MMT vs ZIL: The Battle of Blockchain Platforms for Enterprise Solutions

Introduction: Investment Comparison of MMT vs ZIL

In the cryptocurrency market, the comparison between Momentum (MMT) vs Zilliqa (ZIL) has been an unavoidable topic for investors. The two not only show significant differences in market cap ranking, application scenarios, and price performance, but also represent different positioning in crypto assets.

Momentum (MMT): Launched in March 2025, it has gained market recognition for building the financial operating system of the tokenized world on the Sui blockchain.

Zilliqa (ZIL): Since its launch in January 2018, it has been hailed as a high-throughput public blockchain platform, aiming to solve transaction speed and scalability issues.

This article will comprehensively analyze the investment value comparison between MMT and ZIL, focusing on historical price trends, supply mechanisms, institutional adoption, technological ecosystems, and future predictions, attempting to answer the question investors care about most:

"Which is the better buy right now?"

I. Price History Comparison and Current Market Status

MMT (Coin A) and ZIL (Coin B) Historical Price Trends

- 2025: MMT launched on March 31, reaching $500M in liquidity and $1.1B in daily trading volume.

- 2021: ZIL reached its all-time high of $0.255376 on May 7.

- Comparative analysis: MMT has shown rapid growth since its launch, while ZIL has experienced significant volatility since its peak in 2021.

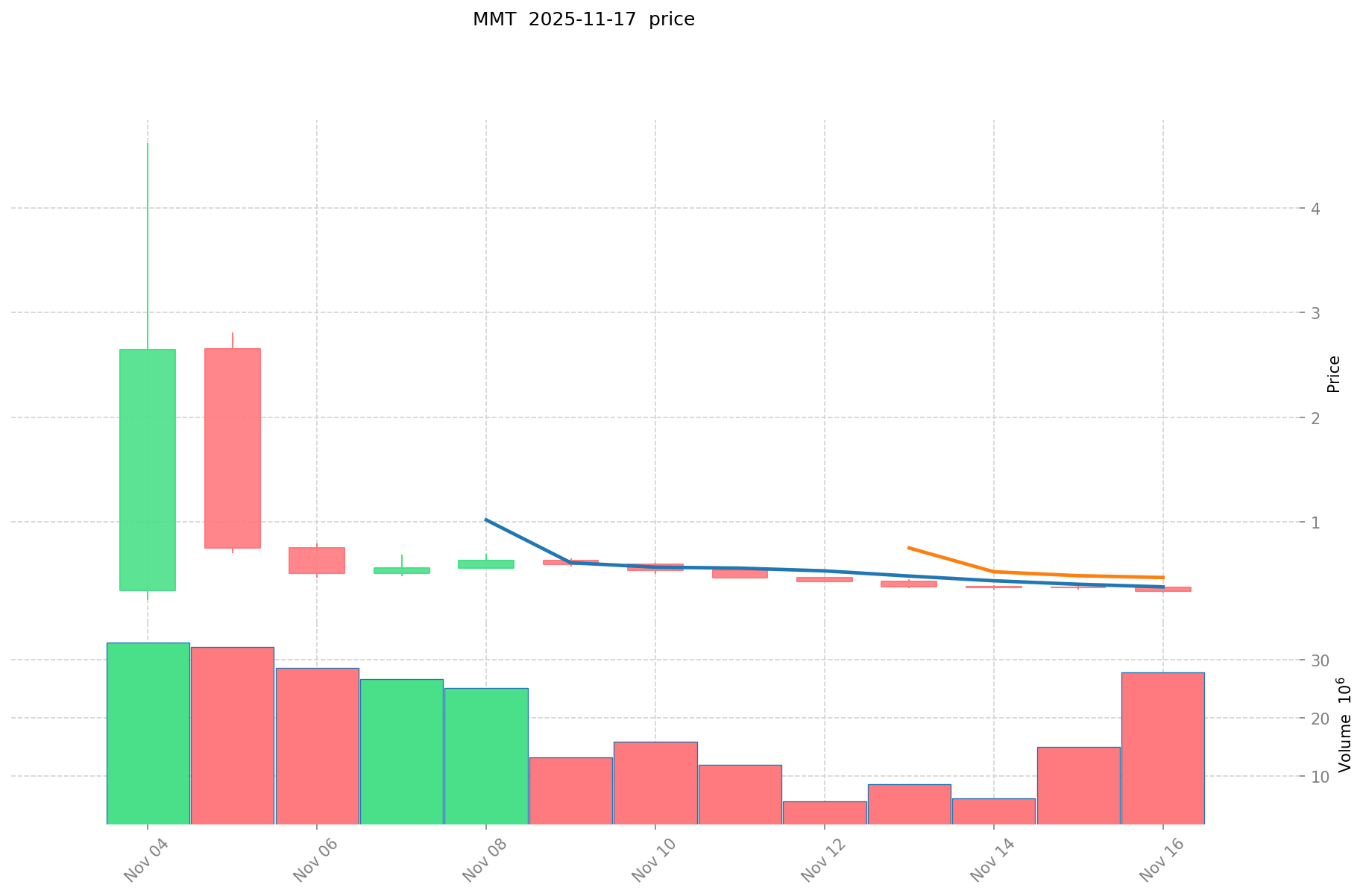

Current Market Situation (2025-11-17)

- MMT current price: $0.3379

- ZIL current price: $0.006778

- 24-hour trading volume: MMT $9,663,075.10 vs ZIL $241,704.45

- Market Sentiment Index (Fear & Greed Index): 10 (Extreme Fear)

Click to view real-time prices:

- View MMT current price Market Price

- View ZIL current price Market Price

II. Core Factors Affecting the Investment Value of MMT vs ZIL

Supply Mechanisms Comparison (Tokenomics)

-

MMT: Limited supply of 1 billion tokens, with strict control over token release and vesting schedules

-

ZIL: Maximum supply cap of 21 billion tokens, with declining inflation rate over time

-

📌 Historical Pattern: Limited supply tokens like MMT tend to show higher price sensitivity during bull markets, while ZIL's larger but controlled supply provides more liquidity but potentially less scarcity value.

Institutional Adoption and Market Applications

- Institutional Holdings: ZIL has attracted more institutional interest, with established partnerships in the fintech and enterprise sectors

- Enterprise Adoption: ZIL demonstrates stronger enterprise adoption in payment systems and supply chain solutions, while MMT is focusing on developing its marketplace ecosystem

- Regulatory Attitudes: Both projects face similar regulatory environments, with ZIL slightly ahead in regulatory clarity due to its longer market presence

Technical Development and Ecosystem Building

- MMT Technical Development: Building a comprehensive marketplace ecosystem with focus on seamless user experience and cross-chain functionality

- ZIL Technical Development: Continued improvement of sharding technology for scalability, with recent focus on interoperability solutions and developer tooling

- Ecosystem Comparison: ZIL has a more mature ecosystem with established DeFi protocols and NFT marketplaces, while MMT is developing specialized marketplace applications with unique transaction models

Macroeconomic Factors and Market Cycles

- Performance in Inflationary Environments: ZIL has demonstrated more resilience during inflationary periods due to its established market position

- Macroeconomic Monetary Policy: Both tokens show sensitivity to interest rate changes, with MMT potentially more volatile during policy shifts

- Geopolitical Factors: ZIL's wider geographic adoption provides some insulation from regional risks, while MMT's ecosystem is still developing its global footprint

III. 2025-2030 Price Prediction: MMT vs ZIL

Short-term Prediction (2025)

- MMT: Conservative $0.17238 - $0.338 | Optimistic $0.338 - $0.4732

- ZIL: Conservative $0.00419864 - $0.006772 | Optimistic $0.006772 - $0.00961624

Mid-term Prediction (2027)

- MMT may enter a growth phase, with expected prices ranging from $0.379236 to $0.5264688

- ZIL may enter a growth phase, with expected prices ranging from $0.005794881664 to $0.011408673276

- Key drivers: Institutional capital inflow, ETF, ecosystem development

Long-term Prediction (2030)

- MMT: Base scenario $0.64864614672 - $0.8821587595392 | Optimistic scenario $0.8821587595392+

- ZIL: Base scenario $0.013052180942808 - $0.013704789989948 | Optimistic scenario $0.013704789989948+

Disclaimer: This information is for educational purposes only and should not be considered as financial advice. Cryptocurrency markets are highly volatile and unpredictable. Always conduct your own research before making any investment decisions.

MMT:

| 年份 | 预测最高价 | 预测平均价格 | 预测最低价 | 涨跌幅 |

|---|---|---|---|---|

| 2025 | 0.4732 | 0.338 | 0.17238 | 0 |

| 2026 | 0.48672 | 0.4056 | 0.389376 | 20 |

| 2027 | 0.5264688 | 0.44616 | 0.379236 | 32 |

| 2028 | 0.564124704 | 0.4863144 | 0.306378072 | 43 |

| 2029 | 0.77207274144 | 0.525219552 | 0.45168881472 | 55 |

| 2030 | 0.8821587595392 | 0.64864614672 | 0.3437824577616 | 91 |

ZIL:

| 年份 | 预测最高价 | 预测平均价格 | 预测最低价 | 涨跌幅 |

|---|---|---|---|---|

| 2025 | 0.00961624 | 0.006772 | 0.00419864 | 0 |

| 2026 | 0.0099148852 | 0.00819412 | 0.0077024728 | 20 |

| 2027 | 0.011408673276 | 0.0090545026 | 0.005794881664 | 33 |

| 2028 | 0.01217558964622 | 0.010231587938 | 0.0097200085411 | 50 |

| 2029 | 0.014900773093506 | 0.01120358879211 | 0.008626763369924 | 64 |

| 2030 | 0.013704789989948 | 0.013052180942808 | 0.008353395803397 | 92 |

IV. Investment Strategy Comparison: MMT vs ZIL

Long-term vs Short-term Investment Strategies

- MMT: Suitable for investors focused on ecosystem potential and marketplace development

- ZIL: Suitable for investors seeking established infrastructure and enterprise adoption

Risk Management and Asset Allocation

- Conservative investors: MMT: 30% vs ZIL: 70%

- Aggressive investors: MMT: 60% vs ZIL: 40%

- Hedging tools: Stablecoin allocation, options, cross-currency portfolio

V. Potential Risk Comparison

Market Risks

- MMT: Higher volatility due to newer market entry and developing ecosystem

- ZIL: Potential market saturation and competition from other established blockchain platforms

Technical Risks

- MMT: Scalability, network stability

- ZIL: Hash power concentration, security vulnerabilities

Regulatory Risks

- Global regulatory policies may impact both tokens differently, with ZIL potentially having a slight advantage due to its longer market presence

VI. Conclusion: Which Is the Better Buy?

📌 Investment Value Summary:

- MMT advantages: Rapid ecosystem growth, innovative marketplace features

- ZIL advantages: Established network, proven scalability, wider institutional adoption

✅ Investment Advice:

- New investors: Consider a balanced approach with a slight tilt towards ZIL for its established market presence

- Experienced investors: Explore MMT for its growth potential while maintaining a position in ZIL

- Institutional investors: Evaluate both for different portfolio objectives; ZIL for stability, MMT for high-growth potential

⚠️ Risk Warning: Cryptocurrency markets are highly volatile. This article does not constitute investment advice. None

VII. FAQ

Q1: What are the main differences between MMT and ZIL? A: MMT is a newer token launched in 2025 on the Sui blockchain, focusing on building a financial operating system for the tokenized world. ZIL, launched in 2018, is a high-throughput public blockchain platform aiming to solve transaction speed and scalability issues.

Q2: Which token has shown better price performance recently? A: MMT has shown rapid growth since its launch in March 2025, while ZIL has experienced significant volatility since its peak in 2021. As of November 17, 2025, MMT's price is $0.3379, and ZIL's price is $0.006778.

Q3: How do the supply mechanisms of MMT and ZIL compare? A: MMT has a limited supply of 1 billion tokens with strict control over token release and vesting schedules. ZIL has a maximum supply cap of 21 billion tokens with a declining inflation rate over time.

Q4: Which token has better institutional adoption? A: ZIL has attracted more institutional interest and has established partnerships in the fintech and enterprise sectors. It also demonstrates stronger enterprise adoption in payment systems and supply chain solutions.

Q5: What are the key factors affecting the investment value of MMT and ZIL? A: Key factors include supply mechanisms, institutional adoption, technical development, ecosystem building, macroeconomic factors, and market cycles.

Q6: What are the long-term price predictions for MMT and ZIL? A: For 2030, MMT's base scenario price range is $0.64864614672 - $0.8821587595392, while ZIL's base scenario price range is $0.013052180942808 - $0.013704789989948.

Q7: How should investors approach MMT and ZIL in terms of risk management? A: For conservative investors, a suggested allocation is 30% MMT and 70% ZIL. For aggressive investors, a suggested allocation is 60% MMT and 40% ZIL. Hedging tools include stablecoin allocation, options, and cross-currency portfolio diversification.

Q8: Which token might be a better buy for different types of investors? A: New investors may consider a balanced approach with a slight tilt towards ZIL for its established market presence. Experienced investors could explore MMT for its growth potential while maintaining a position in ZIL. Institutional investors should evaluate both for different portfolio objectives: ZIL for stability and MMT for high-growth potential.

Share

Content