Gate Ventures Weekly Crypto Recap (November 17, 2025)

Gate Ventures

TL;DR

- The US government reopens after the temporary funding bill passed, releasing liquidity back into the system, economic data to be published.

- This week’s incoming data includes the US ADP weekly employment change, housing and building data, FOMC meeting minutes and manufacturing indexes.

- The crypto market faced heavy selling pressure this week. BTC fell 9.9% and ETH dropped 13.67%, alongside significant ETF outflows (BTC: $1.11B, ETH: $728.57M). Sentiment plunged into Extreme Fear, with the Fear & Greed Index at 14, while the ETH/BTC ratio slipped another 4% to 0.033.

- The total crypto market cap declined 9.4%, with BTC and ETH leading the downturn, while altcoins fell a milder 7.15%. Privacy tokens were the only clear outperformers, driven by strength in ZEC, DASH, and DCR.

- Among the top 30 tokens, the market averaged a ~12% pullback, with only UNI and ZEC posting gains, UNI supported by its upcoming fee-switch tokenomics proposal, and ZEC benefiting from record-high weekly shielded transactions (180k).

- New listings include Pieverse, a compliance-focused Web3 payments protocol, which traded from $0.22 → $0.28, supported by listings on Bybit, Binance Alpha, and Gate.

- Tether eyes $1.16B investment in Neura Robotics as it expands into AI and humanoid systems.

- Sky Protocol unveils new roadmap to tokenized risk capital and Sky Intents.

- Arc blockchain expands with institutional FX trading and global stablecoin partners.

Macro Overview

The US government reopens after the temporary funding bill passed, releasing liquidity back into the system, economic data to be published.

The temporary funding bill has been signed, officially ending the US federal government shutdown. Both parties reached a compromise on appropriations, with parts of the funding extended into January next year. The Senate’s newly revised continuing resolution provides full-year funding for certain programs, and extends funding for the rest of the government through January 30, 2026, while rehiring federal employees laid off during the shutdown. Eight Democratic senators joined the Republican majority in supporting the bill. In exchange, Republicans agreed to hold a vote by mid‑December on extending healthcare tax credits. On November 10, the Senate passed the new bill by a vote of 60 to 40.Before January 30, 2026, the two parties must again negotiate a full‑year act or a new temporary funding measure to sustain government operations.

During the shutdown, some federal spending was suspended, but the Treasury continued issuing debt. As a result, the Treasury General Account (TGA) balance rose in October. Meanwhile, the ON RRP floor failed to offset tightening conditions, leading to a rapid drawdown in financial institution reserves, a key factor in the recent USD liquidity squeeze. With the reopening, resumed government spending is expected to release liquidity back into the system. Meanwhile, the employment data prepared by the Bureau of Labor Statistics (BLS) and the CPI inflation data during the shutdown will be released.

This week’s incoming data includes the US ADP weekly employment change, housing and building data, FOMC meeting minutes and manufacturing indexes from New York, Philadelphia and Kansas. The market is expecting to see more long-delayed official economic data incoming in this week and next few weeks, creating higher levels of uncertainties. At the same time, the private sector data will provide guidance in multiple sectors. (1)

DXY

The US dollar gained against euro and was roughly flat against Japanese yen on Friday, as traders weight whether the Fed is likely to cut the interest rate this December.(2)

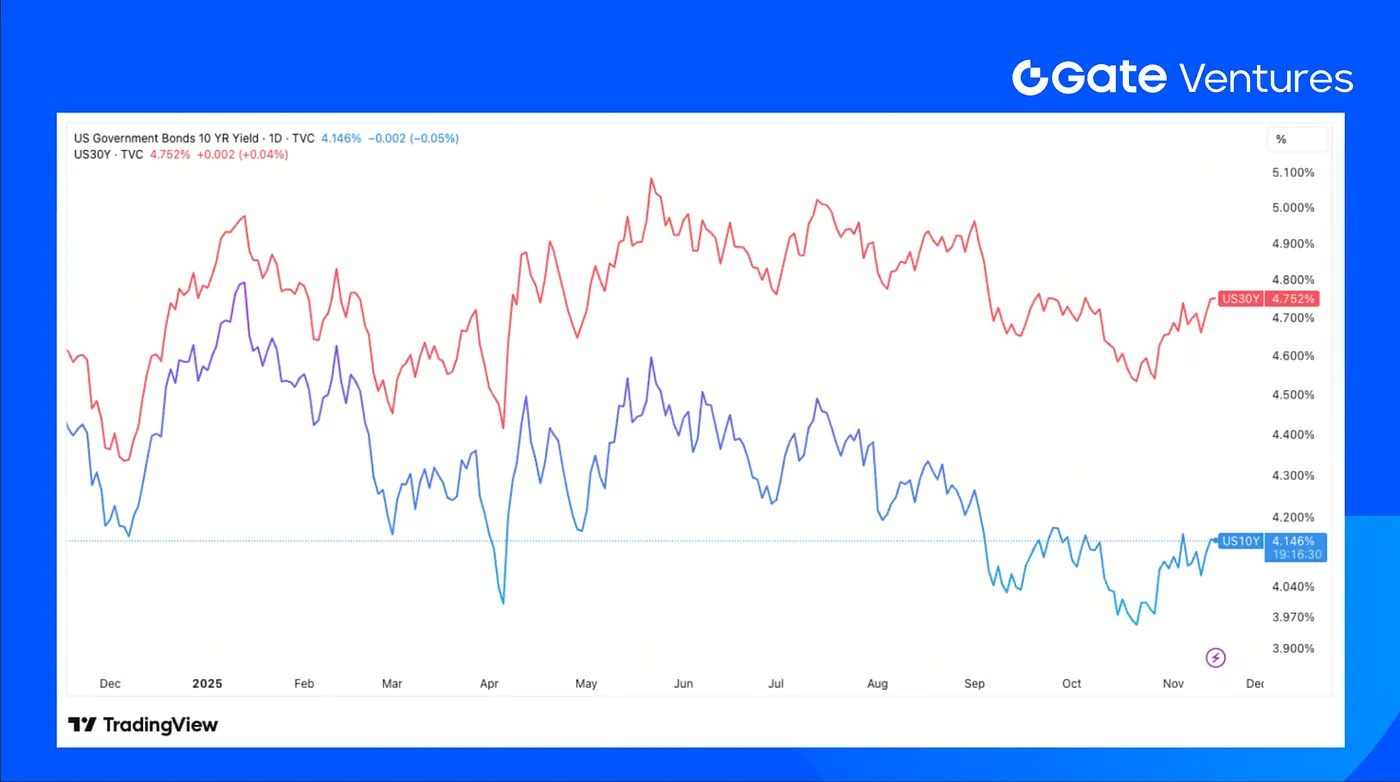

US 10-Year and 30-Year Bond Yields

The US short and long term bond yields rose slightly as the bond price fell last week, as the market is waiting for the long delayed key economic data to be published.(3)

Gold

Gold prices rose and broke the $4,200 line earlier last week, but fell over 3% on Friday as the Fed official delivered hawkish remarks on December rate cut. (4)

Crypto Markets Overview

1. Main Assets

BTC Price

ETH Price

ETH/BTC Ratio

BTC dropped 9.9% this week, while ETH fell 13.67%.BTC ETFs saw $1.11B in net outflows, and ETH ETFs recorded $728.57M in outflows, marking another week that ranks among the three largest outflow weeks on record. (5)

Market sentiment deteriorated sharply, with the Fear & Greed Index sliding to 14, entering Extreme Fear. The ETH/BTC ratio declined another 4% to 0.033, extending its downtrend. (6)

2. Total Market Cap

Crypto Total Marketcap

Crypto Total Marketcap Excluding BTC and ETH

Crypto Total Marketcap Excluding Top 10 Dominance

The total crypto market cap fell 9.4%, while the market excluding BTC and ETH declined 6.17%. Altcoins saw a comparatively milder drawdown of 7.15%, reinforcing that BTC and ETH were the primary drivers of the market’s downturn.

Despite the broader sell-off, privacy coins such as Zcash, Dash, and Decred continued to edge higher, standing out as rare pockets of strength.

On the perpetual dex sector, ASTER posted gains as its perpetual market generated roughly $1.7M in daily revenue for buybacks.

Yet, overall altcoins have entered a deep capitulation zone, with fewer than 5% of holders currently in profit.

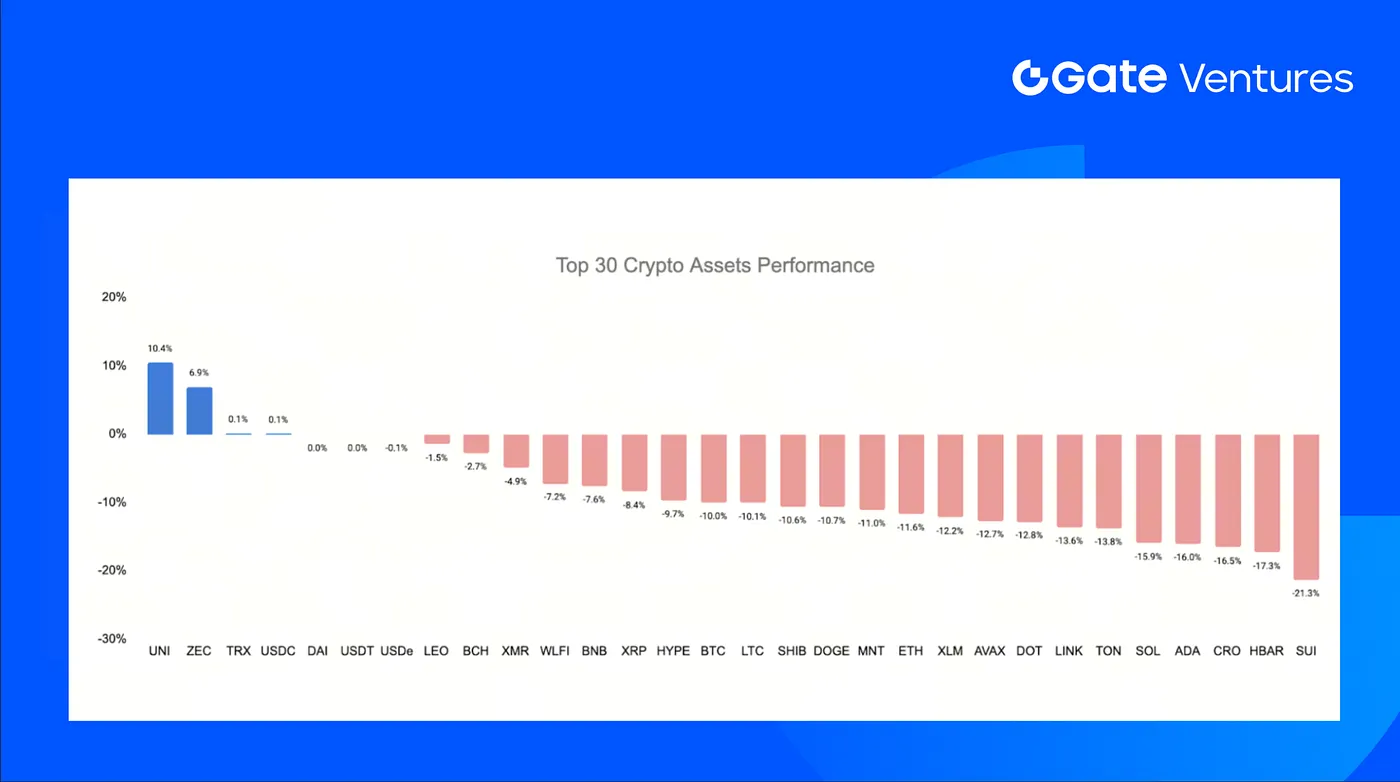

3. Top 30 Crypto Assets Performance

Source: Coinmarketcap and Gate Ventures, as of Nov 17th 2025

Among the top 30 assets, prices fell ~12% on average, with only UNI (Uniswap) and ZEC (Zcash) posting gains.

UNI rose 10.4% last week, driven by the continuous hype around a proposed token-economics upgrade. The plan introduces a version of the long-discussed fee switch, channeling a share of protocol revenue into a token jar (token burnt). (7)

ZEC gained 6.9% this week, supported by improving fundamentals. Shielded transactions have surged to a new all-time high, reaching 180k in a single week. (8)

4. New Token Launched

Pieverse is a compliance-focused Web3 payments infrastructure that converts blockchain timestamps into legally recognized business receipts and invoices, aiming to bridge on-chain activity with real-world financial documentation.

The token debuted around $0.22 and has since climbed to the $0.28 range, supported by listings on major venues such as Bybit, Binance Alpha, and Gate.

The Key Crypto Highlights

1. Tether eyes $1.16B investment in Neura Robotics as it expands into AI and humanoid systems

Tether is reportedly in discussions to lead a $1.16B round for Neura Robotics, valuing the German humanoid-robotics startup at $9.3B–$11.6B, per the Financial Times. With $10B+ in profit generated in the first three quarters of the year, Tether has accelerated diversification into AI, data centers, energy, and mining. Neura plans to commercialize its humanoid robot for industrial and household use, targeting 5 million units by 2030 as competition with Tesla intensifies. (9)

2. Sky Protocol unveils new roadmap to tokenized risk capital and Sky Intents

Sky Protocol published its latest roadmap outlining eight major releases, led by SkyLink, a native bridge for crosschain compatibility, and srUSDS, a liquid token for senior risk positions. The plan introduces tokenized junior and senior external risk capital (EJRC/ESRC), a Hyperliquid-powered buyback system, and Sky Intents, enabling unified trading across Sky-compatible assets. The update also includes SkyLink SSR infrastructure for multi-chain sUSDS access and a Generator System rewrite to simplify Sky’s stablecoin architecture. (10)

3. Arc blockchain expands with institutional FX trading and global stablecoin partners

Circle is expanding its Arc L1 with StableFX, a 24/7 onchain FX engine enabling approved institutions to trade and settle stablecoin currency pairs with atomic settlement and RFQ-based pricing. Alongside it, the new Circle Partner Stablecoins program integrates regional non-USD stablecoins, including BRLA, AUDF, KRW1, QCAD, ZARU, and PHPC — into Arc and Circle’s payments network. Together, they form a unified stack for programmable global FX, ahead of Arc’s 2025 mainnet launch. (11)

Key Ventures Deals

1. Lighter raises $68M at a $1.5B valuation to scale decentralized perpetuals and spot trading on Ethereum

Lighter, a decentralized trading protocol and blockchain founded by Harvard prodigy and former Citadel engineer Vladimir Novakovski, raised $68M in a round led by Founders Fund and Ribbit Capital, joined by Haun Ventures and Robinhood. The raise, structured as equity and token warrants, values Lighter around $1.5B. Positioned as an Ethereum Layer 2 for perpetual and soon spot trading, Lighter aims to verify all financial activity transparently and fairly, already ranking among top L2s by volume.(12)

2. a16z crypto leads $10M round for Seismic to bring private blockchain rails to fintechs

Seismic, a privacy-focused blockchain infrastructure startup helping fintechs protect customer data, raised $10M in a round led by a16z crypto with participation from Polychain, Amber Group, TrueBridge, dao5, and LayerZero — bringing total funding to $17M. Founded by Lyron Co Ting Keh, Seismic provides private transaction rails used by partners like Brookwell and Cred, positioning itself as an alternative to Stripe-backed Tempo. The new capital supports expanding into fiat–crypto ramps and card programs ahead of expected revenue in early 2026. (13)

3. Shodai Network raises $2.5M seed round to fix crypto’s “toxic capital” problem

Shodai Network, founded by Consensys alumni Simon Brown, Dr. Michael Norman, Bryan Peters, and Victor Leipnik, raised a $2.5M seed round backed by Consensys Software, Consensys Mesh, and Joe Lubin to tackle crypto’s long-standing “toxic capital” problem. Shodai is building a founder network and fundraising-support platform that develops new capital-formation tools and governance-aligned structures, aiming to help early Web3 teams raise healthier, incentive-aligned capital and avoid misstructured tokenomics that have undermined past projects. (14)

Ventures Market Metrics

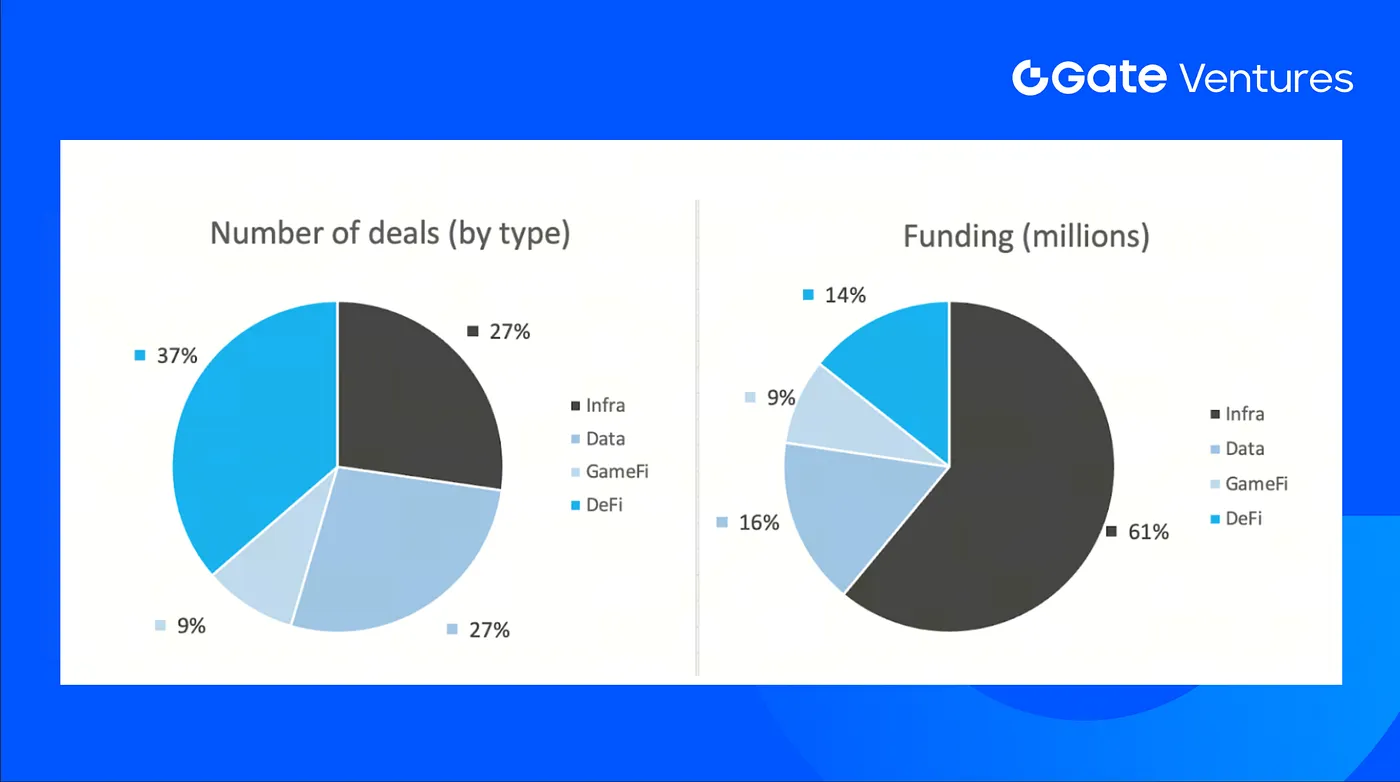

The number of deals closed in the previous week was 11, with DeFi having 4 deals, representing 36% of the total number of deals. Meanwhile, Infra and Data had 3 (27%) for each sector and GameFi had 1 (9%).

Weekly Venture Deal Summary, Source: Cryptorank and Gate Ventures, as of 17th Nov 2025

The total amount of disclosed funding raised in the previous week was $132M, no deals in the previous week didn’t public the raised amount. The top funding came from Infra sector with $80M. Most funded deals: Lighter $68M, Arcurat $11M.

Weekly Venture Deal Summary, Source: Cryptorank and Gate Ventures, as of 17th Nov 2025

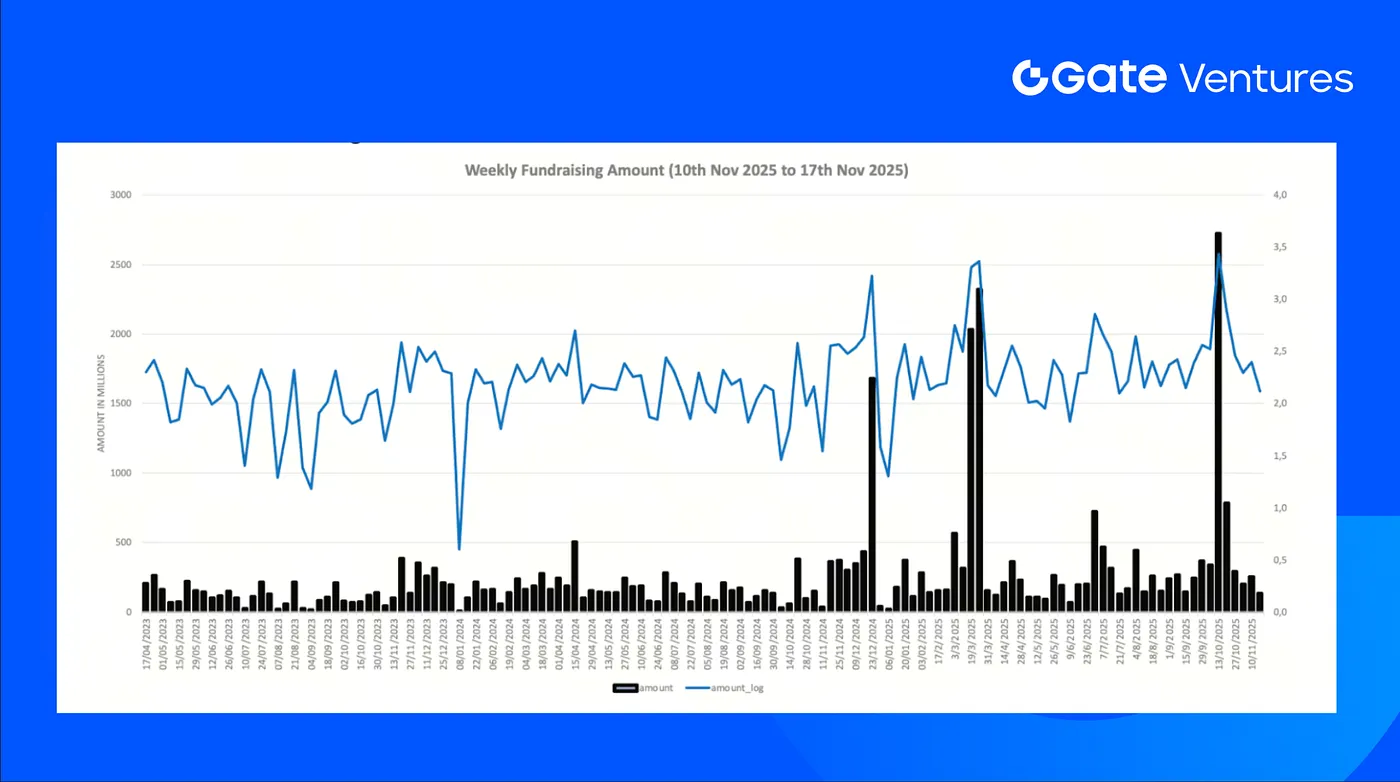

Total weekly fundraising rose to $132M for the 2nd week of Nov-2025, a decrease of -47% compared to the week prior. Weekly fundraising in the previous week was up -63% year over year for the same period.

About Gate Ventures

Gate Ventures, the venture capital arm of Gate.com, is focused on investments in decentralized infrastructure, middleware, and applications that will reshape the world in the Web 3.0 age. Working with industry leaders across the globe, Gate Ventures helps promising teams and startups that possess the ideas and capabilities needed to redefine social and financial interactions.

Website: https://www.gate.com/ventures

The content herein does not constitute any offer, solicitation, or recommendation. You should always seek independent professional advice before making any investment decisions. Please note that Gate Ventures may restrict or prohibit the use of all or a portion of the services from restricted locations. For more information, please read its applicable user agreement.

Reference:

- S&P Global Weekly Ahead Economic Data, https://www.spglobal.com/marketintelligence/en/mi/research-analysis/week-ahead-economic-preview-week-of-17-november-2025.html

- DXY Index, TradingView, https://www.tradingview.com/chart/z1UD772v/?symbol=TVC%3ADXY

- US 10 Year Bond Yield, TradingView, https://www.tradingview.com/chart/z1UD772v/?symbol=TVC%3AUS10Y

- Gold Price, TradingView, https://www.tradingview.com/chart/z1UD772v/?symbol=TVC%3AGOLD

- BTC & ETH ETF Inflow, https://sosovalue.com/tc/assets/etf/us-btc-spot

- BTC Greed and Fear Index, https://alternative.me/crypto/fear-and-greed-index/

- Uniswap fee switch proposal, https://www.dlnews.com/articles/defi/uni-token-soars-as-uniswap-leadership-proposes-fee-switch/

- ZCash performance, https://zechub.wiki/dashboard

- Tether eyes $1.16B investment in Neura Robotics as it expands into AI and humanoid systems,

https://www.theblock.co/post/378952/tether-may-lead-1-2-billion-round-in-german-robotics-startup-ft - Sky Protocol unveils new roadmap to tokenized risk capital and Sky Intents,

https://x.com/tobalgarcia_/status/1989052401693966837?s=46 - Arc blockchain expands with institutional FX trading and global stablecoin partners,

https://www.theblock.co/post/378723/circle-arc-onchain-fx-engine-multi-currency-stablecoin-program - Lighter raises $68M at a $1.5B valuation to scale decentralized perpetuals and spot trading on Ethereum,

https://fortune.com/2025/11/11/lighter-fundraise-founders-fund-ribbit-capital-haun-ventures-robinhood-vladimir-novakovski/ - a16z crypto leads $10M round for Seismic to bring private blockchain rails to fintechs,

https://fortune.com/2025/11/12/crypto-startup-seismic-raises-10-million-to-help-fintechs-protect-customer-data/ - Shodai Network raises $2.5M seed round to fix crypto’s “toxic capital” problem,

https://x.com/shodai_network/status/1988637805765910741?s=20

Thanks for your attention.

Share

Content