ZBT vs APT: Comparing Two Advanced Persistent Threat Groups and Their Impact on Cybersecurity

Introduction: ZBT vs APT Investment Comparison

In the cryptocurrency market, the comparison between ZEROBASE vs Aptos has been an unavoidable topic for investors. The two not only show significant differences in market cap ranking, application scenarios, and price performance, but also represent different positioning in the crypto asset space.

ZEROBASE (ZBT): Since its launch, it has gained market recognition for its decentralized cryptographic infrastructure network using zero-knowledge proofs and trusted execution environments.

Aptos (APT): Since its inception in 2022, it has been hailed as a high-performance PoS Layer 1 blockchain, focusing on security and scalability.

This article will comprehensively analyze the investment value comparison between ZBT and APT, focusing on historical price trends, supply mechanisms, institutional adoption, technological ecosystems, and future predictions, attempting to answer the question investors care about most:

"Which is the better buy right now?"

I. Price History Comparison and Current Market Status

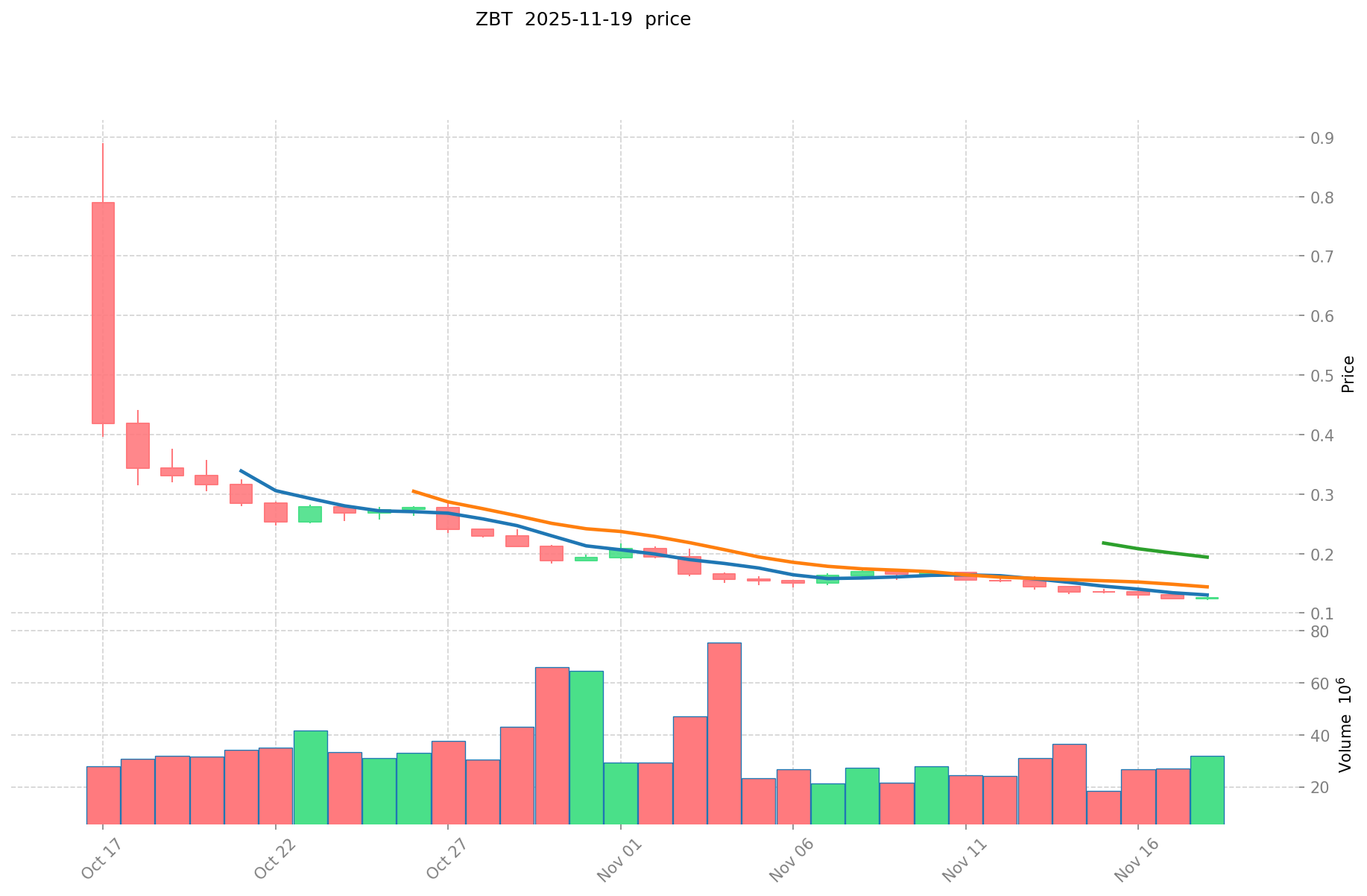

ZEROBASE (ZBT) and Aptos (APT) Historical Price Trends

- 2025: ZBT reached its all-time high of $0.88999 on October 17, before declining to its all-time low of $0.12147 on November 18.

- 2023: APT hit its all-time high of $19.92 on January 26, showing significant volatility in its early trading period.

- Comparative analysis: In the recent market cycle, ZBT has experienced a sharp decline from its peak to its current price, while APT has also seen a substantial drop from its all-time high, currently trading at a fraction of its peak value.

Current Market Situation (2025-11-19)

- ZBT current price: $0.12571

- APT current price: $2.922

- 24-hour trading volume: ZBT $3,897,128.30 vs APT $852,139.23

- Market Sentiment Index (Fear & Greed Index): 15 (Extreme Fear)

Click to view real-time prices:

- Check ZBT current price Market Price

- Check APT current price Market Price

II. Core Factors Affecting Investment Value of ZBT vs APT

Supply Mechanism Comparison (Tokenomics)

-

Zebra (ZBT): Fixed supply of 10 million tokens, with 63% allocated for ecosystem development and community rewards

-

Aptos (APT): Total supply of 1 billion tokens, with 51.02% allocated to the community and 16.5% to the foundation

-

📌 Historical Pattern: Fixed supply models like ZBT's tend to create scarcity value, potentially leading to price appreciation if adoption grows, while APT's larger supply with strategic allocations allows for ecosystem funding but may create dilution concerns.

Institutional Adoption and Market Applications

- Institutional Holdings: Aptos has secured backing from major VCs including a16z, Multicoin Capital, and Binance Labs, while Zebra has received support from Lightspeed Venture Partners and Standard Crypto

- Enterprise Adoption: Aptos has established partnerships with Google Cloud and Microsoft, positioning it for enterprise integration; Zebra is focused on enabling new verification capabilities for ZK applications

- Regulatory Attitudes: Both projects face similar regulatory landscapes as Layer-1 platforms, with neither having faced significant regulatory challenges to date

Technical Development and Ecosystem Building

- Zebra Technical Upgrades: Pioneering zero-knowledge machine for parallel execution of ZK proofs, introducing "sleepy consensus" for improved efficiency and security

- Aptos Technical Development: Employs Move programming language with parallel execution through Block-STM, focusing on high TPS and low latency

- Ecosystem Comparison: Aptos has a more developed ecosystem spanning DeFi, NFTs, and gaming with over 300 applications built on its network; Zebra is newer with a focus on ZK applications and privacy-preserving solutions

Macroeconomic Factors and Market Cycles

- Inflation Performance: As newer Layer-1 tokens, both have limited historical data on inflation resilience, though APT has demonstrated survival through bear market conditions

- Monetary Policy Impact: Both tokens show correlation with broader crypto market trends affected by Federal Reserve policies and interest rate environments

- Geopolitical Factors: Aptos has established global partnerships and community bases across multiple regions; Zebra's focus on privacy and ZK technology may appeal in regions with stronger privacy concerns

III. 2025-2030 Price Prediction: ZBT vs APT

Short-term Prediction (2025)

- ZBT: Conservative $0.0854 - $0.1256 | Optimistic $0.1256 - $0.1583

- APT: Conservative $2.2499 - $2.9220 | Optimistic $2.9220 - $4.1785

Mid-term Prediction (2027)

- ZBT may enter a growth phase, with prices expected in the range of $0.1146 - $0.1865

- APT may enter a consolidation phase, with prices expected in the range of $2.6201 - $4.9490

- Key drivers: Institutional capital inflow, ETFs, ecosystem development

Long-term Prediction (2030)

- ZBT: Base scenario $0.2582 - $0.3330 | Optimistic scenario $0.3330+

- APT: Base scenario $5.7505 - $7.4757 | Optimistic scenario $7.4757+

Disclaimer

ZBT:

| 年份 | 预测最高价 | 预测平均价格 | 预测最低价 | 涨跌幅 |

|---|---|---|---|---|

| 2025 | 0.1582938 | 0.12563 | 0.0854284 | 0 |

| 2026 | 0.200166279 | 0.1419619 | 0.129185329 | 12 |

| 2027 | 0.186459857555 | 0.1710640895 | 0.114612939965 | 36 |

| 2028 | 0.2359658050563 | 0.1787619735275 | 0.119770522263425 | 42 |

| 2029 | 0.308972195044931 | 0.2073638892919 | 0.159670194754763 | 64 |

| 2030 | 0.333036774397255 | 0.258168042168415 | 0.198789392469679 | 105 |

APT:

| 年份 | 预测最高价 | 预测平均价格 | 预测最低价 | 涨跌幅 |

|---|---|---|---|---|

| 2025 | 4.17846 | 2.922 | 2.24994 | 0 |

| 2026 | 3.7277415 | 3.55023 | 3.3727185 | 21 |

| 2027 | 4.94902062 | 3.63898575 | 2.62006974 | 24 |

| 2028 | 4.9810436946 | 4.294003185 | 3.5210826117 | 46 |

| 2029 | 6.863534690904 | 4.6375234398 | 2.504262657492 | 58 |

| 2030 | 7.4756877849576 | 5.750529065352 | 3.56532802051824 | 96 |

IV. Investment Strategy Comparison: ZBT vs APT

Long-term vs Short-term Investment Strategies

- ZBT: Suitable for investors focused on zero-knowledge proof technology and privacy-preserving applications

- APT: Suitable for investors interested in high-performance Layer 1 platforms and diverse ecosystem development

Risk Management and Asset Allocation

- Conservative investors: ZBT: 30% vs APT: 70%

- Aggressive investors: ZBT: 60% vs APT: 40%

- Hedging tools: Stablecoin allocation, options, cross-currency portfolios

V. Potential Risk Comparison

Market Risks

- ZBT: High volatility due to lower market cap and trading volume

- APT: Competitive pressure from other Layer 1 platforms

Technical Risks

- ZBT: Scalability, network stability

- APT: Security vulnerabilities, potential bugs in Move language implementation

Regulatory Risks

- Global regulatory policies may impact both projects differently, with potential focus on privacy features for ZBT and smart contract regulations for APT

VI. Conclusion: Which Is the Better Buy?

📌 Investment Value Summary:

- ZBT advantages: Unique zero-knowledge proof technology, fixed supply tokenomics

- APT advantages: Established ecosystem, institutional backing, high-performance blockchain

✅ Investment Advice:

- New investors: Consider a balanced approach with a tilt towards APT due to its more established ecosystem

- Experienced investors: Explore a mix of both, with ZBT as a higher-risk, higher-reward option

- Institutional investors: Evaluate both for different portfolio needs - APT for broader blockchain exposure, ZBT for specific ZK-technology investment

⚠️ Risk Warning: The cryptocurrency market is highly volatile. This article does not constitute investment advice. None

FAQ

Q1: What are the main differences between ZBT and APT? A: ZBT is a decentralized cryptographic infrastructure network using zero-knowledge proofs, while APT is a high-performance PoS Layer 1 blockchain. ZBT has a fixed supply of 10 million tokens, whereas APT has a total supply of 1 billion tokens. ZBT focuses on privacy and ZK applications, while APT has a more developed ecosystem spanning DeFi, NFTs, and gaming.

Q2: Which token has shown better price performance recently? A: Both tokens have experienced significant price declines from their all-time highs. As of November 19, 2025, ZBT is trading at $0.12571, down from its all-time high of $0.88999, while APT is trading at $2.922, down from its all-time high of $19.92 in January 2023.

Q3: How do the institutional adoptions of ZBT and APT compare? A: APT has secured backing from major VCs including a16z, Multicoin Capital, and Binance Labs, and has partnerships with Google Cloud and Microsoft. ZBT has received support from Lightspeed Venture Partners and Standard Crypto, focusing on enabling new verification capabilities for ZK applications.

Q4: What are the long-term price predictions for ZBT and APT? A: By 2030, ZBT is predicted to reach a base scenario of $0.2582 - $0.3330, with an optimistic scenario of $0.3330+. APT is predicted to reach a base scenario of $5.7505 - $7.4757, with an optimistic scenario of $7.4757+.

Q5: How should investors approach asset allocation between ZBT and APT? A: Conservative investors might consider allocating 30% to ZBT and 70% to APT, while aggressive investors might allocate 60% to ZBT and 40% to APT. The specific allocation should be based on individual risk tolerance and investment goals.

Q6: What are the main risks associated with investing in ZBT and APT? A: ZBT faces high volatility due to lower market cap and trading volume, as well as potential scalability and network stability issues. APT faces competitive pressure from other Layer 1 platforms and potential security vulnerabilities. Both are subject to regulatory risks, with ZBT potentially facing scrutiny over privacy features and APT over smart contract regulations.

Share

Content