2025 AOPrice Prediction: Analyzing Key Factors and Market Trends for the AO Ecosystem

Introduction: AO's Market Position and Investment Value

AO (AO), as a decentralized compute system, has been making waves in the cryptocurrency market since its inception. As of 2025, AO's market capitalization has reached $30,701,206, with a circulating supply of approximately 5,063,698 tokens, and a price hovering around $6.063. This asset, often referred to as "the parallel processing pioneer," is playing an increasingly crucial role in the field of decentralized computing and message passing systems.

This article will provide a comprehensive analysis of AO's price trends from 2025 to 2030, combining historical patterns, market supply and demand, ecosystem development, and macroeconomic factors to offer professional price predictions and practical investment strategies for investors.

I. AO Price History Review and Current Market Status

AO Historical Price Evolution

- 2025: AO launched, price reached all-time high of $28.32 on March 20

- 2025: Market downturn, price dropped to all-time low of $5.284 on September 28

AO Current Market Situation

As of October 3, 2025, AO is trading at $6.063, with a 24-hour trading volume of $16,080.53. The token has experienced a 4.44% decrease in the last 24 hours. AO's market cap currently stands at $30,701,206, ranking it 907th in the overall cryptocurrency market.

AO has shown significant volatility in recent periods:

- 1-hour change: -1.78%

- 7-day change: -11.45%

- 30-day change: -32.12%

The current price is 78.58% below its all-time high and 14.74% above its all-time low. With a circulating supply of 5,063,698.87 AO tokens and a maximum supply of 21,000,000, the token has a circulation ratio of 24.11%.

The fully diluted market cap of AO is $127,323,000, indicating potential for growth if the project achieves its maximum supply. However, the recent downward trend suggests caution among investors.

Click to view the current AO market price

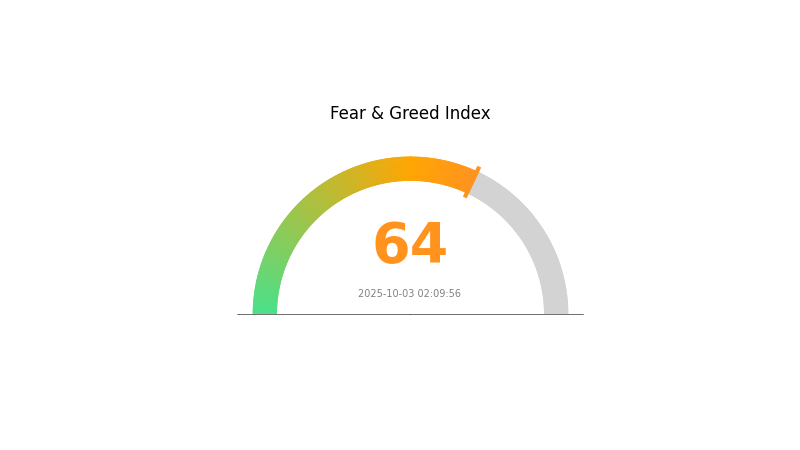

AO Market Sentiment Indicator

2025-10-03 Fear and Greed Index: 64 (Greed)

Click to view the current Fear & Greed Index

The crypto market is showing signs of greed, with the Fear and Greed Index reaching 64. This indicates growing optimism among investors, potentially driven by recent price rallies or positive market news. However, it's crucial to remain cautious as excessive greed can lead to overvalued assets and increased volatility. Traders should consider diversifying their portfolios and setting stop-loss orders to protect gains. As always, thorough research and risk management are essential in navigating the dynamic crypto landscape.

AO Holdings Distribution

The address holdings distribution data for AO token reveals an interesting pattern in its ownership structure. Based on the available information, it appears that the token distribution is relatively dispersed, with no single address holding a significant percentage of the total supply.

This distribution pattern suggests a healthy level of decentralization in AO token ownership. The absence of large concentrated holdings reduces the risk of market manipulation by individual whales and contributes to a more stable price dynamic. Such a structure is generally considered positive for the long-term sustainability and fairness of the token ecosystem.

However, it's important to note that this snapshot of holdings distribution represents a single point in time. Ongoing monitoring of ownership patterns is crucial to identify any emerging trends or shifts in token concentration that could potentially impact market dynamics or governance processes within the AO ecosystem.

Click to view the current AO holdings distribution

| Top | Address | Holding Qty | Holding (%) |

|---|

II. Key Factors Affecting AO's Future Price

Supply Mechanism

- Supply and Demand: The balance between supply and demand significantly influences AO futures prices.

- Production Costs: Changes in production costs can impact AO prices. Rising costs may push prices up, while falling costs could lead to lower prices.

Macroeconomic Environment

- Economic Policies: Macroeconomic policies can affect AO prices.

- International Market Dynamics: Global market trends play a role in shaping AO's price movements.

Technical Development and Ecosystem Building

- Project Progress: Advancements in the AO project can influence its price.

- Market Sentiment: The overall sentiment in the cryptocurrency market affects AO's price.

- Crypto Market Trends: The general direction of the broader cryptocurrency market impacts AO's performance.

III. AO Price Prediction for 2025-2030

2025 Outlook

- Conservative prediction: $5.39 - $6.06

- Neutral prediction: $6.06 - $7.54

- Optimistic prediction: $7.54 - $9.03 (requires favorable market conditions)

2027 Mid-term Outlook

- Market stage expectation: Potential for steady growth

- Price range forecast:

- 2026: $4.37 - $8.22

- 2027: $4.25 - $9.70

- Key catalysts: Increasing adoption, technological advancements

2030 Long-term Outlook

- Base scenario: $11.80 - $12.16 (assuming continued market growth)

- Optimistic scenario: $12.16 - $12.77 (with strong ecosystem development)

- Transformative scenario: $12.77 - $14.48 (with widespread adoption and integration)

- 2030-12-31: AO $12.77 (potential peak price)

| 年份 | 预测最高价 | 预测平均价格 | 预测最低价 | 涨跌幅 |

|---|---|---|---|---|

| 2025 | 9.03387 | 6.063 | 5.39607 | 0 |

| 2026 | 8.22779 | 7.54844 | 4.37809 | 24 |

| 2027 | 9.70238 | 7.88811 | 4.25958 | 30 |

| 2028 | 10.90611 | 8.79525 | 5.1892 | 45 |

| 2029 | 14.4805 | 9.85068 | 8.7671 | 62 |

| 2030 | 12.77387 | 12.16559 | 11.80062 | 100 |

IV. Professional Investment Strategies and Risk Management for AO

AO Investment Methodology

(1) Long-term Holding Strategy

- Suitable for: Risk-tolerant investors with a long-term perspective

- Operational suggestions:

- Accumulate AO tokens during price dips

- Set price targets for partial profit-taking

- Store tokens securely in a non-custodial wallet

(2) Active Trading Strategy

- Technical analysis tools:

- Moving Averages: Monitor short-term and long-term trends

- Relative Strength Index (RSI): Identify overbought or oversold conditions

- Key points for swing trading:

- Set stop-loss orders to limit potential losses

- Take profits at predetermined resistance levels

AO Risk Management Framework

(1) Asset Allocation Principles

- Conservative investors: 1-3% of crypto portfolio

- Aggressive investors: 5-10% of crypto portfolio

- Professional investors: Up to 15% of crypto portfolio

(2) Risk Hedging Strategies

- Diversification: Spread investments across multiple crypto assets

- Use of stablecoins: Convert a portion of AO holdings to stablecoins during high volatility periods

(3) Secure Storage Solutions

- Hot wallet recommendation: Gate Web3 wallet

- Cold storage option: Hardware wallet for long-term holdings

- Security precautions: Enable two-factor authentication, use strong passwords, and keep private keys offline

V. Potential Risks and Challenges for AO

AO Market Risks

- High volatility: AO's price may experience significant fluctuations

- Limited liquidity: Potential difficulty in executing large trades without impacting price

- Market sentiment: Susceptibility to broader crypto market trends

AO Regulatory Risks

- Uncertain regulatory environment: Potential for new regulations affecting decentralized systems

- Cross-border compliance: Challenges in adhering to varying international regulations

- Tax implications: Evolving tax laws regarding crypto assets

AO Technical Risks

- Smart contract vulnerabilities: Potential for exploits in the underlying code

- Scalability challenges: Possible network congestion as user adoption grows

- Interoperability issues: Compatibility concerns with other blockchain networks

VI. Conclusion and Action Recommendations

AO Investment Value Assessment

AO presents an innovative approach to decentralized computing, offering long-term potential in the evolving blockchain ecosystem. However, it faces short-term risks due to market volatility and regulatory uncertainties.

AO Investment Recommendations

✅ Novice investors: Consider small, regular investments to build a position over time ✅ Experienced investors: Implement a balanced approach with both long-term holding and active trading strategies ✅ Institutional investors: Conduct thorough due diligence and consider AO as part of a diversified crypto portfolio

AO Trading Participation Methods

- Spot trading: Buy and sell AO tokens on Gate.com

- Staking: Participate in staking programs if available to earn passive income

- DeFi integration: Explore decentralized finance opportunities using AO tokens

Cryptocurrency investments carry extremely high risks, and this article does not constitute investment advice. Investors should make decisions carefully based on their own risk tolerance and are advised to consult professional financial advisors. Never invest more than you can afford to lose.

FAQ

Is AO a good investment?

AO shows strong potential as an investment. With its innovative technology and growing market presence, AO is poised for significant growth in the coming years. Analysts predict a positive price trajectory for AO in 2025 and beyond.

What is AO value?

AO value refers to the current market price of AO token, which is $6.366765 per AO. It reflects the token's worth in the crypto market.

How much is $AO crypto worth?

As of 2025-10-03, AO crypto is worth $8.92 USD. The price has decreased by 0.37% in the last 24 hours, with a trading volume of $579,391 USD.

How much will ADA be worth in 2025?

Based on market analysis, ADA is projected to reach approximately $0.9 by 2025. However, cryptocurrency prices can be highly volatile and unpredictable.

Share

Content