2025 FUEL Price Prediction: Strategic Analysis of Market Trends and Future Outlook for Investors

Introduction: FUEL's Market Position and Investment Value

Fuel (FUEL), as an innovative solution in the Ethereum ecosystem, has made significant strides since its inception. As of 2025, FUEL's market capitalization has reached $30,559,466, with a circulating supply of approximately 6,060,981,009 tokens, and a price hovering around $0.005042. This asset, often referred to as the "Ethereum rollup transformer," is playing an increasingly crucial role in enhancing Ethereum's scalability and efficiency.

This article will provide a comprehensive analysis of FUEL's price trends from 2025 to 2030, combining historical patterns, market supply and demand, ecosystem development, and macroeconomic factors to offer professional price predictions and practical investment strategies for investors.

I. FUEL Price History Review and Current Market Status

FUEL Historical Price Evolution Trajectory

- 2025: FUEL reached its all-time high of $0.021383 on April 16, marking a significant milestone in its price history.

- 2025: The market experienced a sharp downturn, with FUEL hitting its all-time low of $0.004486 on September 27.

- 2025: FUEL's price has been on a downward trend, with a 92.67% decrease over the past year.

FUEL Current Market Situation

As of October 3, 2025, FUEL is trading at $0.005042, showing a 4.4% increase in the last 24 hours. The current price is 76.42% below its all-time high and 12.39% above its all-time low. FUEL's market capitalization stands at $30,559,466, ranking it 910th in the cryptocurrency market. The 24-hour trading volume is $422,525.77, indicating moderate market activity. The circulating supply is 6,060,981,009 FUEL tokens, representing 59.64% of the total supply. The fully diluted market cap is $51,243,150. Despite the recent 24-hour gain, FUEL has shown negative performance over longer periods, with a 6.14% decrease in the past week and a 15.92% decline over the last month.

Click to view the current FUEL market price

FUEL Market Sentiment Indicator

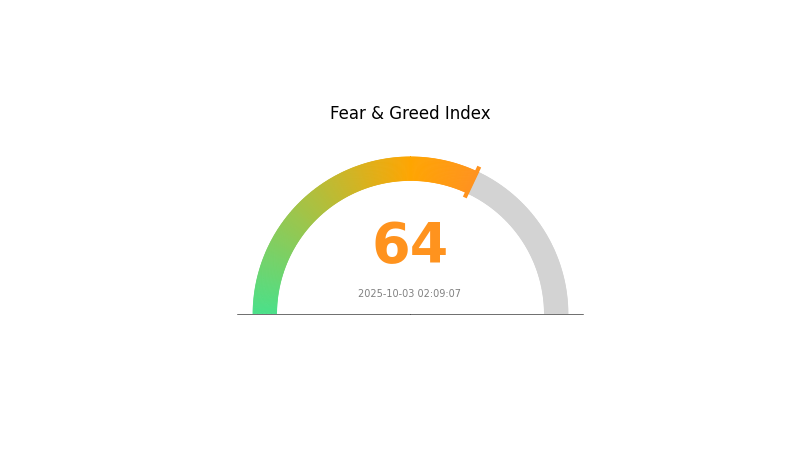

2025-10-03 Fear and Greed Index: 64 (Greed)

Click to view the current Fear & Greed Index

The crypto market is currently experiencing a period of greed, with the Fear and Greed Index at 64. This suggests investors are becoming increasingly optimistic about the market's prospects. However, it's important to remember that extreme greed can often precede market corrections. Traders should exercise caution and consider taking profits or rebalancing their portfolios. As always, thorough research and risk management are crucial in navigating these volatile market conditions.

FUEL Holdings Distribution

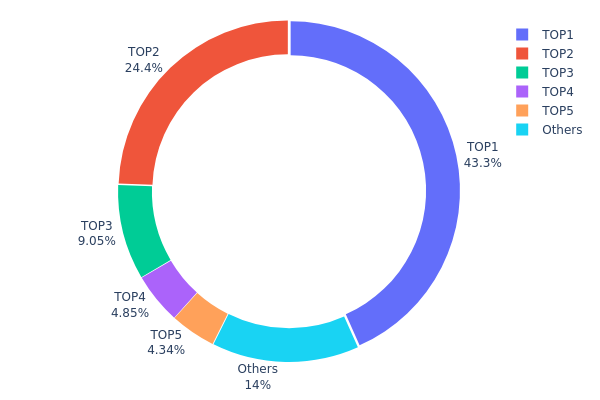

The address holdings distribution data for FUEL reveals a highly concentrated ownership structure. The top address holds a substantial 43.32% of the total supply, while the second-largest holder accounts for 24.40%. Collectively, the top five addresses control 85.94% of FUEL tokens, indicating a significant centralization of power within the network.

This level of concentration raises concerns about market manipulation and price volatility. With such a large portion of tokens held by a few addresses, there is potential for these major holders to exert considerable influence over FUEL's market dynamics. Large sell-offs or acquisitions by these addresses could lead to dramatic price swings and impact overall market stability.

The current distribution suggests a low degree of decentralization within the FUEL ecosystem. This concentration of tokens in few hands may pose challenges to the network's governance and decision-making processes, potentially undermining the principles of decentralization that many blockchain projects strive to achieve.

Click to view the current FUEL Holdings Distribution

| Top | Address | Holding Qty | Holding (%) |

|---|---|---|---|

| 1 | 0xd57d...c169ee | 4441027.92K | 43.32% |

| 2 | 0xa4ca...f43f67 | 2501514.42K | 24.40% |

| 3 | 0x50ed...5edfe8 | 927536.22K | 9.04% |

| 4 | 0x2ac7...ebb0d5 | 497547.13K | 4.85% |

| 5 | 0x8530...708ecc | 444587.18K | 4.33% |

| - | Others | 1437787.16K | 14.06% |

II. Key Factors Influencing FUEL's Future Price

Supply Mechanism

- Market Dynamics: Supply and demand will play crucial roles in determining FUEL's future price.

- Current Impact: The balance between supply and demand is expected to significantly influence price movements.

Institutional and Whale Dynamics

- National Policies: Regulatory changes can significantly impact FUEL's value.

Macroeconomic Environment

- Geopolitical Factors: International political situations may influence FUEL's price trajectory.

Technical Development and Ecosystem Building

- Ecosystem Growth: The expansion of FUEL's ecosystem will be a key factor in its future price performance.

- Ecosystem Applications: The development of main DApps and ecosystem projects will contribute to FUEL's value proposition.

III. FUEL Price Prediction for 2025-2030

2025 Outlook

- Conservative prediction: $0.00272 - $0.00504

- Neutral prediction: $0.00504 - $0.00588

- Optimistic prediction: $0.00588 - $0.00671 (requires positive market sentiment and project developments)

2027-2028 Outlook

- Market stage expectation: Potential growth phase with increasing adoption

- Price range forecast:

- 2027: $0.00571 - $0.00792

- 2028: $0.00730 - $0.00987

- Key catalysts: Technological advancements, wider ecosystem integration, and market expansion

2029-2030 Long-term Outlook

- Base scenario: $0.00870 - $0.00961 (assuming steady market growth and project development)

- Optimistic scenario: $0.01052 - $0.01249 (assuming strong market performance and significant project milestones)

- Transformative scenario: $0.01249+ (extreme favorable conditions such as major partnerships or technological breakthroughs)

- 2030-12-31: FUEL $0.00961 (90% increase from 2025 baseline)

| 年份 | 预测最高价 | 预测平均价格 | 预测最低价 | 涨跌幅 |

|---|---|---|---|---|

| 2025 | 0.00671 | 0.00504 | 0.00272 | 0 |

| 2026 | 0.0084 | 0.00588 | 0.00482 | 16 |

| 2027 | 0.00792 | 0.00714 | 0.00571 | 41 |

| 2028 | 0.00987 | 0.00753 | 0.0073 | 49 |

| 2029 | 0.01052 | 0.0087 | 0.00687 | 72 |

| 2030 | 0.01249 | 0.00961 | 0.0049 | 90 |

IV. FUEL Professional Investment Strategies and Risk Management

FUEL Investment Methodology

(1) Long-term Holding Strategy

- Suitable for: Long-term investors and believers in Ethereum scaling solutions

- Operation suggestions:

- Accumulate FUEL tokens during market dips

- Stay updated on Fuel Network's development progress and adoption

- Store tokens securely in a non-custodial wallet

(2) Active Trading Strategy

- Technical analysis tools:

- Moving Averages: Use to identify trends and potential reversal points

- Relative Strength Index (RSI): Monitor overbought/oversold conditions

- Key points for swing trading:

- Monitor Ethereum ecosystem news and scaling solution developments

- Track total value locked (TVL) in Fuel Ignition as a performance indicator

FUEL Risk Management Framework

(1) Asset Allocation Principles

- Conservative investors: 1-3% of crypto portfolio

- Aggressive investors: 5-10% of crypto portfolio

- Professional investors: Up to 15% of crypto portfolio

(2) Risk Hedging Solutions

- Diversification: Spread investments across multiple Layer 2 scaling solutions

- Stop-loss orders: Implement to limit potential losses

(3) Secure Storage Solutions

- Hot wallet recommendation: Gate web3 wallet

- Cold storage solution: Hardware wallet for long-term holdings

- Security precautions: Enable two-factor authentication, use unique strong passwords

V. Potential Risks and Challenges for FUEL

FUEL Market Risks

- High volatility: FUEL price may experience significant fluctuations

- Competition: Other Layer 2 solutions may gain more traction

- Ethereum upgrades: Future Ethereum improvements could impact L2 demand

FUEL Regulatory Risks

- Uncertain regulations: Potential changes in crypto regulations may affect FUEL

- Cross-border restrictions: Varying international regulations may limit adoption

- Tax implications: Evolving tax laws could impact FUEL transactions and holdings

FUEL Technical Risks

- Smart contract vulnerabilities: Potential security issues in the Fuel Network

- Scalability challenges: Unforeseen issues in handling increased transaction volume

- Integration complexities: Difficulties in widespread adoption by dApps and users

VI. Conclusion and Action Recommendations

FUEL Investment Value Assessment

FUEL presents a high-risk, high-potential opportunity within the Ethereum scaling ecosystem. Long-term value depends on Fuel Network's adoption and performance, while short-term volatility remains a significant risk.

FUEL Investment Recommendations

✅ Beginners: Consider small, exploratory positions after thorough research ✅ Experienced investors: Implement dollar-cost averaging strategy with strict risk management ✅ Institutional investors: Evaluate FUEL as part of a diversified Layer 2 investment thesis

FUEL Trading Participation Methods

- Spot trading: Available on Gate.com and other supported exchanges

- DeFi liquidity provision: Participate in liquidity pools if available

- Staking: Explore staking options if offered by the Fuel Network

Cryptocurrency investments carry extremely high risks. This article does not constitute investment advice. Investors should make decisions carefully based on their own risk tolerance and are advised to consult professional financial advisors. Never invest more than you can afford to lose.

FAQ

What is the forecast for fuel prices?

Based on current trends, FUEL prices are projected to rise moderately in the coming months, potentially reaching $0.15-$0.20 by the end of 2025.

What is the fuel price forecast for 2025?

Based on current projections, the fuel price forecast for 2025 is expected to be around $59 per barrel, showing a significant decline from previous years.

Is oil expected to go up or down?

Oil prices are expected to decline in the coming months, with forecasts predicting a drop from $68 to $59 per barrel. This downward trend is likely to continue in the short term.

Where will oil prices be in 5 years?

Oil prices may stabilize or slightly decrease over the next 5 years, influenced by market trends and geopolitical factors. Volatility is expected to continue.

Share

Content