2025 G Price Prediction: Analysts Forecast Significant Growth Amid Global Economic Recovery

Introduction: G's Market Position and Investment Value

Gravity (G) as the native token of Gravity and utility token for both Gravity and Galxe ecosystems, has established itself as a key player in the blockchain space. As of 2025, G's market capitalization has reached $39,150,605, with a circulating supply of approximately 7,232,700,000 tokens, and a price hovering around $0.005413. This asset, known as the "dual-ecosystem utility token," is playing an increasingly crucial role in powering transactions, securing networks, and facilitating governance across both Gravity and Galxe platforms.

This article will comprehensively analyze G's price trends from 2025 to 2030, combining historical patterns, market supply and demand, ecosystem development, and macroeconomic factors to provide investors with professional price predictions and practical investment strategies.

I. G Price History Review and Current Market Status

G Historical Price Evolution

- 2024: G reached its all-time high of $0.05764 on July 25, marking a significant milestone for the token.

- 2025: The market experienced a downturn, with G hitting its all-time low of $0.00528 on October 10.

G Current Market Situation

As of November 18, 2025, G is trading at $0.005413, representing a 90.60% decrease from its all-time high. The token has shown mixed performance across different timeframes:

- In the past hour, G has seen a slight increase of 0.05%.

- Over the last 24 hours, the price has declined by 2.26%.

- The 7-day performance shows a significant drop of 18.95%.

- In the past 30 days, G has lost 27% of its value.

- The yearly performance indicates a substantial decrease of 81.85%.

The current market capitalization of G stands at $39,150,605.1, with a circulating supply of 7,232,700,000 tokens. The 24-hour trading volume is $11,829.06, indicating moderate market activity. The token's fully diluted valuation is $64,956,000, and it currently ranks 640th in the cryptocurrency market.

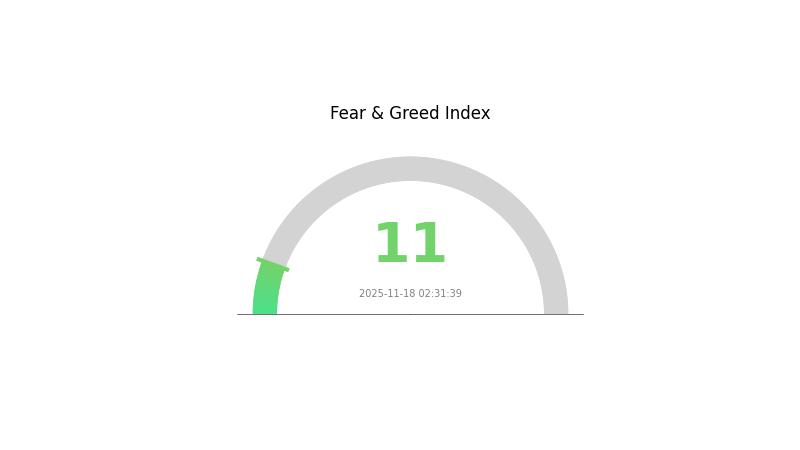

The market sentiment for G appears bearish in the short to medium term, reflecting the overall crypto market conditions, which are currently in a state of "Extreme Fear" with a VIX index of 11.

Click to view the current G market price

G Market Sentiment Indicator

2025-11-18 Fear and Greed Index: 11 (Extreme Fear)

Click to view the current Fear & Greed Index

The crypto market is gripped by extreme fear, with the index plummeting to 11. This level of pessimism often signals a potential buying opportunity for contrarian investors. However, caution is advised as market sentiment can remain bearish for extended periods. Traders on Gate.com should consider dollar-cost averaging and thorough research before making investment decisions. Remember, while fear can create opportunities, it's crucial to manage risks and invest only what you can afford to lose in this volatile market.

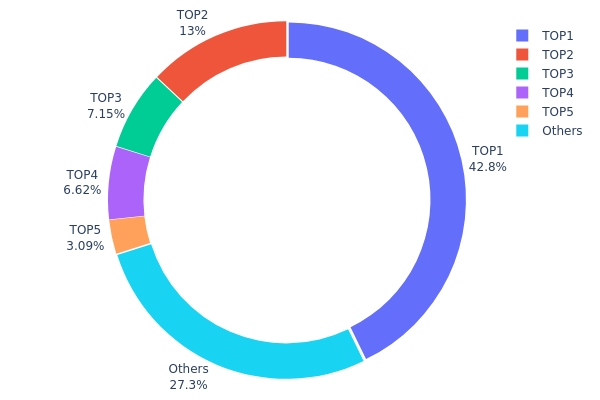

G Holdings Distribution

The address holdings distribution chart provides insight into the concentration of G tokens across different wallet addresses. Analysis of the data reveals a significant centralization of G tokens, with the top 5 addresses controlling 72.66% of the total supply. The largest holder alone possesses 42.81% of all tokens, indicating a highly concentrated ownership structure.

This level of concentration raises concerns about potential market manipulation and price volatility. With such a large portion of tokens held by a few addresses, any significant movement or liquidation could have a substantial impact on G's market price. Furthermore, this concentration may undermine the project's decentralization efforts and could potentially affect governance decisions if G employs a token-based voting system.

The current distribution pattern suggests a relatively low level of token dispersion among the broader community, with only 27.34% held by addresses outside the top 5. This structure may pose challenges for market stability and could deter some investors concerned about centralized control. However, it's worth noting that some of these large addresses might represent exchange wallets or project treasury funds, which could mitigate some concentration risks if managed transparently.

Click to view the current G Holdings Distribution

| Top | Address | Holding Qty | Holding (%) |

|---|---|---|---|

| 1 | 0x7983...364c42 | 4935446.54K | 42.81% |

| 2 | 0x1a70...1e8800 | 1499116.25K | 13.00% |

| 3 | 0xbd6e...fbfb6d | 824607.98K | 7.15% |

| 4 | 0xf977...41acec | 762747.73K | 6.61% |

| 5 | 0x611f...dfb09d | 356375.39K | 3.09% |

| - | Others | 3148263.37K | 27.34% |

II. Key Factors Affecting Future G Price

Macroeconomic Environment

-

Impact of Monetary Policy: The Federal Reserve's policy stance is expected to significantly influence G price movements. Interest rate decisions and quantitative easing measures will play a crucial role in shaping market sentiment and capital flows.

-

Inflation Hedging Properties: G has historically been viewed as an inflation hedge. In the current inflationary environment, its performance will be closely watched by investors seeking to protect their portfolios against rising prices.

-

Geopolitical Factors: International tensions and conflicts can drive demand for G as a safe-haven asset. Ongoing geopolitical uncertainties may continue to impact G prices in the coming months.

Technical Developments and Ecosystem Building

-

Regulatory Developments: The evolving regulatory landscape for cryptocurrencies across different countries will be a key factor influencing G's adoption and price. Positive regulatory clarity could boost investor confidence and market growth.

-

Ecosystem Applications: The expansion of decentralized finance (DeFi) platforms and other blockchain-based applications utilizing G could drive increased demand and utility for the asset.

III. G Price Prediction for 2025-2030

2025 Outlook

- Conservative prediction: $0.00329 - $0.00548

- Neutral prediction: $0.00548 - $0.00665

- Optimistic prediction: $0.00665 - $0.00783 (requires favorable market conditions)

2026-2027 Outlook

- Market phase expectation: Steady growth phase

- Price range forecast:

- 2026: $0.00605 - $0.00805

- 2027: $0.00669 - $0.00868

- Key catalysts: Increased adoption and technological advancements

2028-2030 Long-term Outlook

- Base scenario: $0.00801 - $0.01013 (assuming continued market stability)

- Optimistic scenario: $0.01013 - $0.01144 (assuming strong market growth)

- Transformative scenario: $0.01144 - $0.01212 (assuming breakthrough innovations)

- 2030-12-31: G $0.01144 (potentially reaching new all-time highs)

| 年份 | 预测最高价 | 预测平均价格 | 预测最低价 | 涨跌幅 |

|---|---|---|---|---|

| 2025 | 0.00783 | 0.00548 | 0.00329 | 1 |

| 2026 | 0.00805 | 0.00665 | 0.00605 | 22 |

| 2027 | 0.00868 | 0.00735 | 0.00669 | 35 |

| 2028 | 0.00825 | 0.00801 | 0.00649 | 48 |

| 2029 | 0.01212 | 0.00813 | 0.00643 | 50 |

| 2030 | 0.01144 | 0.01013 | 0.00922 | 87 |

IV. Professional Investment Strategies and Risk Management for G

G Investment Methodology

(1) Long-term Holding Strategy

- Suitable for: Patient investors with a high-risk tolerance

- Operational suggestions:

- Accumulate G tokens during market dips

- Set price targets for partial profit-taking

- Store tokens securely in a hardware wallet

(2) Active Trading Strategy

- Technical analysis tools:

- Moving Averages: Use to identify trends and potential reversals

- RSI (Relative Strength Index): Monitor overbought/oversold conditions

- Key points for swing trading:

- Set clear entry and exit points

- Use stop-loss orders to manage risk

G Risk Management Framework

(1) Asset Allocation Principles

- Conservative investors: 1-3%

- Aggressive investors: 5-10%

- Professional investors: 10-15%

(2) Risk Hedging Solutions

- Diversification: Spread investments across various crypto assets

- Stop-loss orders: Implement to limit potential losses

(3) Secure Storage Solutions

- Hardware wallet recommendation: Gate Web3 Wallet

- Software wallet option: Official Gravity wallet (if available)

- Security precautions: Enable two-factor authentication, use strong passwords

V. Potential Risks and Challenges for G

G Market Risks

- High volatility: G's price may experience significant fluctuations

- Competition: Other blockchain projects may outperform Gravity

- Liquidity risk: Low trading volume may impact ability to buy/sell

G Regulatory Risks

- Uncertain regulations: Crypto regulations may impact G's adoption

- Legal challenges: Potential legal issues could affect G's value

- Tax implications: Changing tax laws may impact G holders

G Technical Risks

- Smart contract vulnerabilities: Potential bugs in G's underlying code

- Network congestion: High transaction volumes may slow the network

- Scalability issues: Challenges in handling increased user adoption

VI. Conclusion and Action Recommendations

G Investment Value Assessment

G offers potential long-term value as a utility token for the Gravity and Galxe ecosystems. However, short-term risks include high volatility and regulatory uncertainties.

G Investment Recommendations

✅ Beginners: Start with small positions, focus on education

✅ Experienced investors: Consider dollar-cost averaging, set clear profit targets

✅ Institutional investors: Conduct thorough due diligence, consider OTC trading

G Participation Methods

- Spot trading: Buy and sell G on Gate.com

- Staking: Participate in staking programs if available

- Ecosystem participation: Use G for governance and utility within Gravity and Galxe ecosystems

Cryptocurrency investments carry extremely high risks, and this article does not constitute investment advice. Investors should make decisions cautiously based on their own risk tolerance and are advised to consult professional financial advisors. Never invest more than you can afford to lose.

FAQ

What is the price prediction for G coin?

Based on current trends, G coin's price is predicted to reach $0.01 by 2026, reflecting a 5% increase. Market conditions may affect this forecast.

Can gala coins reach $1?

Yes, Gala coins could potentially reach $1. It would require significant market adoption and growth in the blockchain gaming sector. While ambitious, it's not impossible given the right conditions and developments.

Is gravity a good investment?

Gravity has potential for high returns but carries significant risk. Its innovative technology and growing ecosystem make it an intriguing investment for risk-tolerant investors in 2025.

Which crypto will reach $1000 in 2030?

Bitcoin is the most likely to reach $1000 by 2030, with some experts predicting it could hit $1 million. Ethereum and other top altcoins also have potential to reach this milestone.

Share

Content