2025 SHELL Price Prediction: Analysis of Key Market Factors and Potential Growth Trajectory for Royal Dutch Shell Shares

Introduction: SHELL's Market Position and Investment Value

MyShell (SHELL) has established itself as a pioneering AI consumer platform since its inception in 2023, enabling users to create, share, and own AI agents. As of 2025, MyShell's market capitalization has reached $32,205,600, with a circulating supply of approximately 270,000,000 tokens and a price hovering around $0.11928. This asset, often referred to as the "AI-Blockchain Bridge," is playing an increasingly crucial role in the fields of AI development and blockchain integration.

This article will provide a comprehensive analysis of MyShell's price trends from 2025 to 2030, considering historical patterns, market supply and demand, ecosystem development, and macroeconomic factors to offer professional price predictions and practical investment strategies for investors.

I. SHELL Price History Review and Current Market Status

SHELL Historical Price Evolution

- 2025: Project launch, price started at $0.022

- February 2025: Reached all-time high of $0.7023

- September 2025: Touched all-time low of $0.10584

SHELL Current Market Situation

As of October 3, 2025, SHELL is trading at $0.11928. The token has seen a 0.32% increase in the past 24 hours, with a trading volume of $613,854.33. SHELL's market cap currently stands at $32,205,600, ranking it at 884th position in the overall cryptocurrency market.

The token has shown mixed performance across different timeframes. While it has gained 1.23% over the past week and 6.05% over the last month, it has experienced a significant decline of 83.52% over the past year. This suggests a recent recovery trend after a prolonged bearish period.

SHELL's current price is 83.02% below its all-time high, indicating substantial room for potential growth if market conditions improve. The token's circulating supply is 270,000,000 SHELL, which represents 27% of its total supply of 1,000,000,000 SHELL.

Click to view the current SHELL market price

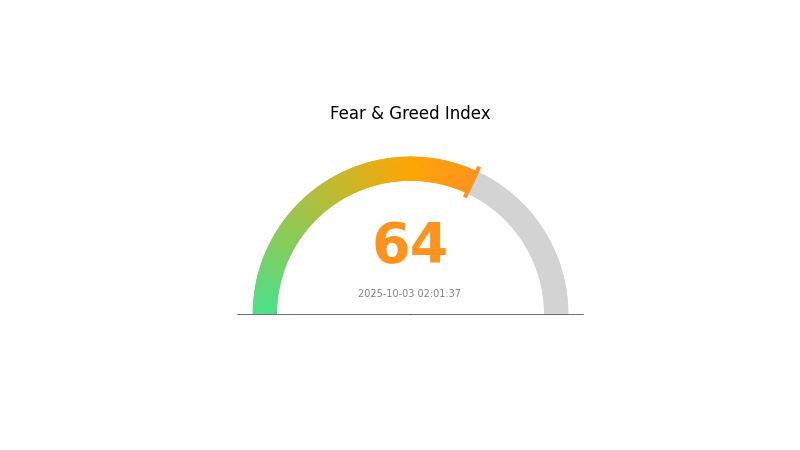

SHELL Market Sentiment Indicator

2025-10-03 Fear and Greed Index: 64 (Greed)

Click to view the current Fear & Greed Index

The crypto market is currently in a state of greed, with the Fear and Greed Index at 64. This suggests investors are becoming overly optimistic, potentially leading to overbought conditions. Traders should exercise caution and consider taking profits or hedging positions. While the market sentiment is positive, it's crucial to remember that extreme greed can often precede corrections. Stay vigilant and maintain a balanced approach to risk management in your trading strategy.

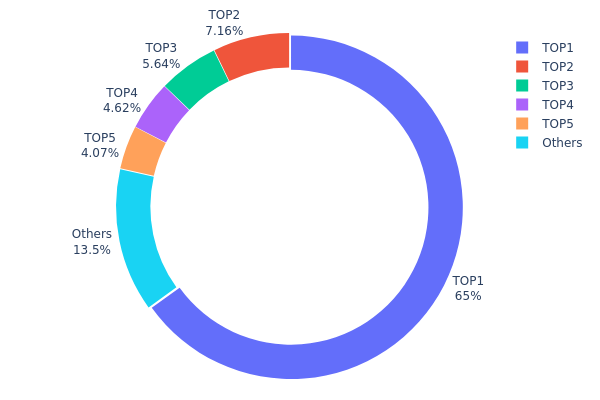

SHELL Holdings Distribution

The address holdings distribution data reveals a highly concentrated ownership structure for SHELL tokens. The top address holds an overwhelming 65.04% of the total supply, equivalent to 320,000,000 SHELL tokens. This significant concentration is followed by four other major holders, each possessing between 4.06% and 7.15% of the supply. Collectively, the top five addresses control 86.5% of all SHELL tokens, leaving only 13.5% distributed among other addresses.

This extreme concentration of holdings raises concerns about market manipulation and price volatility. With a single address controlling nearly two-thirds of the supply, there is a substantial risk of market dominance and potential for large-scale sell-offs that could dramatically impact SHELL's price. Moreover, such a centralized distribution contradicts the principles of decentralization often associated with cryptocurrency projects, potentially affecting investor confidence and the token's long-term stability.

The current holdings distribution suggests a less than ideal market structure for SHELL, with limited liquidity likely available in the open market. This scenario may lead to increased price volatility and susceptibility to market manipulation, warranting caution from potential investors and traders.

Click to view the current SHELL Holdings Distribution

| Top | Address | Holding Qty | Holding (%) |

|---|---|---|---|

| 1 | 0xb760...f96b0c | 320000.00K | 65.04% |

| 2 | 0xc336...e6cf58 | 35214.63K | 7.15% |

| 3 | 0xf977...41acec | 27755.37K | 5.64% |

| 4 | 0xc3b9...c7da6f | 22712.75K | 4.61% |

| 5 | 0x5a52...70efcb | 20000.00K | 4.06% |

| - | Others | 66285.90K | 13.5% |

II. Key Factors Affecting SHELL's Future Price

Supply Mechanism

- Oil and Gas Price Fluctuations: The volatility of oil and natural gas prices directly impacts SHELL's profitability and stock price.

- Historical Pattern: Historically, SHELL's stock price has been closely correlated with global oil and gas prices.

- Current Impact: The current energy market dynamics, including supply constraints and demand fluctuations, are likely to influence SHELL's pricing in the near future.

Institutional and Whale Dynamics

- Corporate Adoption: Major energy consumers and industrial companies that adopt SHELL's products and services can significantly impact demand and pricing.

- National Policies: Government policies on energy transition and environmental regulations play a crucial role in shaping SHELL's market position and future prospects.

Macroeconomic Environment

- Monetary Policy Impact: Central bank policies, especially those affecting interest rates and inflation, can influence SHELL's financing costs and investor sentiment.

- Geopolitical Factors: International conflicts, trade tensions, and global economic shifts can impact oil and gas markets, thereby affecting SHELL's operations and stock price.

Technological Development and Ecosystem Building

- Energy Transition Technologies: SHELL's investments in renewable energy and low-carbon technologies will be crucial for its long-term competitiveness and stock valuation.

- Ecosystem Applications: The company's ability to develop and integrate into new energy ecosystems, including electric vehicle charging networks and hydrogen infrastructure, will impact its future growth potential.

III. SHELL Price Prediction for 2025-2030

2025 Outlook

- Conservative prediction: $0.10613 - $0.11925

- Neutral prediction: $0.11925 - $0.13416

- Optimistic prediction: $0.13416 - $0.14906 (requires positive market sentiment)

2027-2028 Outlook

- Market phase expectation: Potential growth phase

- Price range forecast:

- 2027: $0.14167 - $0.1579

- 2028: $0.0779 - $0.20925

- Key catalysts: Increased adoption and technological advancements

2030 Long-term Outlook

- Base scenario: $0.18099 - $0.21176 (assuming steady market growth)

- Optimistic scenario: $0.21176 - $0.24253 (assuming strong market performance)

- Transformative scenario: $0.24253 - $0.27317 (assuming breakthrough innovations and widespread adoption)

- 2030-12-31: SHELL $0.27317 (potential peak price)

| 年份 | 预测最高价 | 预测平均价格 | 预测最低价 | 涨跌幅 |

|---|---|---|---|---|

| 2025 | 0.14906 | 0.11925 | 0.10613 | 0 |

| 2026 | 0.16099 | 0.13416 | 0.1033 | 12 |

| 2027 | 0.1579 | 0.14757 | 0.14167 | 23 |

| 2028 | 0.20925 | 0.15274 | 0.0779 | 27 |

| 2029 | 0.24253 | 0.18099 | 0.13574 | 51 |

| 2030 | 0.27317 | 0.21176 | 0.17364 | 77 |

IV. Professional Investment Strategies and Risk Management for SHELL

SHELL Investment Methodology

(1) Long-term Holding Strategy

- Suitable for: Long-term investors with high risk tolerance

- Operation suggestions:

- Accumulate SHELL during market dips

- Hold for at least 1-2 years to ride out market volatility

- Store tokens in secure hardware wallets

(2) Active Trading Strategy

- Technical analysis tools:

- Moving Averages: Use to identify trends and potential reversal points

- Relative Strength Index (RSI): Monitor overbought/oversold conditions

- Key points for swing trading:

- Set clear entry and exit points based on technical indicators

- Use stop-loss orders to limit downside risk

SHELL Risk Management Framework

(1) Asset Allocation Principles

- Conservative investors: 1-3% of crypto portfolio

- Aggressive investors: 5-10% of crypto portfolio

- Professional investors: Up to 15% of crypto portfolio

(2) Risk Hedging Solutions

- Diversification: Spread investments across multiple crypto assets

- Stop-loss orders: Set automatic sell orders to limit potential losses

(3) Secure Storage Solutions

- Hardware wallet recommendation: Gate Web3 Wallet

- Software wallet option: Official MyShell wallet (if available)

- Security precautions: Use two-factor authentication, store recovery phrases securely

V. Potential Risks and Challenges for SHELL

SHELL Market Risks

- High volatility: SHELL price may experience significant fluctuations

- Limited liquidity: Trading volume may be insufficient for large transactions

- Competition: Other AI-focused blockchain projects may gain market share

SHELL Regulatory Risks

- Uncertain regulations: Crypto regulations may impact SHELL's operations

- Cross-border compliance: Different jurisdictions may have varying requirements

- AI governance: Future AI regulations could affect MyShell's development

SHELL Technical Risks

- Smart contract vulnerabilities: Potential for exploits or bugs in the token contract

- AI model limitations: MyShell's AI capabilities may not meet market expectations

- Scalability challenges: Handling increased user demand as the platform grows

VI. Conclusion and Action Recommendations

SHELL Investment Value Assessment

SHELL presents a unique opportunity in the AI-blockchain intersection but carries significant risks due to market volatility and regulatory uncertainties. Long-term potential exists if MyShell can successfully deliver on its AI agent platform vision.

SHELL Investment Recommendations

✅ Beginners: Consider small, experimental investments to understand the project

✅ Experienced investors: Allocate a portion of high-risk portfolio, monitor closely

✅ Institutional investors: Conduct thorough due diligence, consider strategic partnerships

SHELL Trading Participation Methods

- Spot trading: Buy and sell SHELL on Gate.com's spot market

- Staking: Participate in staking programs if offered by MyShell or partners

- AI agent creation: Engage with the MyShell platform to create and monetize AI agents

Cryptocurrency investments carry extremely high risks, and this article does not constitute investment advice. Investors should make decisions cautiously based on their own risk tolerance and are advised to consult professional financial advisors. Never invest more than you can afford to lose.

FAQ

Is it a good time to invest in Shell?

Shell shows mixed signals. While it has potential, current market conditions suggest holding rather than buying. Monitor closely for better entry points.

Is Shell a good stock to buy right now?

Yes, Shell appears to be a good stock to buy now. Its strong valuation metrics and Value Score suggest it's undervalued, making it an attractive option for investors in the current market.

Is it smart to invest in Shell?

Yes, investing in Shell is smart. It offers a strong integrated business model, focuses on low-carbon solutions, and has a history of stable dividends. Shell continues to grow in competitive areas and aims to deliver value with reduced emissions.

What is the future price of Shell stock?

Shell stock is expected to reach $72-$92 by 2025 and $119-$164 by 2030, with a 1.68% increase predicted for the next day.

Share

Content