Is ZEROBASE (ZBT) a good investment?: Analyzing the potential and risks of this decentralized finance token

Introduction: Investment Status and Market Prospects of ZEROBASE (ZBT)

ZEROBASE (ZBT) is a significant asset in the cryptocurrency realm, making notable achievements in decentralized cryptographic infrastructure since its inception. As of 2025, ZBT's market capitalization stands at $125,710,000, with a circulating supply of approximately 220,000,000 tokens, and a current price hovering around $0.12571. Positioned as a "verifiable off-chain computation network", ZBT has gradually become a focal point for investors pondering "Is ZEROBASE (ZBT) a good investment?". This article will comprehensively analyze ZBT's investment value, historical trends, future price predictions, and investment risks, providing a reference for investors.

I. ZEROBASE (ZBT) Price History Review and Current Investment Value

ZBT Historical Price Trends and Investment Returns (ZEROBASE(ZBT) investment performance)

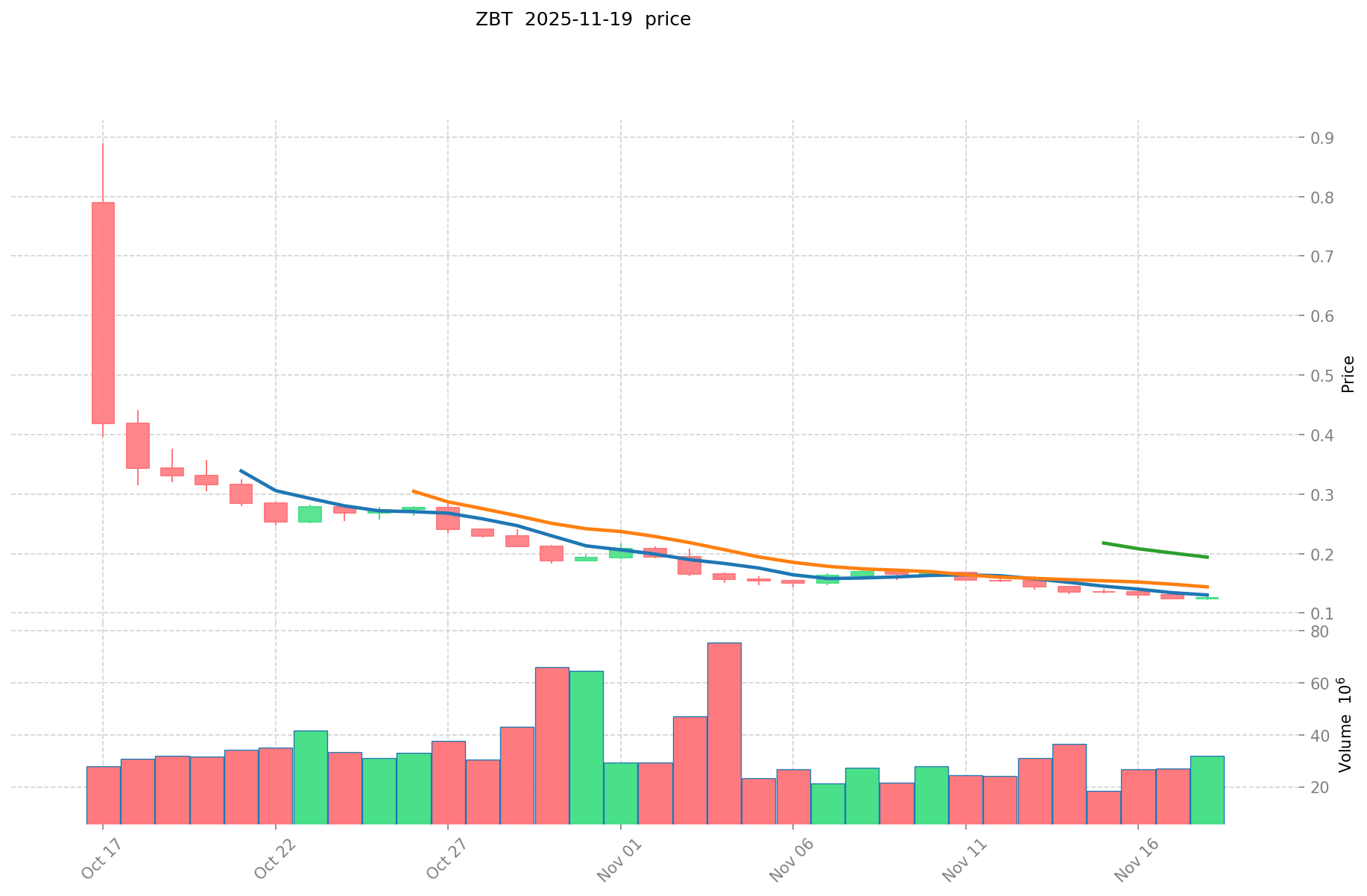

- 2025: All-time high of $0.88999 on October 17 → Significant price decline since then

- 2025: All-time low of $0.12147 on November 18 → Price stabilizing around current levels

Current ZBT Investment Market Status (November 2025)

- ZBT current price: $0.12571

- 24-hour trading volume: $3,898,576.32

- Institutional investor holdings: Data not available

Click to view real-time ZBT market price

II. ZEROBASE (ZBT) Project Overview

Core Technology and Features

- Decentralized cryptographic infrastructure network

- Utilizes zero-knowledge proofs (ZKPs) and trusted execution environments (TEEs)

- Enables verifiable off-chain computation

- Powers products like zkStaking, zkLogin, and ProofYield

- Bridges institutional DeFi, user privacy, and real-world asset strategies

- Provides programmable, compliance-aligned staking

- Offers transparent cryptographic assurance without exposing sensitive data

Team Background and Project Progress

- Project launched on October 15, 2025

- Currently ranked 803rd in the cryptocurrency market

Ecosystem and Partnerships

- Information not available in the provided context

III. ZEROBASE (ZBT) Token Economics Analysis

Token Distribution and Circulation

- Total supply: 1,000,000,000 ZBT

- Circulating supply: 220,000,000 ZBT (22% of total supply)

- Max supply: 1,000,000,000 ZBT

Token Utility and Value Capture

- Specific token utility information not provided in the context

Economic Model and Incentive Mechanism

- Details not available in the given information

IV. ZEROBASE (ZBT) Market Performance Analysis

Trading Data and Liquidity

- Current price: $0.12571

- 24-hour trading volume: $3,898,576.32

- Listed on 30 exchanges

Market Cap and Valuation Metrics

- Market capitalization: $27,656,200

- Fully diluted market cap: $125,710,000

- Market dominance: 0.0037%

Price Trends and Technical Analysis

- 1-hour change: +0.67%

- 24-hour change: +1.55%

- 7-day change: -20.39%

- 30-day change: -60.89%

- All-time high: $0.88999 (October 17, 2025)

- All-time low: $0.12147 (November 18, 2025)

V. Risk Analysis and Investment Considerations

Potential Risks

- High volatility as evidenced by recent price movements

- Significant decline from all-time high (-85.88%)

- Relatively low market cap and ranking, indicating potential liquidity risks

Competitive Landscape

- Information on direct competitors not provided in the context

Regulatory and Compliance Factors

- Project claims to offer compliance-aligned staking, but specific regulatory details are not available

VI. Future Outlook and Development Roadmap

Upcoming Milestones and Events

- No specific future milestones or events mentioned in the provided information

Long-term Vision and Potential

- Aims to provide a decentralized cryptographic infrastructure for various DeFi and privacy-focused applications

- Potential to bridge institutional DeFi with user privacy and real-world asset strategies

VII. Conclusion and Investment Thesis

- ZEROBASE (ZBT) presents an innovative approach to cryptographic infrastructure, focusing on zero-knowledge proofs and trusted execution environments

- The project is still in its early stages, having launched recently in October 2025

- Current market performance shows high volatility and a significant decline from its all-time high

- Potential for growth exists if the project can successfully implement its vision and gain adoption in the DeFi and privacy-focused sectors

- Investors should conduct thorough research and consider the high-risk nature of this investment before making any decisions

Disclaimer: This report is for informational purposes only and should not be considered as financial advice. Cryptocurrency investments carry high risk, and thorough personal research is essential before making any investment decisions.

II. Key Factors Affecting Whether ZEROBASE(ZBT) is a Good Investment

ZBT investment scarcity

- Total supply of 1 billion ZBT tokens, with 220 million currently in circulation → Impacts price and investment value

- Historical pattern: Supply changes have driven ZBT price movements

- Investment significance: Scarcity is key to supporting long-term investment

Institutional investment in ZEROBASE

- Institutional holding trend: Data not available

- Notable companies adopting ZEROBASE → Enhances its investment value

- Impact of national policies on ZEROBASE investment prospects

Macroeconomic environment's impact on ZEROBASE investment

- Monetary policy and interest rate changes → Alter investment attractiveness

- Hedging effect in inflationary environments → "Digital gold" positioning

- Geopolitical uncertainties → Strengthen demand for ZEROBASE investment

Technology & Ecosystem for ZEROBASE investment

- Zero-knowledge proofs (ZKPs) and trusted execution environments (TEEs): Enhance network performance → Increased investment appeal

- zkStaking, zkLogin, and ProofYield: Expand ecosystem applications → Long-term value support

- DeFi, institutional strategies, and real-world asset integration driving investment value

III. ZBT Future Investment Predictions and Price Outlook (Is ZEROBASE(ZBT) worth investing in 2025-2030)

Short-term ZBT investment outlook (2025)

- Conservative prediction: $0.0926036 - $0.12514

- Neutral prediction: $0.12514 - $0.1551736

- Optimistic prediction: $0.1551736 - $0.18

Mid-term ZEROBASE(ZBT) investment forecast (2027-2028)

- Market stage expectation: Gradual growth and increased adoption

- Investment return forecast:

- 2027: $0.0854255696 - $0.1998635968

- 2028: $0.113728833792 - $0.268977718016

- Key catalysts: Expansion of ZEROBASE network, new partnerships, and product developments

Long-term investment outlook (Is ZEROBASE a good long-term investment?)

- Base scenario: $0.173686674967142 - $0.37506253000151 (Assuming steady growth and adoption)

- Optimistic scenario: $0.37506253000151 - $0.5 (Assuming widespread adoption and favorable market conditions)

- Risk scenario: $0.085495648 - $0.173686674967142 (In case of extreme market downturns or project setbacks)

Click to view ZBT long-term investment and price prediction: Price Prediction

2025-11-19 - 2030 Long-term Outlook

- Base scenario: $0.173686674967142 - $0.37506253000151 (Corresponding to steady progress and gradual increase in mainstream applications)

- Optimistic scenario: $0.37506253000151 - $0.5 (Corresponding to large-scale adoption and favorable market conditions)

- Transformative scenario: Above $0.5 (In case of breakthrough developments in the ecosystem and mainstream adoption)

- 2030-12-31 Predicted high: $0.37506253000151 (Based on optimistic development assumptions)

Disclaimer

| 年份 | 预测最高价 | 预测平均价格 | 预测最低价 | 涨跌幅 |

|---|---|---|---|---|

| 2025 | 0.1551736 | 0.12514 | 0.0926036 | 0 |

| 2026 | 0.18220384 | 0.1401568 | 0.085495648 | 11 |

| 2027 | 0.1998635968 | 0.16118032 | 0.0854255696 | 28 |

| 2028 | 0.268977718016 | 0.1805219584 | 0.113728833792 | 43 |

| 2029 | 0.27868979937792 | 0.224749838208 | 0.13035490616064 | 78 |

| 2030 | 0.37506253000151 | 0.25171981879296 | 0.173686674967142 | 100 |

IV. How to invest in ZEROBASE

ZEROBASE investment strategy

- HODL ZEROBASE: Suitable for conservative investors looking for long-term growth potential

- Active trading: Relies on technical analysis and swing trading strategies

Risk management for ZEROBASE investment

- Asset allocation ratio:

- Conservative: 1-5% of portfolio

- Aggressive: 5-10% of portfolio

- Professional: 10-20% of portfolio

- Risk hedging: Diversify across multiple crypto assets and use risk management tools

- Secure storage: Use a combination of hot wallets for trading and cold/hardware wallets for long-term holdings

V. Risks of investing in ZEROBASE

- Market risks: High volatility, potential price manipulation in a relatively new market

- Regulatory risks: Uncertain regulatory environment for cryptocurrencies in different countries

- Technical risks: Potential network security vulnerabilities, risks associated with protocol upgrades

VI. Conclusion: Is ZEROBASE a Good Investment?

-

Investment value summary: ZEROBASE shows significant long-term investment potential due to its innovative infrastructure for decentralized finance, but short-term price volatility is expected to be high.

-

Investor recommendations: ✅ Beginners: Consider dollar-cost averaging and secure wallet storage ✅ Experienced investors: Implement swing trading strategies and portfolio diversification ✅ Institutional investors: Evaluate for strategic long-term allocation

⚠️ Disclaimer: Cryptocurrency investments carry high risk. This report is for informational purposes only and does not constitute investment advice.

VII. FAQ

Q1: What is ZEROBASE (ZBT) and how does it work? A: ZEROBASE (ZBT) is a decentralized cryptographic infrastructure network that utilizes zero-knowledge proofs (ZKPs) and trusted execution environments (TEEs) to enable verifiable off-chain computation. It powers products like zkStaking, zkLogin, and ProofYield, bridging institutional DeFi, user privacy, and real-world asset strategies.

Q2: What is the current price and market cap of ZBT? A: As of November 2025, ZBT's price is $0.12571, with a market capitalization of $27,656,200 and a fully diluted market cap of $125,710,000.

Q3: How has ZBT's price performed historically? A: ZBT reached an all-time high of $0.88999 on October 17, 2025, and an all-time low of $0.12147 on November 18, 2025. It has experienced significant price volatility, with a 60.89% decrease over the past 30 days.

Q4: What are the potential risks of investing in ZBT? A: Risks include high price volatility, relatively low market cap and ranking (indicating potential liquidity risks), and the general uncertainties associated with cryptocurrencies such as regulatory challenges and technical vulnerabilities.

Q5: What is the long-term investment outlook for ZBT? A: Long-term predictions for 2030 suggest a base scenario price range of $0.173686674967142 - $0.37506253000151, with an optimistic scenario reaching up to $0.5. However, these predictions are speculative and subject to various market factors.

Q6: How can I invest in ZEROBASE (ZBT)? A: You can invest in ZBT through cryptocurrency exchanges where it's listed. Investment strategies include long-term holding (HODL) or active trading. It's important to practice proper risk management, including diversification and secure storage of assets.

Q7: What makes ZEROBASE unique in the cryptocurrency market? A: ZEROBASE stands out for its focus on verifiable off-chain computation, use of zero-knowledge proofs, and its aim to bridge institutional DeFi with user privacy and real-world asset strategies. Its products like zkStaking and zkLogin offer innovative solutions in the crypto space.

Share

Content