Bitcoin Price Prediction: BTC Down 15% vs Gold and S&P 500, Is It Undervalued Now?

Preface

Recently, blockchain analytics firm Santiment highlighted that Bitcoin (BTC) could be undervalued, citing a pronounced decoupling in its four-year correlation with gold and the S&P 500. Although these assets have historically exhibited similar market trends, recent months show that this relationship is changing.

Bitcoin Lags Behind Traditional Assets

Data shared by Santiment indicates that since August 11, Bitcoin’s price has dropped roughly 15%. During the same timeframe:

- Gold climbed approximately 21%

- The S&P 500 gained about 7%

(Source: santimentfeed)

Gold has emerged as the top performer, while the U.S. equities index continues its steady rise. In contrast, Bitcoin has moved in the opposite direction. This signals a significant decline in BTC’s correlation with these traditional assets—potentially turning negative.

Bitcoin May Be Undervalued

Santiment points out that Bitcoin maintained a strong correlation with gold and the S&P 500 over the past four years, making the current decoupling notably rare. The firm stated: “Using historical correlation as a reference, BTC can now be considered an undervalued asset.” If the market returns to its long-term correlation, Bitcoin could rally and catch up to the gains posted by traditional assets.

BTC Price Stuck in a Critical Range

Glassnode’s on-chain analysis places Bitcoin between two major cost basis ranges. This model highlights potential support and resistance zones by mapping the profitability of holders.

Key price levels include:

- Upper resistance zone: around $108,500, where roughly 85% of supply remains in unrealized profit.

- Lower support zone: around $100,600, a level that has repeatedly served as a launchpad for rebounds.

Glassnode reports: “Historically, these zones have acted as support and resistance. Once either threshold is breached, the market’s direction becomes much clearer.”

Technical Analysis and Future Outlook

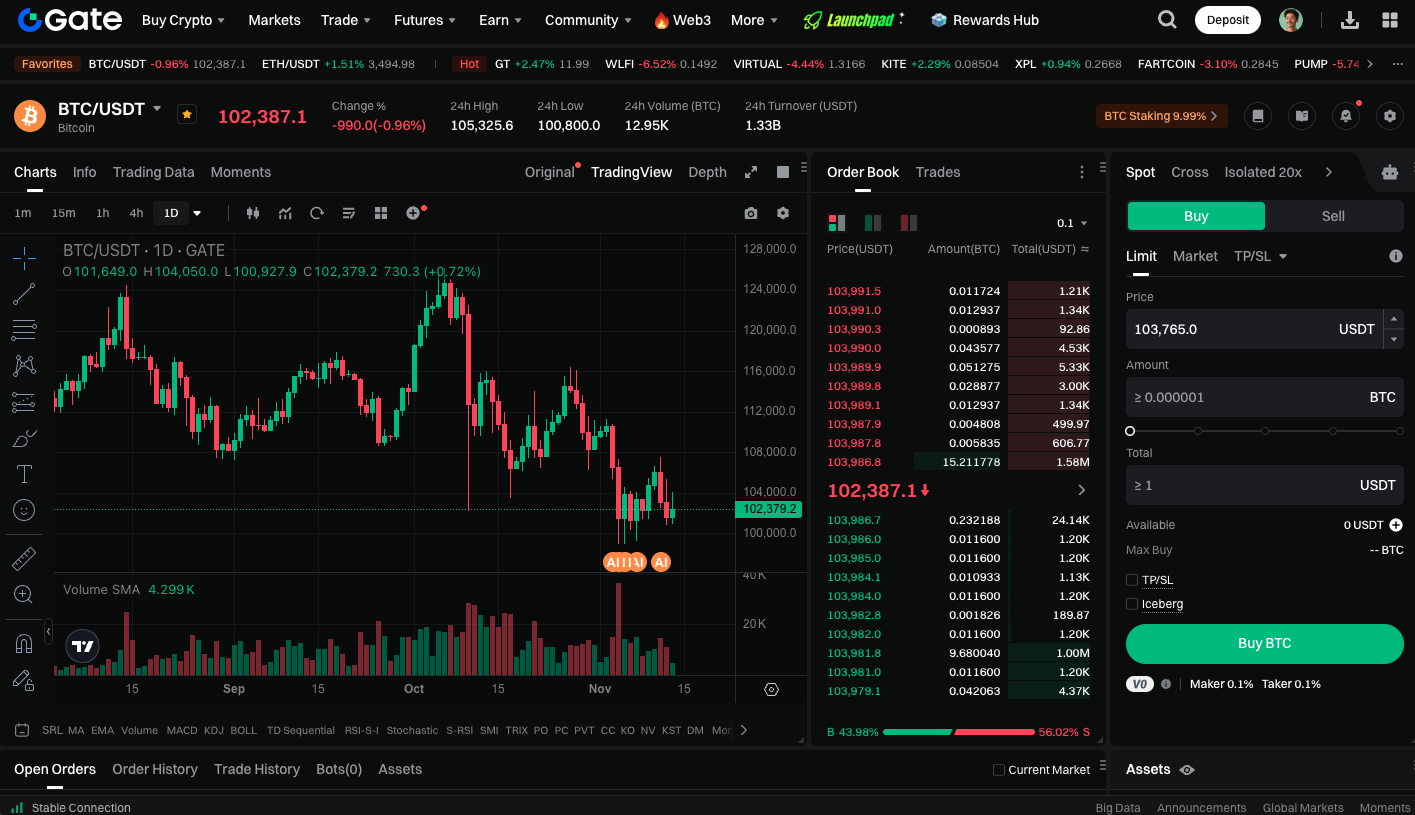

BTC is currently trading between $100,000 and $110,000. Surpassing the $108,500 resistance could spark a short-term rally and resume the upward trend. Conversely, dropping below $100,600 could trigger a deeper correction.

From a macro perspective, with the Federal Reserve pausing further liquidity expansion and traditional assets hitting new highs, Bitcoin’s short-term weakness may prove temporary. Should market sentiment shift back toward risk assets, BTC’s potential for a catch-up rally remains strong.

Start trading BTC spot now: https://www.gate.com/trade/BTC_USDT

Conclusion

Insights from Santiment and Glassnode indicate that Bitcoin’s recent performance does not fully reflect its fundamentals. Historical correlations suggest that BTC is positioned to recover lost ground in the coming months. As gold and stocks reach record highs, Bitcoin’s sideways movement and pullbacks present an attractive entry point for long-term investors.

If the price breaks above $108,500, a technical rebound could follow; if it falls below $100,600, short-term correction risk increases. For now, Bitcoin remains in an accumulation phase. Its undervaluation may signal the beginning of the next market move.

Related Articles

Pi Coin Transaction Guide: How to Transfer to Gate.io

Flare Crypto Explained: What Is Flare Network and Why It Matters in 2025

How to Use a Crypto Whale Tracker: Top Tool Recommendation for 2025 to Follow Whale Moves

What is N2: An AI-Driven Layer 2 Solution

2025 BTC Price Prediction: BTC Trend Forecast Based on Technical and Macroeconomic Data