2025 RSC Price Prediction: Analyzing Trends and Factors Shaping the Future of RSC Tokens

Introduction: RSC's Market Position and Investment Value

ResearchCoin (RSC), as a pioneering token in the field of decentralized scientific research, has made significant strides since its inception. As of 2025, ResearchCoin's market capitalization has reached $32,291,467, with a circulating supply of approximately 125,306,433 coins, and a price hovering around $0.2577. This asset, often referred to as the "Scientific Collaboration Token," is playing an increasingly crucial role in accelerating scientific discovery and fostering open access to research.

This article will provide a comprehensive analysis of ResearchCoin's price trends from 2025 to 2030, considering historical patterns, market supply and demand, ecosystem development, and the macroeconomic environment to offer professional price predictions and practical investment strategies for investors.

I. RSC Price History Review and Current Market Status

RSC Historical Price Evolution Trajectory

- 2023: ResearchCoin (RSC) launched on ResearchHub platform, initial price fluctuations

- 2024: Significant adoption growth, price reached all-time high of $1.6 on January 3, 2025

- 2025: Market correction, price dropped to all-time low of $0.1912 on April 7, 2025

RSC Current Market Situation

As of November 19, 2025, RSC is trading at $0.2577, showing a 11.48% increase in the last 24 hours. The token's market capitalization stands at $32,291,467.94, ranking 742nd in the global cryptocurrency market. RSC has a circulating supply of 125,306,433.60 tokens, representing 12.53% of its total supply of 1 billion tokens. The 24-hour trading volume is $86,086.18, indicating moderate market activity. Despite recent gains, RSC is still down 33.79% over the past 30 days and 74.47% over the last year, reflecting ongoing market volatility and challenges in the broader crypto ecosystem.

Click to view the current RSC market price

RSC Market Sentiment Indicator

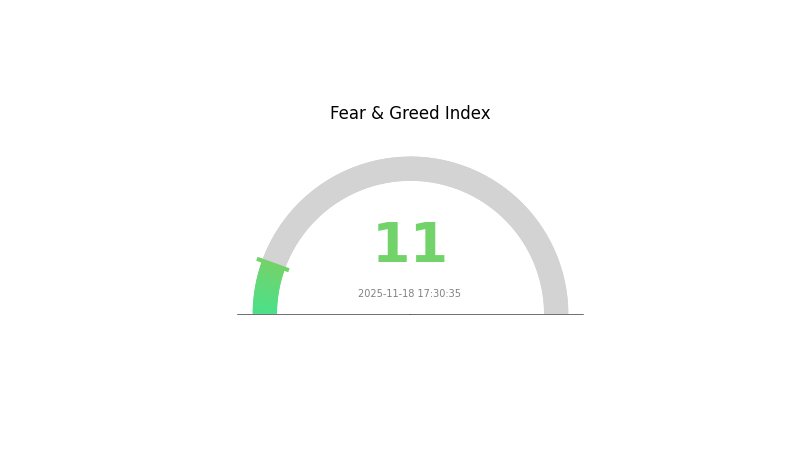

2025-11-18 Fear and Greed Index: 11 (Extreme Fear)

Click to view the current Fear & Greed Index

The crypto market is currently in a state of extreme fear, with the Fear and Greed Index plummeting to a mere 11. This indicates a significant level of pessimism among investors, potentially signaling oversold conditions. While such extreme fear often precedes market bottoms, it's crucial to approach with caution. Savvy investors might see this as an opportunity to accumulate, adhering to the adage "be greedy when others are fearful." However, thorough research and risk management remain paramount in these volatile market conditions.

RSC Holdings Distribution

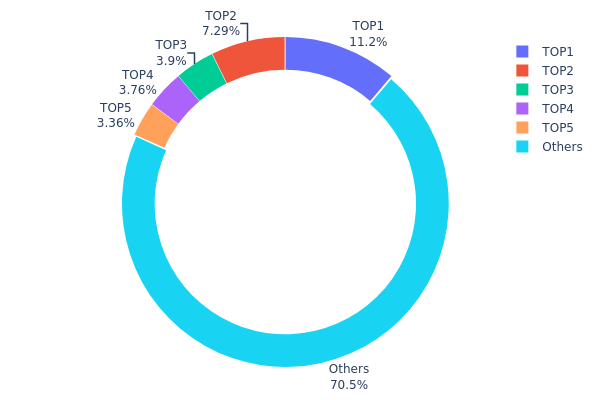

The address holdings distribution chart provides insight into the concentration of RSC tokens among various wallet addresses. Analysis of the current data reveals a moderate level of concentration, with the top 5 addresses holding 29.49% of the total supply. The largest holder possesses 11.21% of RSC tokens, while the remaining top 4 addresses control between 3.36% and 7.28% each.

This distribution pattern suggests a relatively balanced market structure, with no single entity holding an overwhelming majority of tokens. However, the cumulative holdings of the top 5 addresses indicate potential influence over price movements. The fact that 70.51% of tokens are distributed among other addresses demonstrates a degree of decentralization, which may contribute to market stability and reduce the risk of price manipulation by a single large holder.

Overall, the current RSC holdings distribution reflects a market with a moderate level of decentralization and a balanced power structure. While the top holders have significant stakes, the wide distribution among other addresses suggests a diverse user base and potential for organic market growth.

Click to view the current RSC Holdings Distribution

| Top | Address | Holding Qty | Holding (%) |

|---|---|---|---|

| 1 | 0xe92e...c5a03f | 5369.52K | 11.21% |

| 2 | 0x0d07...b492fe | 3488.15K | 7.28% |

| 3 | 0x7851...4d986d | 1865.26K | 3.89% |

| 4 | 0x9e77...0c404d | 1798.06K | 3.75% |

| 5 | 0x55a2...804efe | 1608.80K | 3.36% |

| - | Others | 33748.22K | 70.51% |

II. Core Factors Affecting RSC's Future Price

Supply Mechanism

- Historical Pattern: Past supply changes have shown a close correlation with Bitcoin's overall market trends, as is common with most altcoins.

- Current Impact: If Bitcoin continues its upward trend, RSC is likely to benefit from increased investment inflows. However, adjustments in Bitcoin's price could lead to short-term price drops for RSC.

Institutional and Whale Dynamics

- Corporate Adoption: In November 2024, Reactive established a partnership with QuickSwap, a leading Polygon-based decentralized exchange, showcasing the use of RSC functionality.

Macroeconomic Environment

- Inflation Hedging Properties: The performance of RSC in an inflationary environment is closely tied to the overall cryptocurrency market sentiment and Bitcoin's performance as a potential hedge against inflation.

Technical Development and Ecosystem Building

- Cross-chain Liquidity: QuickSwap can integrate Reactive Network's RSC to automate cross-chain liquidity pool workflows.

- Ecosystem Applications: The partnership with QuickSwap demonstrates the potential for RSC to be integrated into decentralized finance (DeFi) applications and liquidity provision services.

III. RSC Price Prediction for 2025-2030

2025 Outlook

- Conservative forecast: $0.2221 - $0.2644

- Neutral forecast: $0.2644 - $0.2868

- Optimistic forecast: $0.2868 - $0.30935 (requires positive market sentiment)

2027 Mid-term Outlook

- Market phase expectation: Steady growth phase

- Price range predictions:

- 2026: $0.16926 - $0.29548

- 2027: $0.27371 - $0.34359

- Key catalysts: Increased adoption and technological advancements

2030 Long-term Outlook

- Base scenario: $0.33167 - $0.39302 (assuming consistent market growth)

- Optimistic scenario: $0.39302 - $0.45438 (assuming strong market performance)

- Transformative scenario: $0.45438 - $0.54237 (assuming breakthrough innovations and widespread adoption)

- 2030-12-31: RSC $0.54237 (potential peak price)

| 年份 | 预测最高价 | 预测平均价格 | 预测最低价 | 涨跌幅 |

|---|---|---|---|---|

| 2025 | 0.30935 | 0.2644 | 0.2221 | 2 |

| 2026 | 0.29548 | 0.28687 | 0.16926 | 11 |

| 2027 | 0.34359 | 0.29118 | 0.27371 | 12 |

| 2028 | 0.34595 | 0.31738 | 0.17773 | 23 |

| 2029 | 0.45438 | 0.33167 | 0.23217 | 28 |

| 2030 | 0.54237 | 0.39302 | 0.25153 | 52 |

IV. RSC Professional Investment Strategies and Risk Management

RSC Investment Methodology

(1) Long-term Holding Strategy

- Suitable for: Long-term investors and believers in scientific research advancement

- Operation suggestions:

- Accumulate RSC during market dips

- Stay informed about ResearchHub's developments and milestones

- Store tokens securely in a non-custodial wallet

(2) Active Trading Strategy

- Technical analysis tools:

- Moving Averages: Monitor short-term and long-term trends

- RSI (Relative Strength Index): Identify overbought and oversold conditions

- Key points for swing trading:

- Set clear entry and exit points based on technical indicators

- Monitor ResearchHub's community growth and platform adoption rates

RSC Risk Management Framework

(1) Asset Allocation Principles

- Conservative investors: 1-3% of crypto portfolio

- Moderate investors: 3-5% of crypto portfolio

- Aggressive investors: 5-10% of crypto portfolio

(2) Risk Hedging Solutions

- Diversification: Balance RSC with other crypto assets and traditional investments

- Stop-loss orders: Implement to limit potential losses

(3) Secure Storage Solutions

- Hot wallet recommendation: Gate Web3 Wallet for active trading

- Cold storage solution: Hardware wallet for long-term holding

- Security precautions: Enable two-factor authentication, use strong passwords, and regularly update software

V. Potential Risks and Challenges for RSC

RSC Market Risks

- Volatility: Cryptocurrency market fluctuations can lead to significant price swings

- Liquidity: Lower trading volumes may result in slippage during large trades

- Competition: Other blockchain-based research platforms may emerge

RSC Regulatory Risks

- Uncertain regulations: Changing cryptocurrency regulations may impact RSC's adoption

- Academic acceptance: Traditional institutions may be slow to embrace blockchain-based research platforms

- Data privacy concerns: Regulatory scrutiny on handling sensitive research data

RSC Technical Risks

- Smart contract vulnerabilities: Potential bugs in the token's smart contract

- Scalability challenges: Possible network congestion as the platform grows

- Interoperability issues: Limitations in integrating with existing academic systems

VI. Conclusion and Action Recommendations

RSC Investment Value Assessment

ResearchCoin (RSC) presents a unique value proposition in accelerating scientific research through blockchain technology. While it has long-term potential to disrupt academic publishing, short-term volatility and adoption challenges pose significant risks.

RSC Investment Recommendations

✅ Beginners: Start with small positions and focus on understanding the ResearchHub ecosystem ✅ Experienced investors: Consider a balanced approach, allocating based on risk tolerance and belief in the project ✅ Institutional investors: Conduct thorough due diligence on ResearchHub's adoption metrics and long-term viability

RSC Trading Participation Methods

- Spot trading: Buy and sell RSC on Gate.com's spot market

- Limit orders: Set specific buy or sell prices to manage entry and exit points

- Dollar-cost averaging: Regularly invest small amounts to mitigate market volatility

Cryptocurrency investments carry extremely high risks, and this article does not constitute investment advice. Investors should make decisions carefully based on their own risk tolerance and are advised to consult professional financial advisors. Never invest more than you can afford to lose.

FAQ

How much is a RSC coin worth?

As of November 2025, a RSC coin is worth approximately $0.30. The price has shown a steady increase over the past year, reflecting growing interest in the project.

How much is the Trump coin expected to be worth?

The Trump coin is projected to reach between $0.085 and $0.072 by 2030, potentially increasing up to 170% from current levels.

Can Solana reach $1000 in 2025?

Yes, Solana could potentially reach $1000 in 2025. Strong growth in stablecoins, DeFi, and institutional adoption may drive SOL's price significantly higher.

What is the future of KP3R coin?

KP3R coin is projected to reach $23.89 by 2028, with a 15.76% growth rate. This forecast suggests a positive outlook for KP3R in the coming years.

Share

Content