2025 HOME Price Prediction: Navigating the Future of Real Estate Markets in an Evolving Economic Landscape

Introduction: HOME's Market Position and Investment Value

Defi App (HOME), as the world's first decentralized "Everything" app, has made significant strides since its inception. As of 2025, HOME's market capitalization has reached $57,555,200, with a circulating supply of approximately 2,720,000,000 tokens, and a price hovering around $0.02116. This asset, dubbed the "iPhone of DeFi," is playing an increasingly crucial role in bridging the gap between CeFi and DeFi in a user-friendly manner.

This article will comprehensively analyze HOME's price trends from 2025 to 2030, considering historical patterns, market supply and demand, ecosystem development, and macroeconomic factors to provide investors with professional price predictions and practical investment strategies.

I. HOME Price History Review and Current Market Status

HOME Historical Price Evolution Trajectory

- 2025 August: HOME reached its all-time high of $0.04938

- 2025 October: HOME hit its all-time low of $0.01436

- 2025 November: Market recovery phase, price rebounded to $0.02116

HOME Current Market Situation

As of November 17, 2025, HOME is trading at $0.02116, with a 24-hour trading volume of $742,237.91. The token has shown a positive 24-hour price change of 5.85%, indicating short-term bullish momentum. However, looking at longer timeframes, HOME has experienced significant declines: -10.38% over the past week, -26.5% over the past month, and -45.33% over the past year.

HOME's current market capitalization stands at $57,555,200, ranking it 509th in the overall cryptocurrency market. The circulating supply is 2,720,000,000 HOME tokens, which represents 27.2% of the total supply of 10,000,000,000 tokens.

The token's all-time high of $0.04938 was recorded on August 17, 2025, while its all-time low of $0.01436 occurred on October 10, 2025. Currently, HOME is trading 57.15% below its all-time high and 47.35% above its all-time low, suggesting that the token is in a recovery phase but still far from its peak value.

Click to view the current HOME market price

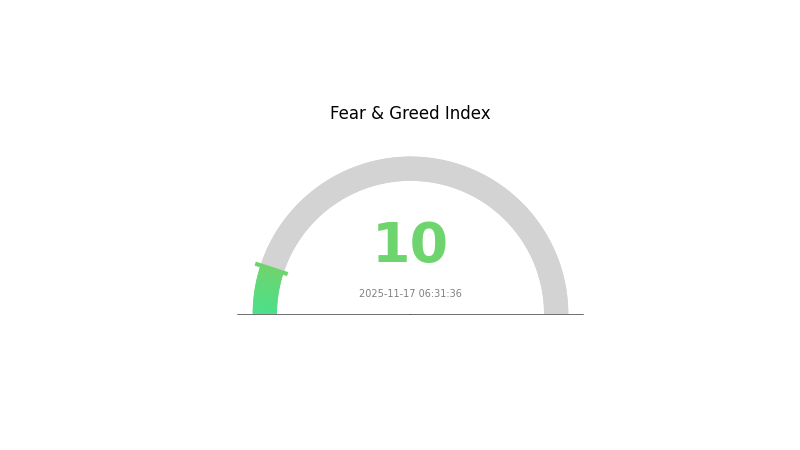

HOME Market Sentiment Index

2025-11-17 Fear and Greed Index: 10 (Extreme Fear)

Click to view the current Fear & Greed Index

The crypto market is experiencing extreme fear, with the sentiment index plummeting to 10. This level of pessimism often signals a potential buying opportunity for contrarian investors. However, it's crucial to approach with caution and conduct thorough research. Remember, market sentiment can shift rapidly. Stay informed and consider diversifying your portfolio to mitigate risks. Gate.com offers a range of tools and resources to help you navigate these turbulent market conditions.

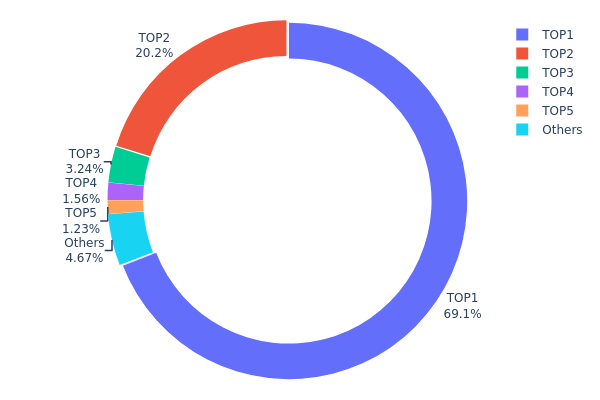

HOME Holdings Distribution

The address holdings distribution data reveals a highly concentrated ownership structure for HOME tokens. The top address holds a staggering 69.08% of the total supply, followed by the second-largest holder with 20.21%. This means that nearly 90% of all HOME tokens are controlled by just two addresses, indicating an extremely centralized distribution.

Such a concentrated ownership structure raises concerns about market stability and potential price manipulation. With such a large portion of tokens held by a few entities, there is a risk of significant market volatility if these major holders decide to sell or transfer their holdings. Furthermore, this concentration of power could potentially compromise the decentralization ethos that many cryptocurrency projects strive for.

The current distribution pattern suggests that HOME's market structure is vulnerable to the decisions of a small number of large holders. This concentration could impact liquidity, price discovery, and overall market dynamics, potentially deterring smaller investors and limiting widespread adoption of the token.

Click to view the current HOME Holdings Distribution

| Top | Address | Holding Qty | Holding (%) |

|---|---|---|---|

| 1 | 0xf977...41acec | 416874.26K | 69.08% |

| 2 | 0xf89d...5eaa40 | 121954.55K | 20.21% |

| 3 | 0xa2bb...174286 | 19561.85K | 3.24% |

| 4 | 0x1ab4...8f8f23 | 9399.19K | 1.55% |

| 5 | 0x98ad...8bba9d | 7422.19K | 1.23% |

| - | Others | 28209.68K | 4.69% |

II. Key Factors Affecting HOME's Future Price

Supply Mechanism

- Halving: The HOME token undergoes a halving event every four years, reducing the block reward by 50%.

- Historical Pattern: Previous halvings have typically led to price increases due to reduced supply inflation.

- Current Impact: The upcoming halving in 2026 is expected to create upward pressure on HOME's price.

Macroeconomic Environment

- Monetary Policy Impact: Central banks are anticipated to maintain a neutral stance, which could provide stability for cryptocurrency markets.

- Inflation Hedging Properties: HOME has shown potential as an inflation hedge, attracting investors during periods of high inflation.

Technical Development and Ecosystem Building

- Layer 2 Scaling: Implementation of Layer 2 solutions is expected to improve transaction speed and reduce fees on the HOME network.

- Smart Contract Upgrades: Enhancements to smart contract functionality aim to expand the range of decentralized applications on the HOME blockchain.

- Ecosystem Applications: Decentralized finance (DeFi) platforms and non-fungible token (NFT) marketplaces are gaining traction within the HOME ecosystem.

III. HOME Price Prediction for 2025-2030

2025 Outlook

- Conservative forecast: $0.01207 - $0.02000

- Neutral forecast: $0.02000 - $0.02200

- Optimistic forecast: $0.02200 - $0.02286 (requires positive market sentiment and increased adoption)

2027-2028 Outlook

- Market phase expectation: Potential growth phase with increased volatility

- Price range prediction:

- 2027: $0.01896 - $0.03363

- 2028: $0.01686 - $0.03821

- Key catalysts: Technological advancements, wider market adoption, and potential partnerships

2029-2030 Long-term Outlook

- Base scenario: $0.03315 - $0.04012 (assuming steady market growth and continued development)

- Optimistic scenario: $0.04012 - $0.04708 (with accelerated adoption and favorable market conditions)

- Transformative scenario: $0.04533 - $0.05000 (with breakthrough innovations and mainstream acceptance)

- 2030-12-31: HOME $0.04533 (potential peak based on current projections)

| 年份 | 预测最高价 | 预测平均价格 | 预测最低价 | 涨跌幅 |

|---|---|---|---|---|

| 2025 | 0.02286 | 0.02117 | 0.01207 | 0 |

| 2026 | 0.02312 | 0.02202 | 0.01761 | 4 |

| 2027 | 0.03363 | 0.02257 | 0.01896 | 6 |

| 2028 | 0.03821 | 0.0281 | 0.01686 | 32 |

| 2029 | 0.04708 | 0.03315 | 0.01724 | 56 |

| 2030 | 0.04533 | 0.04012 | 0.03209 | 89 |

IV. Professional Investment Strategies and Risk Management for HOME

HOME Investment Methodology

(1) Long-term Holding Strategy

- Suitable for: Long-term investors with high risk tolerance

- Operational suggestions:

- Accumulate HOME tokens during market dips

- Set up regular investment plans to average out entry prices

- Store tokens securely in non-custodial wallets

(2) Active Trading Strategy

- Technical analysis tools:

- Moving Averages: Use to identify trends and potential reversal points

- RSI (Relative Strength Index): Monitor overbought/oversold conditions

- Key points for swing trading:

- Monitor market sentiment and news related to Defi App

- Set clear entry and exit points based on technical indicators

HOME Risk Management Framework

(1) Asset Allocation Principles

- Conservative investors: 1-3% of crypto portfolio

- Aggressive investors: 5-10% of crypto portfolio

- Professional investors: Up to 15% of crypto portfolio

(2) Risk Hedging Solutions

- Diversification: Spread investments across multiple DeFi projects

- Stop-loss orders: Implement to limit potential losses

(3) Secure Storage Solutions

- Hot wallet recommendation: Gate Web3 Wallet

- Cold storage solution: Hardware wallet for long-term holdings

- Security precautions: Enable two-factor authentication, use strong passwords

V. Potential Risks and Challenges for HOME

HOME Market Risks

- Volatility: Extreme price fluctuations common in the crypto market

- Competition: Increasing number of DeFi projects may impact market share

- Liquidity: Potential challenges in trading during market stress

HOME Regulatory Risks

- Regulatory uncertainty: Evolving global regulations may impact DeFi platforms

- Compliance requirements: Potential need for KYC/AML implementation

- Cross-border restrictions: Possible limitations on international usage

HOME Technical Risks

- Smart contract vulnerabilities: Potential for exploits or bugs

- Scalability issues: Challenges in handling increased user adoption

- Interoperability: Compatibility issues with other blockchain networks

VI. Conclusion and Action Recommendations

HOME Investment Value Assessment

HOME presents a unique value proposition as a decentralized "Everything" app, combining CeFi and DeFi functionalities. While it offers long-term potential in the evolving DeFi landscape, short-term volatility and regulatory uncertainties pose significant risks.

HOME Investment Recommendations

✅ Beginners: Start with small, regular investments to understand the project ✅ Experienced investors: Consider a moderate allocation with active risk management ✅ Institutional investors: Explore strategic partnerships and conduct thorough due diligence

HOME Trading Participation Methods

- Spot trading: Available on Gate.com and other supported exchanges

- DeFi platforms: Participate in liquidity pools or yield farming (if available)

- OTC markets: For large volume trades, consider over-the-counter options

Cryptocurrency investments carry extremely high risks, and this article does not constitute investment advice. Investors should make decisions carefully based on their own risk tolerance and are advised to consult professional financial advisors. Never invest more than you can afford to lose.

FAQ

Are house prices expected to go up or down in 2025?

House prices are expected to go up in 2025 due to continued demand and limited supply in many markets.

Are home prices in AZ going down?

As of 2025, AZ home prices are stabilizing after a period of growth. While not drastically declining, the market shows signs of cooling, with slower price increases and more balanced conditions for buyers and sellers.

Are house prices dropping in CT?

As of 2025, CT house prices are stabilizing after a period of growth. While not dropping significantly, the market shows signs of cooling, with slower price increases in most areas.

Are home prices going down in SC?

As of 2025, home prices in SC are showing a slight decline due to market adjustments and economic factors. However, the trend varies by location and property type.

Share

Content