2025 NFP Price Prediction: Key Market Factors and Potential Value Trajectories

Introduction: NFP's Market Position and Investment Value

NFPrompt (NFP), as an AI-driven UGC platform designed for the new generation of Web3 creators, has established itself as a comprehensive ecosystem for AI creation, social community, and commercialization since its inception. As of 2025, NFP's market capitalization has reached $31,075,665, with a circulating supply of approximately 503,902,467 tokens, and a price hovering around $0.06167. This asset, often referred to as the "AI-powered Web3 content hub," is playing an increasingly crucial role in the fields of digital content creation and blockchain-based social interactions.

This article will provide a comprehensive analysis of NFP's price trends from 2025 to 2030, combining historical patterns, market supply and demand, ecosystem development, and macroeconomic factors to offer professional price predictions and practical investment strategies for investors.

I. NFP Price History Review and Current Market Status

NFP Historical Price Evolution

- 2023: NFP launched, reaching its all-time high of $1.28501 on December 27

- 2024: Market volatility, price fluctuated between $1 and $0.5

- 2025: Bearish trend, price dropped to its all-time low of $0.04722 on June 22

NFP Current Market Situation

As of October 3, 2025, NFP is trading at $0.06167, with a 24-hour trading volume of $27,864.24. The token has experienced a slight increase of 0.73% in the last 24 hours. NFP's market cap currently stands at $31,075,665, ranking it at 903rd position in the cryptocurrency market. The circulating supply is 503,902,467.28 NFP tokens, which represents 50.39% of the total supply of 1 billion tokens. Despite the recent positive movement, NFP is still down 69.35% from its price a year ago, indicating a significant bearish trend over the long term.

Click to view the current NFP market price

NFP Market Sentiment Indicator

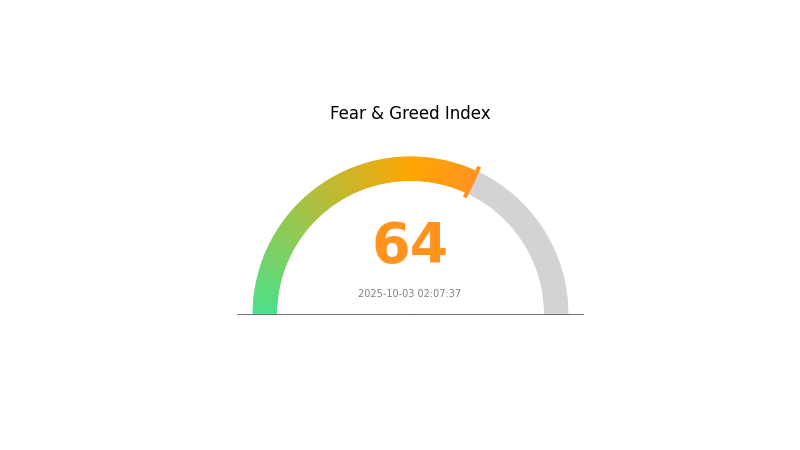

2025-10-03 Fear and Greed Index: 64 (Greed)

Click to view the current Fear & Greed Index

The crypto market is showing signs of exuberance as the Fear and Greed Index reaches 64, indicating a state of greed. This suggests investors are becoming increasingly optimistic, potentially driving prices higher. However, caution is advised as extreme greed can lead to market corrections. Traders should consider diversifying their portfolios and setting stop-loss orders to protect gains. Keep an eye on key resistance levels and be prepared for potential volatility in the coming days.

NFP Holdings Distribution

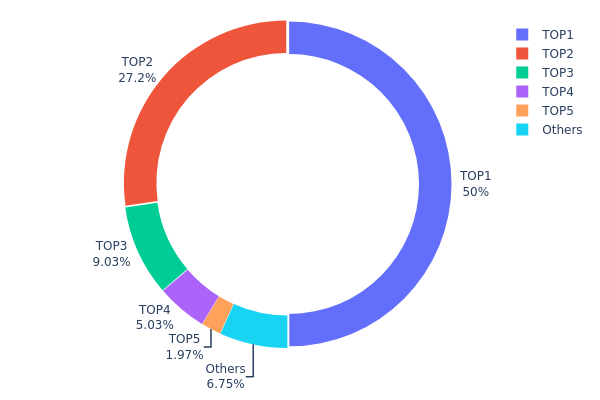

The address holdings distribution data provides critical insights into the concentration of NFP tokens across different wallets. Analysis of this data reveals a highly concentrated ownership structure, with the top 5 addresses controlling 93.22% of the total supply. The largest holder alone accounts for nearly half (49.97%) of all NFP tokens, followed by a second major holder with 27.23%.

This level of concentration raises concerns about market centralization and potential price manipulation risks. With such a significant portion of tokens held by a few addresses, the market may be susceptible to large price swings if these major holders decide to buy or sell substantial amounts. Furthermore, this concentration could potentially impact the project's governance and decision-making processes if NFP implements on-chain voting mechanisms.

The current distribution pattern suggests a relatively low level of decentralization for NFP, which may be a point of concern for investors seeking more widely distributed token ecosystems. However, it's worth noting that 6.78% of tokens are held by smaller addresses, indicating some level of retail participation. Monitoring changes in this distribution over time will be crucial for assessing the project's progress towards greater decentralization and market stability.

Click to view the current NFP Holdings Distribution

| Top | Address | Holding Qty | Holding (%) |

|---|---|---|---|

| 1 | 0x3ebc...f7c6e7 | 496097.53K | 49.97% |

| 2 | 0xf977...41acec | 270342.82K | 27.23% |

| 3 | 0xff97...8d739a | 89595.87K | 9.02% |

| 4 | 0x87a7...054039 | 49962.89K | 5.03% |

| 5 | 0x0000...00dead | 19601.11K | 1.97% |

| - | Others | 67028.41K | 6.78% |

II. Key Factors Affecting Future NFP Prices

Macroeconomic Environment

-

Impact of Monetary Policy: The Federal Reserve's policy expectations are heavily influenced by NFP data. Strong employment growth may prompt the Fed to raise interest rates to control inflation, while weak employment data may lead to maintaining or lowering rates. Changes in interest rate expectations directly affect bond yields, dollar exchange rates, and stock market performance.

-

Inflation Hedging Properties: NFP data can influence inflation expectations. Strong employment numbers may increase concerns about wage inflation, potentially boosting demand for inflation hedges like gold.

-

Geopolitical Factors: International political situations and trade relations can impact the interpretation of NFP data and its effect on various asset classes, including currencies and commodities.

Technical Developments and Ecosystem Building

-

Market Sentiment Analysis: NFP releases often trigger rapid shifts in market sentiment. Data significantly exceeding expectations may boost investor confidence, potentially driving short-term rallies in stocks, while disappointing data could lead to panic selling.

-

Sector Performance Analysis: Different industries respond to employment data with varying sensitivity. The service and retail sectors typically react quickly to employment growth due to their direct link to consumer spending, while manufacturing may show a delayed response.

III. NFP Price Prediction for 2025-2030

2025 Outlook

- Conservative prediction: $0.03881 - $0.05000

- Neutral prediction: $0.05000 - $0.07000

- Optimistic prediction: $0.07000 - $0.09118 (requires positive market sentiment and increased adoption)

2027-2028 Outlook

- Market stage expectation: Potential growth phase with increasing adoption

- Price range forecast:

- 2027: $0.06388 - $0.12086

- 2028: $0.08495 - $0.15435

- Key catalysts: Expanding use cases, technological improvements, and broader market trends

2029-2030 Long-term Outlook

- Base scenario: $0.10576 - $0.14316 (assuming steady market growth and adoption)

- Optimistic scenario: $0.14316 - $0.16872 (with accelerated adoption and favorable market conditions)

- Transformative scenario: Above $0.16872 (with breakthrough applications and mainstream integration)

- 2030-12-31: NFP $0.13607 (potential average price based on current projections)

| 年份 | 预测最高价 | 预测平均价格 | 预测最低价 | 涨跌幅 |

|---|---|---|---|---|

| 2025 | 0.09118 | 0.06161 | 0.03881 | 0 |

| 2026 | 0.09626 | 0.0764 | 0.04813 | 23 |

| 2027 | 0.12086 | 0.08633 | 0.06388 | 39 |

| 2028 | 0.15435 | 0.10359 | 0.08495 | 67 |

| 2029 | 0.14316 | 0.12897 | 0.10576 | 109 |

| 2030 | 0.16872 | 0.13607 | 0.07484 | 120 |

IV. Professional NFP Investment Strategies and Risk Management

NFP Investment Methodology

(1) Long-term Holding Strategy

- Suitable for: Patient investors with a high-risk tolerance

- Operational advice:

- Accumulate NFP during market dips

- Set price targets for partial profit-taking

- Store NFP in secure hardware wallets

(2) Active Trading Strategy

- Technical analysis tools:

- Moving Averages: Use to identify trends and potential reversals

- Relative Strength Index (RSI): Gauge overbought/oversold conditions

- Key points for swing trading:

- Monitor NFP's correlation with broader crypto market trends

- Set strict stop-loss orders to manage downside risk

NFP Risk Management Framework

(1) Asset Allocation Principles

- Conservative investors: 1-3% of crypto portfolio

- Aggressive investors: 5-10% of crypto portfolio

- Professional investors: Up to 15% of crypto portfolio

(2) Risk Hedging Solutions

- Diversification: Spread investments across multiple crypto assets

- Stop-loss orders: Implement to limit potential losses

(3) Secure Storage Solutions

- Hot wallet recommendation: Gate Web3 Wallet

- Cold storage option: Hardware wallets for long-term holdings

- Security precautions: Enable two-factor authentication, use strong passwords

V. Potential Risks and Challenges for NFP

NFP Market Risks

- High volatility: NFP price can experience significant fluctuations

- Liquidity risk: Limited trading volume may impact entry/exit positions

- Market sentiment: AI and Web3 sector trends can greatly influence NFP's value

NFP Regulatory Risks

- Uncertain regulatory landscape: Potential for stricter crypto regulations

- Cross-border compliance: Varying legal status in different jurisdictions

- Tax implications: Evolving tax laws may impact NFP transactions

NFP Technical Risks

- Smart contract vulnerabilities: Potential for exploits or bugs

- Scalability challenges: Platform growth may strain network capacity

- Competitive pressures: Rapid innovation in AI and Web3 space

VI. Conclusion and Action Recommendations

NFP Investment Value Assessment

NFP presents a high-risk, high-potential opportunity in the AI-driven Web3 space. Long-term value proposition is tied to the growth of AI-assisted content creation, while short-term risks include market volatility and regulatory uncertainties.

NFP Investment Recommendations

✅ Newcomers: Start with small, diversified positions; focus on education ✅ Experienced investors: Implement dollar-cost averaging; set clear profit targets ✅ Institutional investors: Consider NFP as part of a broader Web3/AI portfolio allocation

NFP Trading Participation Methods

- Spot trading: Direct purchase and holding of NFP tokens

- Staking: Participate in NFP ecosystem to earn additional rewards (if available)

- NFT integration: Explore NFP's potential connections to NFT markets

Cryptocurrency investments carry extremely high risks, and this article does not constitute investment advice. Investors should make decisions based on their own risk tolerance and are advised to consult professional financial advisors. Never invest more than you can afford to lose.

FAQ

What is NFP crypto?

NFP crypto is an AI-driven platform for Web3 creators, offering tools for content creation and social interaction. It's listed on CoinMarketCap and aims to empower the new generation of digital creators.

What crypto has the highest price prediction?

As of 2025, Bitcoin has the highest price prediction, followed by Ethereum. These two cryptocurrencies are expected to lead in terms of price growth and market dominance.

Does NFP affect crypto prices?

Yes, NFP can impact crypto prices. Positive reports often boost investor confidence, leading to increased investment and potentially higher crypto prices.

How much is nfp to dollars?

As of October 2025, 1 NFP is worth approximately $0.007. The exact price may fluctuate, but it's currently trading around this value.

Share

Content