Bitcoin Price Prediction: Bitcoin Outpaces Gold and S&P 500 Over 5 Years Despite Community Split

Introduction

In recent conversations about the Bitcoin ecosystem, Samson Mow—CEO of JAN3 and a well-known Bitcoin advocate—shared a thought-provoking view: the Bitcoin community is showing signs of fragmentation.

Community Division: Is Bitcoin a Cryptographic Tool or Digital Currency?

Mow observes that today’s Bitcoin community is splitting into two distinct groups:

- One camp regards Bitcoin as a cryptographic tool, emphasizing innovation at the technical and protocol layers;

- The other camp views BTC purely as a currency, prioritizing its roles in value storage and payments.

This debate isn’t new. The Bitcoin Core developer and node operator communities previously engaged in heated discussions over OP_RETURN size limit adjustments. Some operators switched to Bitcoin Knots, and in May, the number of Knots nodes jumped 137%, nearly 6% of all Bitcoin nodes. This surge underscores Bitcoin’s potential beyond simple payments and amplifies the rift within the community.

Bitcoin vs. Traditional Assets: Leading the Pack Over Five Years

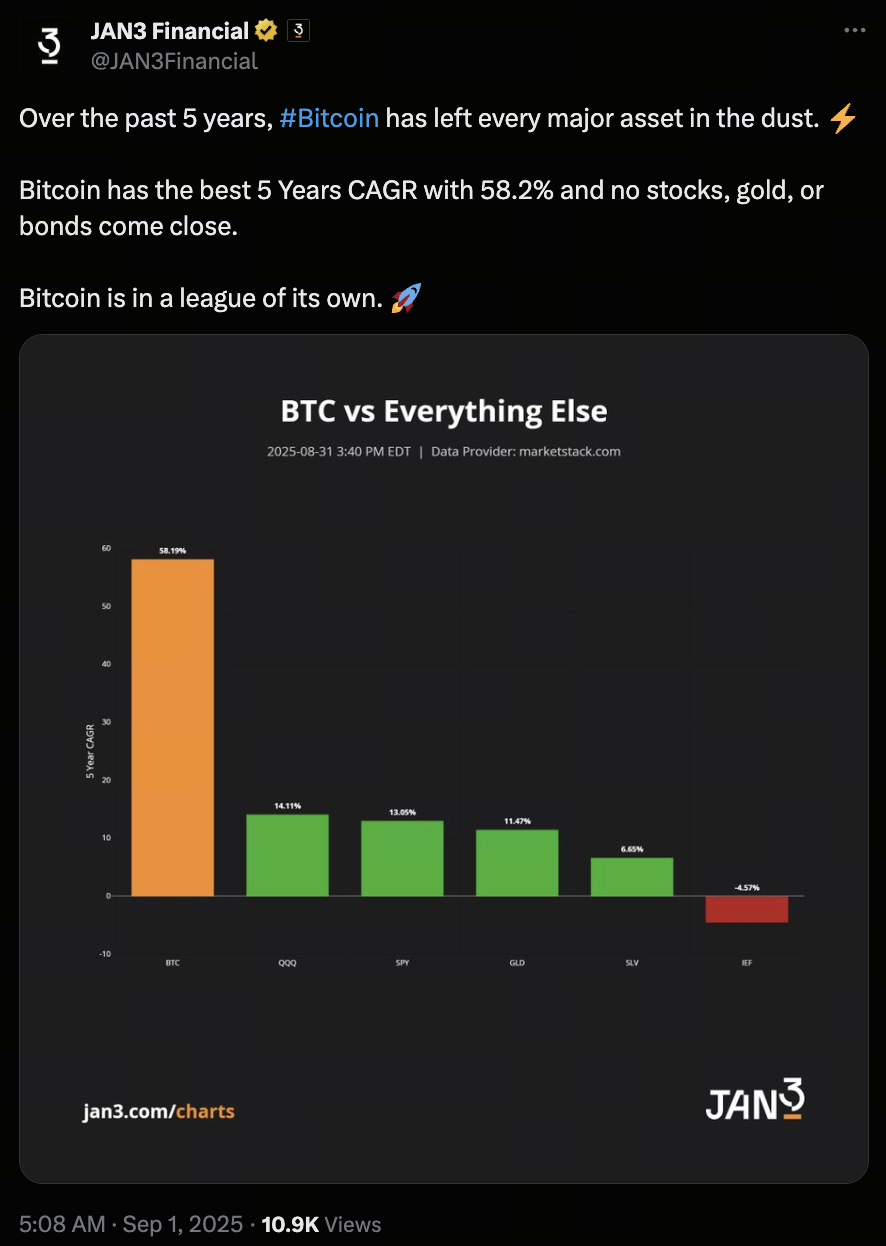

Despite ongoing controversy within the community, Bitcoin’s market performance continues to shine. Mow shared data from JAN3, clearly showing that over the past five years, Bitcoin’s gains have eclipsed those of traditional assets—including the NASDAQ-100 ETF (QQQ), the S&P 500 Index, gold, silver, and the U.S. Treasury ETF (IEF). The “BTC vs Everything Else” chart delivers a clear message: over the past five years, Bitcoin has outpaced every major asset.

(Source: JAN3Financial)

To learn more about Web3, register at: https://www.gate.com/

Market Outlook

Bitcoin has recently reached a record high in price, fueled by continued investment from major institutions. While the debate over Bitcoin’s role within the community isn’t likely to resolve soon. Its long-term trend of outperforming traditional assets is increasingly evident. The key question for investors is whether this community split will slow Bitcoin’s technological and application development—or if, on the contrary, such debate will drive Bitcoin toward broader, richer use cases. No matter the outcome, hard data already demonstrates Bitcoin’s unique value in asset markets.

Related Articles

2025 BTC Price Prediction: BTC Trend Forecast Based on Technical and Macroeconomic Data

Flare Crypto Explained: What Is Flare Network and Why It Matters in 2025

Pi Coin Transaction Guide: How to Transfer to Gate.com

How to Use a Crypto Whale Tracker: Top Tool Recommendation for 2025 to Follow Whale Moves

What is N2: An AI-Driven Layer 2 Solution