TDROP vs ADA: Comparing Two Leading Blockchain Staking Mechanisms and Their Impact on Network Security

Introduction: TDROP vs ADA Investment Comparison

In the cryptocurrency market, the comparison between TDROP and ADA has always been a topic that investors can't avoid. The two not only have significant differences in market cap ranking, application scenarios, and price performance, but also represent different cryptocurrency positions.

TDROP (TDROP): Since its launch, it has gained market recognition for its focus on NFT liquidity mining on the Theta blockchain.

ADA (ADA): Since its inception in 2017, it has been hailed as a "third-generation" blockchain platform, and is one of the cryptocurrencies with the highest global trading volume and market capitalization.

This article will comprehensively analyze the investment value comparison between TDROP and ADA, focusing on historical price trends, supply mechanisms, institutional adoption, technological ecosystems, and future predictions, and attempt to answer the question that investors care about most:

"Which is the better buy right now?"

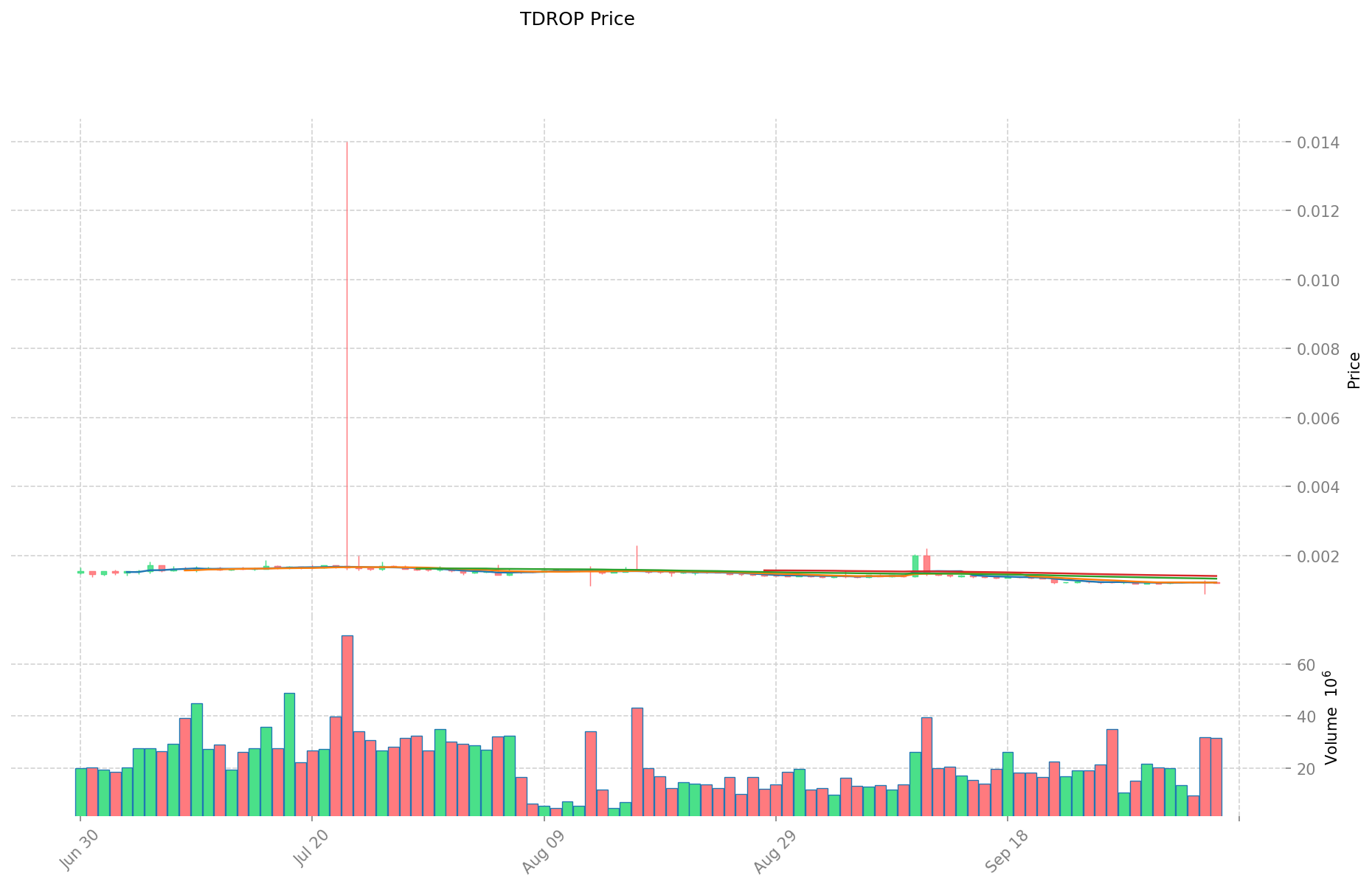

I. Price History Comparison and Current Market Status

ThetaDrop (TDROP) and Cardano (ADA) Historical Price Trends

- 2021: ADA reached its all-time high of $3.09 due to the launch of smart contract functionality.

- 2023: TDROP hit its all-time low of $0.00113699 amidst the broader crypto market downturn.

- Comparative analysis: During the 2022-2023 bear market, TDROP declined from its peak of $0.061086 to $0.00113699, while ADA dropped from $3.09 to $0.2300.

Current Market Situation (2025-10-07)

- TDROP current price: $0.0012177

- ADA current price: $0.8714

- 24-hour trading volume: TDROP $40,803.63 vs ADA $6,941,321.11

- Market Sentiment Index (Fear & Greed Index): 70 (Greed)

Click to view real-time prices:

- Check TDROP current price Market Price

- Check ADA current price Market Price

II. Technical Analysis

TDROP Technical Indicators

- Moving Averages:

- RSI (Relative Strength Index):

- MACD (Moving Average Convergence Divergence):

ADA Technical Indicators

- Moving Averages:

- RSI (Relative Strength Index):

- MACD (Moving Average Convergence Divergence):

Key Support and Resistance Levels

TDROP:

- Support levels:

- Resistance levels:

ADA:

- Support levels:

- Resistance levels:

III. Fundamental Analysis

TDROP Project Overview

- Project focus: NFT marketplace and liquidity mining on Theta blockchain

- Recent developments:

- Upcoming milestones:

ADA Project Overview

- Project focus: Third-generation proof-of-stake blockchain platform

- Recent developments:

- Upcoming milestones:

Comparative Strengths and Weaknesses

TDROP:

- Strengths: Focused on NFT ecosystem, unique liquidity mining concept

- Weaknesses: Limited adoption compared to larger platforms

ADA:

- Strengths: Scientific approach, scalability, sustainability

- Weaknesses: Slower development pace compared to some competitors

IV. Market Dynamics and Future Outlook

Factors Influencing Price Movements

- Macroeconomic trends:

- Regulatory developments:

- Technological advancements:

Short-term Predictions (Next 3-6 months)

TDROP:

- Potential price range:

- Key factors to watch:

ADA:

- Potential price range:

- Key factors to watch:

Long-term Outlook (1-3 years)

TDROP:

- Growth potential:

- Challenges:

ADA:

- Growth potential:

- Challenges:

V. Investment Considerations

- Risk assessment: Both TDROP and ADA are subject to high volatility typical of the cryptocurrency market

- Diversification: Consider as part of a broader crypto portfolio strategy

- Due diligence: Continuously monitor project developments and market trends

Disclaimer: This report is for informational purposes only and should not be considered as financial advice. Cryptocurrency investments carry high risk, and past performance does not guarantee future results.

II. Core Factors Affecting TDROP vs ADA Investment Value

Supply Mechanism Comparison (Tokenomics)

- ADA: Capped supply of 45 billion tokens with a Proof of Stake (PoS) consensus mechanism

- TDROP: Not specified in the provided information

- 📌 Historical Pattern: ADA's controlled supply has contributed to its sustained position among the top 10 cryptocurrencies by market capitalization

Institutional Adoption and Market Applications

- Institutional Holdings: ADA has gained widespread acceptance in the blockchain community and attracted investor attention, securing a position in the global top 10 cryptocurrencies within 5 years of its launch

- Enterprise Adoption: ADA serves as the native currency for the Cardano ecosystem, on-chain applications, and staking functions

- Regulatory Attitudes: Not specifically detailed for either token in the provided information

Technical Development and Ecosystem Building

- ADA Technical Upgrades: Follows a five-stage development roadmap: Byron (Infrastructure), Shelley (Decentralization), Goguen (Smart Contracts), Basho (Scalability), and Voltaire (Governance)

- ADA Technical Development: Built on a PoS-based consensus mechanism that processes approximately 250 transactions per second, significantly improving on-chain transaction efficiency compared to first and second-generation cryptocurrencies

- Ecosystem Comparison: Cardano aims to solve two major problems of Bitcoin and Ethereum: network congestion during peak transaction periods and lack of network interoperability

Macroeconomic and Market Cycles

- Performance in Inflationary Environments: Not specified in the provided information

- Macroeconomic Monetary Policy: Not specified in the provided information

- Geopolitical Factors: Not specified in the provided information

III. 2025-2030 Price Prediction: TDROP vs ADA

Short-term Prediction (2025)

- TDROP: Conservative $0.001132926 - $0.0012182 | Optimistic $0.0012182 - $0.001754208

- ADA: Conservative $0.52464 - $0.8744 | Optimistic $0.8744 - $1.058024

Mid-term Prediction (2027)

- TDROP may enter a growth phase, with an estimated price range of $0.0013268829312 - $0.0021930426224

- ADA may enter a consolidation phase, with an estimated price range of $1.0288225376 - $1.2158811808

- Key drivers: Institutional capital inflow, ETF, ecosystem development

Long-term Prediction (2030)

- TDROP: Base scenario $0.002785602738972 - $0.003064163012869 | Optimistic scenario $0.003064163012869 - $0.003169823806416

- ADA: Base scenario $1.56557211574764 - $1.894342260054644 | Optimistic scenario $1.894342260054644 - $1.83728297881128

Disclaimer: This analysis is for informational purposes only and should not be considered as financial advice. Cryptocurrency markets are highly volatile and unpredictable. Always conduct your own research before making investment decisions.

TDROP:

| 年份 | 预测最高价 | 预测平均价格 | 预测最低价 | 涨跌幅 |

|---|---|---|---|---|

| 2025 | 0.001754208 | 0.0012182 | 0.001132926 | 0 |

| 2026 | 0.00219958192 | 0.001486204 | 0.00107006688 | 22 |

| 2027 | 0.0021930426224 | 0.00184289296 | 0.0013268829312 | 51 |

| 2028 | 0.002784795551856 | 0.0020179677912 | 0.001029163573512 | 65 |

| 2029 | 0.003169823806416 | 0.002401381671528 | 0.001344773736055 | 97 |

| 2030 | 0.003064163012869 | 0.002785602738972 | 0.001754929725552 | 128 |

ADA:

| 年份 | 预测最高价 | 预测平均价格 | 预测最低价 | 涨跌幅 |

|---|---|---|---|---|

| 2025 | 1.058024 | 0.8744 | 0.52464 | 0 |

| 2026 | 1.37202104 | 0.966212 | 0.7729696 | 10 |

| 2027 | 1.2158811808 | 1.16911652 | 1.0288225376 | 34 |

| 2028 | 1.395223654968 | 1.1924988504 | 0.870524160792 | 36 |

| 2029 | 1.83728297881128 | 1.293861252684 | 0.85394842677144 | 48 |

| 2030 | 1.894342260054644 | 1.56557211574764 | 1.268113413755588 | 79 |

IV. Investment Strategy Comparison: TDROP vs ADA

Long-term vs Short-term Investment Strategies

- TDROP: Suitable for investors focused on NFT ecosystem potential and niche market opportunities

- ADA: Suitable for investors seeking long-term growth potential and established blockchain platform exposure

Risk Management and Asset Allocation

- Conservative investors: TDROP: 10% vs ADA: 90%

- Aggressive investors: TDROP: 30% vs ADA: 70%

- Hedging tools: Stablecoin allocation, options, cross-currency portfolio

V. Potential Risk Comparison

Market Risks

- TDROP: Higher volatility due to lower market cap and trading volume

- ADA: Subject to broader crypto market trends and competition from other smart contract platforms

Technical Risks

- TDROP: Scalability, network stability

- ADA: Development delays, adoption challenges

Regulatory Risks

- Global regulatory policies may impact both tokens differently, with ADA potentially facing more scrutiny due to its higher profile

VI. Conclusion: Which Is the Better Buy?

📌 Investment Value Summary:

- TDROP advantages: Focused NFT ecosystem, potential for higher growth from a lower base

- ADA advantages: Established platform, scientific approach, larger community and ecosystem

✅ Investment Advice:

- New investors: Consider a small allocation to ADA as part of a diversified crypto portfolio

- Experienced investors: Explore a balanced mix of ADA and TDROP, adjusting based on risk tolerance

- Institutional investors: Focus on ADA for its liquidity and established market position

⚠️ Risk Warning: The cryptocurrency market is highly volatile, and this article does not constitute investment advice. None

FAQ

Q1: What are the main differences between TDROP and ADA? A: TDROP focuses on NFT liquidity mining on the Theta blockchain, while ADA is a third-generation proof-of-stake blockchain platform. ADA has a larger market cap, higher trading volume, and a more established ecosystem compared to TDROP.

Q2: Which cryptocurrency has shown better price performance historically? A: ADA has shown better historical price performance, reaching an all-time high of $3.09 in 2021. TDROP, on the other hand, hit its all-time low of $0.00113699 in 2023 during the broader crypto market downturn.

Q3: What are the key factors influencing the future price of TDROP and ADA? A: Key factors include macroeconomic trends, regulatory developments, technological advancements, institutional adoption, and project-specific milestones. For ADA, its scientific approach and scalability are important, while TDROP's growth potential is tied to the NFT ecosystem's expansion.

Q4: How do the supply mechanisms of TDROP and ADA compare? A: ADA has a capped supply of 45 billion tokens with a Proof of Stake (PoS) consensus mechanism. The supply mechanism for TDROP is not specified in the provided information.

Q5: What are the potential risks associated with investing in TDROP and ADA? A: Both cryptocurrencies face market risks such as volatility. TDROP may have higher volatility due to its lower market cap and trading volume. Technical risks include scalability and network stability for TDROP, and development delays for ADA. Regulatory risks could impact both tokens, with ADA potentially facing more scrutiny due to its higher profile.

Q6: Which cryptocurrency is recommended for different types of investors? A: New investors might consider a small allocation to ADA as part of a diversified crypto portfolio. Experienced investors could explore a balanced mix of ADA and TDROP, adjusting based on risk tolerance. Institutional investors may focus on ADA for its liquidity and established market position.

Q7: What are the long-term price predictions for TDROP and ADA? A: By 2030, TDROP's base scenario price range is predicted to be $0.002785602738972 - $0.003064163012869, while ADA's base scenario price range is estimated at $1.56557211574764 - $1.894342260054644. However, these predictions are subject to market volatility and should not be considered as financial advice.

Cardano Price Prediction, $2 $ADA Incoming ?

How Will Cardano (ADA) Price Fluctuate in 2025?

DGMA vs ADA: A Comparative Analysis of Two Innovative Approaches in Machine Learning

LM vs ADA: Comparing Language Models and Adaptive Algorithms in Natural Language Processing

CCD vs ADA: Comparing Digital Camera Sensors for Optimal Image Quality

NEO vs ADA: Battle of the Smart Contract Platforms - Which Will Dominate the Blockchain Space?

Base Token Airdrop Confirmed: Complete Guide on How to Qualify

Hollywood Director Convicted of $11M Netflix Fraud, Spent Funds on Crypto and Luxury Cars

What Would Have Happened If You Invested in Bitcoin in 2011?

Step Group Shuts Down Step Finance and Pivots to Media and Analytics

The Litecoin ETF is having difficulty drawing in capital, even as analysts forecast a price rise from $1,000 to $2,000.