2025 MED Price Prediction: Analyzing Market Trends and Potential Growth Factors

Introduction: MED's Market Position and Investment Value

MediBloc (MED), as a blockchain-based open information service platform for medical data management, has been making significant strides since its inception in 2017. As of 2025, MediBloc's market capitalization has reached $32,102,430, with a circulating supply of approximately 10,644,041,819 tokens, and a price hovering around $0.003016. This asset, often referred to as the "medical data blockchain," is playing an increasingly crucial role in revolutionizing healthcare information management.

This article will provide a comprehensive analysis of MediBloc's price trends from 2025 to 2030, combining historical patterns, market supply and demand, ecosystem development, and macroeconomic factors to offer professional price predictions and practical investment strategies for investors.

I. MED Price History Review and Current Market Status

MED Historical Price Evolution

- 2020: Market bottom, price hit all-time low of $0.00161437 on March 13

- 2021: Bull market peak, price reached all-time high of $0.351852 on April 2

- 2025: Prolonged bear market, price declined to $0.003016 as of November 19

MED Current Market Situation

MED is currently trading at $0.003016, down 0.72% in the last 24 hours. The token has seen significant price depreciation over the past year, dropping 67.56% from its value a year ago. Short-term price action shows a 12.26% decrease over the past week and a 22.09% decline over the last month. MED's market capitalization stands at $32,102,430, ranking it 748th among all cryptocurrencies. The current price represents a 99.14% decrease from its all-time high, indicating a prolonged bearish trend.

Click to view current MED market price

MED Market Sentiment Indicator

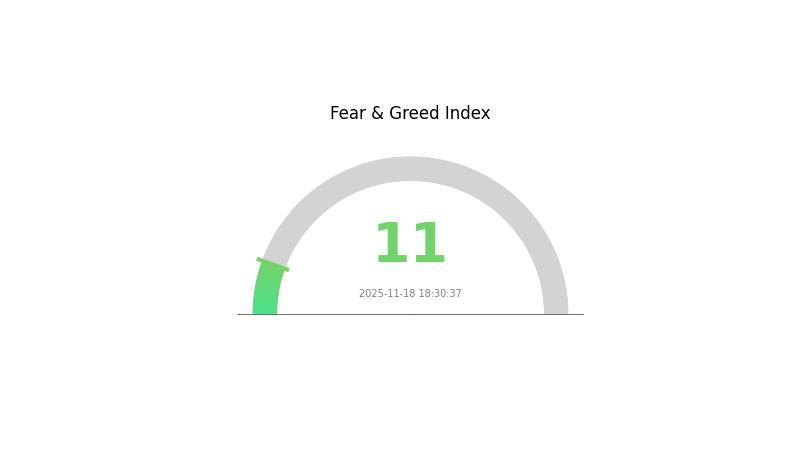

2025-11-18 Fear and Greed Index: 11 (Extreme Fear)

Click to view the current Fear & Greed Index

The crypto market is gripped by extreme fear, with the sentiment index plummeting to 11. This level of pessimism often signals a potential buying opportunity for contrarian investors. However, it's crucial to approach with caution and conduct thorough research. Remember, market cycles are inevitable, and this extreme fear could precede a trend reversal. Stay informed, manage risks wisely, and consider dollar-cost averaging if you decide to enter the market during this fearful phase.

MED Holdings Distribution

The address holdings distribution data for MED shows an empty table, indicating a lack of available information on top holders. This absence of data makes it challenging to conduct a comprehensive analysis of MED's concentration characteristics and market structure.

Without specific holder information, it's not possible to determine if there's an excessive concentration of tokens or assess the potential impact on price volatility and market manipulation. The lack of visible large holders could suggest a more distributed ownership structure, but this cannot be confirmed without further data.

Given the limited information, it's crucial to approach any conclusions about MED's market characteristics, such as decentralization or on-chain stability, with caution. Additional research and data collection would be necessary to provide a meaningful analysis of MED's token distribution and its implications for the market.

Click to view the current MED Holdings Distribution

| Top | Address | Holding Qty | Holding (%) |

|---|

II. Key Factors Affecting MED's Future Price

Supply Mechanism

- Sanctions and Export Disruptions: Supply interruptions and sanctions increase uncertainty in the market.

- Historical Pattern: Past supply changes have significantly impacted price movements.

- Current Impact: Expected supply changes due to geopolitical factors may lead to price volatility.

Macroeconomic Environment

- Monetary Policy Impact: Central bank policies are expected to influence market liquidity and investment flows.

- Inflation Hedging Properties: MED's performance in inflationary environments may affect its appeal as a store of value.

- Geopolitical Factors: International tensions and conflicts can significantly impact MED's price due to its connection with global energy markets.

Technological Development and Ecosystem Building

- Market Expectations: Perceptions of future demand and supply play a crucial role in price formation.

- Industry Trends: Shifts in energy consumption patterns, particularly the growing demand for non-refinery fuels, may impact MED's long-term value.

III. MED Price Prediction for 2025-2030

2025 Outlook

- Conservative prediction: $0.0024 - $0.00301

- Neutral prediction: $0.00301 - $0.00319

- Optimistic prediction: $0.00319 - $0.00337 (requires favorable market conditions)

2027-2028 Outlook

- Market phase expectation: Potential growth phase

- Price range forecast:

- 2027: $0.00194 - $0.00505

- 2028: $0.00259 - $0.00479

- Key catalysts: Increased adoption and technological advancements

2030 Long-term Outlook

- Base scenario: $0.00314 - $0.00476 (assuming steady market growth)

- Optimistic scenario: $0.00476 - $0.00509 (assuming strong market performance)

- Transformative scenario: $0.00509+ (assuming breakthrough innovations and mass adoption)

- 2030-12-31: MED $0.00509 (potential peak price)

| 年份 | 预测最高价 | 预测平均价格 | 预测最低价 | 涨跌幅 |

|---|---|---|---|---|

| 2025 | 0.00337 | 0.00301 | 0.0024 | 0 |

| 2026 | 0.00398 | 0.00319 | 0.00274 | 6 |

| 2027 | 0.00505 | 0.00358 | 0.00194 | 19 |

| 2028 | 0.00479 | 0.00432 | 0.00259 | 43 |

| 2029 | 0.00497 | 0.00456 | 0.00355 | 51 |

| 2030 | 0.00509 | 0.00476 | 0.00314 | 58 |

IV. Professional Investment Strategies and Risk Management for MED

MED Investment Methodology

(1) Long-term Holding Strategy

- Suitable for: Patient investors with a high risk tolerance

- Operation suggestions:

- Accumulate MED during market dips

- Set price targets for partial profit-taking

- Store MED in secure hardware wallets

(2) Active Trading Strategy

- Technical analysis tools:

- Moving Averages: Use to identify trends and potential reversal points

- RSI (Relative Strength Index): Monitor overbought/oversold conditions

- Key points for swing trading:

- Monitor trading volume for confirmation of price movements

- Set strict stop-loss orders to manage risk

MED Risk Management Framework

(1) Asset Allocation Principles

- Conservative investors: 1-3%

- Aggressive investors: 5-10%

- Professional investors: 10-15%

(2) Risk Hedging Solutions

- Diversification: Spread investments across multiple cryptocurrencies and traditional assets

- Stop-loss orders: Implement to limit potential losses

(3) Secure Storage Solutions

- Hot wallet recommendation: Gate Web3 Wallet

- Cold storage solution: Use hardware wallets for long-term holdings

- Security precautions: Enable two-factor authentication, use strong passwords, and regularly update software

V. Potential Risks and Challenges for MED

MED Market Risks

- High volatility: Significant price fluctuations can lead to substantial losses

- Low liquidity: Limited trading volume may result in slippage during large trades

- Market sentiment: Susceptible to rapid changes based on news and social media

MED Regulatory Risks

- Uncertain regulatory environment: Potential for stricter regulations affecting MED's use and value

- Cross-border compliance: Varying regulations across jurisdictions may impact global adoption

- Tax implications: Evolving tax laws may affect investment returns

MED Technical Risks

- Smart contract vulnerabilities: Potential for exploits in the underlying code

- Network congestion: High transaction volumes could lead to slower processing times

- Scalability challenges: Limitations in handling increased adoption and transaction throughput

VI. Conclusion and Action Recommendations

MED Investment Value Assessment

MED presents a high-risk, high-potential investment in the blockchain-based healthcare information sector. While it offers innovative solutions for medical data management, investors should be aware of the significant volatility and regulatory uncertainties in the cryptocurrency market.

MED Investment Recommendations

✅ Beginners: Consider small, exploratory investments to understand the market dynamics ✅ Experienced investors: Implement a dollar-cost averaging strategy with strict risk management ✅ Institutional investors: Conduct thorough due diligence and consider MED as part of a diversified crypto portfolio

MED Trading Participation Methods

- Spot trading: Buy and sell MED on Gate.com's spot market

- Staking: Participate in staking programs if available to earn passive income

- DeFi integration: Explore decentralized finance options for MED, such as liquidity provision or yield farming

Cryptocurrency investments carry extremely high risks, and this article does not constitute investment advice. Investors should make decisions based on their own risk tolerance and are advised to consult professional financial advisors. Never invest more than you can afford to lose.

FAQ

Is MED stock a buy?

Based on current analyst ratings, MED stock is not considered a buy. It has no Buy ratings and mostly Hold recommendations. However, the market can change rapidly.

What is Medifast stock prediction 2025?

Medifast stock (MED) is predicted to reach an average price of $100.25 in 2025, with a potential high of $200.45 and a low of $0.0472.

What is the future of Maxeon stock?

Maxeon stock is projected to reach $13.42 by 2030, $8.62 by 2040, and $81.88 by 2050, based on current market trends.

Is Medtronic a good long term buy?

Yes, Medtronic is a solid long-term buy. It offers steady growth, strong financials, and consistent dividends. Recent trends and attractive valuation support its investment potential.

Share

Content