2025 GIGA Price Prediction: Bullish Outlook as Blockchain Adoption Accelerates

Introduction: GIGA's Market Position and Investment Value

Gigachad (GIGA), positioned as a leading memecoin on the Solana blockchain, has been making waves in the cryptocurrency community since its inception. As of 2025, GIGA's market capitalization stands at $34,881,492, with a circulating supply of approximately 9,604,136,902 tokens, and a price hovering around $0.003632. This asset, dubbed "The Big One," is playing an increasingly crucial role in fostering community engagement and promoting personal growth within the crypto space.

This article will provide a comprehensive analysis of GIGA's price trends from 2025 to 2030, considering historical patterns, market supply and demand, ecosystem development, and macroeconomic factors to offer professional price predictions and practical investment strategies for investors.

I. GIGA Price History Review and Current Market Status

GIGA Historical Price Evolution Trajectory

- 2025 January: GIGA launched at $0.0486, reaching its all-time high of $0.09624 on January 3rd

- 2025 November: GIGA experienced a significant downturn, hitting its all-time low of $0.003362 on November 18th

GIGA Current Market Situation

As of November 18, 2025, GIGA is trading at $0.003632, marking a 91.91% decrease from its all-time high. The token has seen a 24-hour trading volume of $117,841.09, with a market capitalization of $34,882,225.23. GIGA's circulating supply stands at 9,604,136,902.35 tokens, representing 96.04% of its maximum supply of 10 billion tokens. The fully diluted valuation is $34,881,492.60.

In the past 24 hours, GIGA has experienced an 8.85% price decrease. The token has also shown negative performance across various timeframes, with a 33.42% drop over the past week and a 47.29% decline over the last 30 days. The current market sentiment for GIGA appears bearish, reflecting the overall cryptocurrency market's extreme fear state, as indicated by a VIX of 11.

Click to view the current GIGA market price

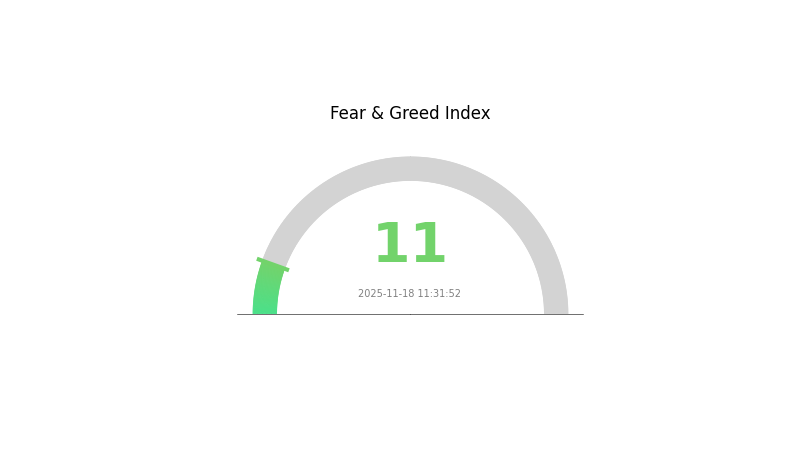

GIGA Market Sentiment Indicator

2025-11-18 Fear and Greed Index: 11 (Extreme Fear)

Click to view the current Fear & Greed Index

The crypto market is gripped by extreme fear, with the sentiment index plummeting to 11. This level of pessimism often signals a potential buying opportunity for contrarian investors. However, it's crucial to approach with caution and conduct thorough research. While fear may indicate oversold conditions, it's essential to consider broader market factors and individual risk tolerance. Experienced traders might see this as a chance to accumulate, but newcomers should tread carefully in such volatile conditions.

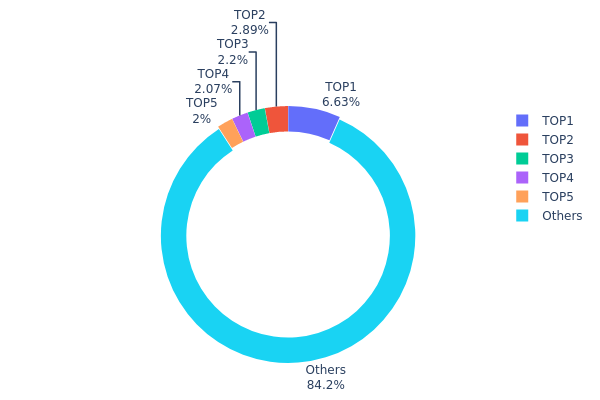

GIGA Holdings Distribution

The address holdings distribution chart provides insights into the concentration of GIGA tokens across different wallet addresses. Analysis of the data reveals that the top 5 addresses collectively hold 15.76% of the total GIGA supply, with the largest holder possessing 6.63%. This distribution pattern indicates a moderate level of concentration, as no single entity holds an overwhelming majority of tokens.

While there is some centralization among the top holders, the fact that 84.24% of GIGA tokens are distributed among other addresses suggests a relatively healthy dispersion. This distribution structure may contribute to market stability by reducing the potential for price manipulation by a single large holder. However, it's worth noting that coordinated actions by the top holders could still have a significant impact on market dynamics.

The current address distribution reflects a balance between centralized and decentralized ownership. This structure potentially supports a more robust market with diverse participation, while also allowing for some level of institutional or large-scale investor involvement. The distribution pattern suggests a maturing ecosystem for GIGA, with a mix of major stakeholders and a broad base of smaller holders contributing to the token's on-chain stability and liquidity.

Click to view the current GIGA holdings distribution

| Top | Address | Holding Qty | Holding (%) |

|---|---|---|---|

| 1 | DdzQbg...oBFt2d | 636928.31K | 6.63% |

| 2 | 5Q544f...pge4j1 | 277951.29K | 2.89% |

| 3 | E2RvJg...qnatYy | 211053.62K | 2.19% |

| 4 | GDarKP...AZ9B3R | 198749.53K | 2.06% |

| 5 | iEwovV...HjXQ58 | 191767.61K | 1.99% |

| - | Others | 8087431.00K | 84.24% |

II. Key Factors Affecting GIGA's Future Price

Supply Mechanism

- Market Demand: The future price of GIGA is largely influenced by market demand, which is closely tied to the overall cryptocurrency market conditions.

Institutional and Whale Dynamics

- Corporate Adoption: The adoption of GIGA by notable enterprises could potentially impact its price trajectory.

Macroeconomic Environment

- Inflation Hedging Properties: As a cryptocurrency, GIGA may be viewed as a potential hedge against inflation, which could affect its performance in inflationary environments.

Technological Development and Ecosystem Building

-

NFT Market Recovery: The strong recovery in the NFT market, with trading volumes reaching $1.58 billion in Q3 2025, is a significant factor. This growth is primarily driven by utility-focused NFTs, especially in the gaming sector, as well as developments in Bitcoin Ordinals, Ethereum, and Solana.

-

Ecosystem Applications: The development of DApps and ecosystem projects on platforms supporting GIGA could contribute to its value proposition and price performance.

III. GIGA Price Prediction for 2025-2030

2025 Outlook

- Conservative forecast: $0.00355 - $0.00366

- Neutral forecast: $0.00366 - $0.00413

- Optimistic forecast: $0.00413 - $0.00461 (requires positive market sentiment)

2027-2028 Outlook

- Market phase expectation: Potential growth phase

- Price range prediction:

- 2027: $0.00447 - $0.00572

- 2028: $0.00312 - $0.00688

- Key catalysts: Increasing adoption, technological advancements

2029-2030 Long-term Outlook

- Base scenario: $0.00612 - $0.00668 (assuming steady market growth)

- Optimistic scenario: $0.00668 - $0.00768 (with favorable market conditions)

- Transformative scenario: Above $0.00768 (with exceptional market performance)

- 2030-12-31: GIGA $0.00768 (potential peak)

| 年份 | 预测最高价 | 预测平均价格 | 预测最低价 | 涨跌幅 |

|---|---|---|---|---|

| 2025 | 0.00461 | 0.00366 | 0.00355 | 0 |

| 2026 | 0.00591 | 0.00413 | 0.00314 | 13 |

| 2027 | 0.00572 | 0.00502 | 0.00447 | 38 |

| 2028 | 0.00688 | 0.00537 | 0.00312 | 48 |

| 2029 | 0.00723 | 0.00612 | 0.00343 | 68 |

| 2030 | 0.00768 | 0.00668 | 0.00494 | 84 |

IV. GIGA Professional Investment Strategies and Risk Management

GIGA Investment Methodology

(1) Long-term Holding Strategy

- Suitable for: Risk-tolerant investors with a long-term perspective

- Operation suggestions:

- Accumulate GIGA tokens during market dips

- Set price targets for partial profit-taking

- Store tokens in a secure Gate web3 wallet

(2) Active Trading Strategy

- Technical analysis tools:

- Moving Averages: Use to identify trend directions and potential reversals

- Relative Strength Index (RSI): Monitor overbought and oversold conditions

- Key points for swing trading:

- Monitor GIGA's correlation with major cryptocurrencies

- Set strict stop-loss orders to manage downside risk

GIGA Risk Management Framework

(1) Asset Allocation Principles

- Conservative investors: 1-3% of crypto portfolio

- Aggressive investors: 5-10% of crypto portfolio

- Professional investors: Up to 15% of crypto portfolio

(2) Risk Hedging Solutions

- Diversification: Spread investments across multiple cryptocurrencies

- Stop-loss orders: Implement to limit potential losses

(3) Secure Storage Solutions

- Hot wallet recommendation: Gate Web3 wallet

- Cold storage solution: Hardware wallet for long-term holdings

- Security precautions: Enable two-factor authentication, use strong passwords

V. Potential Risks and Challenges for GIGA

GIGA Market Risks

- High volatility: Memecoins are subject to extreme price swings

- Market sentiment: GIGA's value heavily influenced by community trends

- Liquidity risk: Potential difficulty in executing large trades

GIGA Regulatory Risks

- Uncertain regulatory landscape: Potential for stricter regulations on memecoins

- Platform delisting: Risk of removal from major exchanges

- Tax implications: Evolving tax laws may impact GIGA transactions

GIGA Technical Risks

- Smart contract vulnerabilities: Potential for exploits in the token contract

- Solana network congestion: May affect transaction speed and costs

- Centralization risks: Potential concentration of token ownership

VI. Conclusion and Action Recommendations

GIGA Investment Value Assessment

GIGA presents a high-risk, high-reward opportunity within the memecoin sector. While it offers potential for significant gains, investors should be aware of its extreme volatility and speculative nature.

GIGA Investment Recommendations

✅ Newcomers: Limit exposure to a small portion of portfolio, focus on education

✅ Experienced investors: Consider short-term trading opportunities with strict risk management

✅ Institutional investors: Approach with caution, only suitable for high-risk allocations

GIGA Trading Participation Methods

- Spot trading: Buy and sell GIGA tokens on Gate.com

- Limit orders: Set specific entry and exit points to manage risk

- Dollar-cost averaging: Gradually accumulate GIGA over time to mitigate volatility

Cryptocurrency investments carry extremely high risks, and this article does not constitute investment advice. Investors should make decisions carefully based on their own risk tolerance and are advised to consult professional financial advisors. Never invest more than you can afford to lose.

FAQ

Can Gigachad hit $1?

Based on current predictions, Gigachad is unlikely to reach $1. Forecasts suggest it may hit $0.0050517574 by year-end, with long-term projections remaining conservative.

Does Gigachad coin have a future?

Yes, Gigachad coin has potential. Its future looks promising with growing community support and increasing market interest in meme coins.

What is Giga stock price prediction?

Giga stock price is predicted to average around $0.0260 in 2025, with potential range from $0.0251 to $0.0303, based on current market analysis.

Will Gigachad recover?

Gigachad is expected to start a cautious recovery. Analysts predict this trend will continue. The all-time high is still distant.

Share

Content