2025 POKT Price Prediction: Analyzing Market Trends and Potential Growth Factors

Introduction: POKT's Market Position and Investment Value

Pocket Network (POKT), as a decentralized Web3 infrastructure middleware protocol, has been providing RPC relay services for blockchain dapps since its inception in 2021. As of 2025, POKT's market capitalization has reached $29,652,165, with a circulating supply of approximately 2,011,680,128 tokens, and a price hovering around $0.01474. This asset, often referred to as the "Web3 API backbone," is playing an increasingly crucial role in facilitating data transmission between blockchains.

This article will comprehensively analyze POKT's price trends from 2025 to 2030, combining historical patterns, market supply and demand, ecosystem development, and macroeconomic factors to provide investors with professional price predictions and practical investment strategies.

I. POKT Price History Review and Current Market Status

POKT Historical Price Evolution

- 2022: All-time high reached, price peaked at $3.11 on January 16

- 2025: Market downturn, price hit all-time low of $0.00883573 on April 17

- 2025: Gradual recovery, current price at $0.01474 as of November 19

POKT Current Market Situation

POKT is currently trading at $0.01474, showing a 5.51% increase in the last 24 hours. However, the token has experienced significant losses over longer time frames, with a 19.78% decrease in the past 30 days and a substantial 70.28% decline over the past year. The current price is 99.53% below its all-time high of $3.11, indicating a major correction from its peak. With a market cap of $29,652,165 and a fully diluted valuation of $34,658,979, POKT ranks 777th in the cryptocurrency market. The circulating supply stands at 2,011,680,128 POKT, representing 85.55% of the total supply. Despite recent gains, the overall market sentiment remains cautious, as reflected in the current "Extreme Fear" reading of the crypto fear and greed index.

Click to view the current POKT market price

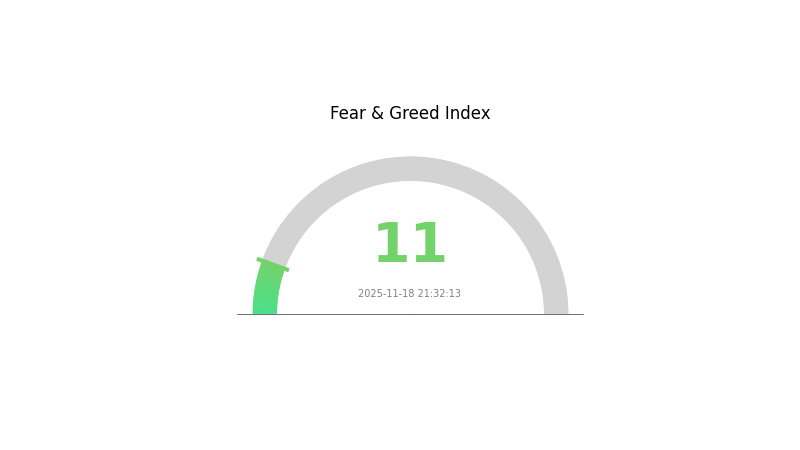

POKT Market Sentiment Indicator

2025-11-18 Fear and Greed Index: 11 (Extreme Fear)

Click to view the current Fear & Greed Index

The crypto market is currently experiencing extreme fear, with the Fear and Greed Index plummeting to 11. This significant drop suggests investors are highly cautious and pessimistic about the market's short-term prospects. Such extreme fear levels often indicate a potential buying opportunity for contrarian investors, as markets tend to overcorrect during periods of panic. However, traders should exercise caution and conduct thorough research before making any investment decisions in this volatile environment.

POKT Holdings Distribution

The address holdings distribution chart provides insight into the concentration of POKT tokens across different wallet addresses. Based on the available data, it appears that there is currently insufficient information to draw concrete conclusions about POKT's distribution patterns.

Without specific address data, it's challenging to assess the level of concentration or decentralization within the POKT network. The absence of clear top holders suggests that the token distribution might be relatively dispersed, potentially indicating a healthier market structure. However, this assumption should be treated with caution until more comprehensive data becomes available.

The lack of visible large holders could be interpreted as a positive sign for POKT's market stability, as it may reduce the risk of price manipulation by individual whales. Nevertheless, a more detailed analysis would be necessary to confirm this and to evaluate the true state of POKT's on-chain structural stability and decentralization level.

Click to view the current POKT Holdings Distribution

| Top | Address | Holding Qty | Holding (%) |

|---|

II. Key Factors Influencing POKT's Future Price

Supply Mechanism

- Market Price Fluctuations: The market price of POKT may affect the price that applications must pay for relays.

Institutional and Whale Dynamics

- Enterprise Adoption: POKT is being adopted as a cost-effective solution for developers to turn their infrastructure into revenue-generating assets.

Macroeconomic Environment

- Inflation Hedging Properties: As a cryptocurrency, POKT may be viewed as a potential hedge against inflation, similar to other digital assets.

Technological Development and Ecosystem Building

- Network Decentralization: As the network becomes more decentralized, gateway operators can independently define their price points, potentially affecting the overall earnings of the POKT network.

- Ecosystem Applications: POKT is positioning itself as a key infrastructure layer for Web3 applications, which could drive its adoption and value.

III. POKT Price Prediction for 2025-2030

2025 Outlook

- Conservative prediction: $0.00986 - $0.01471

- Neutral prediction: $0.01471 - $0.01728

- Optimistic prediction: $0.01728 - $0.01986 (requires positive market sentiment and increased adoption)

2027-2028 Outlook

- Market phase expectation: Potential growth phase with increasing adoption

- Price range forecast:

- 2027: $0.01852 - $0.02581

- 2028: $0.01980 - $0.02458

- Key catalysts: Network expansion, technological improvements, and broader crypto market trends

2029-2030 Long-term Outlook

- Base scenario: $0.02367 - $0.02864 (assuming steady growth and adoption)

- Optimistic scenario: $0.02864 - $0.03361 (with accelerated adoption and favorable market conditions)

- Transformative scenario: $0.03361 - $0.03437 (with breakthrough innovations and mainstream integration)

- 2030-12-31: POKT $0.03437 (potential peak based on optimistic projections)

| 年份 | 预测最高价 | 预测平均价格 | 预测最低价 | 涨跌幅 |

|---|---|---|---|---|

| 2025 | 0.01986 | 0.01471 | 0.00986 | 0 |

| 2026 | 0.02212 | 0.01728 | 0.01383 | 17 |

| 2027 | 0.02581 | 0.0197 | 0.01852 | 33 |

| 2028 | 0.02458 | 0.02276 | 0.0198 | 54 |

| 2029 | 0.03361 | 0.02367 | 0.01822 | 60 |

| 2030 | 0.03437 | 0.02864 | 0.01976 | 94 |

IV. POKT Professional Investment Strategy and Risk Management

POKT Investment Methodology

(1) Long-term Holding Strategy

- Suitable for: Long-term investors with high risk tolerance

- Operation suggestions:

- Accumulate POKT during market dips

- Hold for at least 2-3 years to ride out market volatility

- Store POKT in a secure non-custodial wallet

(2) Active Trading Strategy

- Technical analysis tools:

- Moving averages: Use 50-day and 200-day MAs to identify trends

- RSI: Monitor overbought/oversold conditions

- Key points for swing trading:

- Set stop-loss orders to limit downside risk

- Take partial profits on significant price surges

POKT Risk Management Framework

(1) Asset Allocation Principles

- Conservative investors: 1-3% of crypto portfolio

- Aggressive investors: 5-10% of crypto portfolio

- Professional investors: Up to 15% of crypto portfolio

(2) Risk Hedging Solutions

- Diversification: Spread investments across multiple blockchain projects

- Stop-loss orders: Implement to limit potential losses

(3) Secure Storage Solutions

- Hot wallet recommendation: Gate Web3 Wallet

- Cold storage solution: Hardware wallet for large holdings

- Security precautions: Enable two-factor authentication, use strong passwords

V. Potential Risks and Challenges for POKT

POKT Market Risks

- High volatility: POKT price can experience significant fluctuations

- Limited liquidity: May face challenges in large-volume trades

- Competition: Other blockchain API providers may impact market share

POKT Regulatory Risks

- Uncertain regulatory landscape: Potential for stricter regulations on crypto

- Compliance challenges: Adapting to evolving global regulatory requirements

- Tax implications: Changing tax laws may affect POKT investments

POKT Technical Risks

- Network scalability: Potential challenges in handling increased demand

- Smart contract vulnerabilities: Risk of exploits or bugs in the protocol

- Technological obsolescence: Emergence of superior blockchain API solutions

VI. Conclusion and Action Recommendations

POKT Investment Value Assessment

POKT offers long-term potential in the Web3 infrastructure space but faces short-term volatility and competition risks. Its value proposition lies in decentralized API services, but investors should be prepared for significant price fluctuations.

POKT Investment Recommendations

✅ Beginners: Start with small positions, focus on learning the technology

✅ Experienced investors: Consider dollar-cost averaging and set clear exit strategies

✅ Institutional investors: Conduct thorough due diligence and monitor network growth metrics

POKT Trading Participation Methods

- Spot trading: Buy and hold POKT on Gate.com

- Staking: Participate in POKT network validation for rewards

- DeFi integration: Explore POKT-based DeFi protocols for additional yield opportunities

Cryptocurrency investment carries extremely high risk. This article does not constitute investment advice. Investors should make decisions carefully based on their own risk tolerance and are advised to consult professional financial advisors. Never invest more than you can afford to lose.

FAQ

Can Polkadot reach $100?

Yes, Polkadot could potentially reach $100. While ambitious, long-term projections suggest higher targets for DOT, driven by its innovative technology and growing ecosystem.

Does Polkadot crypto have a future?

Yes, Polkadot has a bright future. Its advanced interoperability and scalability make it superior to Ethereum, positioning it for long-term growth in the blockchain ecosystem.

How much will 1 pi be worth in 2025?

Based on current projections, 1 PI is expected to be worth between $500 and $520 in 2025. This estimate reflects recent market trends and expert analysis.

What is pokt crypto?

POKT is the token for Pocket Network, a decentralized protocol connecting blockchains to nodes, enabling censorship-resistant Web3 data access. It powers node operators and developers, with DAO governance.

Share

Content