2025 SUI价格预测:区块链新贵的未来发展与投资价值分析

引言:sui 的市场地位与投资价值

Sui(SUI)作为新兴的无权限Layer 1区块链平台,自2023年诞生以来已经在web3生态中取得了显著进展。截至2025年,Sui市值已达128亿美元,流通量约35.69亿枚,价格维持在3.59美元左右。这种被誉为"下一代高性能区块链"的资产,正在去中心化应用开发和web3用户体验优化方面发挥着日益关键的作用。

本文将全面分析Sui 2025-2030年的价格走势,结合历史规律、市场供需、生态发展和宏观经济环境,为投资者提供专业的价格预测和实用的投资策略。

一、sui 价格历史回顾与市场现状

sui 历史价格演变轨迹

- 2023年:sui 于5月3日以0.1美元的价格首次亮相,标志着项目正式启动

- 2023年10月19日:sui 经历了历史最低点,价格跌至0.3624美元

- 2025年1月6日:sui 达到历史最高点5.3674美元,展现出强劲的上涨势头

sui 当前市场态势

截至2025年9月9日,sui 的市场表现如下:

- 当前价格:3.5895美元

- 24小时涨幅:3.39%

- 7天涨幅:9.08%

- 30天跌幅:-6.35%

- 1年涨幅:282.43%

sui 目前市值排名第18位,总市值达到358.95亿美元,流通市值为128.10亿美元。24小时交易量为14,846,153.38 sui。市场占有率为0.86%。

sui 的流通量为3,568,833,706.32 sui,占总供应量的35.69%。总供应量和最大供应量均为100亿 sui。

当前价格较历史最高点5.3674美元有一定回落,但仍远高于首次亮相时的0.1美元。sui 在过去一年内实现了282.43%的显著增长,显示出强劲的长期上涨趋势。尽管30天内出现了6.35%的回调,但7天内的9.08%涨幅表明短期内仍有上涨动能。

点击可查看当前 sui 市场价格

sui 市场情绪指标

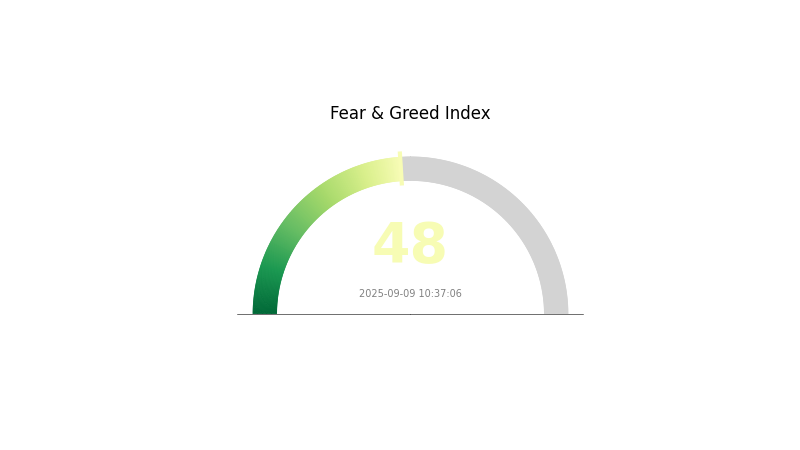

2025-09-09 恐惧与贪婪指数:48(正常)

点击可查看当前恐慌&贪婪指数

今日加密货币市场情绪保持在中性水平,恐惧与贪婪指数为48,显示市场处于相对平衡的状态。这一数值表明投资者对市场的看法既不过分悲观,也不过分乐观。在这种情况下,市场可能会出现短期波动,但总体趋势较为稳定。投资者应保持冷静,密切关注市场动向,做好风险管理,适度参与交易。同时,也要警惕市场情绪可能突然转变,及时调整投资策略。

sui 持仓分布

地址持仓分布反映了加密货币在不同地址间的分配情况,是评估项目去中心化程度和市场结构的重要指标。根据当前数据,sui 的前五大地址合计持有约 5.59% 的总供应量,其中最大持有者占比 3.50%。这表明 sui 的持仓分布相对分散,没有出现单一地址过度集中的情况。

值得注意的是,94.41% 的 sui 由其他地址持有,进一步印证了其较高的分散度。这种分布特征有利于减少大户操纵市场的风险,有助于维持价格的相对稳定性。然而,前五大地址仍然掌握着相当数量的 sui,在短期内仍可能对市场产生一定影响。

总体而言,sui 的地址分布反映出较好的去中心化程度和链上结构稳定性。这种分散的持仓结构有利于生态系统的健康发展,但投资者仍需关注大额地址的动向,以防潜在的市场波动。

点击可查看当前 sui 持仓分布

| Top | Address | Holding Qty | Holding (%) |

|---|---|---|---|

| 1 | 0xac5b...13c33c | 349639.17K | 3.50% |

| 2 | 0x1561...45fc76 | 79565.35K | 0.80% |

| 3 | 0x60dd...b0984d | 53662.71K | 0.54% |

| 4 | 0xdad8...554b5a | 38673.89K | 0.39% |

| 5 | 0x443c...dba79a | 35518.25K | 0.36% |

| - | Others | 9442940.62K | 94.41% |

二、影响 sui 未来价格的核心因素

供应机制

- 有限供应:Sui 的最大供应量为 100 亿枚,目前流通量为 35.69 亿枚。

- 当前影响:有限供应可能在长期内对价格产生支撑作用。

机构与大户动态

- 机构持仓:Sui 得到了包括 Coinbase Ventures、Binance Labs、Electric Capital 和 a16z 等知名投资机构的支持。

- 企业采用:Sui 已被列入 Binance 生态系统。

技术发展与生态建设

- Layer 1 解决方案:Sui 是一个基于 Layer 1 的区块链平台,为去中心化应用提供基础设施。

- MoveVM 技术:Sui 采用 MoveVM 虚拟机技术,可能带来性能和安全性的提升。

- 生态应用:Sui 生态系统正在不断发展,但具体的主要 DApp 或生态项目信息未提供。

三、2025-2030年 ADA 价格预测

2025年展望

- 保守预测:2.66-3.60美元

- 中性预测:3.60-4.00美元

- 乐观预测:4.00-4.67美元(需市场情绪积极)

2027年展望

- 市场阶段预期:稳步增长期

- 价格区间预测:

- 2026年:2.32-4.88美元

- 2027年:2.39-4.78美元

- 关键催化剂:生态系统扩张、技术升级

2030年长期展望

- 基准情景:5.81-7.00美元(假设加密货币市场持续发展)

- 乐观情景:7.00-8.60美元(假设大规模应用落地)

- 变革情景:8.60美元以上(极端利好政策出台)

- 2030-09-09:ADA 5.81美元(稳健增长)

| 年份 | 预测最高价 | 预测平均价格 | 预测最低价 | 涨跌幅 |

|---|---|---|---|---|

| 2025 | 4.67441 | 3.5957 | 2.660818 | 0 |

| 2026 | 4.8793649 | 4.135055 | 2.3156308 | 15 |

| 2027 | 4.777642547 | 4.50720995 | 2.3888212735 | 25 |

| 2028 | 5.245941660805 | 4.6424262485 | 4.410304936075 | 29 |

| 2029 | 6.674648338780875 | 4.9441839546525 | 3.905905324175475 | 37 |

| 2030 | 8.597935897140697 | 5.809416146716687 | 5.635133662315186 | 61 |

四、SUI 专业投资策略与风险管理

SUI 投资方法论

(1)长期持有策略

- 适合人群:看好 Sui 技术发展和生态前景的长期投资者

- 操作建议:

- 定期定额购买,平滑价格波动风险

- 关注项目重大技术升级和生态发展进展

- 使用硬件钱包进行冷存储,确保资产安全

(2)主动交易策略

- 技术分析工具:

- 移动平均线:观察短期和长期均线的交叉,判断趋势变化

- 相对强弱指标(RSI):识别超买超卖区间,把握入场和出场时机

- 波段操作要点:

- 结合项目基本面和市场情绪,判断大周期趋势

- 设置止损位和目标利润,控制风险

SUI 风险管理框架

(1)资产配置原则

- 保守投资者:1-3%

- 积极投资者:5-10%

- 专业投资者:10-20%

(2)风险对冲方案

- 分散投资:配置其他加密资产和传统资产,降低单一资产风险

- 定期再平衡:根据市场变化调整投资组合,维持目标风险水平

(3)安全存储方案

- 硬件钱包推荐:Ledger Nano X、Trezor Model T

- 软件钱包方案:使用官方推荐的 Sui 钱包,如 Sui Wallet

- 安全注意事项:妥善保管私钥和助记词,警惕钓鱼网站和社交工程攻击

五、SUI 潜在风险与挑战

SUI 市场风险

- 价格波动性:作为新兴项目,SUI 价格可能存在较大波动

- 流动性风险:在某些交易平台上,SUI 的交易深度可能不足

- 竞争风险:Layer 1 赛道竞争激烈,SUI 面临来自其他公链的挑战

SUI 监管风险

- 政策不确定性:各国对加密货币的监管政策可能影响 SUI 的发展和使用

- 合规要求:随着监管趋严,SUI 可能需要适应新的合规要求

- 跨境监管:不同国家的监管差异可能影响 SUI 的全球化发展

SUI 技术风险

- 安全漏洞:智能合约或网络架构中可能存在未知的安全隐患

- 扩展性挑战:随着网络使用量增加,可能面临性能瓶颈

- 技术迭代:快速的技术迭代可能带来兼容性问题

六、结论与行动建议

SUI 投资价值评估

SUI 作为一个新兴的 Layer 1 项目,具有独特的技术优势和潜力。长期来看,其横向可扩展性和低成本特性为未来大规模应用提供了可能。然而,短期内仍面临激烈的市场竞争和潜在的技术风险,投资者需谨慎评估。

SUI 投资建议

✅ 新手:建议小额参与,关注项目进展,学习相关知识

✅ 经验投资者:可考虑适度配置,密切关注技术发展和生态建设

✅ 机构投资者:结合深入研究,可将 SUI 纳入多元化投资组合

SUI 交易参与方式

- 中心化交易所:在支持 SUI 交易的主流交易所购买和交易

- 去中心化交易所:使用 Sui 生态内的 DEX 进行交易

- 质押参与:通过质押 SUI 获得收益,同时支持网络安全

加密货币投资风险极高,本文不构成投资建议。投资者应根据自身风险承受能力谨慎决策,建议咨询专业财务顾问。永远不要投资超过你能承受损失的资金。

2025 SUI coin: price, buying guide, and Staking rewards

How to Buy Crypto: A Step-by-Step Guide with Gate.com

HNT Price in 2025: Helium Network Token Value and Market Analysis

What is SwissCheese (SWCH) and How Does It Democratize Investment?

Cardano (ADA) Price Analysis and Outlook for 2025

How to Invest in Metaverse Crypto

2026 MDAO Price Prediction: Expert Analysis and Market Forecast for the Decentralized Autonomous Organization Token

2026 TRC Price Prediction: Expert Analysis and Market Outlook for TRON's Native Token

2026 CTP Price Prediction: Expert Analysis and Market Forecast for Cryptocurrency Trading Platform Token

2026 INSP Price Prediction: Expert Analysis and Market Forecast for Inspectíon Systems Inc.

2026 SKEB Price Prediction: Expert Analysis and Market Forecast for the Next Digital Asset Era