2025 REZ Price Prediction: Future Outlook and Market Analysis for ReserveBitcoin in the Coming Bull Cycle

Introduction: REZ's Market Position and Investment Value

Renzo (REZ), as a Liquid Restaking Token (LRT) and Strategy Manager for EigenLayer, has established itself as a key player in the Ethereum ecosystem since its inception. As of 2025, Renzo's market capitalization has reached $32,023,645, with a circulating supply of approximately 2,631,575,802 tokens, and a price hovering around $0.012169. This asset, often referred to as the "EigenLayer facilitator," is playing an increasingly crucial role in securing Actively Validated Services (AVSs) and offering higher yields than traditional ETH staking.

This article will comprehensively analyze Renzo's price trends from 2025 to 2030, considering historical patterns, market supply and demand, ecosystem development, and macroeconomic factors to provide investors with professional price predictions and practical investment strategies.

I. REZ Price History Review and Current Market Status

REZ Historical Price Evolution

- 2024: REZ reached its all-time high of $0.265 on April 30, 2024

- 2025: The token hit its all-time low of $0.006997 on June 22, 2025

- 2025: Current market cycle, price has rebounded from the low to $0.012169

REZ Current Market Situation

As of October 3, 2025, REZ is trading at $0.012169, with a 24-hour trading volume of $112,340.91. The token has shown a positive 24-hour price change of 1.21%, indicating short-term bullish momentum. Over the past week, REZ has demonstrated strong performance with a 10.9% increase, suggesting growing investor interest. However, the 30-day performance shows a more modest gain of 4.32%.

The current market capitalization of REZ stands at $32,023,645.94, ranking it at 888th position in the overall cryptocurrency market. With a circulating supply of 2,631,575,802.54 REZ tokens out of a total supply of 10,000,000,000, the project has a circulation ratio of 26.32%.

Despite the recent positive short-term performance, it's worth noting that REZ is still down 66.72% over the past year, reflecting the broader market challenges faced by many cryptocurrencies during this period.

Click to view the current REZ market price

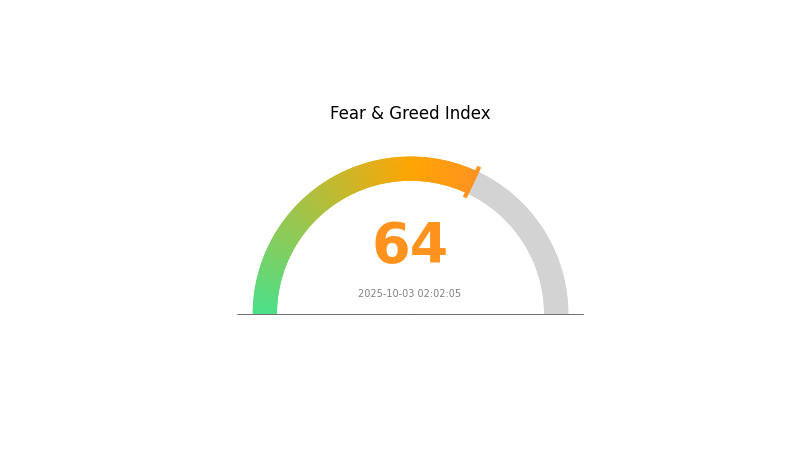

REZ Market Sentiment Indicator

2025-10-03 Fear and Greed Index: 64 (Greed)

Click to view the current Fear & Greed Index

The crypto market is currently in a state of greed, with the Fear and Greed Index at 64. This suggests investors are becoming increasingly optimistic, potentially driving up prices. However, caution is advised as high greed levels can indicate market overheating. Traders should consider taking profits or hedging positions. Remember, market sentiment can shift quickly, so stay informed and manage your risk carefully. Gate.com offers various tools to help navigate these market conditions.

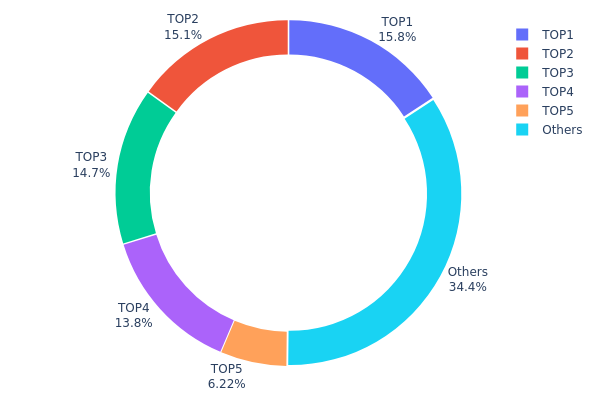

REZ Holdings Distribution

The address holdings distribution data provides crucial insights into the concentration of REZ tokens among different wallet addresses. Analysis of this data reveals a significant level of centralization within the REZ ecosystem. The top five addresses collectively hold 65.59% of the total REZ supply, with the largest holder possessing 15.77% of all tokens. This high concentration in a few wallets raises concerns about potential market manipulation and price volatility.

The distribution pattern suggests that REZ's on-chain structure may be less stable than ideal for a decentralized ecosystem. With over two-thirds of the supply controlled by just five addresses, there's an increased risk of large-scale sell-offs or accumulations that could dramatically impact market dynamics. This concentration also implies that major decisions or movements by these top holders could have outsized effects on the token's value and overall project direction.

While the remaining 34.41% distributed among other addresses provides some level of decentralization, the current holdings structure indicates a need for broader distribution to enhance market resilience and reduce manipulation risks. This concentration level may deter some investors concerned about equitable governance and fair market practices.

Click to view the current REZ Holdings Distribution

| Top | Address | Holding Qty | Holding (%) |

|---|---|---|---|

| 1 | 0x9706...2a1edb | 1577561.62K | 15.77% |

| 2 | 0xcd49...95ffee | 1506927.81K | 15.06% |

| 3 | 0xf977...41acec | 1471530.09K | 14.71% |

| 4 | 0x3363...7202e9 | 1383055.00K | 13.83% |

| 5 | 0x20f2...6f9087 | 622000.00K | 6.22% |

| - | Others | 3438925.47K | 34.41% |

II. Key Factors Affecting REZ's Future Price

Supply Mechanism

- Total Supply: REZ has a total supply of 10 billion tokens.

- Initial Circulation: The initial circulating supply is 1.05 billion tokens.

- Token Distribution: 30% of tokens are allocated to the community, while 31.56% are allocated to investors.

Institutional and Whale Dynamics

- Exchange Listings: REZ's listing on major exchanges like Coinbase has shown to have a significant impact on its price, as evidenced by a 50% surge following its Coinbase listing.

Macroeconomic Environment

- Economic Uncertainty: The market remains cautious about potential economic recession and uncertain tariff policies, which may continue to influence market trends.

Technical Development and Ecosystem Building

- Liquid Restaking: REZ is part of the liquid restaking sector, which is experiencing increased competition and growing demand.

- Ethereum Ecosystem: As the demand for restaking grows, native tokens of related protocols (including REZ) may see an increase in value.

- Blockchain Advancements: Ongoing developments in blockchain technology continue to influence REZ's prospects.

III. REZ Price Prediction for 2025-2030

2025 Outlook

- Conservative prediction: $0.00743 - $0.01217

- Neutral prediction: $0.01217 - $0.01333

- Optimistic prediction: $0.01333 - $0.01449 (requires strong market momentum)

2027-2028 Outlook

- Market phase expectation: Steady growth with potential volatility

- Price range forecast:

- 2027: $0.01198 - $0.0164

- 2028: $0.01027 - $0.0207

- Key catalysts: Increased adoption, technological improvements, and market sentiment

2029-2030 Long-term Outlook

- Base scenario: $0.01802 - $0.01865 (assuming continued market growth)

- Optimistic scenario: $0.01928 - $0.02629 (with favorable market conditions)

- Transformative scenario: $0.02629+ (with exceptional project developments and market adoption)

- 2030-12-31: REZ $0.01865 (potential for significant growth)

| 年份 | 预测最高价 | 预测平均价格 | 预测最低价 | 涨跌幅 |

|---|---|---|---|---|

| 2025 | 0.01449 | 0.01217 | 0.00743 | 0 |

| 2026 | 0.0152 | 0.01333 | 0.01 | 9 |

| 2027 | 0.0164 | 0.01426 | 0.01198 | 17 |

| 2028 | 0.0207 | 0.01533 | 0.01027 | 25 |

| 2029 | 0.01928 | 0.01802 | 0.01549 | 48 |

| 2030 | 0.02629 | 0.01865 | 0.01007 | 53 |

IV. Professional Investment Strategies and Risk Management for REZ

REZ Investment Methodology

(1) Long-term Holding Strategy

- Suitable for: Risk-tolerant investors with a long-term perspective

- Operation suggestions:

- Accumulate REZ tokens during market dips

- Stake REZ tokens to earn additional rewards

- Store tokens in a secure non-custodial wallet

(2) Active Trading Strategy

- Technical analysis tools:

- Moving Averages: Use to identify trends and potential entry/exit points

- Relative Strength Index (RSI): Monitor overbought/oversold conditions

- Key points for swing trading:

- Set clear stop-loss and take-profit levels

- Monitor EigenLayer ecosystem developments for potential price catalysts

REZ Risk Management Framework

(1) Asset Allocation Principles

- Conservative investors: 1-3% of crypto portfolio

- Moderate investors: 3-5% of crypto portfolio

- Aggressive investors: 5-10% of crypto portfolio

(2) Risk Hedging Solutions

- Diversification: Spread investments across different LRT and staking projects

- Stop-loss orders: Implement to limit potential losses

(3) Secure Storage Solutions

- Non-custodial wallet recommendation: Gate Web3 Wallet

- Hardware wallet solution: Use for long-term cold storage of large holdings

- Security precautions: Enable two-factor authentication, use strong passwords, and regularly update software

V. Potential Risks and Challenges for REZ

REZ Market Risks

- Volatility: High price fluctuations common in crypto markets

- Liquidity: Potential issues during market stress or low trading volumes

- Competition: Other LRT projects may impact REZ's market share

REZ Regulatory Risks

- Unclear regulations: Potential for regulatory changes affecting LRT tokens

- Compliance requirements: Possible need for additional licensing or reporting

- Geopolitical factors: Varying regulatory approaches across jurisdictions

REZ Technical Risks

- Smart contract vulnerabilities: Potential for exploits or bugs in the protocol

- Scalability challenges: EigenLayer's ability to handle increased adoption

- Interoperability issues: Compatibility with evolving Ethereum ecosystem

VI. Conclusion and Action Recommendations

REZ Investment Value Assessment

REZ offers exposure to the growing EigenLayer ecosystem and potential for higher yields than traditional ETH staking. However, investors should be aware of the high volatility and regulatory uncertainties in the crypto market.

REZ Investment Recommendations

✅ Beginners: Start with small positions and focus on learning about LRT and EigenLayer ✅ Experienced investors: Consider allocating a portion of ETH holdings to REZ for potential higher yields ✅ Institutional investors: Evaluate REZ as part of a diversified crypto portfolio, focusing on long-term ecosystem growth

REZ Participation Methods

- Direct purchase: Buy REZ tokens on Gate.com

- Staking: Participate in REZ staking programs for additional rewards

- Yield farming: Explore liquidity provision opportunities in REZ pairs

Cryptocurrency investments carry extremely high risks, and this article does not constitute investment advice. Investors should make decisions based on their own risk tolerance and are advised to consult professional financial advisors. Never invest more than you can afford to lose.

FAQ

What is the price prediction for Rez in 2030?

Based on current trends, Rez is predicted to reach $0.052282 by 2030, representing a significant increase from current prices.

What is the price prediction for reserve rights token in 2025?

Based on current market trends, Reserve Rights token is predicted to reach $0.007074 by October 31, 2025.

Is Rez a meme coin?

Yes, Rez is officially recognized as a meme coin. It was announced as such in 2023, and this classification remains current in 2025.

How much is Rez crypto worth?

As of 2025-10-03, Rez crypto (REZ) is worth $0.01272, with a 24-hour trading value of $14,908,584. This represents a 4.98% price increase.

Share

Content