Is OVERTAKE (TAKE) a Good Investment?: Analyzing the Potential and Risks of This Emerging Crypto Asset

Introduction: Investment Status and Market Prospects of OVERTAKE (TAKE)

TAKE is an important asset in the cryptocurrency realm. As of 2025, TAKE's market cap stands at $27,424,364.572, with a circulating supply of approximately 146,654,356 tokens, and a current price hovering around $0.187. With its positioning as a digital asset marketplace for Web2 and Web3 game assets, TAKE has gradually become a focal point for investors discussing "Is OVERTAKE (TAKE) a good investment?" This article will comprehensively analyze TAKE's investment value, historical trends, future price predictions, and investment risks, providing a reference for investors.

I. TAKE Price History Review and Current Investment Value

OVERTAKE (TAKE) Investment Performance

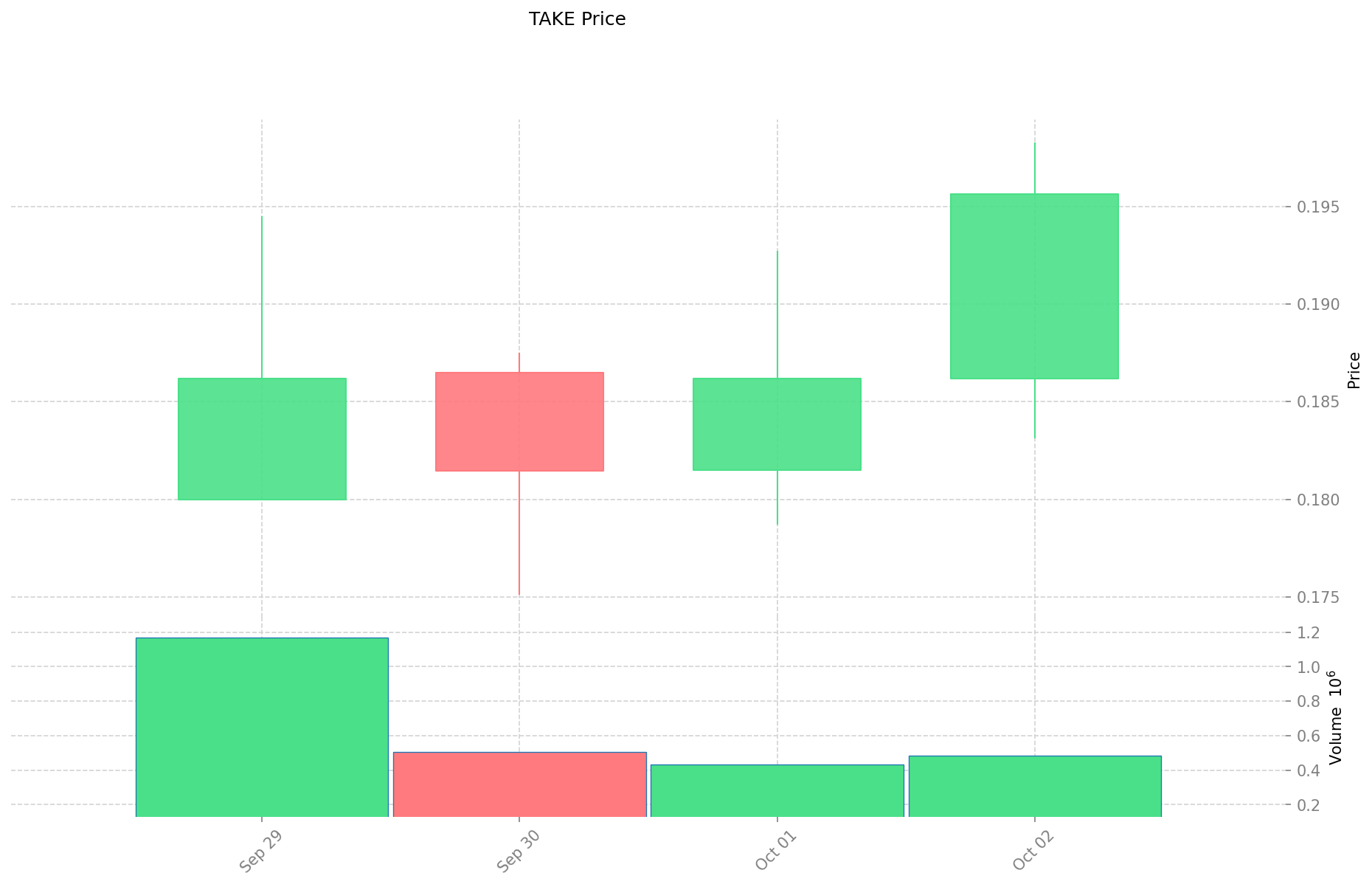

- 2025: All-time high of $0.19829 reached on October 2 → Positive returns for early investors

- 2025: All-time low of $0.1751 on September 30 → Price volatility in recent days

- 2025: Current uptrend → Price increased 37.30% in the past 30 days

Current TAKE Investment Market Status (October 2025)

- TAKE current price: $0.187

- 24-hour trading volume: $112,955.44

- Circulating supply: 146,654,356 TAKE

- Market cap: $27,424,364.57

Click to view real-time TAKE market price

II. Key Factors Affecting Whether OVERTAKE(TAKE) is a Good Investment

Supply Mechanism and Scarcity (TAKE investment scarcity)

- Total supply of 1,000,000,000 TAKE tokens → Impacts price and investment value

- Circulating supply of 146,654,356 TAKE (13.12% of total supply)

- Investment significance: Scarcity is key to supporting long-term investment

Institutional Investment in TAKE

- Current market cap: $27,424,364.572

- Listed on 13 exchanges, indicating growing institutional interest

- Government policies' impact on TAKE investment prospects remains to be seen

Macroeconomic Environment's Impact on TAKE Investment

- Monetary policy and interest rate changes → May alter investment attractiveness

- Potential hedge against inflation → Positioning as "digital asset"

- Geopolitical uncertainties → Could increase demand for TAKE investment

Technology & Ecosystem for TAKE Investment

- Built on SUI blockchain: Enhances network performance → Increases investment appeal

- Focus on Web3 infrastructure for gaming assets: Expands ecosystem applications → Supports long-term value

- Digital asset marketplace: Drives investment value through practical applications in Web2 and Web3 gaming

III. TAKE Future Investment Forecast and Price Outlook (Is OVERTAKE(TAKE) worth investing in 2025-2030)

Short-term TAKE investment outlook (2025)

- Conservative forecast: $0.10817 - $0.1865

- Neutral forecast: $0.1865 - $0.21

- Optimistic forecast: $0.21 - $0.240585

Mid-term OVERTAKE(TAKE) investment forecast (2027-2028)

- Market stage expectation: Growth phase with increasing adoption

- Investment return forecast:

- 2027: $0.23585769125 - $0.353786536875

- 2028: $0.275138033340625 - $0.426312776934375

- Key catalysts: Expanding ecosystem, partnerships, technological improvements

Long-term investment outlook (Is OVERTAKE(TAKE) a good long-term investment?)

- Base scenario: $0.274997138479595 - $0.40440755658764 (Steady growth and mainstream adoption)

- Optimistic scenario: $0.40440755658764 - $0.493377219036921 (Widespread adoption and favorable market conditions)

- Risk scenario: Below $0.274997138479595 (Extreme market volatility or project setbacks)

Click to view TAKE long-term investment and price prediction: Price Prediction

2025-10-03 - 2030 Long-term Outlook

- Base scenario: $0.274997138479595 - $0.40440755658764 (Corresponding to steady progress and gradual increase in mainstream applications)

- Optimistic scenario: $0.40440755658764 - $0.493377219036921 (Corresponding to large-scale adoption and favorable market environment)

- Transformative scenario: Above $0.493377219036921 (In case of breakthrough progress in the ecosystem and mainstream popularization)

- 2030-12-31 Predicted high: $0.493377219036921 (Based on optimistic development assumptions)

Disclaimer

| 年份 | 预测最高价 | 预测平均价格 | 预测最低价 | 涨跌幅 |

|---|---|---|---|---|

| 2025 | 0.240585 | 0.1865 | 0.10817 | 0 |

| 2026 | 0.288282375 | 0.2135425 | 0.172969425 | 14 |

| 2027 | 0.353786536875 | 0.2509124375 | 0.23585769125 | 34 |

| 2028 | 0.426312776934375 | 0.3023494871875 | 0.275138033340625 | 61 |

| 2029 | 0.444483981114343 | 0.364331132060937 | 0.280534971686921 | 94 |

| 2030 | 0.493377219036921 | 0.40440755658764 | 0.274997138479595 | 116 |

IV. How to invest in TAKE

TAKE investment strategy

- HODL TAKE: Suitable for conservative investors looking for long-term growth potential in the digital asset marketplace sector.

- Active trading: Relies on technical analysis and swing trading strategies to capitalize on TAKE's price volatility.

Risk management for TAKE investment

- Asset allocation ratio: Conservative: 1-3% of portfolio Aggressive: 5-10% of portfolio Professional: Up to 20% of portfolio

- Risk hedging: Diversify across multiple crypto assets and use traditional safe-haven assets

- Secure storage: Use a combination of hot wallets for trading and cold/hardware wallets for long-term storage

V. Risks of investing in TAKE

- Market risk: High volatility common in smaller market cap cryptocurrencies

- Regulatory risk: Uncertain regulatory environment for digital asset marketplaces and Web3 gaming assets

- Technical risk: Potential vulnerabilities in the Sui blockchain or Overtake's smart contracts

VI. Conclusion: Is TAKE a Good Investment?

- Investment value summary: TAKE shows long-term potential in the growing digital asset marketplace sector, but investors should expect significant short-term price fluctuations.

- Investor recommendations: ✅ Beginners: Consider dollar-cost averaging and focus on secure storage ✅ Experienced investors: Implement swing trading strategies and portfolio diversification ✅ Institutional investors: Evaluate for strategic long-term allocation in Web3 and gaming sectors ⚠️ Warning: Cryptocurrency investments carry high risk. This report is for informational purposes only and does not constitute investment advice.

VII. FAQ

Q1: What is OVERTAKE (TAKE) and its main purpose? A: OVERTAKE (TAKE) is a cryptocurrency that powers a digital asset marketplace for Web2 and Web3 game assets. It's built on the SUI blockchain and aims to facilitate the trading and management of gaming-related digital assets.

Q2: What is the current price and market cap of TAKE? A: As of October 2025, TAKE's price is approximately $0.187, with a market cap of $27,424,364.572.

Q3: Is TAKE considered a good long-term investment? A: TAKE shows potential for long-term growth in the digital asset marketplace sector, but it comes with significant risks. The base scenario for 2030 predicts a price range of $0.274997138479595 - $0.40440755658764, indicating possible growth. However, cryptocurrency investments are highly volatile and risky.

Q4: How can I invest in TAKE? A: You can invest in TAKE by purchasing tokens on one of the 13 exchanges where it's listed. Investment strategies include long-term holding (HODL) for conservative investors or active trading for more experienced traders.

Q5: What are the main risks associated with investing in TAKE? A: The main risks include market volatility, regulatory uncertainty surrounding digital asset marketplaces and Web3 gaming assets, and potential technical vulnerabilities in the Sui blockchain or Overtake's smart contracts.

Q6: What is the total and circulating supply of TAKE tokens? A: The total supply of TAKE tokens is 1,000,000,000, with a current circulating supply of approximately 146,654,356 tokens (13.12% of the total supply).

Q7: How should I manage risk when investing in TAKE? A: Risk management strategies include diversifying your portfolio, limiting TAKE to a small percentage of your investments (1-20% depending on risk tolerance), using secure storage methods, and staying informed about market developments and regulations affecting digital asset marketplaces and Web3 gaming.

Share

Content