PIEVERSE vs ENJ: Battle of the Blockchain Gaming Titans Shaping the Future of Virtual Worlds

Introduction: PIEVERSE vs ENJ Investment Comparison

In the cryptocurrency market, the comparison between PIEVERSE and ENJ has been an unavoidable topic for investors. The two not only show significant differences in market cap ranking, application scenarios, and price performance, but also represent different positions in the crypto asset landscape.

PIEVERSE (PIEVERSE): Since its launch, it has gained market recognition for its focus on building foundational payment infrastructure for Web3 with on-chain verifiable transactions.

Enjin Coin (ENJ): Launched in 2017, it has been hailed as a pioneer in blockchain gaming and virtual goods, becoming one of the most recognized cryptocurrencies in the gaming sector.

This article will comprehensively analyze the investment value comparison between PIEVERSE and ENJ, focusing on historical price trends, supply mechanisms, institutional adoption, technological ecosystems, and future predictions, attempting to answer the question most concerning to investors:

"Which is the better buy right now?"

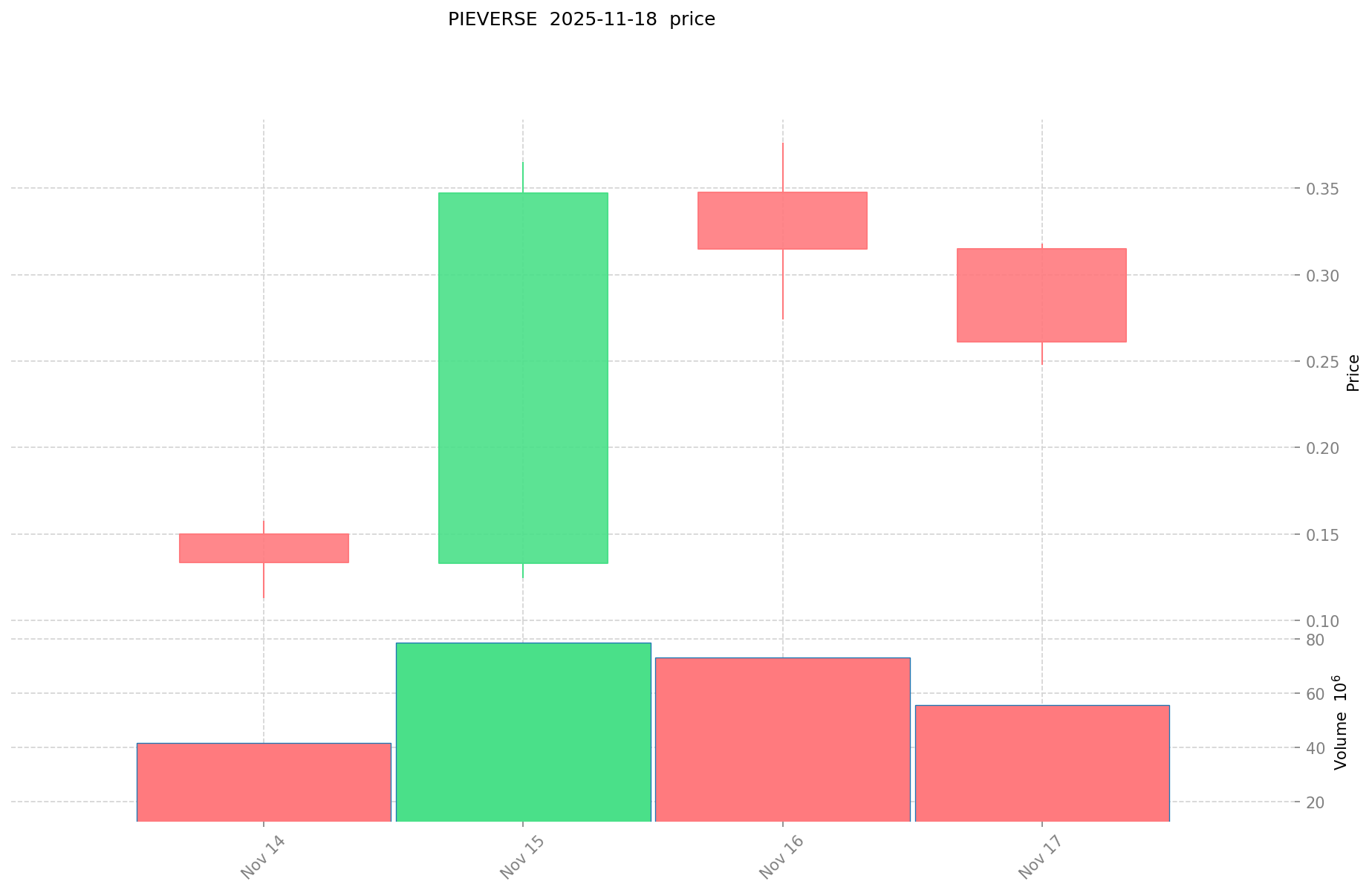

I. Price History Comparison and Current Market Status

PIEVERSE (Coin A) and ENJ (Coin B) Historical Price Trends

- 2025: PIEVERSE reached its all-time high of $0.3764 on November 16, and its all-time low of $0.11286 on November 14, showing significant volatility within a short period.

- 2021: ENJ reached its all-time high of $4.82 on November 25, driven by the overall crypto market bull run and increased interest in gaming tokens.

- Comparative Analysis: In recent market cycles, PIEVERSE has shown extreme volatility within a short timeframe, while ENJ has experienced a significant decline from its all-time high in 2021 to its current price.

Current Market Situation (2025-11-18)

- PIEVERSE current price: $0.24068

- ENJ current price: $0.03663

- 24-hour trading volume: PIEVERSE $14,670,978.17 vs ENJ $86,732.95

- Market Sentiment Index (Fear & Greed Index): 11 (Extreme Fear)

Click to view real-time prices:

- View PIEVERSE current price Market Price

- View ENJ current price Market Price

II. Core Factors Affecting Investment Value of PIEVERSE vs ENJ

Supply Mechanisms Comparison (Tokenomics)

- PIEVERSE: Fixed supply of 1 billion tokens with a multi-chain design

- ENJ: Deflationary model with tokens being locked (melted) into NFTs and gaming assets

- 📌 Historical pattern: Deflationary mechanisms like ENJ's melting process typically create scarcity over time, potentially supporting price stability during market downturns

Institutional Adoption and Market Applications

- Institutional holdings: ENJ has attracted more institutional interest due to its longer track record and established partnerships in the gaming industry

- Enterprise adoption: ENJ has been adopted by various game developers for in-game asset creation, while PIEVERSE is positioning itself for broader metaverse applications

- Regulatory attitudes: Both tokens face varying regulatory approaches across jurisdictions, with gaming tokens generally facing less scrutiny than general cryptocurrencies

Technical Development and Ecosystem Building

- PIEVERSE technical upgrades: Multi-chain functionality supporting various blockchains including Ethereum, BNB Chain, and Polygon

- ENJ technical development: Transition to Efinity parachain on Polkadot for improved scalability and lower transaction costs

- Ecosystem comparison: ENJ has a more established gaming NFT ecosystem with multiple active game integrations, while PIEVERSE is building a broader metaverse platform with potential for more diverse applications

Macroeconomic Factors and Market Cycles

- Performance during inflation: Gaming and metaverse tokens like ENJ and PIEVERSE tend to be more correlated with tech sector performance than serving as inflation hedges

- Macroeconomic monetary policy: Both tokens show sensitivity to broader crypto market trends which are influenced by interest rates and dollar strength

- Geopolitical factors: Gaming and metaverse platforms potentially benefit from increased digital interaction during global instability, though this correlation is not strongly established

III. 2025-2030 Price Prediction: PIEVERSE vs ENJ

Short-term Prediction (2025)

- PIEVERSE: Conservative $0.1992 - $0.24 | Optimistic $0.24 - $0.336

- ENJ: Conservative $0.0252057 - $0.03653 | Optimistic $0.03653 - $0.051142

Mid-term Prediction (2027)

- PIEVERSE may enter a growth phase, with estimated prices $0.297792 - $0.45684

- ENJ may enter a growth phase, with estimated prices $0.047057946 - $0.0584509224

- Key drivers: Institutional capital inflow, ETFs, ecosystem development

Long-term Prediction (2030)

- PIEVERSE: Base scenario $0.499689054 - $0.63460509858 | Optimistic scenario $0.63460509858+

- ENJ: Base scenario $0.07200614950035 - $0.081366948935395 | Optimistic scenario $0.081366948935395+

Disclaimer

PIEVERSE:

| 年份 | 预测最高价 | 预测平均价格 | 预测最低价 | 涨跌幅 |

|---|---|---|---|---|

| 2025 | 0.336 | 0.24 | 0.1992 | 0 |

| 2026 | 0.3888 | 0.288 | 0.25056 | 19 |

| 2027 | 0.45684 | 0.3384 | 0.297792 | 40 |

| 2028 | 0.5407632 | 0.39762 | 0.337977 | 65 |

| 2029 | 0.530186508 | 0.4691916 | 0.441040104 | 94 |

| 2030 | 0.63460509858 | 0.499689054 | 0.32979477564 | 107 |

ENJ:

| 年份 | 预测最高价 | 预测平均价格 | 预测最低价 | 涨跌幅 |

|---|---|---|---|---|

| 2025 | 0.051142 | 0.03653 | 0.0252057 | 0 |

| 2026 | 0.05523336 | 0.043836 | 0.03769896 | 19 |

| 2027 | 0.0584509224 | 0.04953468 | 0.047057946 | 35 |

| 2028 | 0.068570857524 | 0.0539928012 | 0.034015464756 | 47 |

| 2029 | 0.0827304696387 | 0.061281829362 | 0.04228446225978 | 67 |

| 2030 | 0.081366948935395 | 0.07200614950035 | 0.060485165580294 | 97 |

IV. Investment Strategy Comparison: PIEVERSE vs ENJ

Long-term vs Short-term Investment Strategies

- PIEVERSE: Suitable for investors focused on metaverse potential and multi-chain infrastructure

- ENJ: Suitable for investors interested in gaming and NFT ecosystems

Risk Management and Asset Allocation

- Conservative investors: PIEVERSE: 30% vs ENJ: 70%

- Aggressive investors: PIEVERSE: 60% vs ENJ: 40%

- Hedging tools: Stablecoin allocation, options, cross-currency portfolios

V. Potential Risk Comparison

Market Risks

- PIEVERSE: High volatility, relatively new to the market

- ENJ: Dependent on gaming industry trends, past performance shows significant price swings

Technical Risks

- PIEVERSE: Scalability, network stability across multiple chains

- ENJ: Reliance on Efinity parachain development, potential smart contract vulnerabilities

Regulatory Risks

- Global regulatory policies may impact both tokens differently, with gaming tokens potentially facing less scrutiny

VI. Conclusion: Which Is the Better Buy?

📌 Investment Value Summary:

- PIEVERSE advantages: Multi-chain functionality, broader metaverse applications

- ENJ advantages: Established gaming ecosystem, deflationary tokenomics

✅ Investment Advice:

- New investors: Consider a balanced approach, leaning towards ENJ for its more established history

- Experienced investors: Explore PIEVERSE for potential growth in the metaverse sector

- Institutional investors: Evaluate both for portfolio diversification, with a focus on ENJ's gaming industry partnerships

⚠️ Risk Warning: The cryptocurrency market is highly volatile. This article does not constitute investment advice. None

VII. FAQ

Q1: What are the main differences between PIEVERSE and ENJ? A: PIEVERSE focuses on building foundational payment infrastructure for Web3 with multi-chain functionality, while ENJ specializes in blockchain gaming and virtual goods. PIEVERSE has a fixed supply of 1 billion tokens, whereas ENJ uses a deflationary model with tokens being locked into NFTs and gaming assets.

Q2: Which token has shown better price performance recently? A: PIEVERSE has shown extreme volatility within a short timeframe, reaching its all-time high of $0.3764 on November 16, 2025. ENJ, on the other hand, has experienced a significant decline from its all-time high of $4.82 in November 2021 to its current price of $0.03663.

Q3: How do the ecosystems of PIEVERSE and ENJ compare? A: ENJ has a more established gaming NFT ecosystem with multiple active game integrations. PIEVERSE is building a broader metaverse platform with potential for more diverse applications across various blockchains including Ethereum, BNB Chain, and Polygon.

Q4: What are the long-term price predictions for PIEVERSE and ENJ? A: By 2030, PIEVERSE is predicted to reach a base scenario of $0.499689054 - $0.63460509858, with an optimistic scenario exceeding $0.63460509858. ENJ's base scenario for 2030 is $0.07200614950035 - $0.081366948935395, with an optimistic scenario above $0.081366948935395.

Q5: How should investors allocate their portfolio between PIEVERSE and ENJ? A: Conservative investors might consider allocating 30% to PIEVERSE and 70% to ENJ, while aggressive investors could opt for 60% PIEVERSE and 40% ENJ. However, individual investment strategies should be based on personal risk tolerance and market research.

Q6: What are the main risks associated with investing in PIEVERSE and ENJ? A: PIEVERSE risks include high volatility and being relatively new to the market. ENJ faces risks related to gaming industry trends and potential smart contract vulnerabilities. Both tokens are subject to regulatory risks, though gaming tokens like ENJ may face less scrutiny.

Share

Content