2025 PHB Fiyat Tahmini: Phoenix Global Token için Gelecek Perspektifi ve Piyasa Analizi

Giriş: PHB'nin Piyasadaki Konumu ve Yatırım Potansiyeli

Phoenix (PHB), akıllı Web 3 uygulamalarına güç veren bir blok zinciri altyapısı olarak, kuruluşundan bu yana önemli gelişmelere imza attı. 2025 yılı itibarıyla Phoenix’in piyasa değeri 30.546.466 $ seviyesine ulaştı; dolaşımdaki arz yaklaşık 59.061.227 token ve fiyatı 0,5172 $ civarında seyrediyor. "Web 3 etkinleştiricisi" olarak tanımlanan bu varlık, kurumsal blok zinciri, yapay zeka ve mahremiyet odaklı hesaplama alanlarında giderek daha önemli bir rol üstleniyor.

Bu makalede, 2025-2030 döneminde Phoenix’in fiyat trendleri detaylı olarak analiz edilecek; geçmiş fiyat hareketleri, piyasa arz-talep dengesi, ekosistem gelişimi ve makroekonomik etkenler bir araya getirilerek yatırımcılara profesyonel fiyat tahminleri ve uygulanabilir yatırım stratejileri sunulacaktır.

I. PHB Fiyat Geçmişi ve Mevcut Piyasa Durumu

PHB Tarihsel Fiyat Gelişimi

- 2023: Piyasa dibi, 27 Mart’ta fiyat tüm zamanların en düşük seviyesi olan 0,05455 $’a indi

- 2024: Güçlü toparlanma, 9 Mart’ta fiyat tüm zamanların en yüksek seviyesi olan 4,1245 $’a ulaştı

- 2025: Piyasa düzeltmesi, fiyat zirveden belirgin şekilde geriledi

PHB Güncel Piyasa Durumu

03 Ekim 2025 itibarıyla PHB, 0,5172 $ seviyesinden işlem görüyor ve son 24 saatte %1,42 değer kaybetti. Bu fiyat, 09 Mart 2024’te kaydedilen 4,1245 $’lık zirveye göre %87,46’lık azalmaya işaret ediyor. Ancak, 27 Mart 2023’te görülen 0,05455 $’lık dip seviyeye göre hâlâ %848,12 artış göstermektedir.

PHB’nin piyasa değeri 30.546.466 $ ve tüm kripto paralar arasında 910’uncu sırada. Dolaşımdaki arz 59.061.227,50 PHB olup, toplam arzın %92,28’ine karşılık gelmektedir (maksimum arz: 64.000.000 PHB).

Son dönemdeki fiyat trendlerinde PHB, farklı zaman dilimlerinde karma bir performans sergiledi:

- 1 saat: -%0,5

- 24 saat: -%1,42

- 7 gün: +%7,43

- 30 gün: -%3,05

- 1 yıl: -%71,21

PHB’nin 24 saatlik işlem hacmi 36.403,46 $ olup, bu rakam orta düzeyde piyasa hareketliliğine işaret etmektedir. Kripto piyasasında mevcut duyarlılık “Açgözlülük” bölgesinde ve VIX 64 seviyesinde; PHB’deki son fiyat düşüşüne rağmen yatırımcılar arasında iyimserlik ağır basıyor.

Güncel PHB piyasa fiyatını görüntülemek için tıklayın

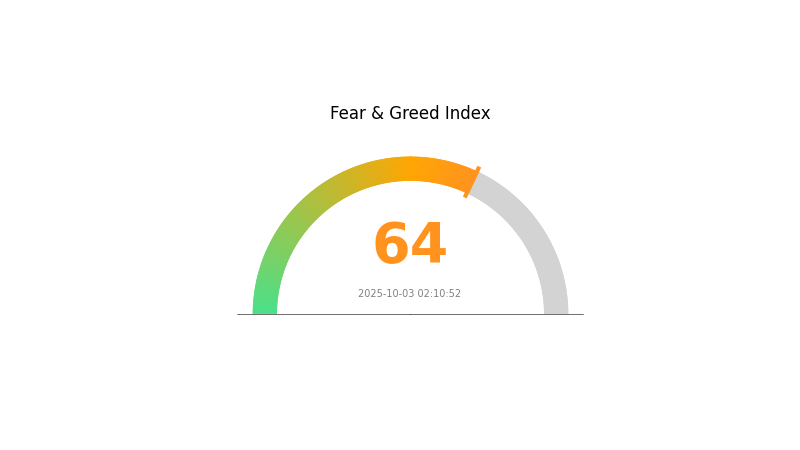

PHB Piyasa Duyarlılığı Endeksi

03 Ekim 2025 Korku ve Açgözlülük Endeksi: 64 (Açgözlülük)

Güncel Korku & Açgözlülük Endeksini görüntülemek için tıklayın

Kripto piyasasında açgözlülük etkisi hissediliyor; Korku ve Açgözlülük Endeksi 64 seviyesinde. Bu durum, yatırımcıların olumlu piyasa eğilimleri veya olumlu haberlerle artan iyimserliğini gösteriyor. Ancak, aşırı açgözlülük varlıkların aşırı değerlenmesine ve volatilitenin yükselmesine yol açabilir. Yatırımcılar, riskleri yönetmek adına temkinli olmalı, kapsamlı analiz ve risk değerlendirmesi yapmadan pozisyon almamalıdır. Piyasa duyarlılığı hızla değişebilir; güncel kalmanız ve stratejinizi buna göre ayarlamanız önemlidir.

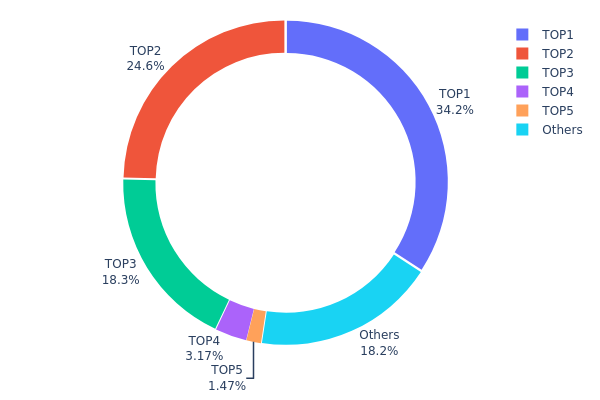

PHB Varlık Dağılımı

Adres varlık dağılımı verileri, PHB token sahipliğinin büyük oranda birkaç adreste yoğunlaştığını gösteriyor. En büyük üç adres, toplam arzın %77,15’ini elinde bulundururken, en büyük sahip %34,21’lik paya sahip. Bu konsantrasyon, merkezileşme ve olası piyasa manipülasyonu risklerini artırıyor.

Böyle yoğunlaşmış bir sahiplik, piyasa dinamiklerinde belirgin etkiler yaratabilir. Başlıca sahipler fiyat hareketlerinde büyük rol oynayabilir, volatiliteyi artırabilir ve yeni yatırımcıların ilgisini azaltabilir. Bu dağılım, merkeziyetsizlik seviyesinin düşük olduğunu gösteriyor; bu durum PHB’nin uzun vadeli istikrarı ve benimsenmesi üzerinde etkili olabilir.

Tokenlerin %18,22’si diğer adreslerde dağılmış olsa da, bu parçalanma başlıca sahiplerin hakimiyetini dengelemeye yetmiyor. Zincirdeki bu dengesizlik, PHB ekosisteminin gelişimini olumsuz etkileyebilir ve paydaşlar ile potansiyel yatırımcılar açısından risk oluşturabilir.

Güncel PHB Varlık Dağılımı verisini görüntülemek için tıklayın

| En Üst | Adres | Varlık Miktarı | Varlık (%) |

|---|---|---|---|

| 1 | 0xf977...41acec | 20.207,42K | %34,21 |

| 2 | 0xada5...282285 | 14.543,36K | %24,62 |

| 3 | 0x5a52...70efcb | 10.825,08K | %18,32 |

| 4 | 0x8894...e2d4e3 | 1.871,12K | %3,16 |

| 5 | 0x0639...70d206 | 869,83K | %1,47 |

| - | Diğerleri | 10.744,43K | %18,22 |

II. PHB'nin Gelecekteki Fiyatını Etkileyen Temel Faktörler

Arz Mekanizması

- Piyasa Büyümesi: Küresel polihidroksialkanoat (PHA) pazarı, 2024’te 111,11 milyon $’dan 2032’de 169,23 milyon $’a ulaşacak ve yıllık bileşik büyüme oranı %8,7 olacak.

- Mevcut Etki: Bu büyüme, artan çevre hassasiyeti ve biyolojik olarak parçalanabilen malzemelere talep sayesinde gerçekleşiyor.

Kurumsal ve Balina Dinamikleri

- Kurumsal Benimsenme: PHB; tıp, ambalaj, tek kullanımlık gıda kapları ve biyoyakıtlar gibi pek çok sektörde geniş kullanım alanına sahip.

Makroekonomik Çevre

- Enflasyon Koruma Özellikleri: Biyolojik olarak parçalanabilen bir ürün olarak PHB, çevre politikaları ve sürdürülebilir ürün eğilimleriyle birlikte daha fazla talep görebilir.

- Jeopolitik Etkenler: Küresel çevre düzenlemeleri ve biyolojik olarak parçalanabilen malzemeleri teşvik eden politikalar, PHB’nin piyasa talebi ve fiyatını etkileyebilir.

Teknik Gelişim ve Ekosistem Oluşumu

- Endüstriyel Üretim: PHB, PHBV, PHBHHx ve P34HB dahil dört PHA türü endüstriyel üretim aşamasına ulaştı.

- Ekosistem Uygulamaları: PHB; tıp, ambalaj ve biyoyakıtlar gibi sektörlerde kullanılır ve ekosistem büyümesine katkı sağlar.

III. 2025-2030 PHB Fiyat Tahmini

2025 Görünümü

- İhtiyatlı tahmin: 0,43002 $ - 0,5181 $

- Tarafsız tahmin: 0,5181 $ - 0,60 $

- İyimser tahmin: 0,60 $ - 0,68389 $ (pozitif piyasa algısı ve proje gelişmeleriyle)

2027-2028 Görünümü

- Piyasa aşaması: Artan benimsenmeyle büyüme potansiyeli

- Fiyat aralığı tahmini:

- 2027: 0,3594 $ - 0,86393 $

- 2028: 0,63758 $ - 1,0419 $

- Önemli katalizörler: Teknolojik gelişmeler, artan kullanım ve genel piyasa trendleri

2030 Uzun Vadeli Görünüm

- Temel senaryo: 0,99596 $ - 1,08257 $ (istikrarlı piyasa büyümesiyle)

- İyimser senaryo: 1,08257 $ - 1,56972 $ (güçlü proje başarısı ve olumlu piyasa şartlarıyla)

- Dönüştürücü senaryo: 1,56972 $+ (çığır açan yenilikler ve kitlesel benimsenme ile)

- 31 Aralık 2030: PHB 1,08257 $ (mevcut tahminlere göre olası ortalama fiyat)

| Yıl | Tahmini En Yüksek Fiyat | Tahmini Ortalama Fiyat | Tahmini En Düşük Fiyat | Değişim (%) |

|---|---|---|---|---|

| 2025 | 0,68389 | 0,5181 | 0,43002 | 0 |

| 2026 | 0,78129 | 0,601 | 0,34858 | 16 |

| 2027 | 0,86393 | 0,69115 | 0,3594 | 33 |

| 2028 | 1,0419 | 0,77754 | 0,63758 | 50 |

| 2029 | 1,25541 | 0,90972 | 0,77326 | 75 |

| 2030 | 1,56972 | 1,08257 | 0,99596 | 109 |

IV. PHB İçin Profesyonel Yatırım Stratejisi ve Risk Yönetimi

PHB Yatırım Yaklaşımı

(1) Uzun Vadeli Tutma Stratejisi

- Kimler için: Yüksek risk toleransına sahip uzun vadeli yatırımcılar

- İşlem önerileri:

- Piyasa geri çekilmelerinde PHB biriktirin

- Düzenli yatırım planı oluşturun

- PHB’yi güvenli donanım cüzdanında saklayın

(2) Aktif Alım-Satım Stratejisi

- Teknik analiz araçları:

- Hareketli Ortalamalar: Eğilim ve destek/direnç seviyelerini belirlemek için kullanılır

- RSI (Göreceli Güç Endeksi): Aşırı alım/aşırı satım seviyelerini tespit etmeye yardımcı olur

- Dalgalı alım-satımda önemli noktalar:

- Piyasa duyarlılığını ve haberleri takip edin

- Riskinizi yönetmek için zarar durdur emri kullanın

PHB Risk Yönetimi Çerçevesi

(1) Varlık Dağılımı Prensipleri

- Temkinli yatırımcılar: %1-3

- Agresif yatırımcılar: %5-10

- Profesyonel yatırımcılar: %10-15

(2) Riskten Koruma Çözümleri

- Çeşitlendirme: Birden fazla kripto para arasında yatırım dağıtımı yapın

- Zarar durdur emirleri: Potansiyel kayıpları sınırlamak için otomatik satış emirleri kullanın

(3) Güvenli Saklama Çözümleri

- Donanım cüzdanı önerisi: Gate Web3 Cüzdan

- Yazılım cüzdanı alternatifi: Güvenilir çoklu imza cüzdanları kullanın

- Güvenlik önlemleri: İki faktörlü kimlik doğrulama açın, güçlü şifreler kullanın

V. PHB İçin Potansiyel Riskler ve Zorluklar

PHB Piyasa Riskleri

- Yüksek oynaklık: PHB fiyatında ciddi dalgalanmalar yaşanabilir

- Kısıtlı likidite: Büyük işlemlerin gerçekleştirilmesinde zorluklar olabilir

- Piyasa duyarlılığı: Yatırımcı algısındaki hızlı değişimlere açıktır

PHB Düzenleyici Riskler

- Düzenleyici belirsizlik: Kripto para düzenlemelerindeki değişim PHB’yi etkileyebilir

- Uyum gereksinimleri: Artan bildirim ve KYC yükümlülükleri söz konusu olabilir

- Sınır ötesi kısıtlamalar: Uluslararası işlemlerde sınırlamalar gündeme gelebilir

PHB Teknik Riskler

- Akıllı sözleşme açıkları: Temel kodda istismar riski

- Ağ tıkanıklığı: Yüksek ağ aktivitesinde işlem gecikmeleri

- Teknolojik eskime: Yeni blok zinciri çözümleriyle rekabette geride kalma riski

VI. Sonuç ve Eylem Tavsiyeleri

PHB Yatırım Değeri Analizi

PHB, Web 3.0 altyapısında yüksek riskli ancak yüksek potansiyelli bir yatırım fırsatı sunuyor. Kurumsal blok zinciri ve yapay zeka entegrasyonu alanında yenilikçi çözümler üretse de, piyasa oynaklığı ve düzenleyici belirsizlikler nedeniyle yatırıma temkinli yaklaşılmalıdır.

PHB Yatırım Tavsiyeleri

✅ Yeni başlayanlar: Küçük, deneme pozisyonlarıyla başlayın ve eğitime odaklanın

✅ Deneyimli yatırımcılar: Yüksek riskli portföyünüzün bir kısmını PHB’ye ayırmayı değerlendirin

✅ Kurumsal yatırımcılar: Detaylı inceleme yapın, PHB’yi çeşitlendirilmiş kripto stratejinizin bir parçası olarak ele alın

PHB Alım-Satım Katılım Yöntemleri

- Spot alım-satım: PHB’yi doğrudan Gate.com üzerinden alıp satın

- Staking: PHB staking programlarına katılarak ödül potansiyelinden yararlanın

- DeFi entegrasyonu: PHB tokenlarıyla merkeziyetsiz finans çözümlerini keşfedin

Kripto para yatırımları çok yüksek risk içerir; bu makale yatırım tavsiyesi değildir. Yatırımcılar, kendi risk toleranslarına göre dikkatli karar vermeli ve profesyonel finansal danışmanlardan destek almalıdır. Asla kaybetmeyi göze alamayacağınız miktardan fazla yatırım yapmayınız.

Sıkça Sorulan Sorular

2030'da 1 pi'nin fiyatı ne olacak?

Mevcut tahminlere göre, 1 pi’nin fiyatı 2030’da 1,14 $ seviyesine ulaşabilir ve bu mevcut rakamlara göre dikkat çekici bir büyüme anlamına gelir.

2025 için PI coin fiyat tahmini nedir?

PI coin’in fiyatı, 2025 yılında piyasa analizlerine göre 0,18 $ ile 0,73 $ arasında değişebilir.

PhB bir yapay zeka coini midir?

Evet, PhB bir AI coindir. Phoenix AI’nin yerel tokenidir ve merkeziyetsiz AI ekosisteminde kullanılır. PhB, Phoenix AI platformunda çeşitli yapay zeka işlevleri için kullanılır.

PHB coin bugün ne kadar?

03 Ekim 2025 itibarıyla PHB coin’in güncel fiyatı 0,53 $. Fiyat, piyasa koşullarına göre anlık olarak güncellenmektedir.

Mira Ağı Fiyat Tahmini ve Pazar İçgörüleri

Unibase (UB) Nedir ve Merkeziyetsiz Yapay Zekâ Hafızası Nasıl Çalışır?

AIEPK nedir: Eğitim ve Bilgi İşleme Alanında Yapay Zekânın Geleceği

2025 yılında XLM-RoBERTa, diğer çok dilli modellerle kıyaslandığında hangi özelliklere sahiptir?

LKI nedir: Üç harfli kısaltmanın ardındaki gizemi ortaya koymak

Atomic Swaps: Merkeziyetsiz Borsaların Nasıl Çalıştığına Dair Kapsamlı Rehber