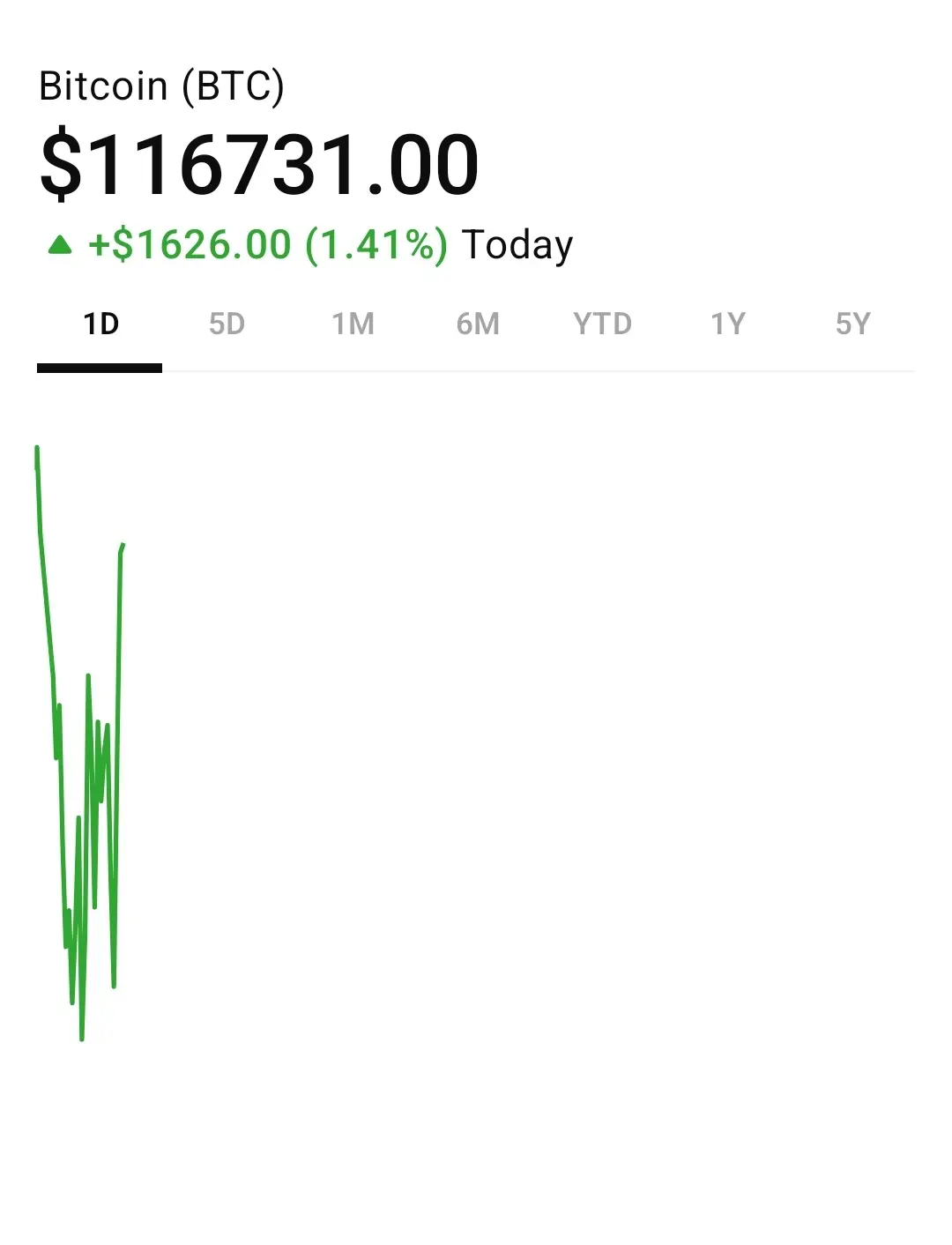

# Mr Beast

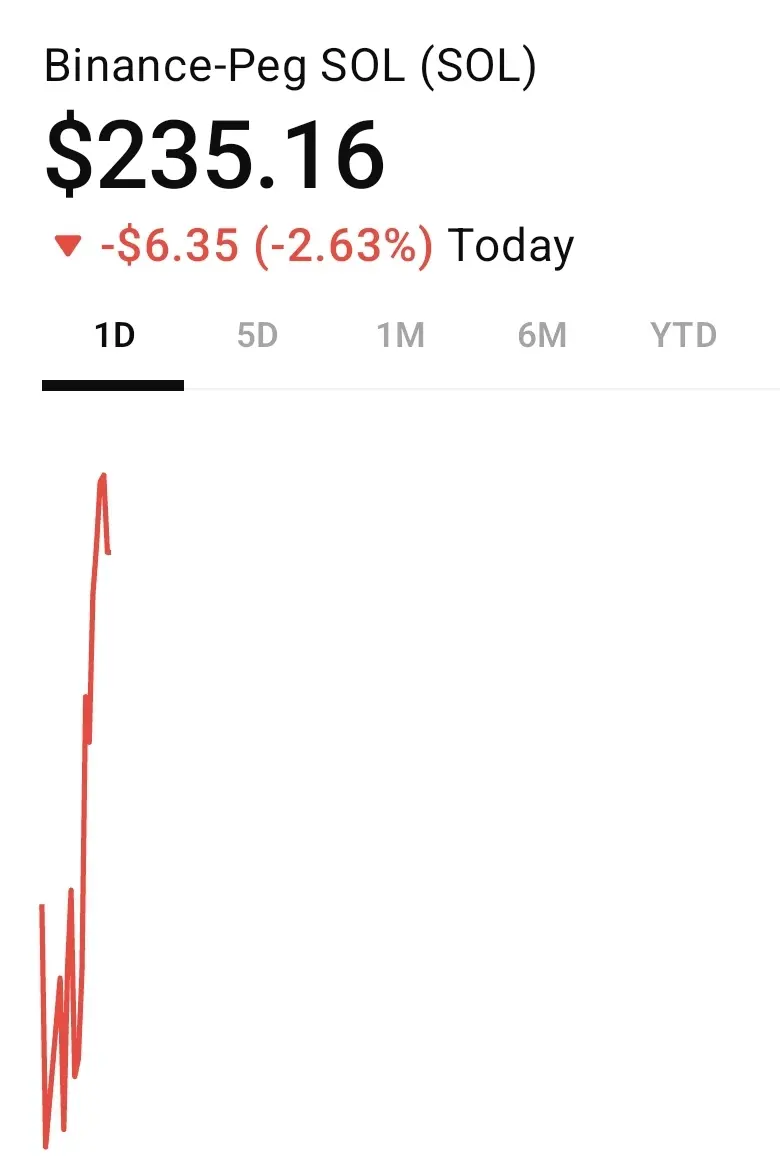

# market

# Mr Beast

ASTER11.01%