2025 CPrice Prediction: Analyzing Market Trends and Economic Factors Shaping Cryptocurrency Valuations

Introduction: C's Market Position and Investment Value

Chainbase (C), as a foundational layer for the DataFi era, has achieved significant milestones since its inception. As of 2025, Chainbase's market capitalization has reached $27,536,000, with a circulating supply of approximately 160,000,000 tokens, and a price hovering around $0.1721. This asset, dubbed the "Hyperdata Network for AI," is playing an increasingly crucial role in transforming fragmented onchain signals into structured, verifiable, and AI-ready data.

This article will provide a comprehensive analysis of Chainbase's price trends from 2025 to 2030, combining historical patterns, market supply and demand, ecosystem development, and macroeconomic factors to offer professional price predictions and practical investment strategies for investors.

I. C Price History Review and Current Market Status

C Historical Price Evolution Trajectory

- 2025 July: C reached its all-time high of $0.5396, marking a significant milestone for the project

- 2025 September: The token experienced a sharp decline, hitting its all-time low of $0.1654

- 2025 October: C is currently in a recovery phase, with price fluctuations between $0.1695 and $0.1831 in the past 24 hours

C Current Market Situation

As of October 3, 2025, C is trading at $0.1721, with a 24-hour trading volume of $162,273.99. The token has experienced a 4.82% decrease in the last 24 hours. C's market capitalization stands at $27,536,000, ranking it at 952th in the overall cryptocurrency market. The circulating supply is 160,000,000 C tokens, which represents 16% of the total supply of 1,000,000,000 tokens. The fully diluted market cap is $172,100,000.

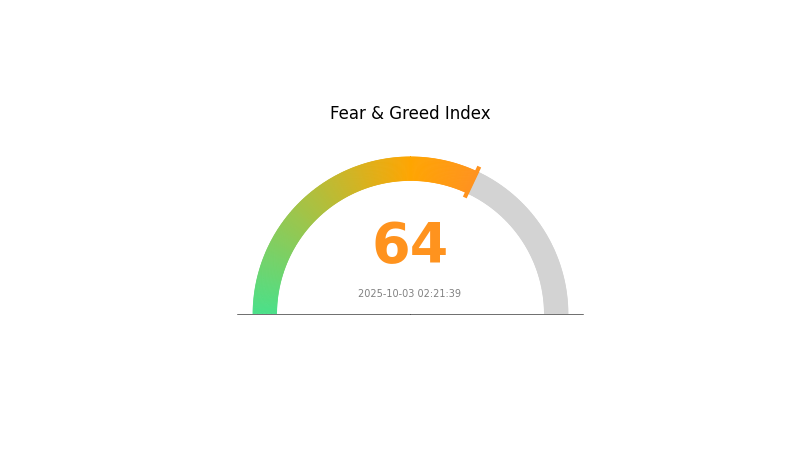

Over the past week, C has seen an 8.09% decrease in value, while the 30-day decline stands at 19.93%. The yearly performance shows a 16.73% decrease. Despite recent downtrends, the market sentiment for C remains in the "Greed" zone with a VIX of 64, indicating potential investor optimism.

Click to view the current C market price

C Market Sentiment Indicator

2025-10-03 Fear and Greed Index: 64 (Greed)

Click to view the current Fear & Greed Index

The crypto market is showing signs of exuberance with a Fear and Greed Index of 64, indicating "Greed." This suggests investors are becoming increasingly optimistic, potentially driving prices higher. However, it's crucial to remain cautious as extreme greed can lead to market corrections. Diversification and risk management are key in such market conditions. Keep an eye on fundamental factors and avoid making impulsive decisions based solely on market sentiment. As always, conduct thorough research before making any investment choices.

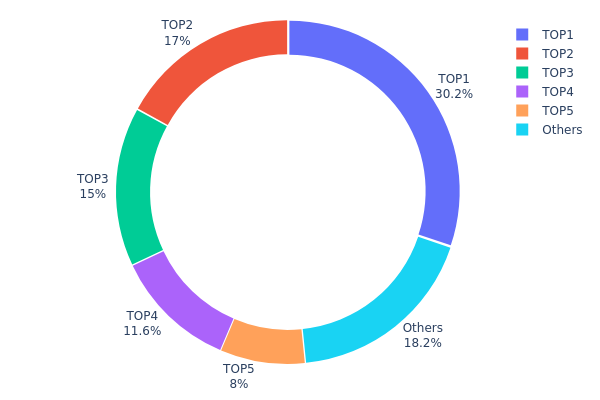

C Holdings Distribution

The address holdings distribution chart provides crucial insights into the concentration of C tokens across different addresses. Analysis of the provided data reveals a highly centralized distribution pattern. The top address holds a substantial 30.17% of the total supply, while the top 5 addresses collectively control 81.77% of all tokens.

This concentration level raises concerns about potential market manipulation and price volatility. With such a significant portion of tokens held by a few addresses, large-scale transactions could dramatically impact C's market price. Furthermore, this centralization may undermine the project's claims of decentralization and could potentially deter new investors who prioritize more distributed token economies.

The current distribution structure suggests a relatively low level of on-chain stability and a high risk of market fluctuations. While this concentration might enable quicker decision-making for the project, it also presents significant challenges for maintaining a balanced and fair market ecosystem for C tokens.

Click to view the current C holdings distribution

| Top | Address | Holding Qty | Holding (%) |

|---|---|---|---|

| 1 | 0x81e7...fdb2b2 | 301714.29K | 30.17% |

| 2 | 0x2219...4fb170 | 170000.00K | 17.00% |

| 3 | 0xee91...a6504b | 150000.00K | 15.00% |

| 4 | 0xff5a...931888 | 116000.00K | 11.60% |

| 5 | 0xa06f...47c2c5 | 80000.00K | 8.00% |

| - | Others | 182285.71K | 18.23% |

II. Key Factors Influencing C's Future Price

Regulatory Dynamics

- Global Policy Shifts: The transition from strict prohibition to active promotion in various countries significantly impacts the global cryptocurrency market development.

- Historical Impact: China's crackdown on cryptocurrency trading and mining in 2021 led to the relocation of mining operations and market turbulence.

- Current Influence: The U.S. has adopted a more open stance, with the SEC approving Bitcoin and Ethereum ETFs in 2024, potentially driving market growth.

Institutional and Major Player Movements

- Corporate Adoption: El Salvador became the first country to adopt Bitcoin as legal tender in 2021, actively promoting its use for payments and investments.

- National Policies: The EU has introduced the Markets in Crypto-Assets (MiCA) regulation, establishing a clear legal framework for the industry.

Macroeconomic Environment

- Monetary Policy Impact: Federal Reserve interest rate decisions significantly affect cryptocurrency prices. Rate hikes typically lead to capital flow towards low-risk assets, causing cryptocurrency prices to fall.

- Inflation Hedging Properties: In inflationary environments, cryptocurrencies may be viewed as potential hedges, influencing their demand and price.

- Geopolitical Factors: International tensions and economic uncertainties can drive interest in cryptocurrencies as alternative assets.

Technical Development and Ecosystem Growth

- Market Sentiment: Cryptocurrency prices are highly susceptible to market sentiment, often influenced by social media discussions, news topics, and overall market atmosphere.

- FOMO and FUD: Fear of Missing Out (FOMO) and Fear, Uncertainty, and Doubt (FUD) frequently cause significant price fluctuations in the cryptocurrency market.

III. C Price Prediction for 2025-2030

2025 Outlook

- Conservative prediction: $0.09666 - $0.1726

- Neutral prediction: $0.1726 - $0.20

- Optimistic prediction: $0.20 - $0.22611 (requires favorable market conditions)

2027-2028 Outlook

- Market phase expectation: Potential growth phase

- Price range forecast:

- 2027: $0.19741 - $0.31353

- 2028: $0.19921 - $0.31928

- Key catalysts: Increased adoption and technological advancements

2030 Long-term Outlook

- Base scenario: $0.29608 - $0.34346 (assuming steady market growth)

- Optimistic scenario: $0.34346 - $0.39083 (assuming strong market performance)

- Transformative scenario: $0.39083 - $0.44993 (assuming exceptional market conditions and widespread adoption)

- 2030-12-31: C $0.44993 (potential peak price)

| 年份 | 预测最高价 | 预测平均价格 | 预测最低价 | 涨跌幅 |

|---|---|---|---|---|

| 2025 | 0.22611 | 0.1726 | 0.09666 | 0 |

| 2026 | 0.26514 | 0.19935 | 0.10167 | 15 |

| 2027 | 0.31353 | 0.23225 | 0.19741 | 34 |

| 2028 | 0.31928 | 0.27289 | 0.19921 | 58 |

| 2029 | 0.39083 | 0.29608 | 0.28128 | 72 |

| 2030 | 0.44993 | 0.34346 | 0.24729 | 99 |

IV. Professional Investment Strategies and Risk Management for C

C Investment Methodology

(1) Long-term Holding Strategy

- Suitable for: Long-term investors and believers in AI and data technology

- Operation suggestions:

- Accumulate C tokens during market dips

- Stay informed about Chainbase's development and partnerships

- Store tokens in a secure hardware wallet

(2) Active Trading Strategy

- Technical analysis tools:

- Moving Averages: Use to identify trends and potential reversal points

- RSI (Relative Strength Index): Monitor overbought and oversold conditions

- Key points for swing trading:

- Set clear entry and exit points based on technical indicators

- Monitor market sentiment and news related to AI and data projects

C Risk Management Framework

(1) Asset Allocation Principles

- Conservative investors: 1-3% of crypto portfolio

- Aggressive investors: 5-10% of crypto portfolio

- Professional investors: Up to 15% of crypto portfolio, depending on risk tolerance

(2) Risk Hedging Solutions

- Diversification: Spread investments across different blockchain and AI projects

- Stop-loss orders: Implement to limit potential losses

(3) Secure Storage Solutions

- Hardware wallet recommendation: Gate Web3 Wallet

- Software wallet option: Official Chainbase wallet (if available)

- Security precautions: Enable two-factor authentication, use strong passwords, and keep private keys offline

V. Potential Risks and Challenges for C

C Market Risks

- Volatility: Cryptocurrency markets are highly volatile, leading to significant price swings

- Competition: Increasing competition in the AI and data space may impact Chainbase's market share

- Market sentiment: Overall crypto market trends can affect C's price regardless of project fundamentals

C Regulatory Risks

- Uncertain regulations: Evolving cryptocurrency regulations may impact C's adoption and use

- Data privacy concerns: Stricter data protection laws could affect Chainbase's operations

- Cross-border restrictions: International regulations may limit C's global accessibility

C Technical Risks

- Smart contract vulnerabilities: Potential bugs or exploits in the token's smart contract

- Scalability challenges: Issues in handling increased network load as the project grows

- Integration complexities: Difficulties in integrating with various blockchain networks and AI systems

VI. Conclusion and Action Recommendations

C Investment Value Assessment

Chainbase (C) presents a compelling long-term value proposition in the growing AI and data economy. However, short-term volatility and regulatory uncertainties pose significant risks.

C Investment Recommendations

✅ Beginners: Consider small, long-term investments to gain exposure to the AI data sector ✅ Experienced investors: Implement a dollar-cost averaging strategy and actively monitor project developments ✅ Institutional investors: Conduct thorough due diligence and consider C as part of a diversified blockchain technology portfolio

C Trading Participation Methods

- Spot trading: Purchase C tokens on Gate.com for direct ownership

- Staking: Participate in staking programs if offered by Chainbase for passive income

- DeFi integration: Explore decentralized finance opportunities involving C tokens as they become available

Cryptocurrency investments carry extremely high risks, and this article does not constitute investment advice. Investors should make decisions carefully based on their own risk tolerance and are advised to consult professional financial advisors. Never invest more than you can afford to lose.

FAQ

Is C stock a good buy?

Based on current valuation metrics, C stock appears overvalued. Financial indicators suggest it may not be a good buy for investors at this time.

What is the 12 month forecast for C stock?

Based on current trends and market analysis, the 12-month forecast for C stock is projected to range between $78.25 and $102.26, with a potential increase of 10.81% from current prices.

How high will Constellation Energy stock go?

Constellation Energy stock is projected to reach a high of $1,038.39 by December, based on current market analysis and forecasts.

How volatile is C stock?

C stock tends to perform well in volatile markets, supported by its long-term growth plans. This resilience aligns with current market trends.

Share

Content