2025 VR Price Prediction: Affordability and Innovation Driving Mass Adoption

Introduction: VR's Market Position and Investment Value

Victoria VR (VR), as a pioneering project in the virtual reality space, has made significant strides since its inception. As of 2025, Victoria VR's market capitalization has reached $28,780,894, with a circulating supply of approximately 8,141,695,688 tokens, and a price hovering around $0.003535. This asset, often referred to as the "VR world creator," is playing an increasingly crucial role in the development of immersive virtual reality experiences.

This article will comprehensively analyze Victoria VR's price trends from 2025 to 2030, considering historical patterns, market supply and demand, ecosystem development, and the macroeconomic environment to provide investors with professional price predictions and practical investment strategies.

I. VR Price History Review and Current Market Status

VR Historical Price Evolution

- 2021: VR reached its all-time high of $0.615957 on December 11, marking a significant milestone for the project

- 2025: VR experienced a substantial decline, hitting its all-time low of $0.00222735 on September 6

- 2025: The market cycle saw VR's price drop from its peak to current levels around $0.003535

VR Current Market Situation

VR is currently trading at $0.003535, with a 24-hour trading volume of $238,199.78. The token has shown a slight recovery in the past 24 hours, with a 0.68% increase. However, looking at longer timeframes, VR has experienced significant declines. Over the past week, it has dropped by 9.83%, and in the last 30 days, it has fallen by 28.13%. The year-to-date performance is even more dramatic, with a 62.39% decrease.

The market capitalization of VR stands at $28,780,894, ranking it 784th in the overall cryptocurrency market. The circulating supply is 8,141,695,688 VR tokens, which represents 48.46% of the total supply of 16,800,000,000 tokens.

Despite the recent price decline, VR has maintained a presence on 5 exchanges, indicating continued interest in the token. The project has 12,997 token holders, suggesting a relatively distributed ownership structure.

Click to view the current VR market price

VR Market Sentiment Indicator

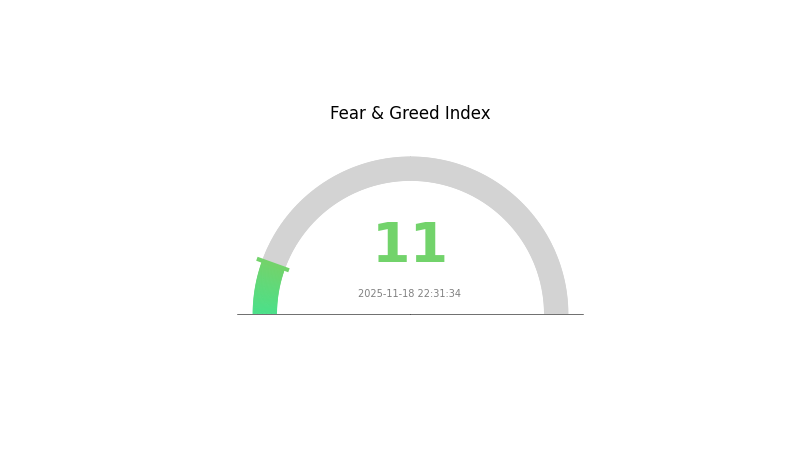

2025-11-18 Fear and Greed Index: 11 (Extreme Fear)

Click to view the current Fear & Greed Index

The VR market sentiment has plunged into extreme fear territory, with the index registering a mere 11 points. This indicates a significant pessimism among investors, potentially signaling a buying opportunity for contrarian traders. However, caution is advised as the market may continue to decline. It's crucial to conduct thorough research and consider your risk tolerance before making any investment decisions. Remember, market sentiment can shift rapidly, and today's extreme fear could be tomorrow's opportunity.

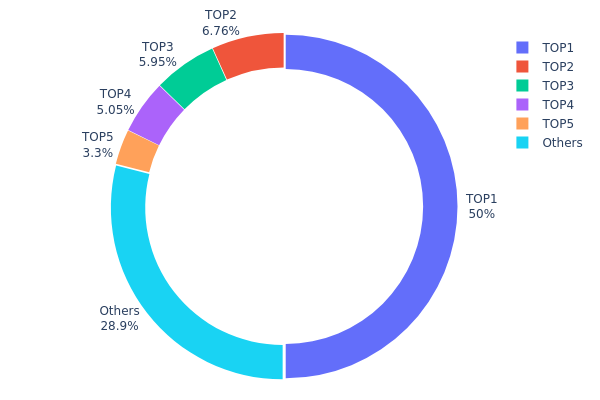

VR Holdings Distribution

The address holdings distribution data provides crucial insights into the concentration of VR tokens among different addresses. Analysis of this data reveals a highly centralized distribution pattern. The top address holds a dominant 50% of the total supply, while the top 5 addresses collectively control 71.04% of VR tokens. This concentration level raises concerns about potential market manipulation and price volatility.

Such a skewed distribution could significantly impact market dynamics. The presence of large holders, often referred to as "whales," may lead to increased price volatility if they decide to sell or buy substantial amounts. Moreover, this concentration could potentially undermine the project's decentralization efforts and raise questions about equitable token distribution.

From a market structure perspective, this high concentration suggests a relatively immature or early-stage project where tokens have not yet been widely distributed. It may indicate a need for improved token distribution mechanisms or community engagement strategies to enhance decentralization and reduce potential market risks associated with large holder actions.

Click to view the current VR Holdings Distribution

| Top | Address | Holding Qty | Holding (%) |

|---|---|---|---|

| 1 | 0x27e6...c5f721 | 8400000.00K | 50.00% |

| 2 | 0xd621...d19a2c | 1136407.28K | 6.76% |

| 3 | 0xc3f9...f87152 | 999999.90K | 5.95% |

| 4 | 0x9b87...6048bc | 848000.10K | 5.04% |

| 5 | 0x362a...ae81ce | 553978.21K | 3.29% |

| - | Others | 4861614.51K | 28.96% |

II. Key Factors Influencing Future VR Prices

Supply Mechanism

- Hardware Cost Reduction: As VR technology matures and production scales up, component costs are expected to decrease, potentially lowering overall device prices.

- Historical Pattern: Previous generations of VR devices have seen price reductions over time as manufacturing processes improved and economies of scale were achieved.

- Current Impact: The introduction of new high-end devices like Apple's Vision Pro may initially keep average prices high, but is expected to drive innovation and eventually lead to more affordable options.

Institutional and Major Player Dynamics

- Corporate Adoption: Companies like Meta, Sony, and HTC are heavily investing in VR technology, signaling long-term commitment to the industry.

- National Policies: Several countries, including China, have issued policies supporting VR industry development, potentially influencing market growth and pricing.

Macroeconomic Environment

- Monetary Policy Impact: Central banks' policies on interest rates and inflation could affect consumer spending power and VR device affordability.

- Geopolitical Factors: Global supply chain disruptions or trade tensions may impact production costs and pricing strategies for VR manufacturers.

Technological Developments and Ecosystem Building

- Display Technology Advancements: Improvements in Micro OLED and potential breakthroughs in Micro LED could enhance VR visual quality while potentially reducing costs.

- Optical Solutions: The shift towards Pancake lenses is making VR headsets thinner and lighter, though currently at a higher cost.

- Ecosystem Applications: The growth of VR content and applications in gaming, education, healthcare, and enterprise solutions is likely to drive demand and influence pricing strategies.

III. VR Price Prediction for 2025-2030

2025 Outlook

- Conservative prediction: $0.0018 - $0.00353

- Neutral prediction: $0.00353 - $0.00371

- Optimistic prediction: $0.00371 - $0.00388 (requires favorable market conditions)

2027-2028 Outlook

- Market phase expectation: Potential growth phase

- Price range forecast:

- 2027: $0.00342 - $0.00473

- 2028: $0.00269 - $0.00511

- Key catalysts: Increasing adoption of VR technology, market expansion

2030 Long-term Outlook

- Base scenario: $0.00319 - $0.00532 (assuming steady market growth)

- Optimistic scenario: $0.00532 - $0.00633 (assuming accelerated VR adoption)

- Transformative scenario: Above $0.00633 (given breakthrough VR applications)

- 2030-12-31: VR $0.00633 (potential peak price)

| 年份 | 预测最高价 | 预测平均价格 | 预测最低价 | 涨跌幅 |

|---|---|---|---|---|

| 2025 | 0.00388 | 0.00353 | 0.0018 | 0 |

| 2026 | 0.00475 | 0.00371 | 0.00263 | 4 |

| 2027 | 0.00473 | 0.00423 | 0.00342 | 19 |

| 2028 | 0.00511 | 0.00448 | 0.00269 | 26 |

| 2029 | 0.00585 | 0.00479 | 0.00264 | 35 |

| 2030 | 0.00633 | 0.00532 | 0.00319 | 50 |

IV. VR Professional Investment Strategies and Risk Management

VR Investment Methodology

(1) Long-term Holding Strategy

- Suitable for: Long-term investors with high risk tolerance

- Operational suggestions:

- Accumulate VR tokens during market dips

- Stake VR tokens to earn rewards

- Store tokens in secure hardware wallets

(2) Active Trading Strategy

- Technical analysis tools:

- Moving Averages: Use to identify trends and potential reversals

- Relative Strength Index (RSI): Measure overbought/oversold conditions

- Key points for swing trading:

- Monitor VR ecosystem developments and partnership announcements

- Set strict stop-loss and take-profit levels

VR Risk Management Framework

(1) Asset Allocation Principles

- Conservative investors: 1-3% of crypto portfolio

- Aggressive investors: 5-10% of crypto portfolio

- Professional investors: Up to 15% of crypto portfolio

(2) Risk Hedging Solutions

- Diversification: Spread investments across multiple metaverse projects

- Stop-loss orders: Implement to limit potential losses

(3) Secure Storage Solutions

- Hot wallet recommendation: Gate Web3 Wallet

- Cold storage solution: Hardware wallets for long-term holdings

- Security precautions: Enable two-factor authentication, use strong passwords

V. Potential Risks and Challenges for VR

VR Market Risks

- High volatility: VR token price may experience significant fluctuations

- Competition: Other metaverse projects may outperform Victoria VR

- Adoption risk: Slow user adoption could impact token value

VR Regulatory Risks

- Uncertain regulations: Crypto regulations may affect VR token trading

- Tax implications: Changing tax laws could impact VR token holders

- Cross-border restrictions: International regulations may limit VR ecosystem growth

VR Technical Risks

- Smart contract vulnerabilities: Potential security flaws in VR token contracts

- Scalability issues: VR platform may face challenges with user growth

- Technological obsolescence: Rapid advancements in VR tech could outpace Victoria VR

VI. Conclusion and Action Recommendations

VR Investment Value Assessment

Victoria VR shows long-term potential in the metaverse sector, but faces short-term volatility and adoption challenges. Investors should consider it as a high-risk, high-reward opportunity within a diversified crypto portfolio.

VR Investment Recommendations

✅ Beginners: Start with small, regular investments to build a position over time ✅ Experienced investors: Implement dollar-cost averaging and actively monitor project developments ✅ Institutional investors: Consider VR as part of a broader metaverse investment strategy

VR Trading Participation Methods

- Spot trading: Buy and sell VR tokens on Gate.com

- Staking: Participate in VR token staking programs for passive income

- Ecosystem participation: Engage in Victoria VR platform activities to earn rewards

Cryptocurrency investments carry extremely high risks, and this article does not constitute investment advice. Investors should make decisions carefully based on their own risk tolerance and are advised to consult professional financial advisors. Never invest more than you can afford to lose.

FAQ

How high will vet go in 2025?

VET is projected to reach $0.0825 at best, with an average price of $0.0589 in 2025.

Can Solana reach $1000 in 2025?

While possible, it's unlikely Solana will reach $1000 in 2025. Its peak in 2025 was around $300. Future growth depends on market conditions and adoption.

How high will Trumpcoin go?

Trumpcoin is projected to reach around $100 by 2025. While estimates vary, most analysts predict this level, subject to market conditions.

What is the best AI crypto prediction for 2030?

AI predicts Bitcoin will remain dominant, with Ethereum and emerging altcoins like Solana and Cardano thriving. DeFi and NFTs are expected to see significant growth by 2030.

Share

Content